The Bear Cave #187 + Planet Fitness CEO Resigns

New Activist Report, Planet Fitness CEO Resigns, Recent Resignations, and Tweets of the Week

Welcome to The Bear Cave! Our last premium articles were “Even More Problems at Roblox (RBLX)” and “Problems at Oddity Tech (ODD)” and our next premium investigation comes out this Thursday, September 21.

New Activist Report

Railroad Ranch Capital published on Etsy (NASDAQ: ETSY — $7.99 billion), an e-commerce platform focused on handmade items and craft supplies. Railroad Ranch raised concerns about competition from MakerPlace by Michaels, a newly launched platform that is offering sellers much lower fees than Etsy. Railroad Ranch also noted high insider selling by Etsy management.

Citron Research, which previously criticized Etsy in February for its widespread promotion of counterfeit goods, tweeted positively about the company this week and said it had fixed many of its product quality issues.

Planet Fitness CEO Resigns

On Friday, Planet Fitness disclosed that its CEO, Chris Rondeau, departed immediately and would continue to serve on the board. Mr. Rondeau had been CEO for nearly eleven years.

In June 2023, the company’s Chief Operating Officer departed after just five months. In August 2022, the company’s President of Corporate Clubs resigned after just seven months and in May 2022 the company’s Chief Marketing Officer departed after two and a half years.

The Bear Cave previously raised numerous concerns with Planet Fitness. In January of this year, The Bear Cave “uncovered hundreds of consumer complaints concerning overbilling, fraudulent transactions, excessive fees, and uncancellable memberships.” The Bear Cave concluded, in part,

“After reviewing the evidence, The Bear Cave is left wondering whether Planet Fitness is actually a thriving gym franchise or an illegal billing operation with gyms on the side.”

In February, The Bear Cave also highlighted potential governance issues at Planet Fitness and noted that Mr. Rondeau “held 25% ownership of PF Principals, LLC and 50% ownership of PF Principals II, LLC, both of which have directly and indirectly provided financing to a limited number of qualified Planet Fitness franchisees.” The Bear Cave also found that one of Planet Fitness’s co-founders, Marc Grondahl, was also involved in the financing operation. The Bear Cave concluded,

“In sum, Planet Fitness’s CEO and co-founder have an entity for ‘miscellaneous financial investment activities’ with unknown assets that does business with an unknown number of franchisees.”

The company’s new interim CEO, board member Craig Benson, was also the co-founder of Cabletron, a publicly traded computer equipment company that later spun off Enterasys, where Mr. Benson served on the audit committee and was a large shareholder. Four executives at Enterasys were later sentenced to prison terms for accounting fraud. Mr. Benson was not charged with wrongdoing.

Following the unexpected resignation of Mr. Rondeau, one of Planet Fitness’s co-founders Mike Grondahl (brother of Marc Grondahl), tweeted, “expect bad news.”

Recent Resignations

Other notable executive departures disclosed in the past week include:

CEO, CFO, and General Counsel of Orthofix Medical (NASDAQ: OFIX — $479 million) were all terminated for cause following “an investigation conducted by independent outside legal counsel and directed and overseen by the company's independent directors.” The company also disclosed, “As a result of the investigation, the Board determined that each of these executives engaged in repeated inappropriate and offensive conduct that violated multiple code of conduct requirements and was inconsistent with the company's values and culture.”

CFO of Goldman Sachs BDC (NYSE: GSBD — $1.64 billion) resigned after a little over one year “to pursue a new professional opportunity.” The company has had five CFOs in the last three years and in May the company’s Chief Operating Officer also resigned “to pursue a new professional opportunity.”

CFO of Legacy Housing Corp (NASDAQ: LEGH — $515 million) “stepped down” after a little over one year. The company has had five different CFOs in the last five years as well as six board member departures. The company is audited by CohnReznick LLP.

CEO of DocGo (NASDAQ: DCGO — $592 million) resigned “effective immediately due to personal reasons” after nearly two years. The resignation follows news reporting that the CEO “had falsified portions of his professional biography regarding his educational history” and lied about obtaining a graduate degree from Clarkson University when he never attended the school. The company is down ~40% since its November 2021 SPAC merger.

