CorVel is a national provider of workers’ compensation solutions for employers, third-party administrators, insurance companies, and government agencies. Despite a $1.2 billion market capitalization the company receives almost no coverage on Wall Street, which is why many of its red flags may have gone unnoticed — until now.

Accounting Issues

The Securities and Exchange Commission sent CorVel two comment letters this year. In a letter dated February 20, 2020 the SEC scrutinized CorVel’s accounting and revenue recognition. The SEC letter referenced CorVel’s contract balances and read, in part,

“Tell us how you could recognize $16,372,000 of revenue from the beginning of the period when your deferred revenue at that time was only $15,316,000.”

CorVel responded a month later writing,

“We re-evaluated the calculations included in the disclosure referred to in your comment and agree with the inconsistency noted. Based on our re-evaluation, some items were misclassified…”

Following CorVel’s response, the SEC sent a follow-up letter on April 3 asking more questions.

CorVel’s auditor is Haskell & White LLP. According to PCAOB records, Haskell & White LLP audited 13 different public companies in the calendar year 2019. The median market capitalization of its clients was approximately $31 million. Other than CorVel, Haskell & White LLP does not audit any companies with a market capitalization above $300 million.

Last night, CorVel filed its 10-K. In its audit opinion Haskell & White LLP noted a critical audit matter:

“Certain customer contracts contain provisions that permit the customer to compensate the Company only for services that it chooses to accept, which directly impacts the amount of revenue recognized by the Company. Significant judgment is exercised by management in determining revenue recognition for these customer contract provisions…”

This language did not appear in CorVel’s prior 10-K.

CorVel has had other instances of questionable internal controls. In 2006, CorVel’s auditor, Grant Thornton, noted some material weaknesses in CorVel’s financial reporting. In its 2006 audit opinion, Grant Thornton wrote,

“The Company did not maintain a sufficient number of personnel and appropriate depth of experience for its accounting and finance departments.”

“The Company did not maintain effective controls over its period-end financial reporting processes.”

“The Company did not maintain adequate segregation of duties.”

“The Company did not maintain effective controls over access to systems, financial applications and data.”

“The Company did not maintain effective controls over the preparation of account analyses, account summaries and account reconciliations.”

“The Company did not maintain effective controls over the documentation of accounting policies and procedures.”

“The Company did not maintain effective controls over accounts payable and month-end accruals, including salaries and wages, bonuses, workers compensation, rebates, professional fees, and PPO expenses.”

“The Company did not maintain effective controls related to expenditure processing.”

“The Company did not maintain effective controls over the recording of, and accounting for, fixed assets.”

“The Company did not maintain effective control over the preparation and review of income taxes.”

“The Company did not maintain effective controls related to revenue and receivables reporting, including the complete and timely review of revenue entries and the collection and application of payments and credits to accounts receivable.”

“The Company does not maintain effective controls over payroll processing.”

“The Company did not maintain effective monitoring controls over transaction authorities and limits, including authorized signers for bank accounts and stock option activity.”

“The Company did not maintain effective controls over accounting for leases.”

“The Company did not maintain effective monitoring of third party controls supporting financial reporting.”

“The Company did not maintain effective controls over spreadsheets used in the Company’s financial reporting process. Specifically, controls were not designed and in place throughout the year to ensure that unauthorized modification of the data or formulas within spreadsheets was prevented.”

Shortly after giving its opinion, the company dismissed Grant Thornton as its auditor. Since then CorVel stock is up approximately 600% compared to 150% for the S&P 500.

CorVel has had three different CFOs in the last three years. CorVel’s current CFO is 39 years old and has worked at CorVel in various positions for the last seventeen years.

CorVel also keeps an unusually low profile. The company appears to have no analyst Q&A on recent earnings calls and no investor presentations available on its website. In addition, the company has received 18 confidential treatment orders from the SEC in the last five years.

Perhaps unsurprisingly, it does not appear that any healthcare funds are large holders of CorVel stock. Some of CorVel’s largest institutional shareholders include BlackRock, Renaissance Technologies, and Vanguard.

Business Model Issues

CorVel faces issues beyond accounting. One of the issues central to workers’ compensation is whether and when you pay out claims. Some anecdotes raise concerns that CorVel may be unreasonable in denying or delaying claims.

In 2015 the Mayor of Fort Worth called for an audit of CorVel after a CorVel representative asked “inflammatory questions” to a police officer who was recovering from a gunshot wound in a hospital. The article also quotes Rick Van Houten, president of the Fort Worth Police Officers Association, who said,

“Every officer that is injured complains about this company.”

In April of this year Luci Garcia, an employee at Cohn Wholesale Fruit and Grocery, filed a lawsuit against CorVel (Case 5:20-cv-05030-LLP). Ms. Garcia was injured when a grill blew up and caused her severe burns. As a result of the accident, Ms. Garcia needed to be airlifted to a hospital for life-threatening injuries. Her lawsuit alleges that she faced months of delays for supplies like hand cream and therapeutic gloves because of CorVel. Her lawyer wrote,

“There has been a practice of denial and delay of medical equipment and supplies necessary for her treatment.”

