Problems at Canoo (GOEV)

Problems at Canoo (GOEV)

Canoo (NASDAQ: GOEV — $1.93 billion), an electric car prototype company, has had a slew of resignations, self-dealing, consistent losses, a shifting business plan, and has been rife with conflicts. Since going public through a SPAC in December, Canoo’s co-founder and CEO, CFO, General Counsel, and Head of Corporate Strategy have all resigned. Employee reviews describe a company in crisis and the company’s Q4 earnings call proved disastrous.

When Canoo began its SPAC merger process, it planned to lease electric cars in a subscription model, “the Netflix of cars.” The company recently pivoted toward making fleets for commercial uses. Below are Canoo’s projected prototypes:

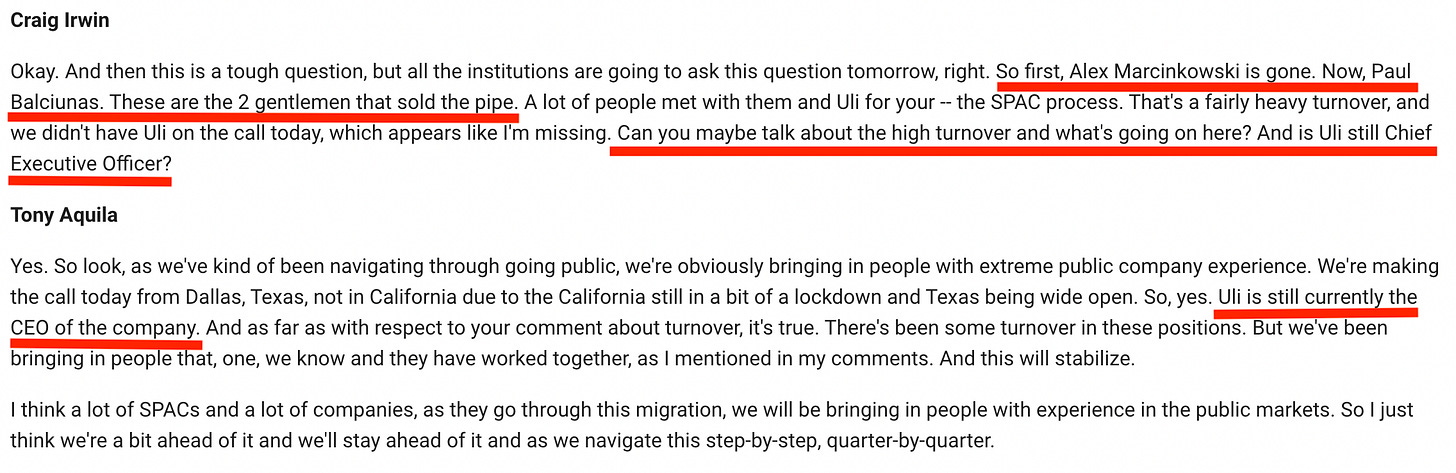

Canoo’s aspirations have proven challenging. On its Q4 earnings call, the company told investors that its partnership with Hyundai had fallen apart. On the call, Roth analyst Craig Irwin asked if Uli Kranz, a former BMW engineer and Canoo cofounder, was still CEO.

Uli Kranz, who did not participate in the earnings call, resigned less than a month later. That left executive chairman Tony Aquila to take over as CEO.

Mr. Aquila has been party to numerous lawsuits that should raise concerns for investors. Aquila was previously CEO of Solera, an automotive data company that was acquired by Vista Equity Partners. Mr. Aquila later sued Solera for unpaid compensation after being fired. In a response dated September 2019, Solera wrote (C.A. No. 2019-0702-SG),

“Solera terminated Aquila’s employment in May 2019 for cause.”

“Following the take-private transaction, Aquila’s leadership failures and misplaced spending priorities, among other things, led to Solera missing its plan objectives. Aquila’s brash, vulgar, and belittling comments to colleagues resulted in significant personnel turnover, including in the executive ranks. A 2018 investigation initiated after a complaint from one of Aquila’s subordinates uncovered aggressive and abusive behavior by Aquila in violation of Solera’s code of conduct, substantiated by Aquila’s own admissions.”

