Our 2024 Hedge Fund Analyst Christmas List

A list of the best free and paid resources for professional investors

The Bear Cave has curated the best resources for professional investors, featuring new tools, government databases, emerging managers, and underfollowed accounts for idea generation. Enjoy the list; our regular newsletter returns this Sunday!

A+ Free Resources

SEC Full-Text Search — Search through 20 years of SEC filings for specific terms, people, or entities.

PCAOB Auditor Search — Find the auditor and specific audit partner for any company, as well as their track record. Use the search bar in the top right and click auditor search.

Google Advanced Search — Use Google’s advanced search filters to find unique information. For example, filter by time for older results or search for: [Company name] filetype:pdf site:.gov to bring up interesting government records related to the company.

Wayback Machine — A non-profit that regularly archives millions of the most visited sites. Use it to see how a site or specific webpage changes over time.

Webpage Archive — An alternative to the Wayback Machine that makes it incredibly easy to archive digital webpages. It often has several archives of media articles the week of publication, making it easy to track any changes over time.

Perplexity AI — Powerful AI agent that can often provide answers when Google fails.

Diffchecker — Compare any two bodies of text for potential differences (e.g., compare a company’s 2023 and 2024 risk factor disclosures).

IBorrowDesk — Website with stock borrow rates and short availability.

SocialBlade — Follow the social media growth of a company or individual. Two other strong alternatives include HypeAuditor and ViewStats (YouTube only).

Glassdoor — Go reverse chronological and read through all reviews, pay extra attention to complaints about toxic work environment, sales culture, leadership, turnover, and fraud allegations. Also, look to see if reviews are evenly spaced or clustered around a day or week (a sign the reviews may be manipulated).

BBB — A non-profit consumer review and business accreditation site. Will often issue public alerts for particularly problematic businesses.

SiteJabber — Wide collection of consumer reviews for online businesses.

TrustPilot — Another good consumer review site.

ReverseWHOIS — Shows you all websites registered to a particular company/email. For example, here is a list of ~12,000 public web domains owned by Apple.

PACER — Find lawsuits against any company or individual.

Court Listener — Search millions of legal decisions by case name, topic, or company.

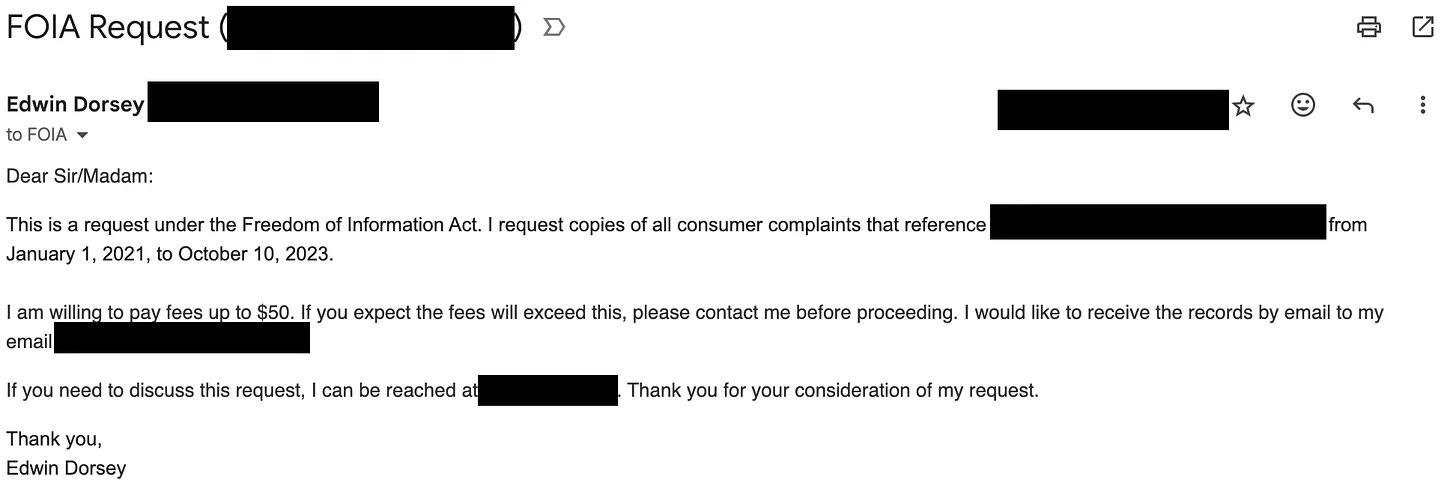

FTC Freedom of Information Act requests — The Freedom of Information Act (FOIA) allows any U.S. citizen to request records from government agencies. The Bear Cave frequently sends FOIA requests to the FTC (FOIA@FTC.gov) to obtain copies of consumer complaints. Here’s a template for inspiration in your own research process. Learn more about the Freedom of Information Act on FOIA.gov

Hacker News — Search through the Y Combinator message boards for any company or topic to see what Silicon Valley thinks.

