Over the last two months, The Bear Cave has shown how overseas stock manipulation groups use WhatsApp chats to pump and dump dozens of Nasdaq-listed Chinese companies. Today’s investigation shows what these WhatsApp-fueled promotions look like before, during, and after a stock collapse and concludes with 10 actionable tips for professional investors to predict and profit from disrupting these scams.

The overseas stocks scammers first recruit victims through Instagram ads, Facebook ads, fake profiles on X, and sham websites and instruct victims to trade legitimate stocks to gain trust and ensure the victims have capital and will follow their recommendations. Then, the victims are added to various “VIP” or “core” WhatsApp groups.

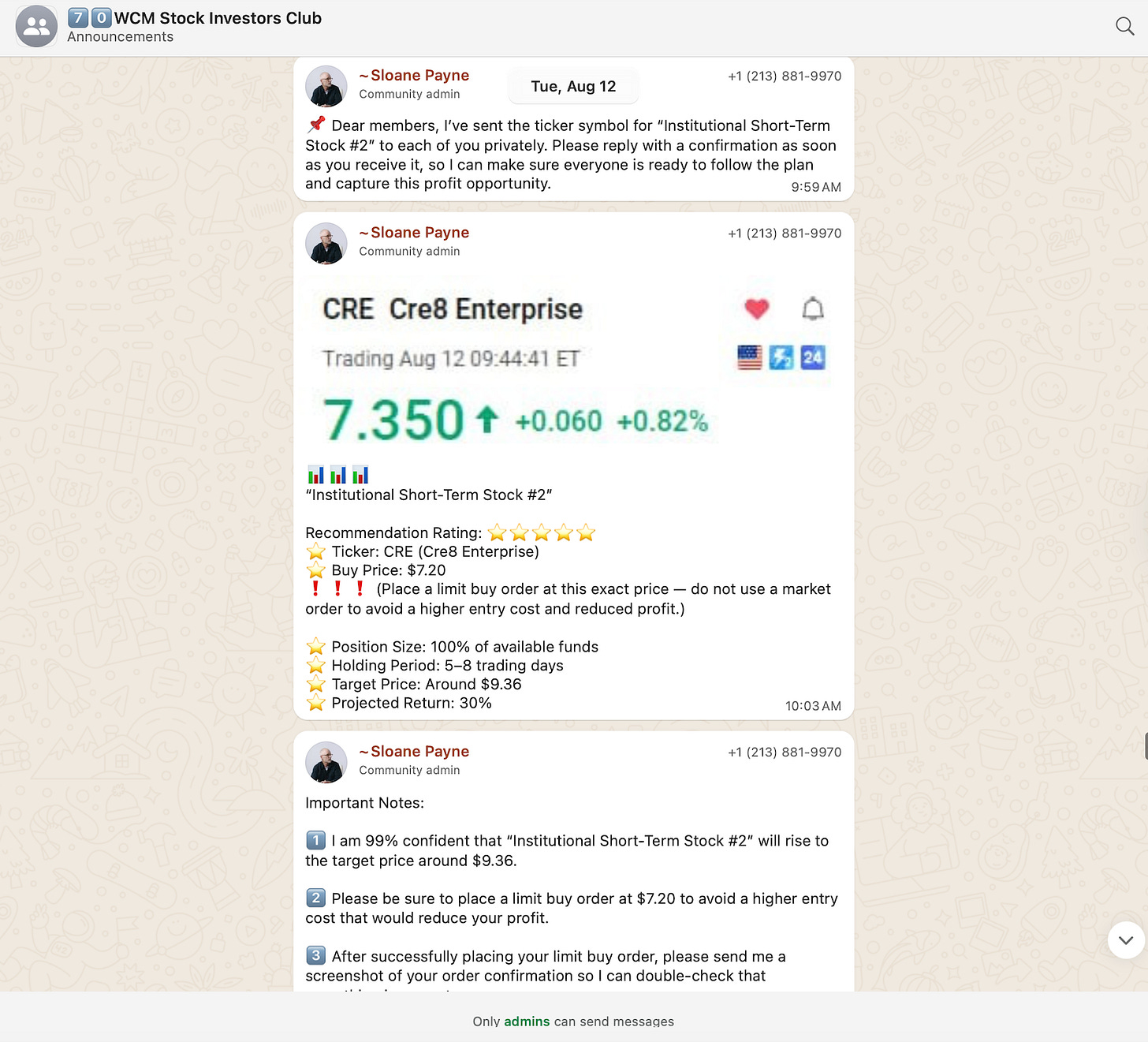

One such WhatsApp group is “70 WCM Stock Investors Club,” which impersonates the legitimate firm WCM Investment Management. Last month, on August 12, the leader of that group, “Sloane Payne,” recommended investors buy Cre8 Enterprise (NASDAQ: CRE) with “100% of available funds.”

In the message shown below, Payne told members to place limit orders at $7.20, just below the market price, claiming with “99 percent confidence” that CRE would reach $9.26 within five to eight trading days.

Instead, CRE fell ~80% after the market closed that day. The stock currently trades for $0.63 per share.

The fake Mr. Payne told the group:

“Someone leaked our trading code for this transaction to the community, which caused the opposition to suppress it. In addition, malicious short selling by competing institutions has affected the normal price movement of ‘Institutional Short-Term Stock #2.’ Originally, today the stock was expected to continue rising.”

