Welcome to The Bear Cave — your weekly source of short-seller news! If you are new, you can join here. Please hit the heart button if you like today’s newsletter and reply with any feedback.

New Activist Reports

New activist Blue Sky Management published on Tattooed Chef (NASDAQ: TTCF — $587 million), a plant-based food company that sells healthy frozen items like cauliflower pizza. Blue Sky called Tattooed Chef “extremely overvalued” and said “an upcoming equity raise, future revenue and margin deterioration, and slowing demand for the company's products are catalysts to drive the stock lower.” Moreover, the report highlights nearly $10 million in company marketing spend that went to an agency called NitroC. That agency would allegedly engage in spurious projects like placing Tattooed Chef ads “on AOL and online solitaire games” but Tattooed Chef’s CEO continued the spending because of a “close relationship with [a] person from NitroC.” Tattooed Chef is down ~30% since its May 2020 SPAC merger.

In January 2022, The Bear Cave also published on Tattooed Chef and noted that its CEO personally transferred stock to one of the company’s independent directors and outside counsel, among numerous other accounting issues.

Muddy Waters Research published an update on Hannon Armstrong Sustainable Infrastructure Capital (NYSE: HASI — $3.52 billion), a renewable energy investment company. In the update, Muddy Waters looked at three of the company’s energy deals and found “highly questionable investments on behalf of its investors.” As evidence, Muddy Waters published excerpts of conversations from a former HASI executive and concluded that “HASI is dumb money, making investments that yield far more narrative than financial return.”

Muddy Waters previously said the company’s “accounting is so complex and misleading that its financial statements are effectively meaningless.” In addition, in July Jehoshaphat Research criticized the company’s heavy reliance on gain-on-sale accounting of very long-duration loans.

Recent Resignations

Notable executive departures disclosed in the past week include:

CEO of Enfusion Inc (NYSE: ENFN — $1.25 billion) resigned after two and a half years “so that he can spend more time with his family.” The company’s Executive Chairman also retired in March and the company is down ~45% since its October 2021 IPO.

CEO of Vacasa Inc (NASDAQ: VCSA — $2.10 billion) resigned after a little over two and a half years and will also be leaving the board. The company is down over 50% since its November 2021 SPAC merger.

CFO of Babylon Holdings (NYSE: BBLN — $279 million) “will leave his position to pursue another opportunity” after almost five years. The company’s Chief Operating Officer also resigned in February and the company is down ~95% since its October 2021 SPAC merger.

CFO of Hagerty Inc (NYSE: HGTY — $4.17 billion) “will transition to a special projects advisory role” after fourteen years. Hagerty’s Chief Strategy Officer “was separated from employment with the company” in June and the company is up ~25% since its December 2021 SPAC merger.

Dennis Durkin resigned from the board and audit committee of Smartsheet Inc (NYSE: SMAR — $4.40 billion) after just eighteen days “due to personal reasons.” In May 2020, The Bear Cave noted numerous accounting red flags at the company.

President of Corporate Clubs at Planet Fitness (NYSE: PLNT — $6.75 billion) resigned after about seven months. In the last four months, the company’s Chief Technology and Information Officer, President, and Chief Marketing Officer have all announced resignations as well.

Chief Operating Officer of Seer Inc (NASDAQ: SEER — $634 million) resigned “for personal reasons” seven months after returning from a leave of absence. The company is down ~70% since The Bear Cave published on the company and wrote it “may be more bark than bite” in November 2021.

President of EMEA at Beauty Health Co (NASDAQ: SKIN —$1.70 billion) “transitioned out of the company” after eleven months. In June the President of APAC also “transitioned out of the company” after just ten months and in December 2021 the company’s CEO also departed and left the board as well. The company is up ~10% since its May 2021 SPAC merger.

Chief Accounting Officer of ESS Tech (NYSE: GWH — $628 million) resigned after a little over one year. The company is down ~60% since its October 2021 SPAC merger.

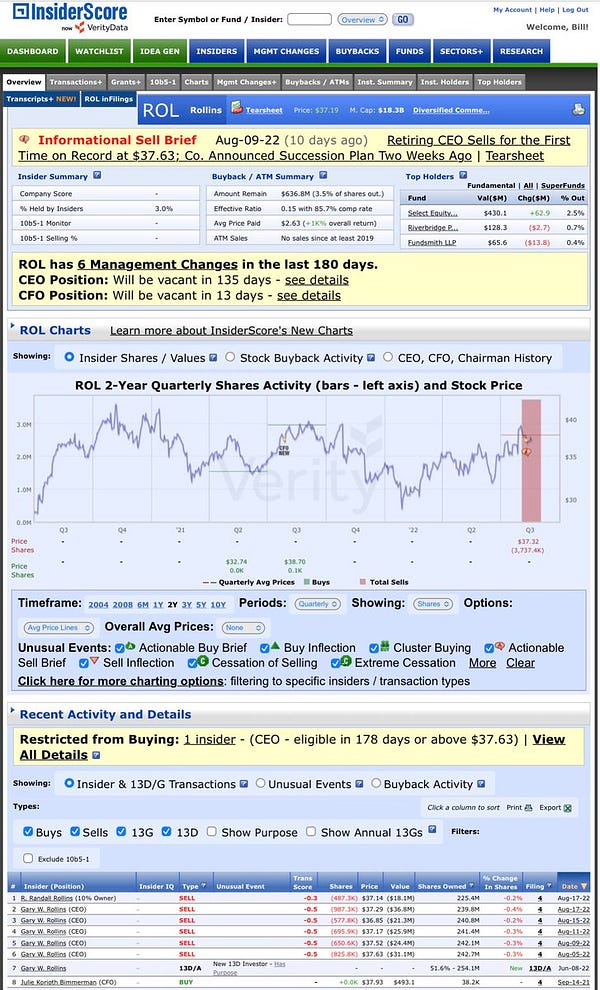

Data for this section is provided by VerityData from VerityPlatform.com

What to Read

“When Private Equity Takes Over a Nursing Home” (The New Yorker)

“Just over a year ago, I decided to observe a nursing-home acquisition up close. The question I grappled with was: Why do deaths skyrocket in private-equity-owned homes?”

“The Family That Mined the Pentagon’s Data for Profit” (WIRED)

“In a 2017 analysis of 229,000 FOIA requests, those from journalists accounted for just 8 percent. In 2020, there were nearly 800,000 requests made. At some federal agencies, the vast majority of requests are now from commercial operators who resell or use data for profit. Their turf is where a lot of the battle over the erosion of the freedom of information in America has been fought.”

“Hedge-Fund Pioneer Julian Robertson Jr. Dies at 90” (WSJ)

“A native of North Carolina, Mr. Robertson served as an officer in the U.S. Navy before joining Kidder Peabody in 1957, becoming a director of the brokerage firm and running its investment subsidiary. He left in 1978 and started Tiger in 1980, launching the firm with $8 million. The firm’s name derived from the term Mr. Robertson used for those whose name he couldn’t recall, according to Daniel Strachman, who wrote a biography of Mr. Robertson. In turn, staffers called Mr. Robertson ‘Big Tiger.’”

Tweets of the Week

Until Thursday,

The Bear Cave