Betterware de Mexico (NASDAQ: BWMX — $1.36 billion) is a Mexican MLM and one of the best performing SPAC deals since its March 2020 listing. The company has reported triple-digit sales growth and claims to have “1,230,699 active associates,” more than six times the number of employees of Walmart Mexico, the country’s largest employer. Since November 2019, the company has switched auditors, had three different CFOs, disclosed numerous material weaknesses, received a 34-point SEC comment letter, and seen its stock rise ~300%.

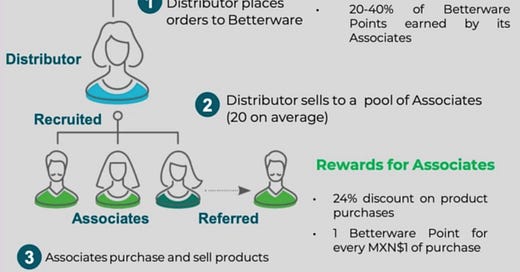

Formed in 1995, Betterware de Mexico (herein “Betterware”) sells backpacks, water coolers, cutting boards, and other similar products through a multi-level marketing model. Betterware sells to distributors, who then sell to associates, who resell to end customers or consume the products themselves. Below is a slide explaining Betterware’s two-tier sales model:

In January 2019, Betterware’s chairman approached a Mexican SPAC sponsor (DD3 Capital Partners) about potentially going public through a SPAC. That deal was ultimately consummated with Betterware’s March 2020 merger and public NASDAQ listing. Since then, Betterware has reported triple-digit sales growth and shares are up ~300%. However, a close review of public filings, transcripts, and company documents raise potential concerns.

In October 2019, the SEC sent Betterware a 34-point comment letter that questioned its SPAC merger disclosures. The SEC wrote, in part,

“EBITDA is typically further adjusted for items that are non-recurring in nature. Please tell us why you believe your presentation of Adjusted EBITDA, with the exclusion of employee benefits, is appropriate.”

Betterware responded,

“The Company previously believed that these employee benefits could be excluded because they represent variable bonuses to employees, but after further assessment of their nature, the Company determined that they occur on an annual basis and has revised the disclosure.”

The SEC also wrote,

“We note your disclosure that… Deloitte [conducted] a tax due diligence of Betterware, and… that ‘[n]o material risks were found,’ and… ‘they consider that Betterware reasonably complied with their tax obligations for the fiscal year 2018.’ Please provide the written consent of Deloitte as an exhibit to your registration statement or tell us why you do not believe you are required to do so.”

Betterware responded,

“In response to the Staff’s comment, the Company has revised the disclosure to delete references to the findings and conclusions.”

The SEC wrote,

“We note your disclosure that ‘Betterware received an Employee Net Promoter Score of 69 (out of 100) as of 2018, higher than those of top companies like [A]didas, [T]rip [A]dvisor and American [E]xpress.’ Please disclose the entity that provides companies with this Employee Net Promoter Score.”

Betterware responded,

“In response to the Staff’s comment, the Company has revised the disclosure… to remove the reference to the Employee Net Promoter Score.”

The SEC wrote,

“Please clarify the percentage of Associates that are ‘final consumers’ versus ‘the selling point with other clients.’”

Betterware responded, “In response to the Staff’s comment, the Company has revised the disclosure on page 128 of Amendment No. 1.” The revised disclosure reads:

“Betterware cannot know with certainty what percentage of Associates are final consumers versus the selling point with other clients because its selling procedure does not provide this information.”

The SEC also wrote,

“We note your disclosure that, in connection with preparation of Betterware’s combined financial statements, material weaknesses in internal controls over financial reporting have been identified, and that ‘Betterware has begun taking measures to remediate the underlying causes of the material weaknesses.’ Please briefly describe the measures taken by Betterware, and any measures Betterware intends to take in the future, to remedy these weaknesses in internal controls.”

On December 23, 2019, two months after receiving the SEC comment letter and one week before the year-end, Betterware “dismissed KPMG Cárdenas Dosal, S.C as our auditors” and “approved the appointment of Galaz, Yamazaki, Ruiz Urquiza.”

In February 2020, Jose del Monte departed as Betterware’s CFO. He had joined just ten months earlier, according to his LinkedIn.

Mr. Monte was replaced by Gustavo Rodarte. Mr. Rodarte signed Betterware’s 2019 financial statement Sarbanes-Oxley disclosures on May 4, 2020. At some point in 2020, Mr. Rodarte departed as Betterware’s CFO. His experience at Betterware is not listed on his LinkedIn.

Rodarte was replaced as CFO by Diana Jones, 39, sometime in 2020 – Betterware’s third CFO that year.

In its most recent annual report Betterware disclosed multiple material weaknesses:

“The material weaknesses are mainly… as follows: (i) we have not completed the design and implementation of an effective risk assessment to identify and communicate appropriate objectives and fraud, and identifying and assessing changes in the business that could affect our system of internal controls, (ii) we did not design and implement effective control activities to adequately select and develop control activities and objectives for information and related technologies, (iii) inadequate segregation of duties over system changes management process, lack of analysis of useful lives of assets, lack of management review regarding the identification of significant non-recurring or unusual transactions. Additionally, during our assessment of internal control over financial reporting, we identified deficiencies, and based on their nature, management considers that these deficiencies individually represent significant deficiencies.” (Page 47 of 20-F)

To address its material weaknesses Betterware created “a review process of financial and internal control information with our board of directors.” One of those directors is Santiago Campos, the 29-year-old younger brother of Betterware’s CEO, Andres Campos. Santiago Campos was selected “due to his natural instinct in product innovation.” Their father, Luis Campos, is the board’s chairman.

