XP Inc (NASDAQ: XP — $14.8 billion) is a Brazilian investment services company on a mission “to transform the financial markets in Brazil to improve the lives of people in our country.” Through a collection of more than 13,000 autonomous brokers, XP offers a variety of financial products to Brazilians ranging from stock trading, credit cards, and private funds. The Bear Cave believes the XP model is on the brink of implosion, with infuriated brokers, a broken sales culture, and meddling management among the company’s many problems.

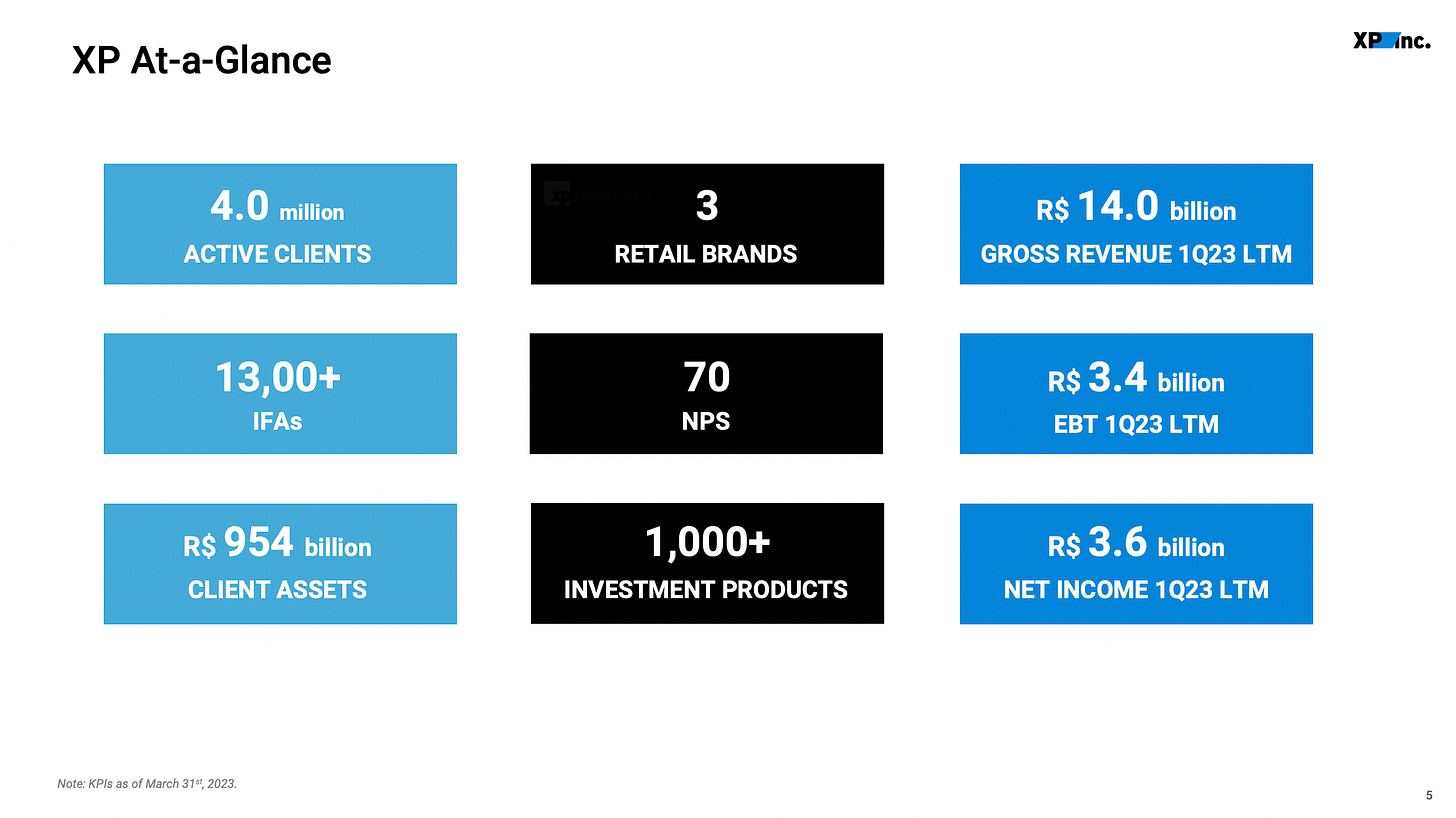

Founded in 2001, XP has grown rapidly into a Brazilian powerhouse that now serves over 4 million clients ranging from working families to multi-millionaires. Many lower-income clients self-administer financial plans through XP’s website while others use one of XP’s 13,000+ Independent Financial Advisors (IFAs).

