Hercules Capital (NYSE: HTGC — $1.79 billion) describes itself as “a specialty finance company focused on providing financing solutions to high-growth, innovative venture capital-backed companies in [the] technology, life sciences and renewable technology industries.” Investors view Hercules as a strong and attractive lender in these high-risk sectors, as evidenced by the BDC’s consistent premium to book value, hefty 12% dividend yield, and de minimis loan losses. The Bear Cave believes Hercules’s strength is a mirage.

The Bear Cave has uncovered numerous concerning portfolio marks in the Hercules loan portfolio. For example, a portfolio company that recently filed for bankruptcy was marked above par just two months ago, and many others Hercules portfolio companies appear to be in severe distress. These issues are compounded by a handful of board and executive departures, the bankruptcy of Hercules’s close competitor Silicon Valley Bank, and a six-month prison sentence for Hercules founder Manuel Henriquez’s role in a college admissions scandal.

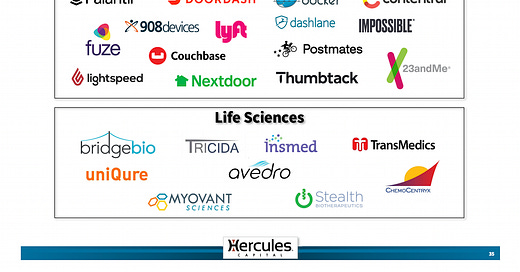

For a sense of how far Hercules Capital’s fortunes have fallen, investors can go to the company’s Q4 2020 investor presentation titled, “Microsoft PowerPoint - Q4 2020 Investor Pres Web Final 2.” In its presentation, Hercules says it is “financing the growth of tomorrow’s companies today” and highlights a collection of successful investments that had an equity or warrant component:

Hercules’s slide includes 13 companies that are public today. Since December 31, 2020, 12 out of the 13 companies have fallen at least 40%: Palantir Technologies (NYSE: PLTR) has fallen ~60%, DoorDash (NYSE: DASH) has fallen ~55%, 908 Devices (NASDAQ: MASS) has fallen ~85%, Lyft (NASDAQ: LYFT) has fallen ~80%, Lightspeed Commerce (NYSE: LSPD) has fallen ~80%, Couchbase (NASDAQ: BASE) has fallen ~50%, Nextdoor (NYSE: KIND) has fallen ~75%, 23andMe (NASDAQ: ME) has fallen ~80%, BridgeBio Pharma (NASDAQ: BBIO) has fallen ~80%, Insmed (NASDAQ: INSM) has fallen ~45%, UniQure (NASDAQ: QURE) has fallen ~50%, and Tricida (OTC: TCDAQ) has fallen ~99% and has since been deleted from the Hercules investor presentation.

More important than Hercules Capital’s $134 million equity portfolio is its $2.8 billion loan portfolio spread across about 120 portfolio companies. If you listen to management, all is well with the Hercules loan book. In its most recent February 2023 earnings call, CEO Scott Bluestein boasted,

“Hercules Capital delivered another strong year of record originations performance, record financial results and continued strong credit performance.”

Analysts seem to agree. On the earnings call, Kevin Fultz, an analyst at JMP Securities, said in part,

“Congratulations on a great year. Clearly, the portfolio credit quality is in excellent shape.”

John Hecht, an analyst at Jefferies, expressed a similar sentiment:

“You've had a history of extraordinarily low losses. And obviously, your current credit book is still really strong.”

But is the Hercules loan book actually strong, or does it just have the illusion of strength?