Problems at The Joint Corp (JYNT)

Problems at The Joint Corp (JYNT)

The Joint Corp (NASDAQ: JYNT — $1.39 billion) describes itself as “a rapidly growing franchisor and operator of chiropractic clinics.” The company’s franchise base has grown from 309 clinics in 2016 to 555 today. Over that time, shares are up ~3,500% and currently trade at ~80x profit and ~40x franchise royalty and fee revenue. Investors believe the franchise network is healthy and has room to grow. The Bear Cave doesn’t.

Through numerous Freedom of Information Act requests, The Bear Cave has uncovered dozens of complaints concerning overbilling, forged transactions, and other misconduct. The Bear Cave believes The Joint has concealed struggles at the franchise level by acquiring weak franchises. In addition, The Bear Cave has uncovered an undisclosed related-party, Cowboy Chiro LLC, that makes debt and equity investments in The Joint franchises. One person described Cowboy Chiro as “a private bank for The Joint franchisees” and Cowboy Chiro’s certificate of formation shows “Joint Accounting” as the registered agent. The Joint has been overseen by five different CFOs and three different auditors since Roth Capital took the company public in 2014. The Joint’s audit chairman has also worked for other failed microcaps.

Franchisors like The Joint are required to provide potential franchisees a Franchise Disclosure Document (“FDD”), a legally mandated set of disclosures to help prospective franchisees evaluate their investment decision. The Bear Cave obtained a copy of The Joint’s 475-page 2021 FDD. It opposes the market’s rosy view of the company.

For example, The Joint’s FDD discloses that Eric J. Simon, Vice President of Franchise Development, filed for personal bankruptcy in 2014. The FDD also details The Joint’s 28 different fee types including a $39,990 initial franchise fee, 7% royalty fee, 2% advertising fund fee, audit fees, and a $599 monthly “computer system” fee that can be increased to $799 with a 30-day notice. If a franchisee is late on any royalty payment the balance accrues at 18% interest. In addition, The Joint requires franchisees to buy from certain vendors and credit card processors that send rebates back to the company.

The FDD also discloses that six franchisees in California sued The Joint “alleging breach of contract, breach of implied covenant of good faith and fair dealing, fraud, [and] negligent misrepresentation.” The lawsuit was settled in December 2016 for $800,000. The FDD currently requires franchisees to resolve disputes through mediation or litigation only in Arizona. The FDD warns,

“Out-of-state mediation or litigation may force you to accept a less favorable settlement for disputes.”

One thing The Joint bulls will highlight is the low level of store closures. According to the FDD, only eleven of The Joint franchises ceased operations or were terminated in 2019 and 2020, and nine more were re-acquired by the franchisor during that period.

In total, The Joint has re-acquired a total of roughly 50 franchises, including eight in April 2021. The Joint’s limited disclosures indicate the company is re-acquiring struggling franchises, which may temporarily conceal problems at the franchise level.

For example, in July 2019 The Joint re-acquired three franchises for a total of $1,650,000. On August 1, 2019, The Joint paid $750,000 to re-acquire one franchise. And on August 15, 2019, paid $325,000 to acquire another. These prices, ~$500k per location, indicate distress. At that level, the entire franchise base would be worth only ~$280 million.

The low prices go both ways. In 2017, The Joint sold six company-owned clinics to an existing franchise operator for $6—one dollar each. The merry-go-round of low-priced franchises is not the only way to conceal problems from investors.

Buried in one sentence of a form SC 14N filed in December 2018 with the SEC is the following disclosure:

“The Nominee is a minority investor in Cowboy Chiro LLC, which was formed to provide equity and debt financing for JYNT franchises, and is in the process of looking for franchise locations.”

That nominee is Glenn J. Krevlin, who runs Glenhill Capital Advisors and joined The Joint’s board and audit committee in 2019. According to an SEC Full-Text Search, “Cowboy Chiro” is not mentioned in any other SEC filing by The Joint. The Joint makes no reference to Cowboy Chiro or debt and equity investments in franchisees in its 10-Ks, 10-Qs, earnings calls, investor presentations, or other public material.

The Bear Cave purchased a copy of Cowboy Chiro’s Certificate of Formation from the Office of the Secretary of State of Texas for fifty cents. Surprisingly, the registered agent for Cowboy Chiro is not Mr. Krevlin or an independent investor; instead, it is The Joint’s own accounting department!

The certificate of formation discloses that the purpose of Cowboy Chiro is “any and all lawful business.”

To summarize, Mr. Krevlin, who joined The Joint as an “independent” director in 2019, invested an undisclosed amount into Cowboy Chiro LLC, an entity that was formed by The Joint in November 2018 to make loans and equity investments into The Joint franchises. Cowboy Chiro LLC’s assets and number of franchise loans are not currently known.