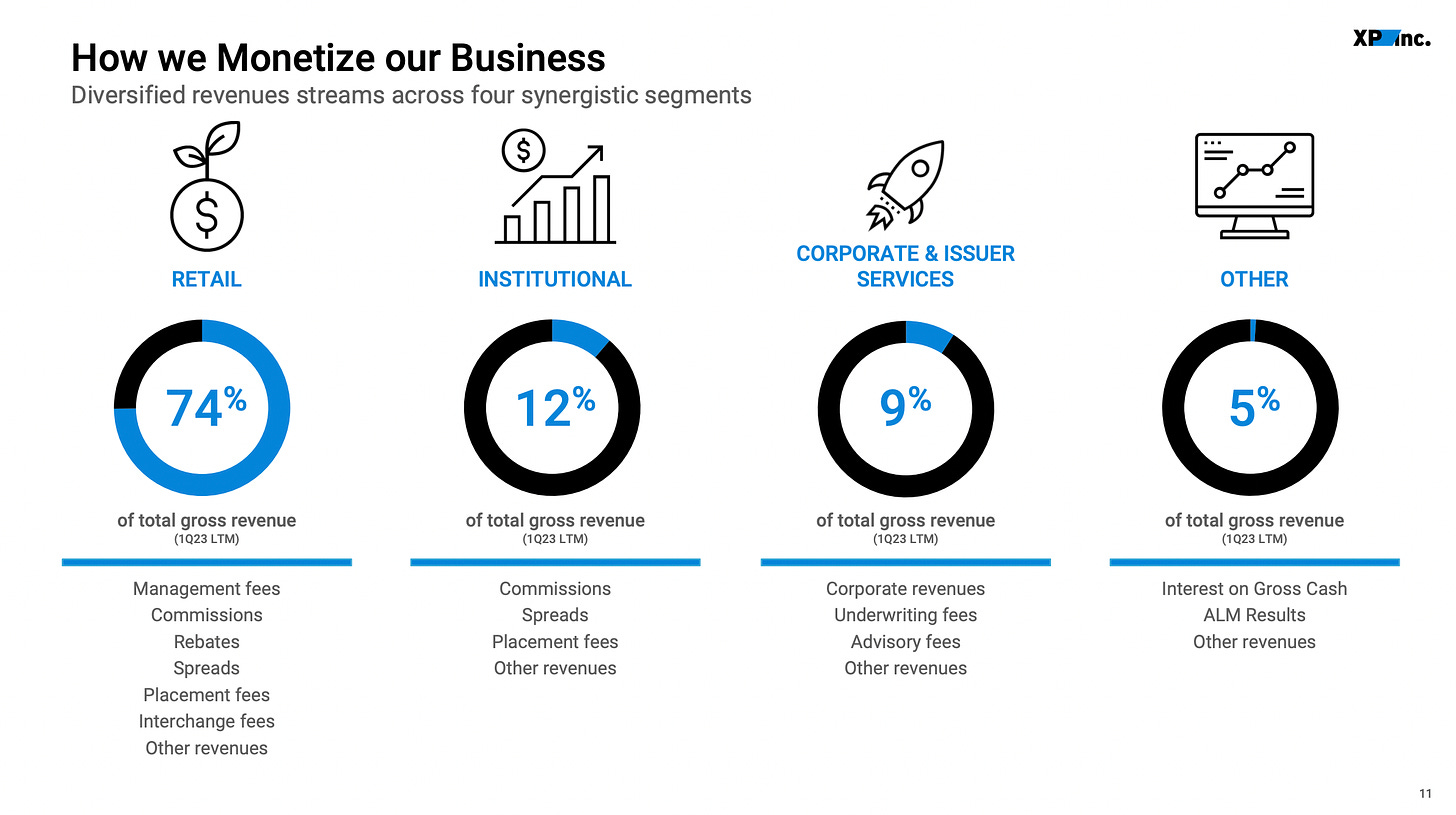

XP earns money through “management fees,” “commissions,” “rebates,” “spreads,” and other fees charged on the clients of XP’s Independent Financial Advisors. In its most recent annual 20-F filing, XP discloses its Independent Financial Advisors “are located in 2,558 offices in 242 cities across the country and form the largest independent financial advisor network in Brazil, which is a competitive advantage for XP.”

That retail segment is crucial to XP and accounts for nearly three-fourths of the company’s revenue.

In short, the success of XP depends on the success, growth, integrity, and satisfaction of its Independent Financial Advisor network. The Bear Cave has doubts.

Signs of trouble are easy to find on the anonymous employee review site Glassdoor, where some reviews have turned starkly negative in recent months. One April 2023 review, translated from Portuguese, reads,

“Extremely unethical company. It forces employees to sell products based on goals, without considering the customer's profile. [XP] changes the campaign and [payment] rules, close to the end of the semester.”

Another April 2023 review titled “Jump Off the Boat” is translated to read,