NASDAQ Rule 5605(b)(2) requires of U.S. companies that “independent directors meet regularly in executive sessions at which only independent directors are present.” Because Betterware is based in Mexico, it does not need to follow this rule. Instead, Betterware discloses, “non-management directors are not required to meet in executive sessions without management.”

In its most recent annual filing Betterware’s auditor, Galaz, Yamazaki, Ruiz Urquiza wrote,

“As part of our audit, we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Group’s internal control over financial reporting. Accordingly, we express no such opinion.”

The engagement partner responsible for auditing Betterware’s 2019 financials, Ramón Alvarez Cisneros, has never audited another U.S. listed company according to PCAOB records. Mr. Cisneros was replaced on the 2020 audit by Jose Gerardo Castillo Morales, who also has no experience auditing U.S. listed companies according to PCAOB records. Galaz, Yamazaki, Ruiz Urquiza is an affiliate of Deloitte and was fined $750,000 in 2016 for “failing to effectively implement quality control policies” after being sanctioned in 2010.

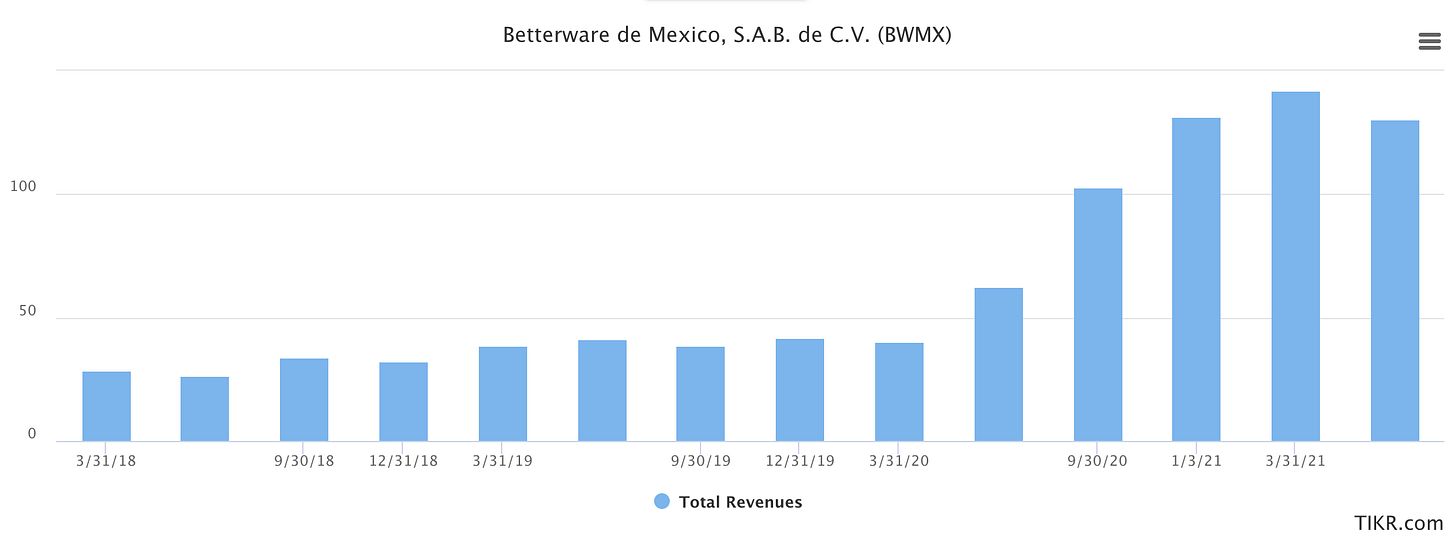

Nonetheless, Betterware’s shares have risen from about $10 following its March 2020 merger to $37 today. The rise is largely due to exploding sales growth from ~USD$47million in Q1 2020 to ~USD$129 million in Q2 2021.

Betterware’s reported inventories more than tripled from ~USD$17 million in 2019 to ~USD$63 million in 2020 and sales grew 135%. Despite this, the company curiously did not need to expand its distribution center presence.

“We lease premises of approximately 26,318 square meters.” 2019 annual report

“As of January 3, 2021, we leased premises of approximately 26,318 square meters.” 2020 annual report

Some analysts have raised concerns about other oddities at Betterware. In its Q4 2020 conference call, a private investor asked management:

“How has Betterware been able to maintain days payables over 120 days when 90% of your goods come from China? Almost all supply relationships in China are within 2-month terms, with majority requiring upfront deposits.”

Management responded that “the banks are the ones who pay the money upfront to the vendor and then we have to pay the bank in 120 days.” For comparison, Walmart’s days of payables is ~43 days and Costco’s is ~36 days.

The analyst also highlighted potential disparities between import data and Betterware’s cost of goods sold:

“ABRAMS world trade data shows that Betterware has imported $182 million in total value of shipments for 2013 to today. Your COGS numbers, just in the last 3, 4 years, is $300 million… how do you explain this gap?”

In response, Betterware’s CEO said, “We don't know the source you are talking about… our Investor Relations team will get back to you.”

Betterware currently trades at 2.5x reported revenue and 27x reported net income.

Caveat emptor.

This article is not investment advice and represents the opinions of its author, Edwin Dorsey. You can reach the author by email at edwin@585research.com. This article is for premium subscribers of The Bear Cave newsletter. If this article was forwarded to you please consider becoming a premium subscriber to receive articles like this twice every month. Learn more here.