Welcome to The Bear Cave! Our last premium articles were “Problems at Coca-Cola (KO)” and “Even More Problems at Rumble (RUM)” and our next premium investigation comes out Thursday, October 19.

New Activist Reports

Spruce Point Capital published on Rollins (NYSE: ROL — $17.8 billion), a North American pest control company. Spruce Point highlighted “multiple growing long-term macroeconomic and microeconomic issues that are likely to pressure Rollins’ historical growth and margins.” Specifically, Spruce Point noted that “industry competition is increasing with the recent merger of Rentokil and Terminix,” said that Rollins had a one-time pandemic benefit, and raised concerns that the company may have ongoing accounting issues following a 2022 SEC settlement alleging “that it engaged in improper accounting practices in order to boost its publicly-reported quarterly earnings per share to meet research analysts’ consensus estimates.”

Bonitas Research published on AFC Gamma (NASDAQ: AFCG — $234 million), a REIT focused on loaning money to cannabis-related businesses. Bonitas alleged that the company inflated income to boost management fees in large part by accepting a growing amount of “non-cash payment-in-kind revenues” from distressed tenants. Bonitas also questioned the legitimacy of the company’s reported cash balance because, in the last two years, the company borrowed tens of millions from a related party in December and paid back the loans in January, potentially to show inflated cash metrics on its year-end balance sheet.

Capybara Research published on FingerMotion (NASDAQ: FNGR — $335 million), a Singapore-based phone data company. Capybara called the company “one of the biggest stock promotions we have ever seen” and alleged the company issued stock to “consultants” that helped pump the stock with claims of a potential short squeeze. Capybara also alleged that the company effectively works as a middleman to procure telecom equipment but counts the entire transaction price, rather than just its commission, as revenue.

Recent Resignations

Notable executive departures disclosed in the past week include:

CFO of American Electric Power Company (NASDAQ: AEP — $37.2 billion) “was terminated” after ten months. In August, one board member resigned “for personal reasons” after ten and a half years and the company’s former CEO resigned as Executive Chairman after nine months “for personal reasons.” In April, the company’s Vice President of External Affairs departed after nine months to “pursue other opportunities” and in March the company’s Chief Accounting Officer retired after 22 years. The company has had four different CFOs in the last three years.

CFO of USA Compression Partners (NYSE: USAC — $2.49 billion) “submitted his resignation to pursue other opportunities” after a little over one year.

CFO of Metropolitan Bank (NYSE: MCB — $362 million) resigned after three years “for personal reasons” and the company “has commenced a search for qualified candidates for the CFO position.” The company also announced its longtime General Counsel was retiring in 2024. In April, the company disclosed it made loans to executives that “were likely impermissible under applicable law and/or regulations.” In December 2022, The Bear Cave wrote about Metropolitan and noted the company held deposits for Pax Dollar, a crypto stablecoin, and issued credit cards on behalf of another crypto platform.

CFO of Symbotic Inc (NASDAQ: SYM — $19.4 billion) “retired” after three years. In June, the company’s Principal Accounting Officer departed after one year and in November 2022 the company’s CEO departed after just eight months. The Bear Cave published on the Softbank-backed automation company in March and said “The Bear Cave believes Symbotic is more bark than bite and has a long way to fall.” Symbotic is up ~250% since its June 2022 SPAC merger.

CEO of Spirit AeroSystems Holdings (NYSE: SPR — $1.76 billion) “entered into a separation agreement and general release” and departed the board after a little over seven years. The company has fallen ~80% in the last five years.

Chief Operating Officer of Zentalis Pharmaceuticals (NASDAQ: ZNTL — $1.42 billion) “departed” after just eight months. The company is down ~15% since its April 2020 IPO.

Chief Marketing and Communications Officer of Roblox (NYSE: RBLX — $18.8 billion) resigned after three and a half years “to pursue other opportunities.” The Bear Cave has extensively published on child safety issues at Roblox. In response, Roblox’s press office called The Bear Cave’s articles “misleading, irresponsible and in many cases false accusations about Roblox that are without merit.”