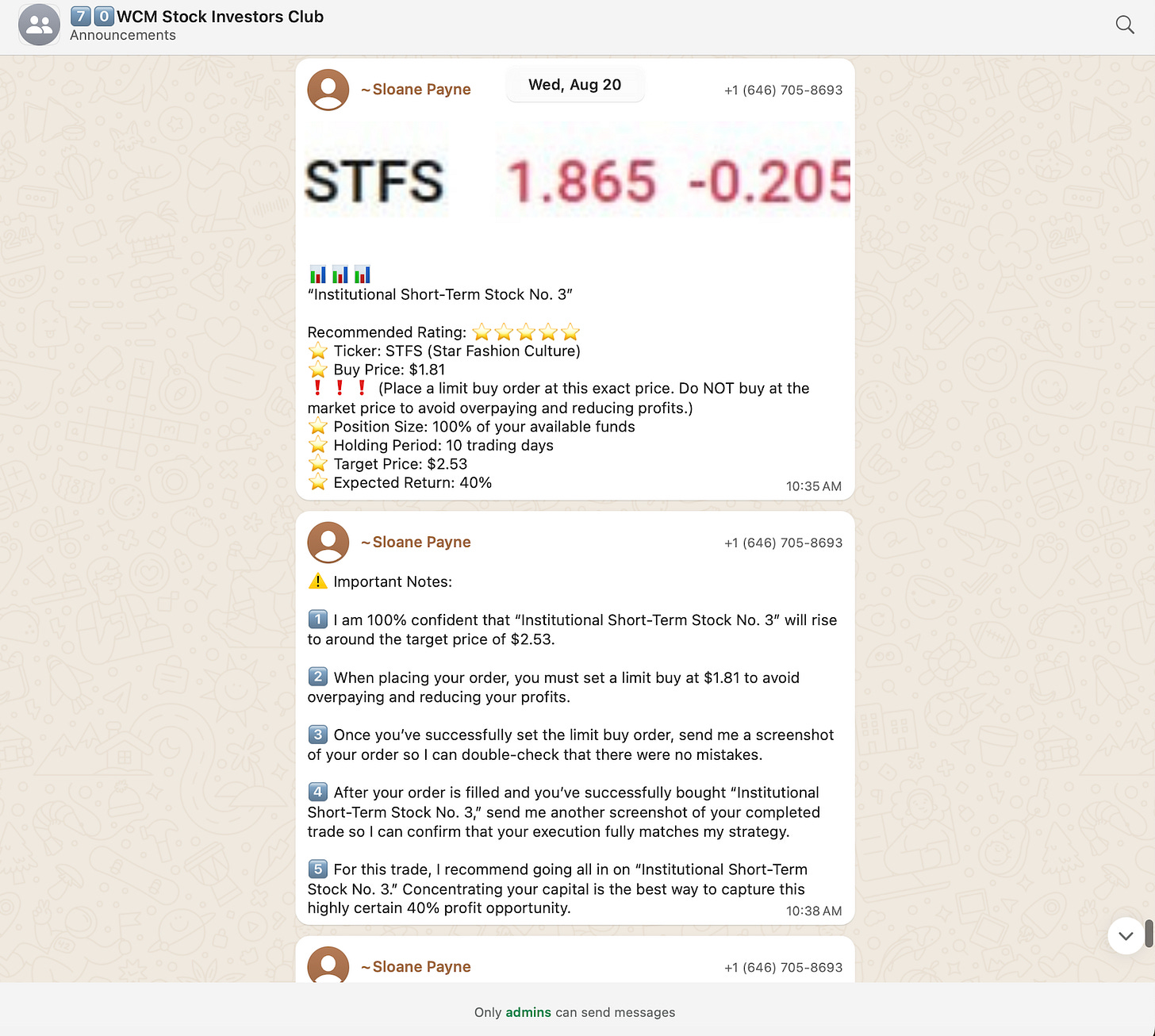

Never fear, Mr. Payne promised to help investors earn their money back. At around 10:30am ET on August 20, Mr. Payne recommended a new pick: Star Fashion Culture Holdings (NASDAQ: STFS), a Chinese content marketing company. Mr. Payne advised a purchase with “100% of available funds” using limit orders at $1.81 per share and said he was “100% confident” the stock would rise around 40% to the target of $2.53 per share.

Instead, STFS fell ~70% shortly after 3pm ET that day. The stock closed yesterday at fourteen cents.

After the collapse of STFS, Mr. Payne told the WhatsApp members, in part,

“As I read through your messages, I felt a heavy heart, but I immediately realized what needs to be done—what’s needed right now is not just an explanation, but a practical, systematic plan to help us get back on track. That’s why I’ve decided to kick off our Q3 ‘Wealth Growth Plan’ early…. We are shifting towards cryptocurrency and diversified investments to better handle uncertainty and explore new growth opportunities… We need to act immediately to recover these losses and seize the next growth opportunity.”

The Bear Cave was added to groups as numbered as low as “WCM Stock Investors Club 33” and as high as “WCM Stock Investors Club 177,” suggesting there are likely hundreds of identical WCM Stock Investor groups with thousands, or tens of thousands, of total victims.

Not all of the stock manipulation schemes are as straightforward.