One person familiar with Cowboy Chiro told The Bear Cave:

“My understanding is that Cowboy Chiro operates as something of a private bank for The Joint franchisees.”

Mr. Krevlin previously served on the audit committee of Centric Brands Inc (CTRCQ), which went bankrupt, and served on the board of Restoration Hardware from 2001 to 2008. In July 2020, Mr. Krevlin and other defendants were sued for “self-dealing” and “breach of fiduciary duty of loyalty” according to The Joint’s FDD.

Serving on The Joint’s audit committee with Mr. Krevlin is Ronald V. DaVella, who is the audit chair. Mr. DaVella previously served as CFO of Nanoflex Power Corp (OTC: OPVS — $3 million), a microcap that fell 85% during his tenure and currently trades for one cent. Mr. DaVella also served as the vice president of finance for the Alkaline Water Company (NASDAQ: WTER — $141 million), a heavily promoted microcap that fell ~50% during his ten-month tenure.

The Joint’s audit committee has had many issues to face. In March 2019, the company filed a late filing notice for its Q1 10-Q because “the Company needs additional time to make certain accounting adjustments.” In its most recent 10-K, The Joint’s auditor, Plante & Moran, highlighted a critical audit matter:

“The Company’s revenue recognition process for company-owned and managed clinics and royalties involves a custom application… Auditing the Company's accounting for revenue from company-owned and managed clinics and royalties was challenging and complex due to the high volume of individually-low-monetary-value transactions… and the use of multiple data sources in the revenue recognition process.”

Weeks after issuing the critical audit matter, The Joint dismissed Plante & Moran as its auditor and hired BDO. David Steimel, the Plante & Moran audit partner responsible for The Joint, has not audited any other publicly traded companies in the last four years according to PCAOB records. In total, The Joint has had five different CFOs and three different auditors since going Roth Capital took the company public in 2014.

The problems at The Joint extend beyond accounting and franchisee health.

The Joint franchises offer customers single visit passes for $39, but primarily sell customers a $79/month “wellness plan” that grants them four chiropractic adjustments per month. The Bear Cave filed public record requests with some state attorneys general for consumer complaints against The Joint. Below are excerpts from complaints to the Texas Attorney General:

“It all seems like a scam to get patients to sign up for a plan that is continuously charged on your credit card monthly. They also claim that they require a two month minimum which, if I'm correct, is illegal to make someone sign a contract, especially for things that are supposed to be medical.” (May 2018 Texas AG complaint)