10x EBITDA — A compilation of many hedge fund activist presentations.

X/Twitter — Amazing platform for equity research. Search by ticker and limit the search to “people you follow” to find high-quality tweets.

SEC comment letters — On EDGAR, search for a company then “CORRESP” or “UPLOAD” in the document type search to find SEC comment letters, which are a type of informal correspondence between the SEC and public companies that bring up unique issues.

Google Alerts — Set Google email alerts for news related to a specific company. For example, The Bear Cave has Google alerts set for when “Roblox” and “arrest” are used in the same news release.

Google Trends — Long-term trends in search volume for certain terms on Google.

Reddit — Often will have surprisingly good content from industry experts or former employees.

TikTok — Great place to search for consumer sentiment on any brand/company.

LinkedIn — See employees, their former workplaces, and how they know each other (e.g., red flags: CFO went to the University of Phoenix or bank loan officers previously worked for banks that failed).

Value Investors Club — Public platform to share stock write-ups.

ImportYeti — Search 70 million U.S. customs sea shipment records instantly.

“The Sketchy Companies Paying YouTubers to Promote Their Stock” — Outstanding investigation exposing the anatomy of stock promotion schemes on YouTube.

“The Makings of a Multibagger” — Amazing Alta Fox Capital case study on 104 multi-bagger stocks.

Useful Databases

CFPB Consumer Complaint Database — Searchable database of millions of consumer complaints to the Consumer Financial Protection Bureau.

SEC FOIA Logs — SEC’s monthly disclosures about FOIA requests the SEC receives. Learn more about the value of SEC FOIA logs here and here.

Wisconsin Department of Financial Institutions FDD database — Find nearly any Franchise Disclosure Document (FDD) for franchisors that do business in Wisconsin. For example, view McDonald’s FDD here (downloadable at the bottom of the page).

Open Payments Data — Centers for Medicare & Medicaid Services database to search payments made by drug and medical device companies to physicians for speaking fees, consulting fees, and meal reimbursements.

CMS Drug Spending — Centers for Medicare & Medicaid Services database to provide greater transparency on spending for drugs in the Medicare and Medicaid programs.

Open Corporates — Quickly find the executives, board members, or state registration for private businesses. Go to the Department of State filing search for more information on any entity.

Federal Procurement Data System — Searchable database of U.S. government purchase orders. Great for researching military/government contractors.

NYC Health Restaurant Inspection Scores — Easily search for health inspection scores by restaurant chain.

U.S Energy Information Administration — Independent statistics and analysis about U.S. energy.

Manufacturer and User Facility Device Experience (MAUDE) Database — MAUDE is a searchable database of medical device reports of adverse events involving medical devices over the last ten years.

BrokerCheck by FINRA — A free tool to research the background,

experience, and disciplinary history of financial brokers, advisers and firms.FDIC Search Form — Searchable database of FDIC enforcement actions.

ClinicalTrials.gov — Searchable database of clinical research studies. Website maintained by the National Institutes of Health.

RankMyHotel — Database from government sources on hotel revenue figures for each hotel in the state of Texas.

A+ Paid Resources

EdmundSEC — An AI-powered platform with two primary use cases. First, EdmundSEC has an earnings transcript summarizer that highlights and cites the important insights from any earnings call. Second, EdmundSEC has a powerful search functionality allowing keyword searches for a company’s SEC filings, earnings calls, and conference transcripts — more powerful than a simple SEC Full-Text Search. In addition, EdmundSEC allows users to keyword search through all the filings and transcripts of public companies.

For example, with the help of AI from EdmundSEC, The Bear Cave reviewed earnings and investor day transcripts from the ~1,000 largest public companies for their commentary around AI and call centers.