“Over the next six months, Aquila spent the significant amounts of time flying Solera’s jet around the world at Solera’s expense to raise money for his next venture.”

Aquila’s lawsuit was dismissed, but the problems raised from the litigation appear to be occurring again at Canoo.

For example, Canoo paid Aquila $541,000 as a reimbursement for travel he did on his own jet for company business in 2020. Canoo also entered a five-year lease in an office facility owned by Mr. Aquila. The total proceeds over five years will exceed $1.2 million.

Canoo also signed a 15-year, $1.8 million per year, lease for office space from Remarkable Views Torrance, LLC. Remarkable Views is owned by Victor Chu, a roughly 17% shareholder of Canoo.

A week after Uli Kranz resigned as CEO, Andrew Wolstan, who had served as Canoo’s General Counsel for three years, resigned on April 30, 2021. He was replaced by Hector Ruiz, who previously worked at Solera for 9 years in tax compliance.

Incidentally, this is not the first time Mr. Aquila has had problems with company lawyers. In August 2020, Aquila was sued by Ryan Aprill, a lawyer he hired and then allegedly stiffed on salary and bonuses (Case: 1:20-cv-04657):

“At the meeting Aquila attempted to retract the terms of Ryan’s employment agreement.”

“Despite repeated promises of payment of compensation by Aquila, neither AF Ventures nor AFV Partners paid any salary or bonuses to Ryan.”

“Aquila reacted negatively to the conversation, became verbally hostile and accused Ryan of not trusting him. Thereafter, Aquila attempted to convince Ryan to accept a lower salary than previously agreed.”

“After reviewing AFV Partners’ current financial statements, Ryan learned that AFV Partners had been paying Aquila’s personal Gulfstream expenses without reimbursement.”

“As a result, Ryan grew concerned over Aquila’s use of company resources for his own benefit and his lack of adherence to corporate formalities at APG.”

During his tenure as executive chairman and now CEO, Aquila installed many of his former employees from Solera as executives as Canoo.

The Head of Total Rewards at Canoo, who joined in December 2020, was previously director of Global Benefits at Solera.

The VP of Investor Relations at Canoo, who joined in January 2021, was previously VP of Investor Relations at Solera.

The VP of Intellectual Property at Canoo, who joined in February 2021, was previously Chief Intellectual Capital Counsel at Solera.

The Administrative Assistant at Canoo, who joined in March 2021, was previously an administrative assistant at Solera.

Renato Ginger, the interim CFO of Canoo since March 2021, was previously CFO for Solera for about 17 years.