CFO of Viridian Therapeutics (NASDAQ: VRDN — $766 million) resigned after two years and will “receive certain severance benefits consistent with an ‘Involuntary Termination.’” The company has had four different CEOs and three different CFOs in the last five years and in April 2023 the company’s Chief Operating Officer also departed after just ten months.

CFO of SandRidge Energy (NYSE: SD — $583 million) resigned after three years “to pursue other opportunities.” The company has had five CEOs and two CFO transitions in the last five years. In June 2022, the company also dismissed Deloitte as the company’s auditor and hired Moss Adams LLP, which in turn was dismissed in May 2023 and replaced with Grant Thornton LLP.

CEO of BP (NYSE: BP — $111 billion) resigned “with immediate effect” after three and a half years. BP said that it received new allegations relating to the CEO’s “conduct in respect of personal relationships with company colleagues.” The company added it was continuing its investigation “with the support of external legal counsel.”

CEO of CS Disco (NYSE: LAW — $384 million) resigned “effective immediately” after nearly ten years and also left the board. The company had little additional disclosure and the Wall Street Journal noted that the CEO had been given a $110 million stock pay package just one year earlier. The company is down ~85% since its July 2021 IPO.

Debra Coleman resigned from the board and audit committee of Bridger Aerospace (NASDAQ: BAER — $378 million) “effective immediately” after two years. Ms. Coleman said her resignation was “a result of the functioning of the Board’s Audit Committee.” The company is down ~15% since its January 2023 SPAC merger.

Data for this section is provided by VerityData from VerityPlatform.com

What to Read

“Private Jets and Pop-Up Workspaces: Boeing Eases Return to Office for Top Brass” (WSJ)

“Company flight patterns suggest CEO Calhoun travels infrequently to headquarters from two distant homes, while CFO West occupies a new office five minutes from his Connecticut doorstep…”

“BP CEO Bernard Looney Resigns Over Past Relationships With Colleagues” (WSJ)

“BP said Tuesday that the company’s board in May 2022 reviewed allegations of what it said were Looney’s personal relationships with colleagues, based on anonymous information. It said Looney disclosed a small number of such past relationships that occurred before he became CEO. BP said it found no breach of company code. But the board has received further allegations, which it continues to investigate….

BP has gone through abrupt executive transitions before. In 2007, then-CEO John Browne, who was largely responsible for building the company into a global powerhouse through a series of deals, stepped down after newspapers planned to publish details about his homosexuality.”

“Former Wells Fargo Executive Might Face Prison Time in Fake Accounts Scandal” (WSJ)

“Prosecutors acknowledged in their sentencing request this month that Tolstedt has no criminal history and little risk of recidivism. But they said a jail sentence was necessary to deter corporate executives who are tempted to deceive regulators to protect their jobs.”