Here’s what some of EdmundSEC’s customers are saying:

Join us and test EdmundSEC here or use code “BEARCAVE” for an extra 15% off their already affordable plans (~$240/year). The Bear Cave uses EdmundSEC more than any tool on this list and we have an affiliate deal with the platform.

TIKR — An institutional-grade investing platform for individuals. Discover & research 100,000+ global stocks with the highest-quality data and tools. The Bear Cave uses TIKR frequently and we also have an affiliate deal with the platform. TIKR has lots of free functionality and plans as low as $12/month.

Tegus — A powerful platform that lets you find dozens of expert network calls on any company in seconds. Great for rapidly learning about any new company/industry. ($$$)

InsiderScore by Verity — Track and screen management changes, auditor changes, buybacks, and insider buying. The Bear Cave uses InsiderScore by Verity to help generate our weekly summaries of notable executive departures. ($$)

VisualPing — Get alerts for changes made to any website. For example, The Bear Cave occasionally uses VisualPing to see if a company changes executive bios or website disclosures. ($)

Canary Data — A new database created by a former Tiger Cub short analyst that tracks millions of data points to evaluate investment risk and risk of illegal or unethical behavior by management. Increasingly adding functionality and everyone we know loves it. ($$$)

PodIntel — A new AI-powered startup that continuously listens to podcasts 24/7, identifying and categorizing every mention of companies to uncover actionable financial insights. PodIntel can generate specific company reports highlighting the most relevant podcasts and key insights for investors. PodIntel formally launches soon. Learn more here and join their email list for early access. ($)

Seeking Alpha Premium — The comment section on Seeking Alpha articles is still very active and often has sophisticated investors sharing worthwhile information. In our view, the comments, not the articles, are what makes Seeking Alpha worth paying for. ($$)

Honorable mentions include:

Blue Sky Advisors — A consulting firm that works with large asset managers “to address bad corporate behavior in a way that creates lasting reforms, promotes long-term shareholder value, and reduces securities litigation costs.” Blue Sky is looking to expand their advisory services with hedge funds and activist investors and has particular expertise in governance matters. Reach out here.

Maiden Financial — A recently launch boutique equity research service producing long-form research reports on under-analyzed and out-of-favor companies. Led by a very talented and thorough analyst, Gwen Hofmeyr.

Snowball Research — The best research idea generation service you’ve never heard of. India-based Snowball provides a monthly monitor of special situations and shares a curated list of 10-15 high-potential U.S. stocks under $5 billion market cap. Email raghu@snowballresearch.com if you are interested in a trial or their sample work.

Wappalyzer — Find out the technology stack of any website.

Bollwerk AI — Early-stage AI research platform, worth watching for a formal launch soon.

Daloopa — Platform that makes financial modeling easier and faster.

List of Short Activists

Below are all the short report authors summarized in The Bear Cave this year:

Black Mamba Research (Website, @blackmambashort)

Bleecker Street Research (Website, @Bleecker__St)

Blue Orca Capital (Website, @blueorcainvest)

Bonitas Research (Website, @BonitasResearch)

Capybara Research (Website, @CapybaraShort)

Citron Research (Website, @CitronResearch)

Culper Research (Website, @CulperResearch)

DF Research (Website)

Fuzzy Panda Research (Website, @FuzzyPandaShort)

GlassHouse Research (Website, @GlassH_Research)

Gotham City Research (Website, @GothamResearch)

Grizzly Research (Website, @ResearchGrizzly)

Hindenburg Research (Website, @HindenburgRes)

Hunterbrook Media (Website, @hntrbrkmedia)

Iceberg Research (Website, @IcebergResear)

J Capital Research (Website, @JCap_Research)

Jehoshaphat Research (Website, @JehoshaphatRsch)

Kerrisdale Capital (Website, @KerrisdaleCap)

Muddy Waters Research (Website, @muddywatersre)

NINGI Research (Website, @NingiResearch)

Old Time REITster (Website)

Safkhet Capital (Website, @SafkhetCapital)

Scorpion Capital (Website, @ScorpionFund)

Snowcap Research (Website, @SnowCapResearch)

Spruce Point Capital (Website, @sprucepointcap)

Sunshine Research (Website, @sunshine_rsrch)

The Friendly Bear (Website, @FriendlyBearSA)

Viceroy Research (Website, @viceroyresearch)

Wolfpack Research (Website, @WolfpackReports)

View a list of all the accounts on X here.

