Toronto-Dominion Bank (NYSE: TD — $114 billion) is Canada’s second-largest bank with a sizeable and growing presence in the United States. The company employs over 90,000 people, is the fifth-largest bank in North America, and claims to be “America’s Most Convenient Bank.” That’s debatable.

A May 2022 investigation from The Capitol Forum found widespread sales practice issues at TD Bank and found that TD Bank employees “wrongly pressured customers into opening accounts and using banking services they didn’t want.” Last month, Senator Elizabeth Warren asked regulators to “closely examine any ongoing wrongdoing.” Today, an analysis by The Bear Cave finds that TD Bank has more fraudulent account opening complaints than every other bank except Wells Fargo. In addition, hundreds of consumer complaints reviewed by The Bear Cave show a pattern of misconduct regarding fraudulent accounts, unnecessary products, and excessive fees. In sum, TD Bank appears to be a losing proposition that victimizes customers.

TD Bank is a giant. The company has over $900 billion in retail deposits in the U.S. and Canada, around 2,000 branches in North America, and is trying to grow its footprint by acquiring First Horizon Bank (NYSE: FHN — $11.8 billion). That deal, and TD’s future success, now hang in the balance following reporting from The Capitol Forum, a Washington-focused investigative news outlet.

The Capitol Forum reported that the Office of the Comptroller of the Currency, a banking regulator, detected problems with TD Bank during an industrywide review following the Wells Fargo scandals. However, Trump appointee Keith Noreika reportedly decided to give TD Bank a private reprimand instead of a public penalty. The Capitol Forum also reported that TD Bank’s inappropriate sales practices continue to this day and wrote, in part:

“Nine people who work at TD Bank or have left in the last two years told The Capitol Forum that the company still expects its branch workers to nudge customers into accounts, cards and loans that they don’t need.”

“Employees earn points when a customer opens a checking account and extra points when new customers sign up for overdraft protection. Employees entice customers to enroll by misstating the costs and benefits of overdraft services.”

“Call center workers field customer complaints, but they’re also expected to sell TD Bank’s financial services. If they get disconnected from customers before a sale is complete, the call center employees often finish the paperwork for the new account or service even though the customers didn’t give their consent.”

The report caught the attention of Senator Elizabeth Warren who jointly sent a June 14, 2022 letter with three members of Congress to Michael Hsu, the Acting Comptroller of the Currency. Senator Warren said “the OCC should closely examine any ongoing wrongdoing and block any merger until TD Bank is held responsible for its abusive practices” and analogized the situation to Wells Fargo:

“In 2016, Wells Fargo was accused of creating millions of accounts for their customers without their consent or knowledge, leading to billions paid in civil and criminal probes, the resignation of Wells Fargo CEO John Stumpf, and the imposition of a growth cap by the Federal Reserve. The new report found that TD Bank uses similar tactics, which were uncovered in the OCC’s industrywide probe following the revelations about Wells Fargo practices.”

Senator Warren’s letter also criticized Keith Noreika for his conflicts because he represented TD at Simpson Thacher & Bartlett LLP, before leading the OCC. After leaving the OCC, Mr. Noreika went back to Simpson Thacher & Bartlett LLP and moved back into his same old office. Now, Simpson Thacher & Bartlett LLP is advising TD Bank on its First Horizon Bank acquisition.

Earlier this week, Simpson Thacher & Bartlett LLP deleted Mr. Noreika’s professional biography from the firm’s site. Mr. Noreika also updated his LinkedIn to show he left Simpson Thacher & Bartlett LLP in July 2022.

In addition to the OCC, the Consumer Finance Protection Bureau (CFPB) is a powerful banking regulator and maintains a public database of over two million consumer complaints against financial institutions.

