Diamonds Aren’t Forever

The diamond industry is dying.

Three weeks ago, The Bear Cave highlighted the disruption from lab-grown diamonds, which are chemically, optically, and physically identical to natural diamonds but much cheaper and environmentally sustainable. The Bear Cave wrote, “The trend of lab-grown diamonds is accelerating quickly [and] will cause a strong devaluation in both mined and lab-grown diamond prices.”

Today, the situation is even worse.

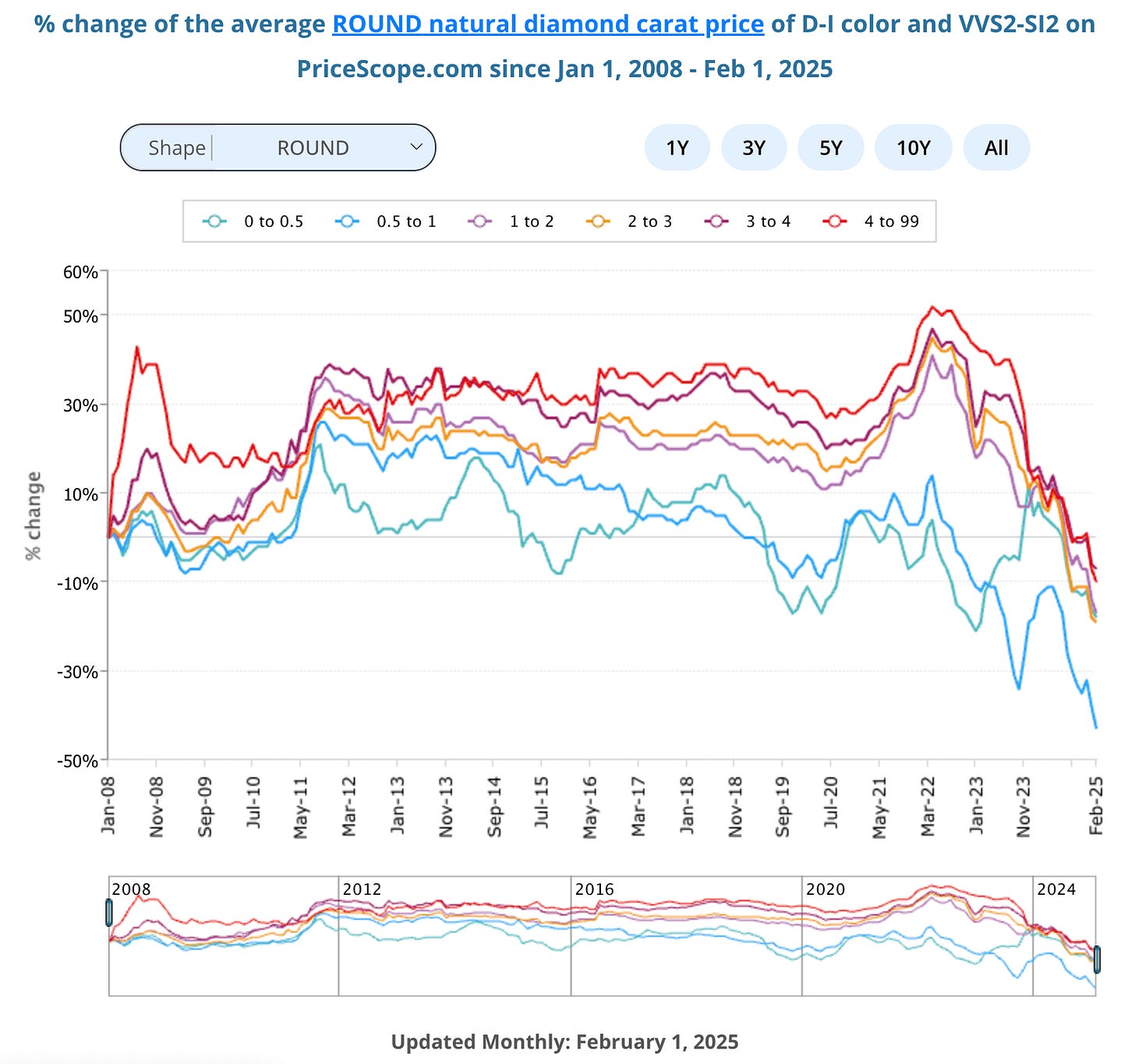

PriceScope, which calls itself “the largest diamond and jewelry community,” publishes average price data for the 1.2 million mined diamonds listed on its platform.