Honorable mentions include @AureliusValue and @QCMFunds (both of whom haven’t published in the last year), journalist Herb Greenberg, who shares L/S ideas on his Substack, and former hedge fund manager Leo Perry, who recently started posting short ideas on his Substack.

X Accounts For Idea Generation

Most Underfollowed

@Taocentric12 — Former healthcare executive, talking about healthcare stocks (123 followers)

@MultiplesCap — Hospitality executive and investor sharing occasional ideas (257 followers)

@accelerationcap — Former OpenAI engineer with infrequent but smart tech tweets (278 followers)

@CousinGraig — Equity ideas (449 followers)

@BrokenMoats — Smart L/S investor (465 followers)

@vikasxkumarbk — Senior Editor at The Capitol Forum, great actionable tweets (784 followers)

@glbeaty — Smart L/S investor (846 followers)

@ParthenosCap — Smart fund manager, up ~750% since January 2019 launch (1,163 followers)

@red_dog_capital — L/S ideas and microcaps (1,399 followers)

@emo__girl_ — L/S analyst with interesting ideas (1,400 followers)

@TheWinklerGroup — Shares interesting nuggets from SEC filings (2,766 followers)

@finphysnerd — Individual investor, global L/S ideas (2,823 followers)

@catechwilliams — Very smart L/S equity ideas (3,223 followers)

@PharmakoiBoy — Short research, with forensic accounting focus (4,020 followers)

@Jaro_rogue — L/S mid-cap fund manager (4,929 followers)

View a list of all these accounts on X here.

Must Follows

@laurenbalik — Independent researcher, great long/short tech ideas

@Seawolfcap — Phenomenal L/S financials investor

@RagingVentures — L/S ideas and more from Bill Martin

@orrdavid — L/S fund manager, independent thinker

@RealJimChanos — The OG

@CrosscheckC — L/S generalist with a focus on airlines/industrials/shorts

@AlderLaneEggs — Prolific short-seller Marc Cohodes

@PD13158196 — Unique short ideas

@BlueDuckCap — L/S equities

@rsandler21969 — CIO of Eminence Capital, large L/S equity fund, occasionally shares ideas

@maninapurpledr1 — Exposing small caps/pump and dumps

@winsteadscap — L/S equities

@partners_road — Anonymous L/S hedge fund manager

@GMTResearch — Exposing Asian frauds and promotes

@Mike10947310 — Extremely smart microcap investor

@ActAccordingly — Independent research provider

@NonGaap — Actionable tweets about governance and disclosure changes

@ParrotCapital — Deep due diligence into frauds and misconduct

@FriendlyBearSA — The Friendly Bear short research

@AureliusValue — Very smart independent short-seller

@DeepSailCapital — L/S equities

@akramsrazor — L/S tech ideas

@PhilTimyan — Smart long/short financials investor

@gatorcapital — Very smart L/S financial investor

@colarion — Financials fund manager

@CorpusCol — Financials investor

@ChrisCamillo — Smart investor, good at following social media trends

@stockgutter — Short ideas and stock promotions

@AltayCapital — L/S equities and overseas investing

@EricTheUmpire — L/S equities

@OddDiligence — L/S event-driven trading

@unemon1 — L/S equities

@Craig_McDermott — L/S equities

@OnodaCapital — L/S equities

@BigRiverCapita1 — L/S equities, longtime MPW skeptic

@adamfeuerstein — Biotech reporter

@MartinShkreli — Former biotech exec convicted of securities fraud, now sharing specific stock short ideas

@blondesnmoney — Smart L/S trader

@footnoted — Expert on SEC filings and oddities

@VetTechTrader — Longtime tech investor

@guastywinds — L/S equities

@TheBenSchmark — L/S equities

@irbezek — Independent, Latin American equity ideas

@Capitol_Forum — Publication for policymakers and hedge funds on corporate misconduct and competition

@taubamush — Short ideas and stock promotions

View a list of all the accounts on X here, and find even more accounts on last year’s list here. And apologies in advance to the many great accounts we missed.