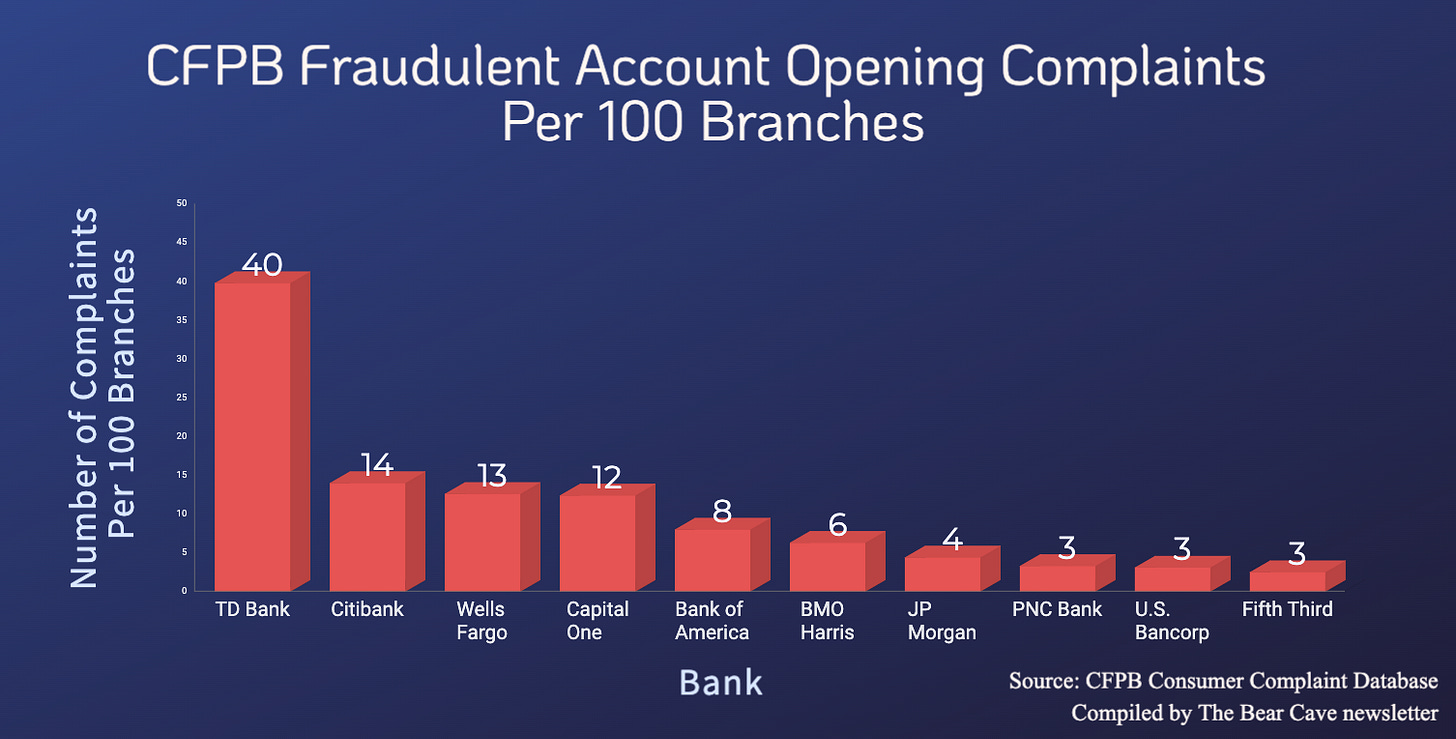

An analysis of the CFPB database by The Bear Cave finds an elevated level of complaints against TD Bank, especially complaints filed under the sub-issue “account opened as a result of fraud.” In the last three years, TD Bank has had more fraudulent account opening complaints than any other bank except Wells Fargo.

TD’s level of fraudulent account complaints is especially concerning given the bank is meaningfully smaller than other banks with high levels of complaints. On a per branch basis, TD bank is multiples higher than rival institutions. In fact, TD’s rate of fraudulent account complaints per U.S. branch is around three times that of Wells Fargo.

The problems for TD Bank don’t stop there. The Bear Cave has uncovered hundreds of consumer complaints alleging excessive overdraft fees, fraudulent account openings, fee stacking, unwanted money market accounts with $12 monthly fees, and a wide range of potentially illegal conduct.