Its data, ranging from small diamonds under 0.5 carats to larger ones over 4 carats, was updated on February 1 and shows another steep decline in diamond prices:

Recent reporting suggests even more problems ahead.

A January 18 article in the Guardian titled “Mined diamonds are a waste of money, an expert says” interviewed Steve Richards of Australian Diamond Wholesale Brokers, who said,

“I’m a gemologist and a diamond technologist and I’ve been doing it for 30 years and if you put one next to the other I wouldn’t have a freakin’ clue which is lab-grown… I wouldn’t buy mined diamonds again; you’re wasting your money.”

The article also stated:

“Market participants told Guardian Australia that a one-carat natural diamond, triple excellent – excellent cut, excellent polish and excellent symmetry – wholesales for about $3,500. A lab-grown equivalent wholesales for about $250, or one-fourteenth the price.” (Emphasis ours)

Likewise, a Bloomberg article published two days ago titled “The $80 Billion Diamond Market Crash Leaves De Beers Reeling” reported that many diamond buyers of De Beers were “furious and alienated.” The article continued:

“Last year, De Beers for months refused to lower its diamond prices even though the rest of the market was collapsing — and so many of its customers simply refused to buy. When it finally capitulated in December, the cuts were seen as too little, too late…”

“[De Beers] had capitulated with a cut of between 10% and 15%. But De Beers rough diamonds were still far more expensive than diamonds in the secondary market, where traders and manufacturers sell among each other… Again, buyers were left fuming.”

“What started as a post-pandemic slump has spiraled out of control so that even in a market renowned for boom and bust cycles, industry veterans say the crisis is the worst they’ve ever seen.”

“Trade buyers and industry experts estimate that between $30 million and $40 million a month of excess polished diamonds are being dumped back into the Indian wholesale market by Chinese retailers, with about $700 million in total flowing back to India. More than $1 billion has recirculated in China, they say.”

“De Beers has also committed to spending more on promoting diamonds than at any point in the past 15 years.”

Women are happily shifting away from mined diamonds.

World’s Your Oysta is a women-focused podcast on “navigating career shifts and balancing ambition with self-care to cultivating joy in the everyday.” The September 6 2024 podcast is with Leah Silberman, the founder of Elle Perahia, which sells “high-quality fine jewelry using lab diamonds and solid gold. Made for the modern, chic woman.”

The host, Paula Sanders, asks Ms. Silberman if she would want a lab-grown engagement ring. The exchange exemplifies the shift of younger women away from mined diamonds.

Ms. Silberman: “It’s so funny you ask that. At this point, I can’t imagine getting a natural diamond. And if you asked me that a year ago, I probably would have said I want a natural diamond for an engagement. But at this point, I can’t really justify it. I mean, get me a lab-grown ring, and then let’s talk other things. Let’s go on a great trip after and do all of these other things.” (36:12)

Ms. Sanders (host): “Honestly, it’s so true. Diamonds just feel antiquated to me. In this day and age, there are so many other things I want. If I can have a three-and-a-half carat emerald-shaped diamond for a third of the price and go on an amazing trip instead and spend three nights in Hôtel du Cap, I would so much rather have that. Because who even cares and who even knows [if you have a lab-grown]?”

Ms. Silberman: “Exactly, nobody is coming up to you and saying ‘is this natural?’”

The Bear Cave believes collapsing prices, internal industry turmoil, and consumer sentiment shifts all mark the beginning of the end for the diamond industry.

The Bear Cave has identified two $1 billion+ U.S. companies, several small international diamond miners, and an entire country set to be significantly harmed by the downfall of diamonds.

They are: