Even More Problems at DraftKings (DKNG)

The Bear Cave has published three articles about DraftKings (NASDAQ: DKNG — $13.6 billion) in recent months, highlighting competitive risks posed by prediction markets like Kalshi:

“Problems at DraftKings (DKNG)” (September 18, 2025)

“More Problems at DraftKings (DKNG)” (October 2, 2025)

“Betting on Tomorrow: A Primer on Prediction Markets” (November 6, 2025)

DraftKings stock is down ~36% since our first article, and The Bear Cave believes its value proposition is even less compelling today.

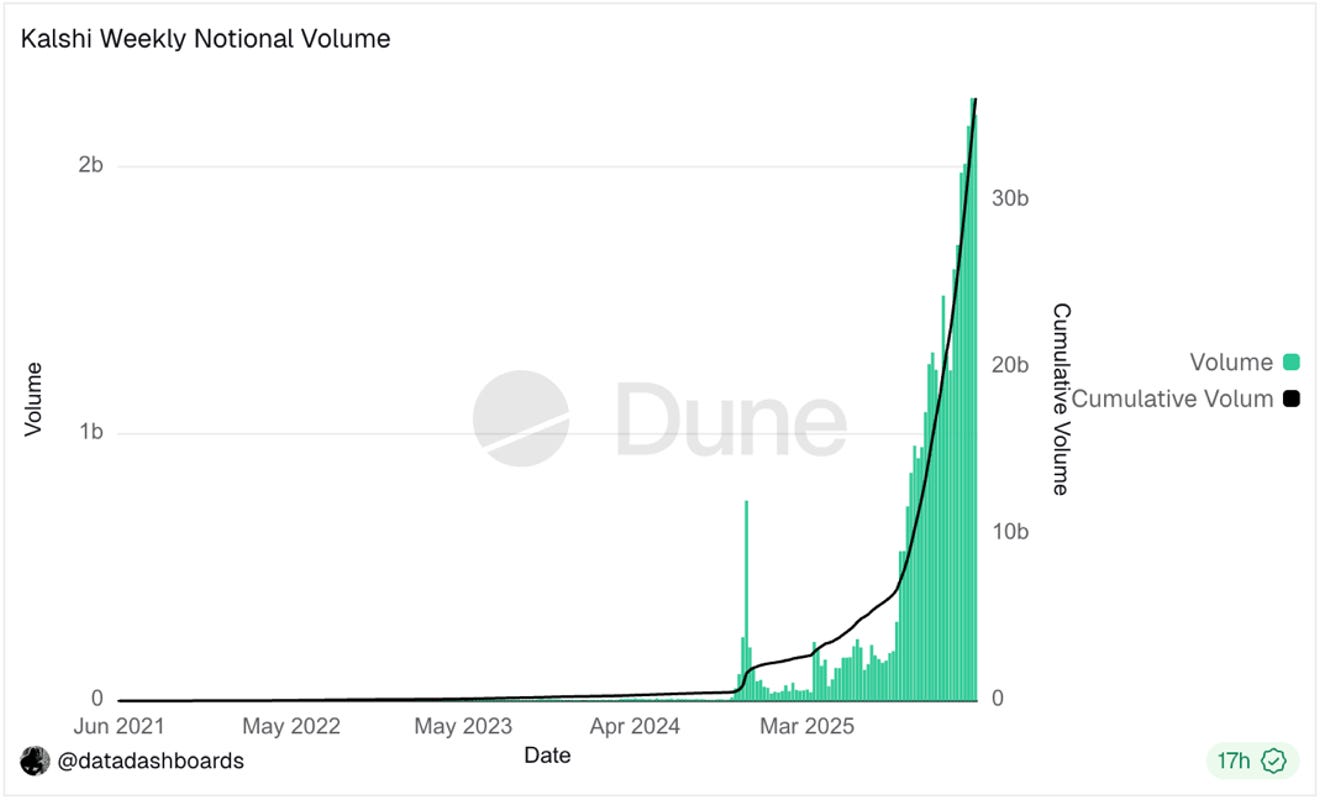

Kalshi’s execution has exceeded expectations, while DraftKings continues to fall short. The Bear Cave believes the gap in execution and long-term business model disruption will become painfully obvious to DraftKings investors in the coming months.

Kalshi’s growth is fueled by ad campaigns, earned media, social virality and, above all, superior depth, breadth, and distribution compared to traditional online sportsbooks.

