Welcome to The Bear Cave — your weekly source of short-seller news! If you are new, you can join here. Please hit the heart button if you like today’s newsletter and reply with any feedback.

New Activist Reports

Spruce Point Capital published a 20,626-word report on Alpha Metallurgical Resources (NYSE: AMR — $2.84 billion), a Tennessee-based coal company. Spruce Point said it conducted “a forensic review of Alpha Metallurgical Resources” and found:

“[A] staggering evidence of misstated production, revenues and expenses, up to $690 million of ‘hidden’ debt obligations, overstated cash and recent cash shortfalls, inflated inventories, and shrinking economic reserves. In short, despite recent strength in coal markets driving its share price to all-time highs, we believe AMR is masking significant financial stress in its core mining operations and has used aggressive tax refunds to drive cash flow.”

Spruce Point also alleged that company executives improperly disclosed ~$24 million in stock sales and highlighted that the company’s CFO had his CPA license suspended, in part for not taking required ethics courses. Alpha Metallurgical Resources is up nearly 850% in the last twelve months.

Wolfpack Research published on PMV Pharmaceuticals (NASDAQ: PMVP — $648 million), a cancer drug company. Wolfpack Research alleged that some of the company’s trial data presented to investors had been photoshopped and predicted that Phase I data scheduled to be released on May 26th would disappoint investors. The company is down over 60% since its September 2020 IPO.

Boatman Capital Research published on AVZ Minerals (ASX: AVZ — AUD$2.75 billion), an Australian mineral exploration company developing a lithium mine in the Democratic Republic of Congo. Boatman Capital wrote,

“We believe that AVZ Minerals is in the process of being outmaneuvered by a group of powerful Chinese battery manufacturers, who are plotting to take control of the Manono lithium project.”

Boatman highlighted that AVZ believes it exercised a right to acquire a larger stake in the mine, but its local partners and the local courts have not acknowledged its stake. In addition, a Chinese mining partner has obtained a stake in the mine in a “signed and sealed” contract viewed by Boatman, although AVZ is attempting to dispute its validity.

The Bear Cave published on ZoomInfo Technologies (NASDAQ: ZI — $16.0 billion), a sales software company, and wrote,

“Through the Freedom of Information Act, The Bear Cave has obtained hundreds of pages of consumer complaints from small-businesses desperate to cancel ZoomInfo contracts. ZoomInfo often renews contracts against the wishes of its customers, threatens litigation to enforce renewals, and has admitted to the Washington State Attorney General of sometimes doing renewals ‘in error.’ In addition, The Bear Cave has found that ZoomInfo’s data collection practices are much more aggressive, and potentially illegal, compared to its dozens of competitors. Upcoming legislation and ongoing litigation may add to the company’s headwinds.”

ZoomInfo responded and said, "this report is sensationalizing a small number of complaints to achieve a short-term market outcome.” (The Bear Cave takes no position against the companies we cover.)

Recent Resignations

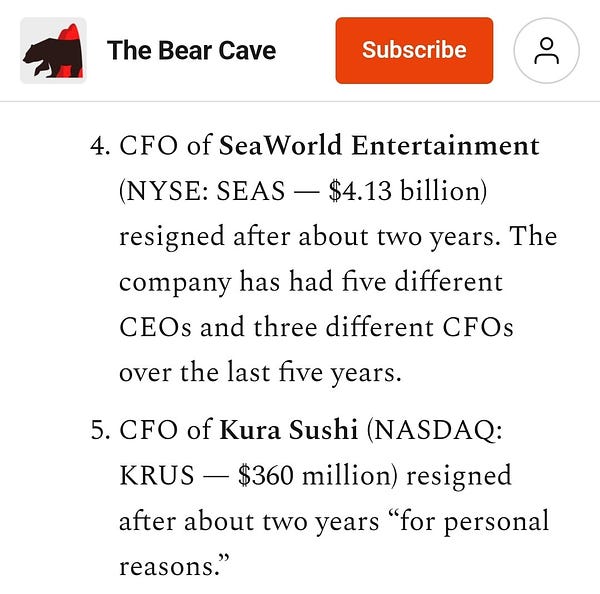

Notable executive departures disclosed in the past week include:

CFO of Mirati Therapeutics (NASDAQ: MRTX — $3.52 billion) resigned after six months. The company had had four different CFOs in the last three years.