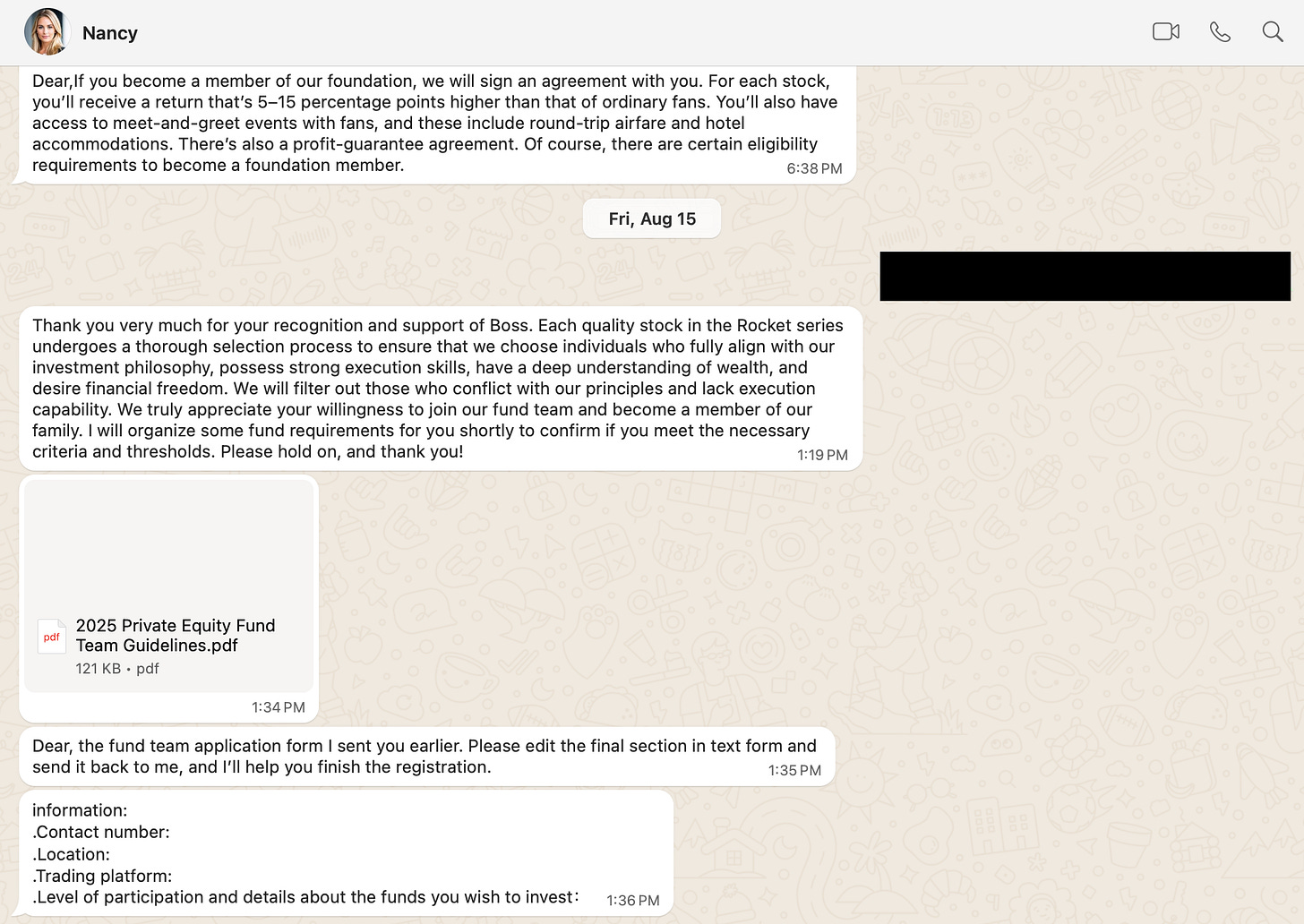

At the start of the stock manipulation schemes, victims are often encouraged to sign frivolous “investment agreements” that 1) promise reimbursement for losses, 2) grant the scammers a share of potential profits, and 3) require victims to closely follow and document trade recommendations.

Victims say the agreements add legitimacy to a dubious process, create the expectation of future profits, and give scammers a pretext to threaten victims.

In one case, The Bear Cave was told to agree to a “private equity fund team guidelines” document before being pitched a manipulated stock.

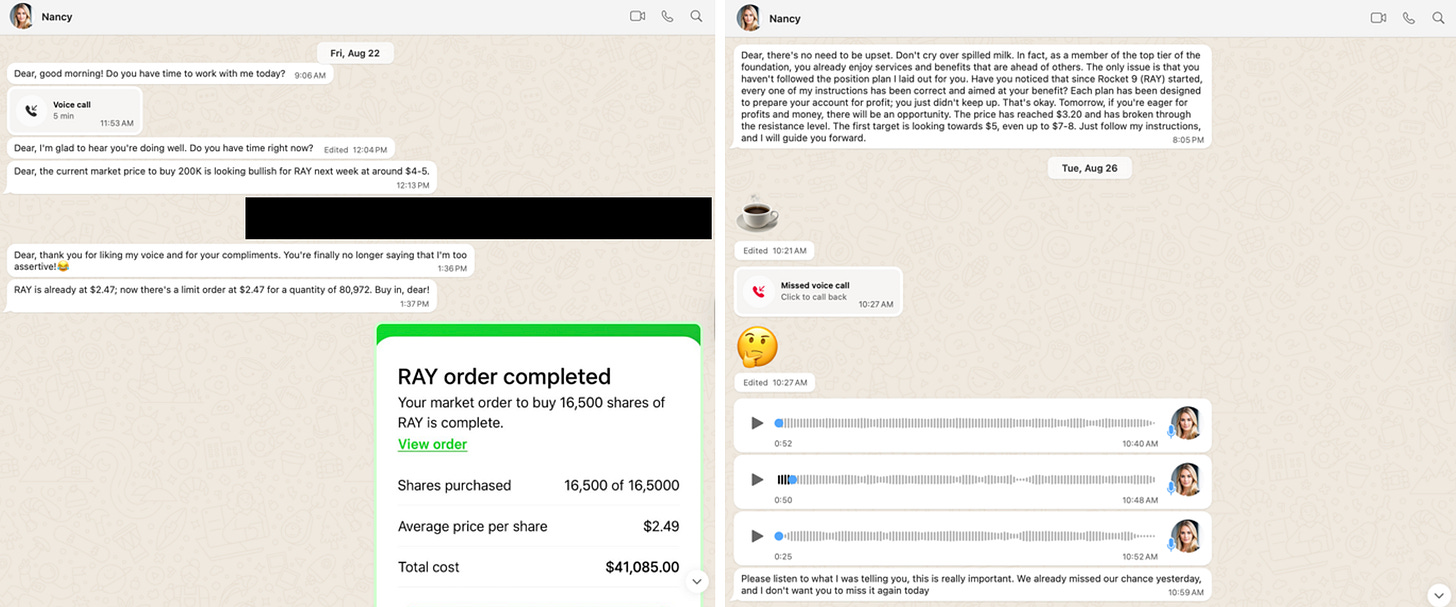

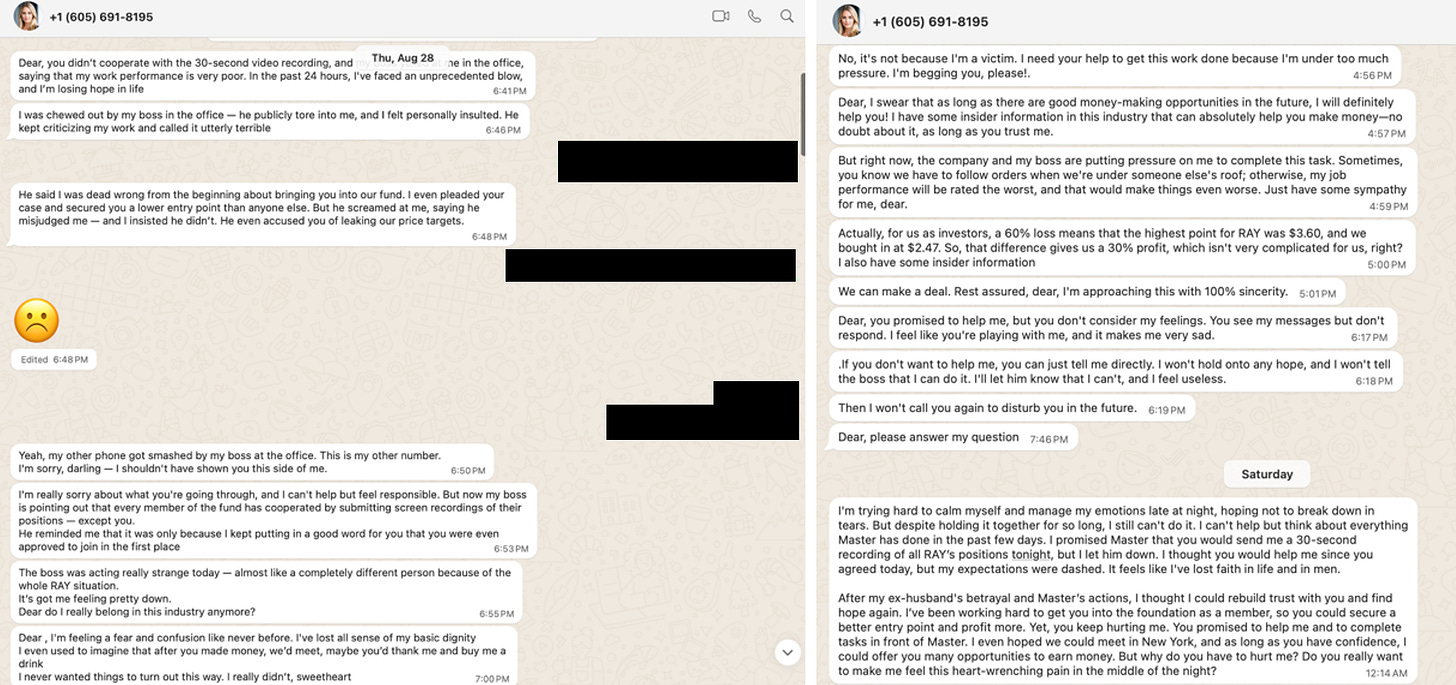

Starting on August 20, a WhatsApp scammer named “Nancy,” who is an Admin in a larger WhatsApp group titled “Wealth Appreciation 0102,” sent The Bear Cave increasingly strong messages, voice memos, and WhatsApp calls to purchase stock in Raytech Holding Limited (NASDAQ: RAY), a Hong Kong-based electronics wholesaler. “Nancy” also insisted The Bear Cave send screenshots of order confirmations.

To gain the trust of the stock scammers, The Bear Cave uses ChatGPT to create fake order confirmations for trades in the manipulated stocks. This gives scammers the illusion of generating more victims without actually doing so, while also helping expose the inner workings of these scam operations.

“Nancy” and others in her group gave RAY near-term price targets ranging from $4 to $8 per share for the week ending Friday, August 29, which would represent a 100%+ return. Instead, the stock fell ~70% over the week and now trades for $0.80.

After a collapse, the scammers often demand video proof of victim losses. The Bear Cave believes that low-level scammers earn bonuses when they collect this footage.

These scams using Nasdaq-listed stocks are widespread and, by The Bear Cave’s rough estimate, cost retail investors around $10 billion annually. StopNasdaqChinaFraud.com, The Bear Cave’s crowdsourced database of WhatsApp stock manipulation chats, has over 600 submissions in the last month and VampireStocks, a Reddit group dedicated to exposing these scams, has highlighted them at a frequency greater than once a week.

Yesterday evening, Nasdaq Inc (NASDAQ: NDAQ — $53.8 billion), the exchange that hosts nearly all these manipulated stocks, “proposed a new set of enhancements to its initial and continued listing standards.” Nasdaq highlighted “an accelerated process for suspending and delisting companies with a listings deficiency that also have a market value below $5 million” and “a $25 million minimum public offering proceeds requirement for new listings of companies principally operating in China.” Nasdaq’s press release stated, in part,

“The actions announced today follow Nasdaq’s proactive review of trading activity, particularly emerging patterns associated with potential pump-and-dump schemes in U.S. cross-market trading environments.”

John Zecca, Global Chief Legal, Risk & Regulatory Officer at Nasdaq added,

“Investor protection and market integrity are central to Nasdaq’s mission.”

While these actions, if implemented, are a step in the right direction, they may create short-term pressure for the stock manipulators to increase the pace and scope of their manipulation efforts.

Based on stories from traders who have profitably shorted these scams, The Bear Cave’s expertise in tracking them, and our review of dozens of past collapses, here are our top 10 tips for investment professionals: