Problems at CuriosityStream (CURI)

Problems at CuriosityStream (CURI)

The paywall has been removed from our investigation into CuriosityStream. If you want investigations like this in your inbox twice a month, please become a premium subscriber of The Bear Cave.

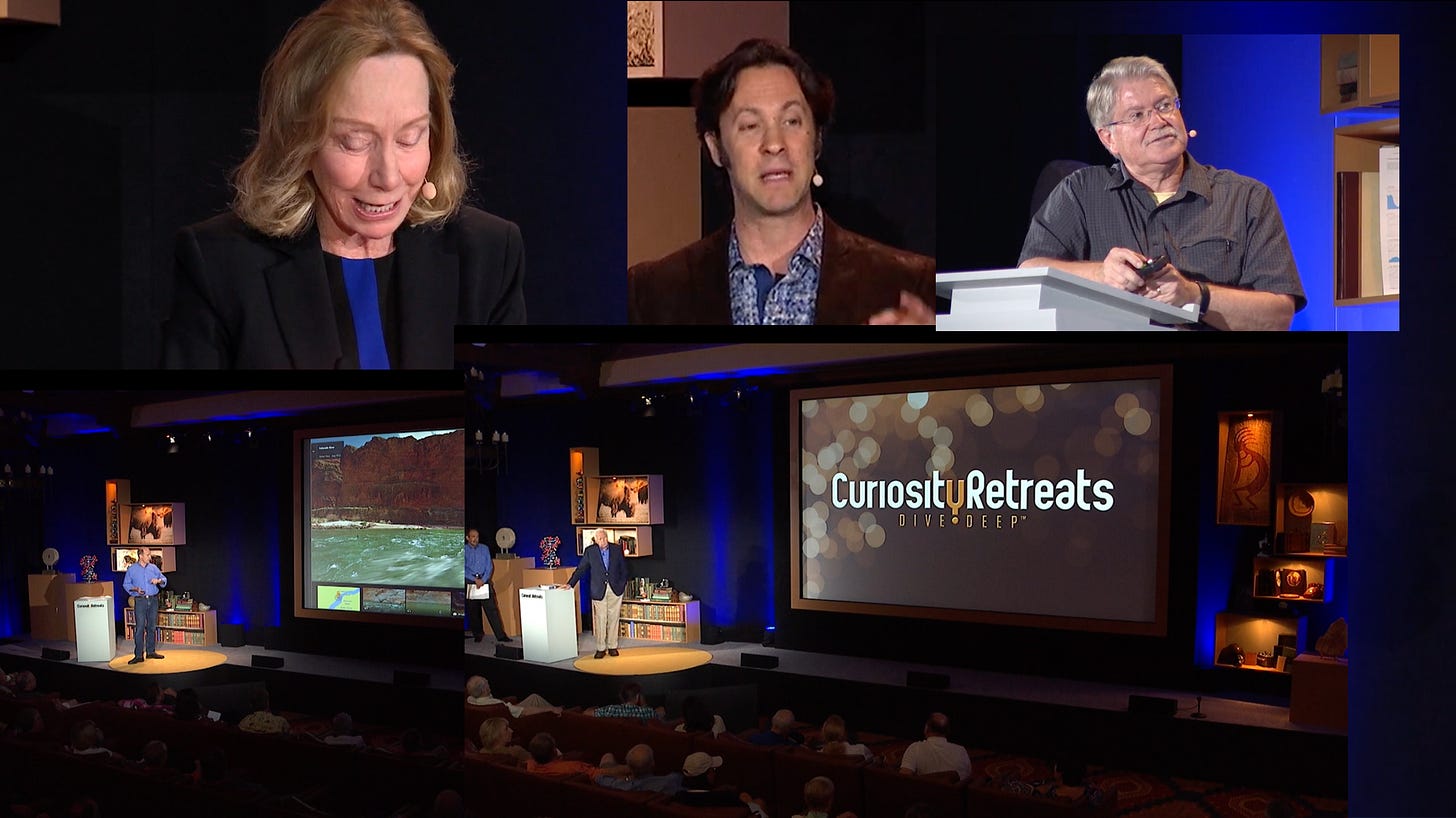

CuriosityStream (NASDAQ: CURI — $816 million) is an online streaming platform for educational documentaries. CuriosityStream stock has doubled since its November SPAC merger and the company tells investors it owns $1.3 billion worth of original content. In reality, most of CuriosityStream’s “documentaries” are less than three minutes long and much of the platform’s content is copied from public sources.

On slide two of its investor presentation, CuriosityStream tells investors that company-owned content has a “$1.3B estimated original production value.” CuriosityStream also discloses that it has 919 “original titles” for a rough value of $1.4 million per title.

I signed up for CuriosityStream’s service and cataloged its original content. The results are surprising.

Most of these “original titles” are three minutes or less. For example, “The History Of Telemedicine” is 93 seconds, “The Wright Brothers” is three minutes, “What Is A Meteor?” is 45 seconds, and “Planet Pluto” is 37 seconds.

Watch this 47-second documentary on “The Next Tech Revolution” and evaluate whether it is worth $1.4 million.

On slide 30 of its investor presentation, CuriosityStream also forecasted that it would have around 230 hours of original programming by the end of 2020, meaning the company values its original content at $5.65 million per hour. However, on the same slide CuriosityStream also discloses that it spends $158 thousand per hour of original productions!

An astute reader may be wondering how CuriosityStream can have 230 hours of original content if it has only 919 original titles, most of which are around 3 minutes. The answer is CuriosityStream also records dozens of hour-long academic lectures. These may be of value to some subscribers but they are certainly not worth $5.65 million per lecture.

In sum, CuriosityStream represents to investors that it owns $1.3 billion worth of leading and valuable content, when in reality it mostly produces three-minute YouTube-style videos and records hourlong lectures. CuriosityStream’s investor relations department told me the $1.3 billion estimate was made internally.

CuriosityStream also tells investors it licenses around 2,000 other “titles” for its streaming platform. On its first earnings call CuriosityStream’s CEO, Clint Stinchcomb, told investors:

“The thought I would leave you with about our content is its quality and its range. CuriosityStream programs to the full category of factual entertainment…. We have the unique competitive advantage of having a library that… is difficult to replicate.”

In a Bloomberg interview last year Mr. Stinchcomb also stressed the streaming platform’s high-quality exclusive content and said,

“At CuriosityStream we have premium factual programming that you really can’t find on YouTube okay.”

That is not true. For example, in its entrepreneurship section CuriosityStream displays a 47-episode interview-series conducted by David Rubenstein. Those interviews are public and widely distributed on the web, but CuriosityStream puts them behind its subscription paywall. In addition, the “European Inventor Awards” are public presentations available on the European Patent Office website and on YouTube. Likewise, the “Billion Dollar Flower Market” is also available on YouTube.

Taking free content from the web and marketing it behind a paywall is not a viable business strategy. CuriosityStream seems to agree because the company secured a Payroll Protection Program loan of $1.2 million last year. The company currently employs 59 full-time employees.

The CuriosityStream board is chaired by its founder, John Hendricks, who also founded the Discovery Channel. His daughter, Elizabeth Hendricks, also serves on the board. According to CuriosityStream’s prospectus, Mr. Henricks owns 52% of the company’s stock and “[served as] legacy CuriosityStream’s Chief Editorial Officer since October 2018.” Nonetheless, CuriosityStream considers both Mr. Hendricks and his daughter, who was also employed at the company, as “independent” directors.

Chairing CuriosityStream’s audit committee is Jonathan Huberman, who previously served on the audit committee of Breitling Energy in 2013 and 2014. In 2016 the SEC charged Breitling Energy and its CEO with a fraud scheme “dating back to at least 2011.” Mr. Huberman’s role at Breitling is omitted from CuriosityStream’s filings.

CuriosityStream currently trades around 20x its forecasted $40 million in 2020 revenue. The company is serially unprofitable and markets aggressively on YouTube, Facebook, Snapchat, podcasts, and elsewhere.

Unlike Netflix, Disney, Hulu, and HBO, which have no direct free competitors, CuriosityStream is competing against YouTube’s huge collection of free educational content. With the benefit of the pandemic and $40 million in 2019 advertising spend the company is still losing about $6 million per quarter. Most troubling is that CuriosityStream seems to misrepresent itself in its SEC filings.

Below is slide 24 of CuriosityStream’s September 2020 investor presentation. In the center is logo for “hooli” — a fictional company from the television show Silicon Valley.

CurisiotyStream’s investor relations team declined to explain the reference or whether it was a joke, but said the slide “is just an illustrative example of the different avenues that our content can be marketed.”

By comparing themselves to a fake company, CuriosityStream may have been telling investors a hidden truth.

This article is not investment advice and represents the opinions of its sole author, Edwin Dorsey. You can reach the author by email at edwin@585research.com. This article is for paid subscribers of The Bear Cave newsletter. If this article was forwarded to you please consider becoming a paid subscriber to receive articles like this twice every month for $44/month. Learn more here.