CFO of Evolv Technologies (NASDAQ: EVLV — $344 million) resigned after seven months. The company’s Senior Vice President of Strategic Finance was “terminated” in January and Evolv is down ~75% since its July 2021 SPAC merger.

CFO of Goldman Sachs BDC Inc (NYSE: GSBD — $1.77 billion) notified the company of his intention to resign “to pursue a new professional opportunity” after nine months. The company has had three different CFOs in the last two years.

CFO of Bakkt Holdings Inc (NYSE: BKKT — $670 million) “is departing on good terms” after a little over one year. The company is down ~75% since its October 2021 SPAC merger.

CFO of Weyerhaeuser Co (NYSE: WY — $28.0 billion) was “terminated” after a little over one year.

CEO of Siriuspoint Ltd (NYSE: SPNT — $933 million) resigned after a little over one year “to pursue other opportunities.” The company’s CEO, CFO, and auditor were all replaced in February 2021.

CFO of Myers Industries (NYSE: MYE — $822 million) “resigned to pursue other opportunities” after about one and a half years. The company has had three different CFOs in the last three years.

CFO of Vivint Smart Home (NYSE: VVNT — $1.16 billion) “stepped down” after a little over two years. Vivint’s Chief Technology Officer is also departing in June and the company is down ~45% since its January 2020 SPAC merger.

CEO of the Neuehealth subsidiary within Bright Health Group (NYSE: BHG — $1.21 billion) resigned after a little over one year. The company is down nearly 90% since its June 2021 IPO.

Chief Commercial Officer of Pacific Biosciences of California Inc (NASDAQ: PACB — $1.26 billion) resigned “to pursue new opportunities” after one and a half years.

General Counsel of MDC Holdings (NYSE: MDC — $2.63 billion) resigned after one and a half years. A member of the company’s audit committee resigned in August 2021 and the company’s Chief Accounting Officer resigned after ten months in June 2021.

Chief Strategy Officer of NeoGenomics (NASDAQ: NEO — $1.10 billion) resigned after a little over two years “to pursue other interests.” Earlier this month, the President of Pharma Services at the company resigned after eleven months. In April, the company’s CEO “stepped down” after eleven months as well. In March, the company’s Chief Operating Officer also resigned after only nine months. The Florida-based genetic testing company is down 75% over the last year.

Kevin Hochman is stepping down as President of KFC within Yum Brands (NYSE: YUM — $31.9 billion) after five years. He is leaving to become CEO of Brinker International (NYSE: EAT — $1.20 billion), the parent company of Chili's and Maggiano's Little Italy.

Data for this section is provided by VerityData from VerityPlatform.com

What to Read

“Idea Brunch with Spencer Walsh of Kinesic Capital” (Sunday’s Idea Brunch)

“Regarding technology investing specifically, the additional variable you have to account for is that these are winner-take-most markets. Based on our research, the top 3 players in most digital industries (e.g. internet marketplaces and enterprise software) capture ~45% of the entire sector’s revenue and capture 55-70% of the entire sector’s profit pool. What is the consequence of that? It means that if you wish to generate outsized returns as a technology investor, you need to first identify the future winners.”

“SEC Official Decries Delay Tactics Used by Some Defense Lawyers” (WSJ)

“A senior U.S. Securities and Exchange Commission official called on lawyers to work more cooperatively with the agency, saying regulators have seen recent incidents in which the defense counsel for public companies had used delay tactics to stymie investigations. The remarks by Gurbir Grewal, director of the SEC’s enforcement division, were a rare rebuke of the corporate defense bar, some of whom previously served as staff attorneys for the regulator.”

“Archegos' Bill Hwang asks for Morgan Stanley probe after costly short squeeze” (Reuters)

“Archegos Capital Management founder Bill Hwang has asked for a probe into Morgan Stanley to review if someone at the bank tipped off outsiders of the firm's plan to buy Futu Holdings stock in bulk. Archegos had alerted U.S. authorities of a short squeeze on Futu, which took almost $4 billion out of Hwang's portfolio, after regulators launched a probe into block-trading at Morgan Stanley earlier this year.”

Tweets of the Week

Until next week,

The Bear Cave