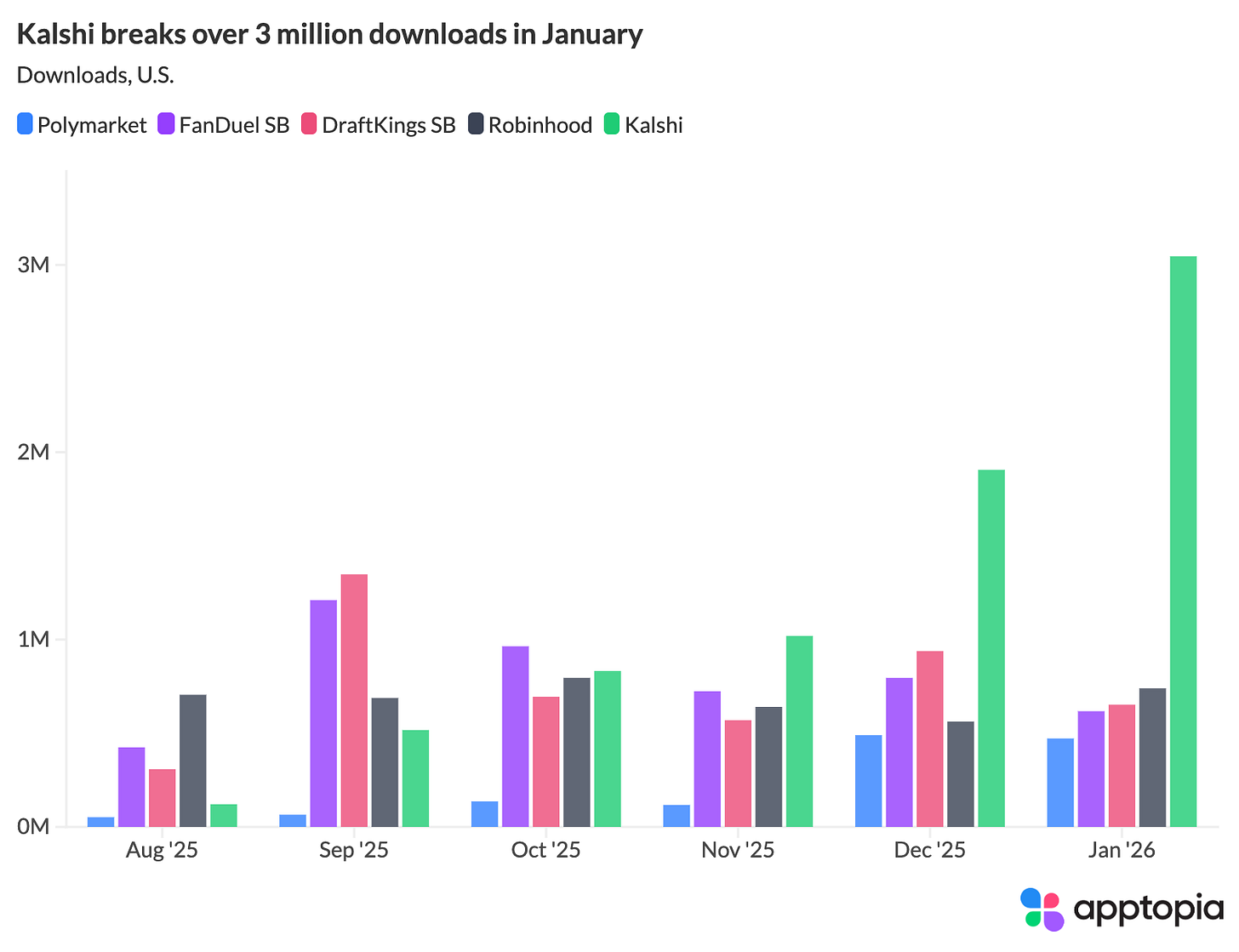

The results speak for themselves:

Kalshi’s depth is evident in its order books. For example, the Kalshi market on the Super Bowl winner can accept a $5 million+ Yes bet on either team without moving the price a cent.

Kalshi’s breadth is evident in the types of bets available within its markets. For example, Kalshi now offers active markets for point spreads, over/under totals, player touchdowns, and custom combos (parlays) on its main platform and, as of January 16, through Robinhood.

Kalshi also hosts novelty markets on what the announcers will say during the game, which brands will advertise during the Super Bowl, who will attend the Super Bowl, and who will perform with Bad Bunny during the halftime show, among many others. These markets, which are generally not available on DraftKings, as well as Kalshi’s array of non-sports markets, provide another source of differentiation.

