Allegro MicroSystems (NASDAQ: ALGM — $7.45 billion) describes itself as “a leading global designer, developer, manufacturer and marketer of sensor integrated circuits.” Investors believe the company is a play on the electric vehicle revolution, a bet on the growth of clean energy, and a special situation trading at a discounted price. In reality, Allegro MicroSystems is rife with conflicts and irregularities including numerous executive resignations, two auditor dismissals, and a major supplier that is owned by the company’s largest customer and controlling shareholder.

For a sense of the peculiarities surrounding Allegro MicroSystems, investors can turn to the company’s most recent 10-Q, filed for the quarter ended December 23, 2022. (Yes, December 23.) Allegro MicroSystems discloses, in part,

“The company sells products to, and purchases in-process products from, Sanken. As of December 23, 2022, Sanken held approximately 51.5% of the company’s outstanding common stock.”

“Sanken” refers to Sanken Electric (Tokyo: 6707), a large Japanese semiconductor conglomerate that began reducing its ownership of Allegro in October 2017 by selling a stake to private equity firm One Equity Partners followed by an IPO in October 2020. By being a controlling shareholder, supplier, and customer, Sanken might be incentivized to engage in non-economic transactions (e.g., supplying goods below market) in order to help inflate the value of its publicly traded Allegro stake.

One area of concern for investors could be Polar Semiconductor, a joint venture owned 30% by Allegro and 70% by Sanken. Polar Semiconductor is an important supplier for Allegro and on the company’s March 14, 2023 analyst day, Allegro CFO Derek D'Antilio said,

“On the front end, we source wafers from 3 fab partners, approximately 50% of our wafers are sourced from UMC in Taiwan, 30% to 40% from Polar Semiconductor in Minnesota and the remainder from TSMC.”

Further exemplifying the intertwined nature of Sanken, Allegro, and Polar is a recent contract between Allegro and Polar that was signed by Allegro CEO, Vineet Nargolwala, and Polar CEO, Kojiro Hatano. Mr. Hatano also serves on the board of Allegro and is an employee of Sanken. It is unusual for public companies to sign supplier agreements with their own board members.

But are these sales between Polar and Allegro done at fair market rates?

The Bear Cave believes not.

One simple test to determine whether Polar is transacting at market rates is to look at Polar’s profitability. Because Allegro owns a 30% stake in Polar, Allegro disclosed on page F-11 of its 10-K filed 2022 that its Polar investment “is included on [Allegro’s] balance sheet as an equity investment in a related party, including $1,007 and $1,413 of income earned during the fiscal years ended March 25, 2022 and March 26, 2021.” From this, investors in Allegro can see that Polar was modestly profitable, with Polar’s profits declining as Allegro’s dealings with Polar grew.

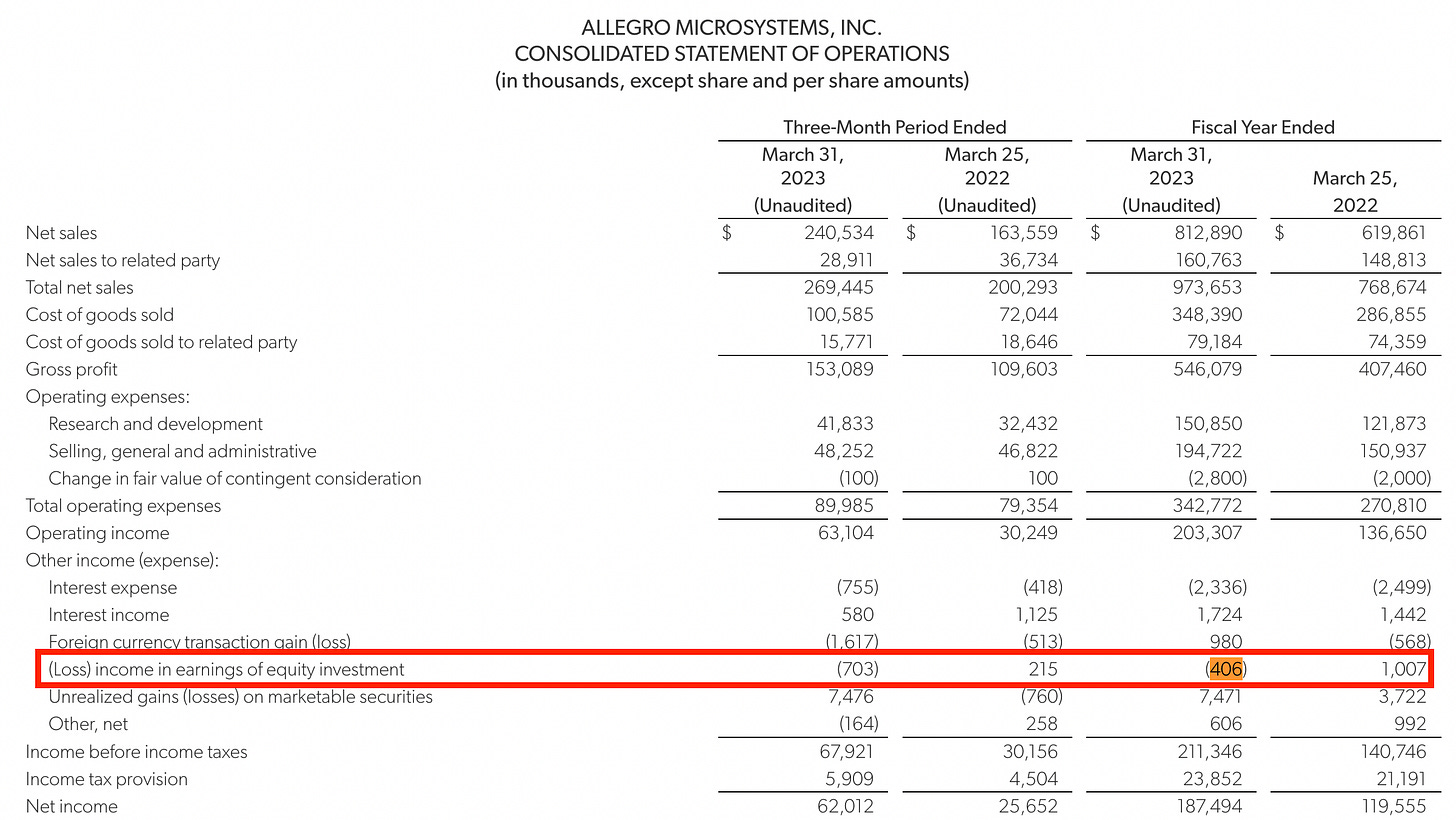

In its May 10, 2023 press release for the recent fiscal year ending March 2023, Allegro released new financial results and disclosed that its “income in earnings of equity investment” from its 30% stake in Polar produced a $406,000 loss!

In short, publicly traded Allegro makes money and its related-party supplier, Polar (which is majority owned by Sanken), loses money.

Other peculiarities abound.