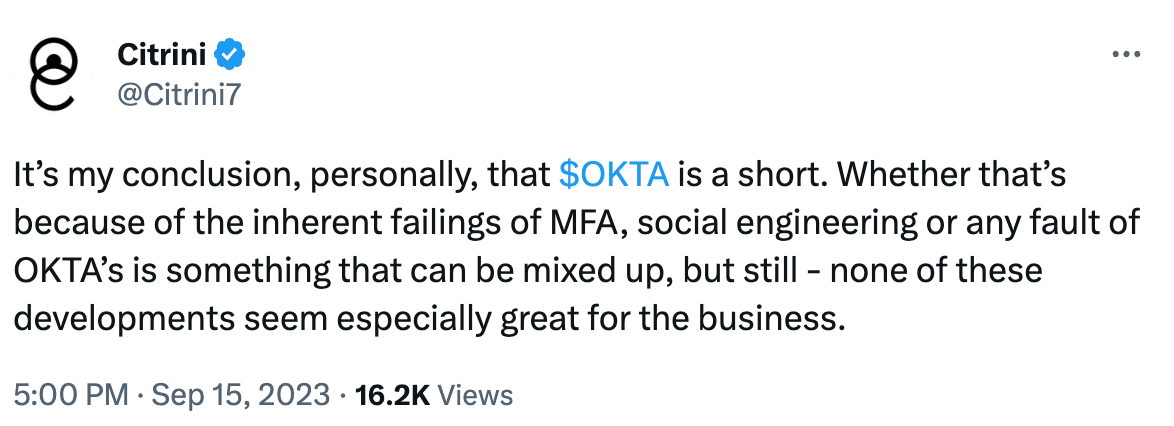

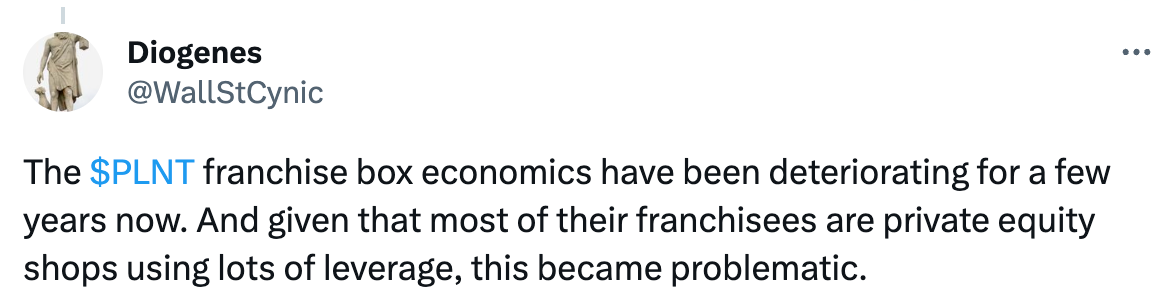

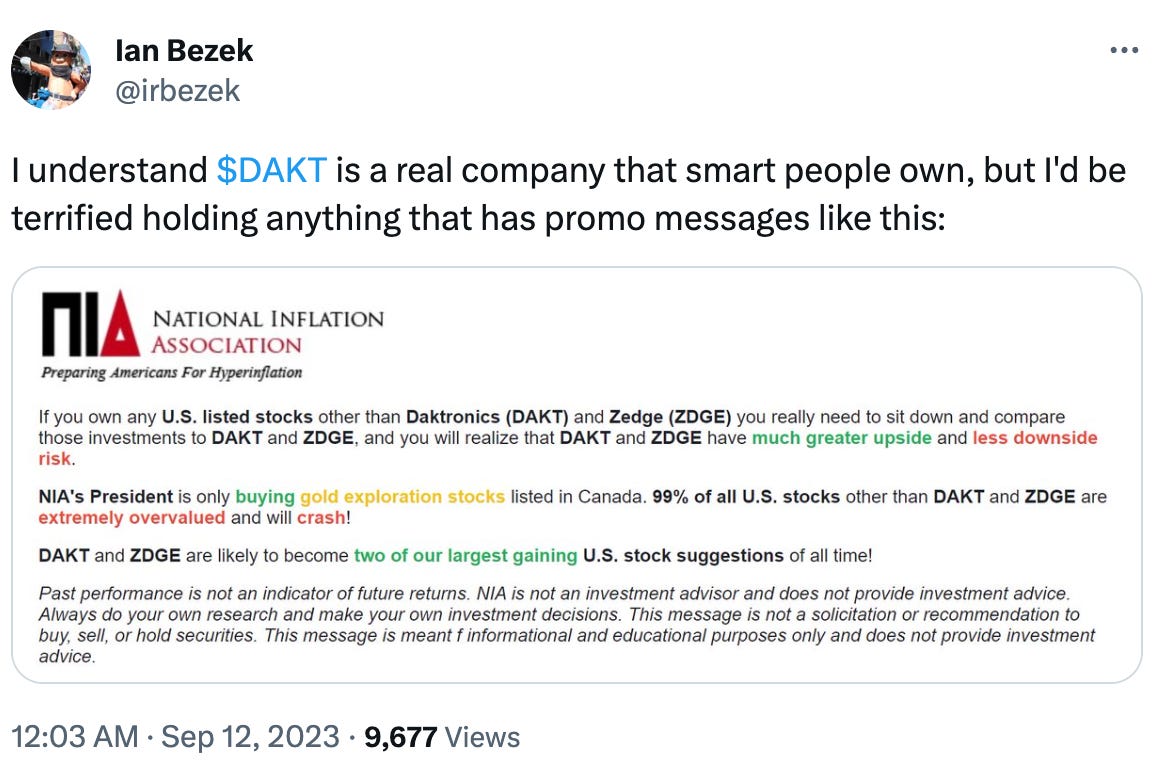

Tweets of the Week

Until Thursday,

The Bear Cave