Why bet on DraftKings when you can get better odds, bigger bets, and more betting options on prediction markets like Kalshi?

Consumers are voting with their fingertips.

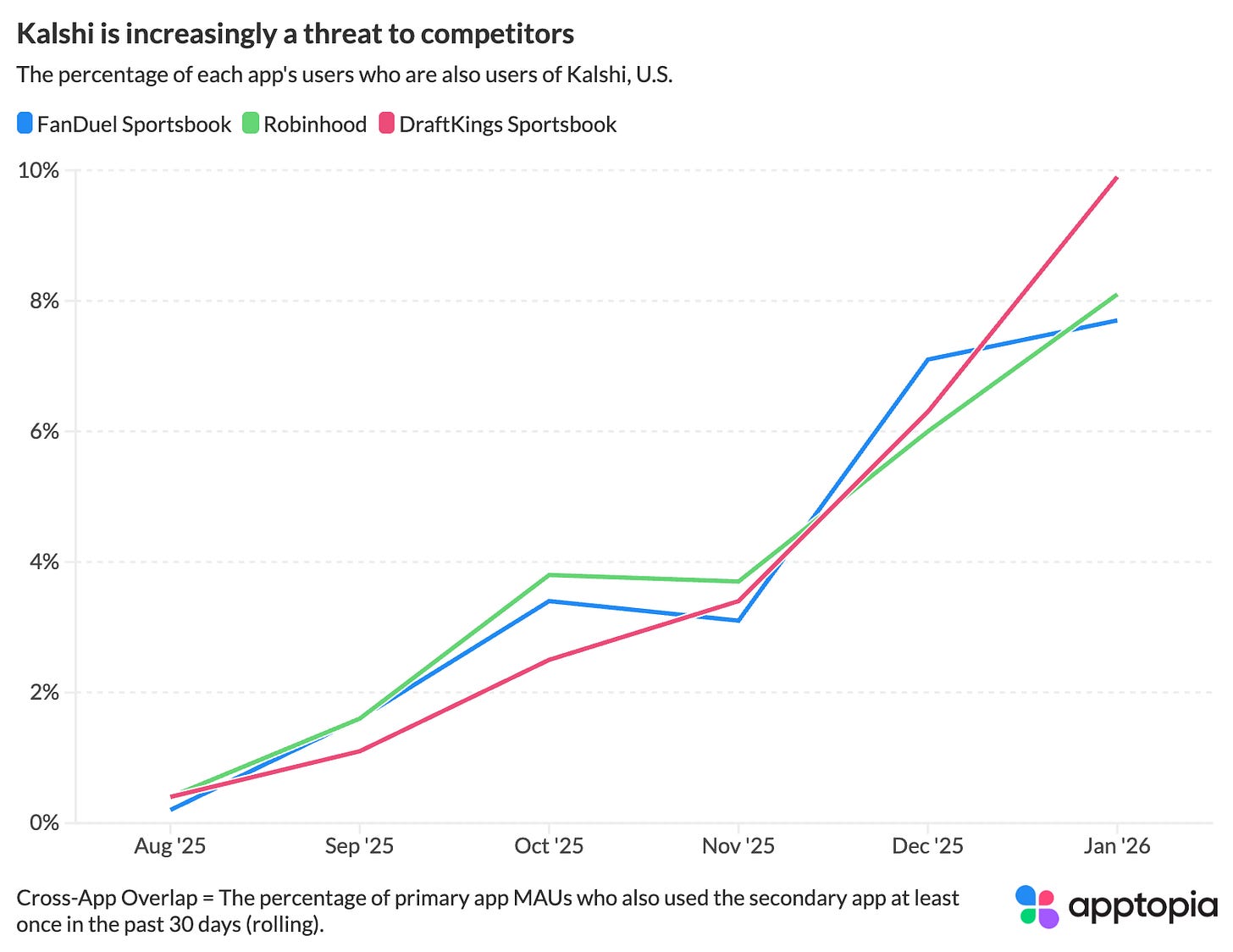

Users who download Kalshi are often also customers of legacy sportsbooks like DraftKings. According to a February 3 analysis from Apptopia:

“Apptopia’s consumer device panel is able to measure cross-app overlap, or the percentage of one app’s users who are also using another app. About 10% of DraftKings Sportsbook app users were also using Kalshi in January. The cross-app overlap between Kalshi and the major sportsbooks has been growing almost every month since August.”