Problems at Silvergate Capital (SI)

Silvergate Capital (NYSE: SI — $868 million) describes itself as “the leading provider of innovative financial infrastructure solutions and services to participants in the nascent and expanding digital currency industry.” The company also frequently touts its Silvergate Exchange Network (SEN), a “proprietary, virtually instantaneous payment network” that has processed a total of over $1 trillion in transactions. The Bear Cave believes Silvergate’s potential regulatory infractions, shrinking deposit base, and diminishing credibility are not being fully recognized by the market.

In a July 2019 podcast interview, Silvergate’s CEO, Alan Lane, talked about the risks in banking the digital currency industry and said, in part,

“The biggest risk is that [Anti-Money Laundering] risk. So, the broad regulation, it's the Bank Secrecy Act. AML, KYC, it's all different ways of kind of saying the same thing, which is making sure that you know who your customers are and making sure that you're not in any way providing funding, financing etc for illicit activity… The penalties are fines and they can be really severe. You can essentially put the entire bank at jeopardy.”

Later in his interview, Mr. Lane again stressed the risks involved and said,

“The risk is real. All you need to do is watch a press conference, by the Secretary of the Treasury, to know that they're taking this seriously. I actually took some comfort in watching his press conference, because what he was basically saying is, if you're going to be doing this, you better be doing it right. So we certainly believe that we're doing it right… We joke that we're kind of like the good housekeeping seal of approval.”

A cursory glance suggests maybe not.

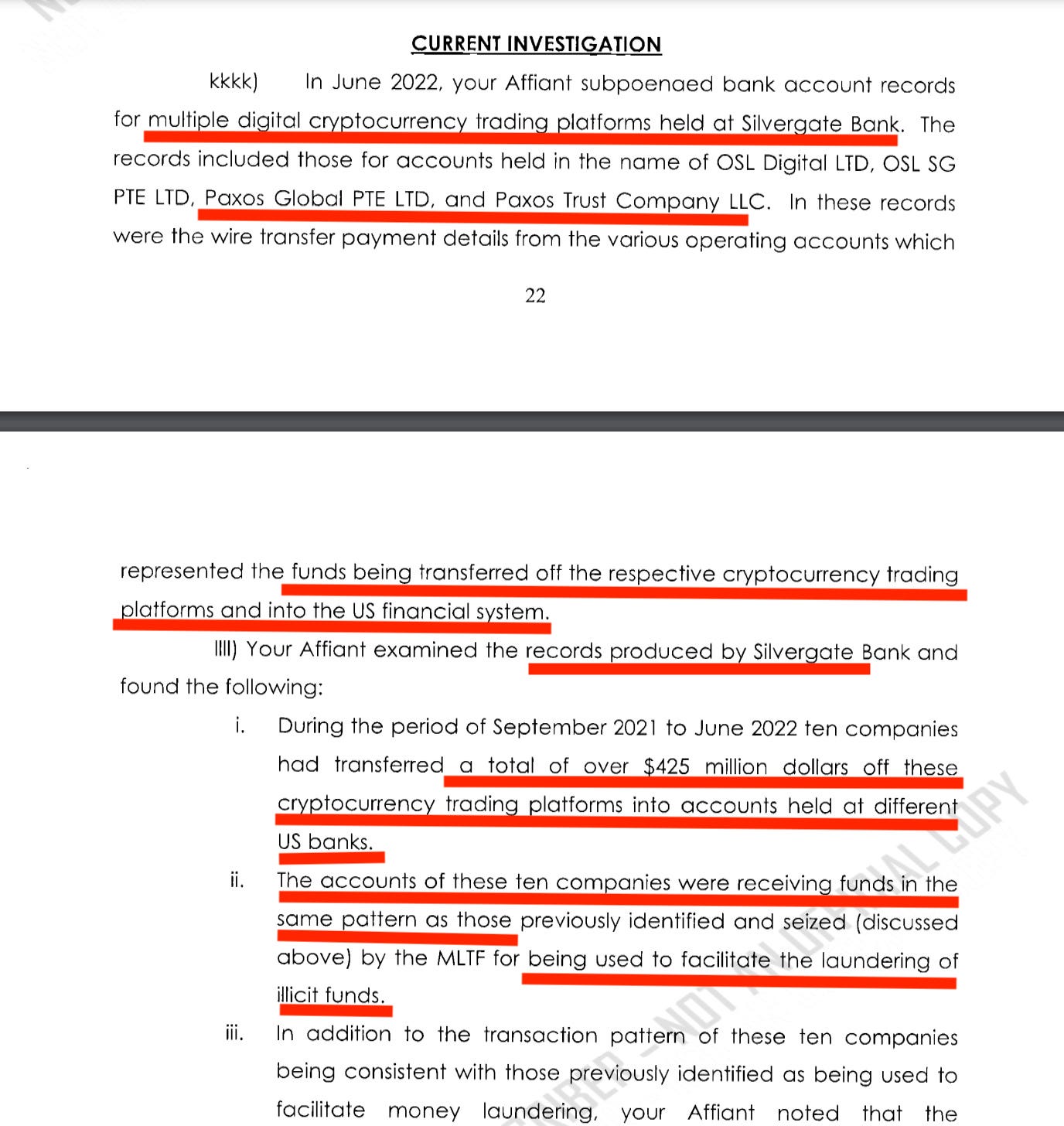

Two weeks ago, The Bear Cave highlighted an August 2022 forfeiture application for probable cause filed in Broward County that alleges Silvergate was connected to a money laundering operation. The filing, first highlighted by Marcus Aurelius Research, reads in part,

“Records produced by Silvergate Bank found: (i) During the period of September 2021 to June 2022 ten companies had transferred a total of over $425 million dollars off these cryptocurrency trading platforms into accounts held at different US banks. (ii) The accounts were receiving funds in the same pattern as those… used to facilitate the laundering of illicit funds.”

Another concerning case is a July 2021 plea agreement for Joel Greenberg filed in the Middle District Court of Florida, Orlando Division. The agreement states Mr. Greenberg “used interstate wires to transfer $200,000 from the account of the Tax Collector’s Office at Florida Capital Bank to Silvergate Bank” for the purpose of purchasing cryptocurrency.

Mr. Greenberg ultimately pled guilty to six federal charges including sex trafficking a minor.