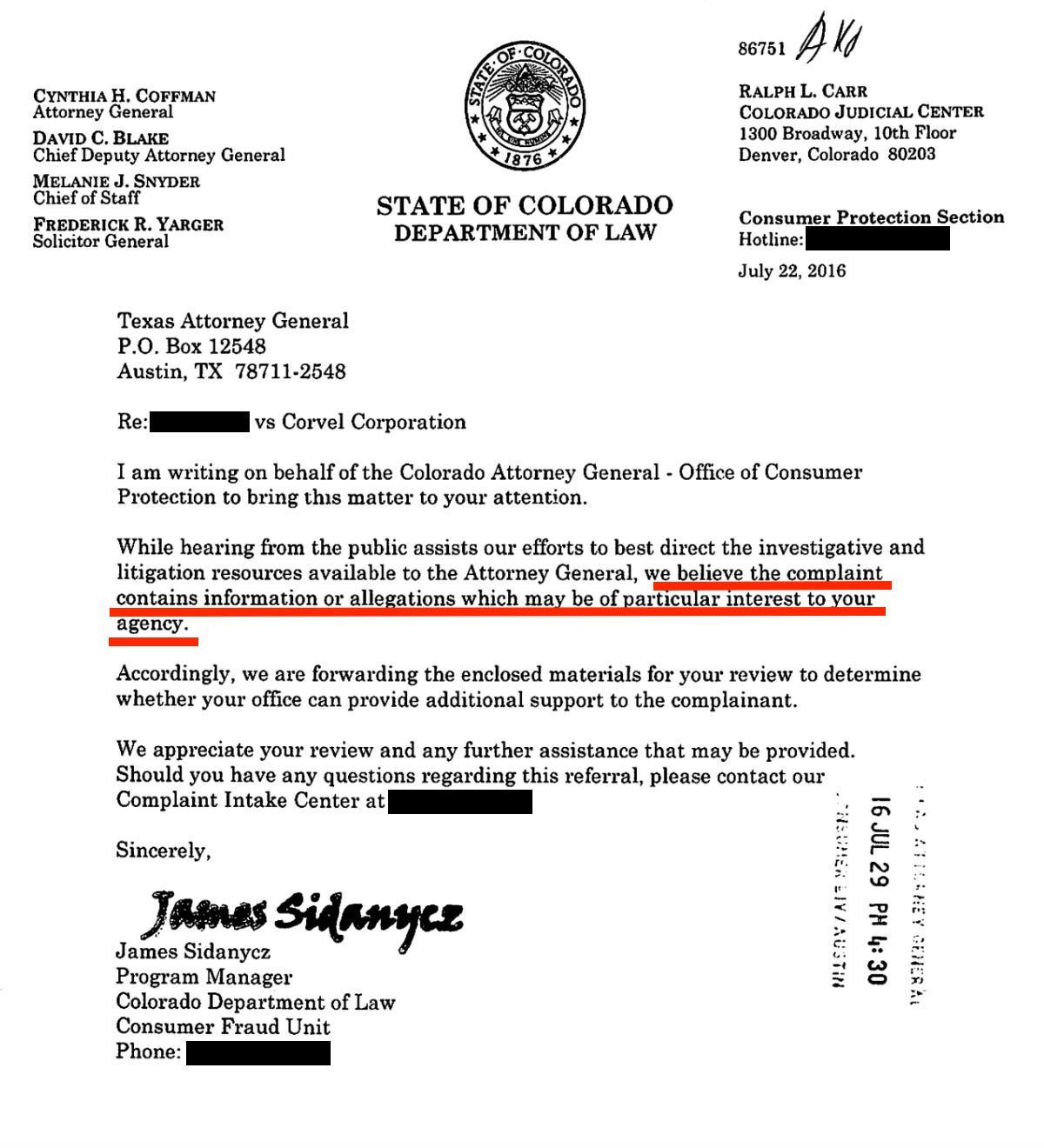

As part of my research, I filed public records requests for documents related to CorVel. One of the documents I received was an interagency referral between the Colorado and Texas Attorneys General about CorVel:

In my opinion, interagency letters like this, when combined with other public evidence, suggest CorVel might be unreasonable in denying or delaying claims.

On its website, CorVel notes that its practices save money. CorVel stresses that these payment reductions are due to its “early intervention strategy.” From CorVel’s own whitepaper:

“Another example of savings resulting from an early intervention strategy comes from one of CorVel’s clients, Pasadena Unified School District, who reduced disability payments by 50 percent…”

Conclusion

In my opinion, the market has not adequately scrutinized CorVel. The company trades around 25x earnings and has de minimis short interest. I hope this article provides a good starting ground for anyone interested in researching CorVel. For now, you can count me a skeptic.

If you are not currently on The Bear Cave email list please consider joining here.

All the best,

Edwin