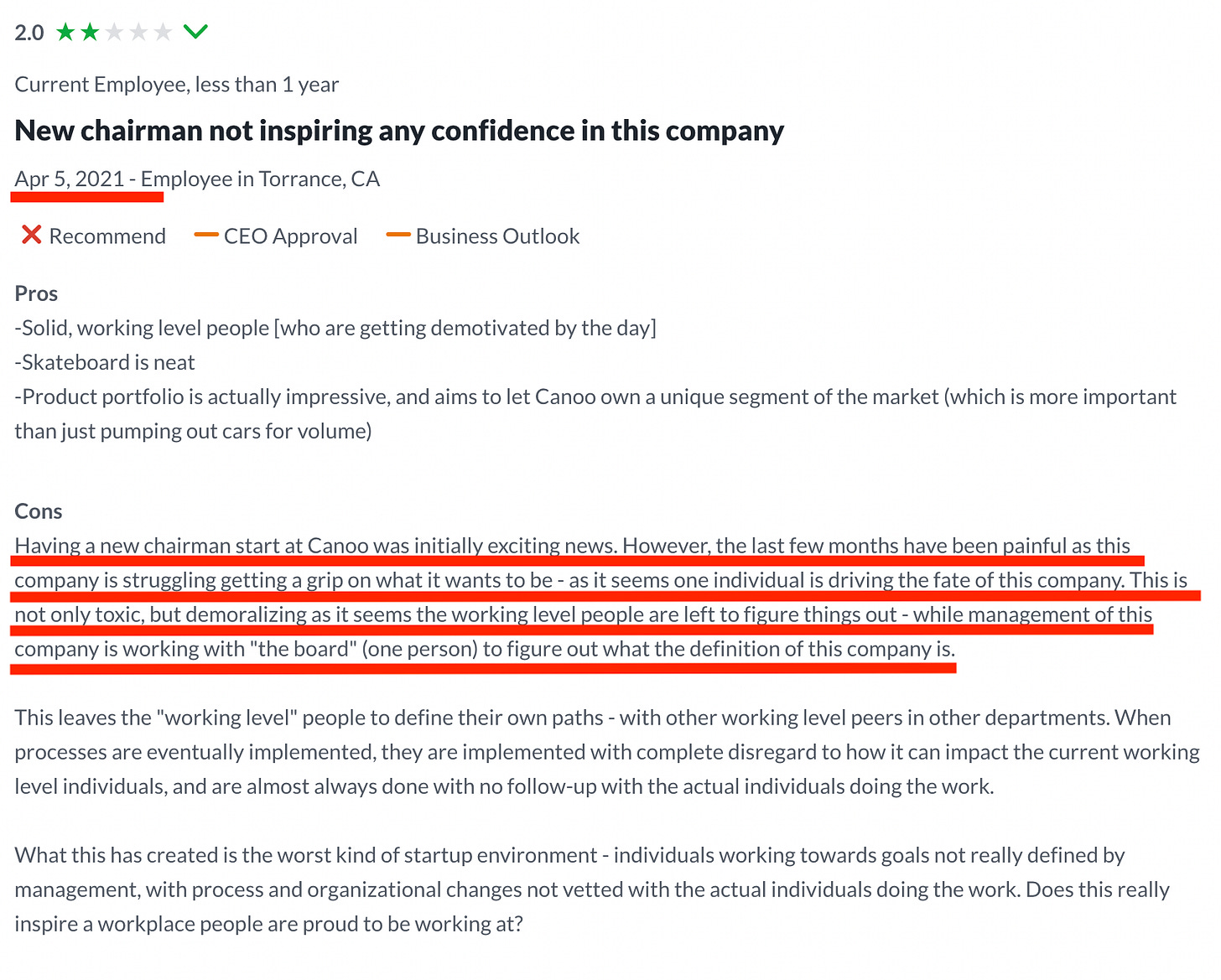

Aquila’s new team has received very critical reviews from Glassdoor:

Who is independently overseeing Aquila and his Solera friends at Canoo?

Thomas Dattilo is Canoo’s “lead independent director.” Canoo notes that “the position of lead independent director has been structured to serve as an effective balance to a combined Chief Executive Officer/Board chairman.” Inexplicably, Canoo fails to disclose that Dattilo was also a board member at Solera along with Aquila!

Last month, Canoo hired Tony S. Lee as the new Chief Administrative Officer. He is a peculiar choice for an electric car company. His LinkedIn Profile shows no experience in the electric car space and instead shows work for a family office and roles in asset-backed loans. Of note, Mr. Lee sued the estate of Tony Hsieh, the former Zappos executive, for $7 million. Mr. Lee claimed to be Hsieh’s “friend” and financial advisor and claimed he was promised a $1.5 million annual salary for five years.

The Wall Street Journal later reported, “Mr. Hsieh had offered to pay friends to move to Park City and work… jobs with vague descriptions; some collected salaries while doing little and living in his homes, and encouraged his drug and alcohol abuse.”

In sum, investors should view Canoo’s management team with healthy skepticism.

Canoo currently has around $700 million in cash, primarily from its SPAC merger and concurrent PIPE. The company has negligible revenue, $200 million in annual losses, and 35 pages of risk factors.

Regarding one risk factor, the SEC sent Canoo a letter that highlighted:

“We note that Section 10p. of your subscription agreement, filed as Annex H, contains a provision stating that ‘[E]ach party hereto hereby waives any right to a jury trial in connection with any litigation pursuant to this subscription agreement and the transactions contemplated hereby.’”

Caveat emptor.

This article is not investment advice and represents the opinions of its author, Edwin Dorsey. You can reach the author by email at edwin@585research.com. This article is for paid subscribers of The Bear Cave newsletter. If this article was forwarded to you please consider becoming a paid subscriber to receive articles like this twice every month for $44/month. Learn more here.