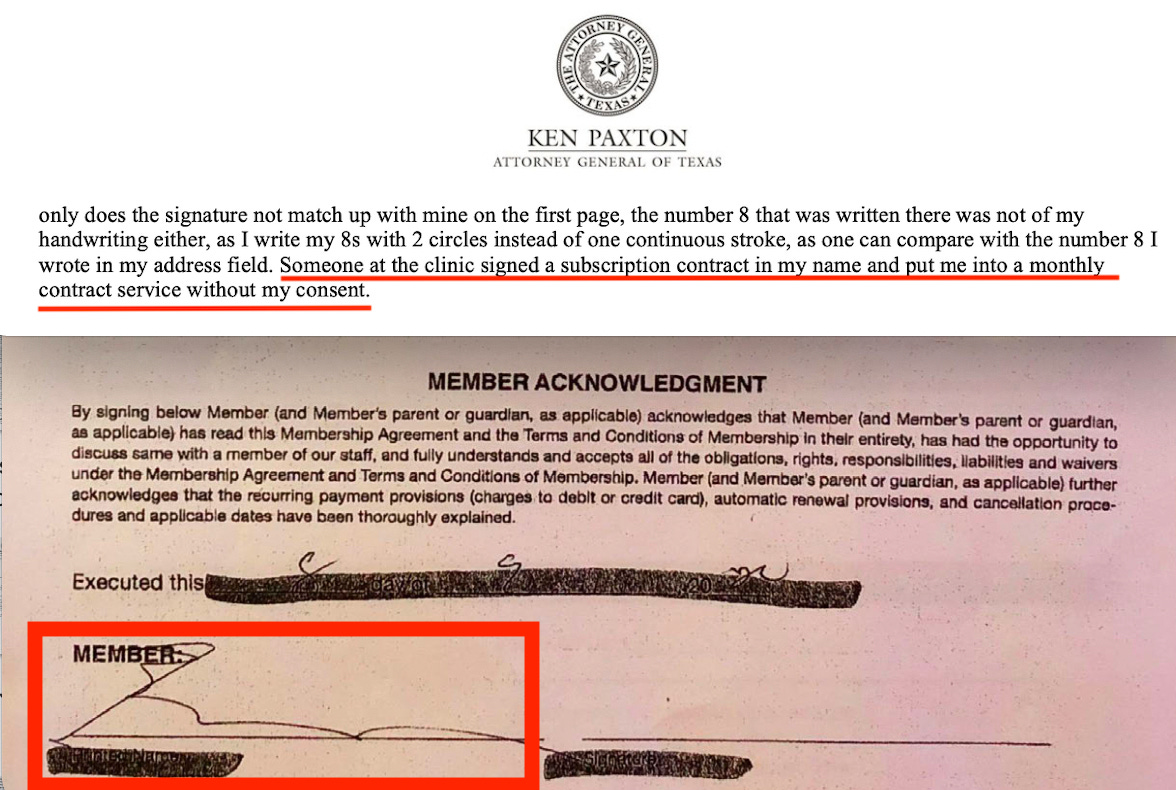

“I specifically told them I just wanted one treatment but conceded into buying the package to get something started, and never once did the receptionist mention she was selling me a subscription contract that would bill me every month for 69 dollars…. Someone at the clinic signed a subscription contract in my name and put me into a monthly contract service without my consent.” (See below)

The records also indicate at least two correspondences between the Texas Attorney General’s Office and The Joint. In both letters, the Texas Attorney General’s Office wrote, “We appreciate your time and interest in preventing consumer law violations.”

In Florida, a similar pattern emerges. In a letter to the Florida Attorney General one consumer wrote,

“They advertised a deal for $29 for an initial visit and treatment. When I went for the treatment, they actually charged me $99.”

In Georgia, the pattern repeats. One May 2021 complaint to the Georgia Attorney General reads,

“I signed up for treatment. I was misled by the person signing me up for the treatment. I was charged for a larger amount than agreed, and my card has been charged monthly even though I did not leave my card information on file. I only intended on the one time payment, hence why I did not leave my card information on file.”

In response to a FOIA request, the Federal Trade Commission provided 29 more complaints against The Joint, largely about overbilling.

Below are some complaints from the website Pissed Consumer, where The Joint has a 1.3/5 rating:

“I tried to cancel last month, and received an email saying it had been canceled. Got charged TODAY for $69.”

“Yeah, trying over the phone is nearly impossible. I have been trying for a month. They say they will call you back, ha!”

“I have been charged $65.00/month for 3 years without going once!”

“I refuse to go to the place in person because I KNOW I will not be able to contain my rage.”

DoNotPay, a consumer protection company, has a website dedicated solely to canceling The Joint memberships.

Glassdoor reviews from The Joint employees appear to show that the problems around overbilling are well known:

“I was threatened to be fired if I told the customers there is a minimum term on the membership, (corporate policy) but then got yelled at by customers because of not telling them. Then we have to make it extremely hard to cancel the membership… Poor HR practices include allowing some to fake transactions but not others.” (Link)

“Employs terrible sales tactics to generate money.” (Link)

“Patients are not money!!! If you are in the true business to care for patients then be honest to them. I have seen many buy packages and spend hundreds for no reason at all.” (Link)

In sum, the aggressive terms with franchisees, the re-acquiring and re-selling of The Joint locations, the undisclosed vehicle for loans and equity investments in franchises, the accounting issues, the changes in auditors and CFOs, and the aggressive billing, all call into question whether The Joint’s fast growth is as great and healthy as the market thinks.

The pattern of hypergrowth followed by a painful downfall is nothing new for franchisors — or The Joint’s management. Before joining The Joint as CEO in 2016, Peter D. Holt served as COO and later CEO of Tasti D-Lite, a frozen yogurt franchisor, from February 2007 to June 2015. Based on limited public disclosures it appears the company experienced rapid growth from 34 locations in 2007 to 170 locations in 2011, in part by acquiring a competitor. However, by 2015 the number of locations had shrunk to 128. Tasti D-Lite was sold that year on undisclosed terms.

If insider transactions are any indication, The Joint’s management does not seem too bullish on its future.

The Joint’s 39-year-old CFO, Jack Singleton, sold about $1 million in stock in June and September of this year, representing the majority of his position.

Matthew Rubel, The Joint’s lead independent director, has sold about $1.5 million in stock this year, representing the majority of his position.

Ronald DaVella, audit chair, has sold about $2 million in stock this year, representing the majority of his position.

James Amos, The Joint’s governance chair, has sold about $4 million in stock this year, representing the majority of his position.

Most meaningful are the trades of Glenn Krevlin. Mr. Krevlin’s franchise-level view through Cowboy Chiro, high-level view on the board, accounting-level view on the audit committee, and background investing in public companies leave him best equipped to judge The Joint’s future.

Mr. Krevlin has sold about 90% of his stock (~$14 million) over the last seven months.

Caveat emptor.

This article is not investment advice and represents the opinions of its author, Edwin Dorsey. You can reach the author by email at edwin@585research.com or on Twitter @StockJabber. This article is for paid subscribers of The Bear Cave newsletter. If this article was forwarded to you, please consider becoming a paid subscriber to receive articles like this twice every month for $44/month. Learn more here.