Emerging Managers Worth Watching

@Jaro_rogue — Rogue Funds, Small/Mid-Cap (Idea Brunch interview)

@blueoutliercap — Blue Outlier, value/special situations (Idea Brunch)

@orrdavid — Militia Capital, global L/S, (Idea Brunch)

@natstewart5 — N.A.S. Capital, value/small-caps (Idea Brunch)

@aaronjsallen — Merion Road, small-caps (Idea Brunch)

@Mike10947310 — Independent, small-caps (Idea Brunch)

@HindeGroup — Hinde Group, high-quality compounders (Idea Brunch)

@gatorcapital — Gator Capital, L/S financials (Idea Brunch)

@fin_capital — Findell Capital, L/S small-caps (Idea Brunch)

@Josh_Young_1 — Bison Capital, Oil/value investing (Idea Brunch)

@rgrfan — RF Capital, global equities (Idea Brunch)

@SafkhetCapital — Safkhet Capital, concentrated shorts (Idea Brunch)

@WorchCapital — Worch Capital, L/S growth-oriented (Idea Brunch)

@JeffreyCherkin — Tourlite Capital, L/S equity (Idea Brunch)

@PhilTimyan — Independent, community banks (Idea Brunch)

@stoic_point — Stoic Point, L/S equity and de-SPACs (Idea Brunch)

@JonCukierwar — Sohra Peak, concentrated global equities (Idea Brunch)

@LaughingH20Cap — Laughing Water, value-oriented (Idea Brunch)

@Seawolfcap and @VD718 — Seawolf Capital, L/S (Idea Brunch)

@hkuppy — Praetorian Capital, concentrated special situations (Idea Brunch)

@1MainCapital — 1 Main Capital, high-quality growth (Idea Brunch)

(View a list of all the accounts on X here.)

Christian Putz of ARR Investment Partners, (Idea Brunch)

Dan Roller of Maran Capital, value/compounders (Idea Brunch)

Theodore Rosenthal of TMR Capital, L/S equity (Idea Brunch)

Brain Bellinger of Monimus Capital, L/S equity, (Idea Brunch)

Lawrence Creatura of PRSPCTV Capital, small-cap value (Idea Brunch)

Connor Haley of Alta Fox Capital, very smart, L/S equity

Jamie Sterne of Skye Global, very smart, L/S tech

Rob Romero of Connective Capital, L/S equity and tech (Idea Brunch)

Michael Melby of Gate City Capital, Microcaps (Idea Brunch)

If you know of a great emerging manager who should be included on this list or featured on Sunday’s Idea Brunch, please reach out to edwin@585research.com

Newsletters for Idea Generation

Doomberg — The best energy & finance commentary

The Captain’s Log — Lauren Balik shares actionable ideas

Nat Stewart — Small-cap value ideas

Citrini Research — Smart thematic L/S equity ideas

NonGAAP — Actionable insights into corporate governance matters

Unemon — Sporadic differentiated L/S investment ideas

The Technology Letter — Interviews with the CEOs/CFOs of major tech companies

The Diff — Inflections in tech and finance

Net Interest — Financial sector insights from a former hedge fund manager

Behind the Balance Sheet — Investment ideas and professional thoughts from a retired hedge fund partner

Bison Interests — Oil and gas commentary

1 Foot Hurdle — Cheap Japanese stocks

Altay Capital — Cheap Japanese stocks

Value Zoomer — L/S equity ideas

Mostly metrics — A CFO draws back the curtain on metrics

Overlooked Alpha — Differentiated stock ideas

Chief’s Substack — A smart trader shares ideas

Timyan — Phil Timyan on bank stocks

Pernas Research — L/S equity ideas

Market Sentiment — General market research

310 Value — Compounder/value ideas

Clark Square Cap — Overlooked stocks and special situations

John Hempton’s Newsletter — Thoughts from L/S investor John Hempton

Generals and Workouts — Benjamin Graham style deep-value ideas

Stock Narratives — Smart microcap ideas

NoNameStocks — Smart nanocap ideas

Other Great Lists

If you are looking for even more great resources, check out this resources list from Clark Square Capital (and his tweet on free sell-side research), Malhar Manek’s list of import/export tracking tools, this list from Idea Hive, Dan Schum’s resource list on nanocap research tools, Thomas Chua’s resource toolkit, and this list of additional databases for tracking trends.

Please leave a comment with any great resources or accounts we missed. And if you found this list useful, please consider forwarding The Bear Cave to a friend, gifting a subscription, or purchasing The Bear Cave for your firm. Each reader makes a big difference.

Thank you for your support and happy holidays!

Until Sunday,

Edwin

Great list, thanks Edwin!

This is an A.M.A.Z.I.N.G. compilation!!