Data for this section is provided by VerityData from VerityPlatform.com

What to Read

“Abercrombie & Fitch ex-CEO accused of exploiting men” (BBC)

“A BBC investigation found a highly organized network used a middleman to find young men for the events with Mike Jeffries and Matthew Smith. Eight men told the BBC they attended these events, some of whom alleged they were exploited or abused…”

“America’s Food Giants Confront the Ozempic Era” (WSJ)

“Big food companies and investors are watching as Ozempic and other similar weight-loss drugs flow to millions of people, upending America’s diet industry and raising new questions about how consumers will eat.”

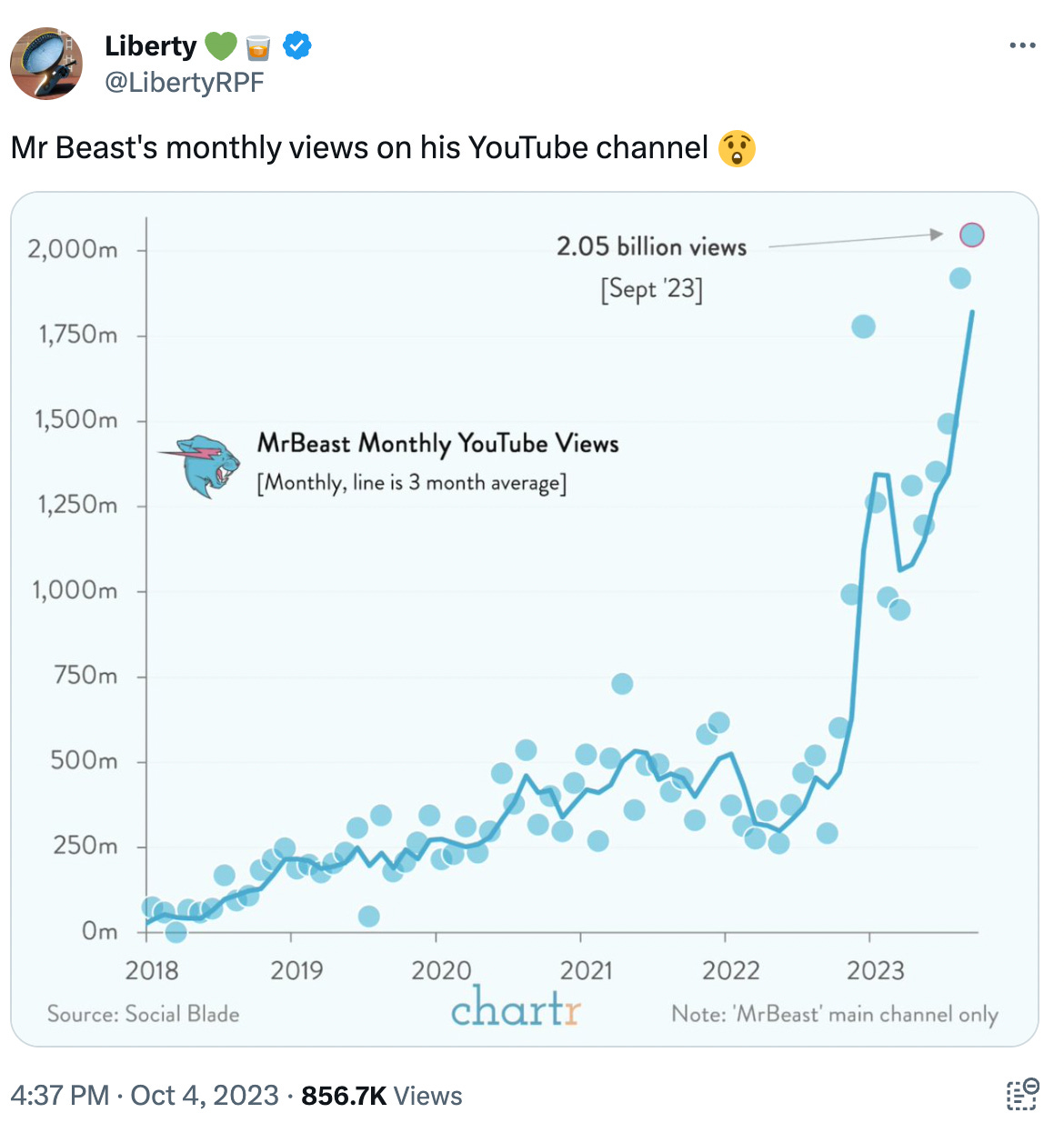

“Hornets launch jersey-patch deal with influencer MrBeast” (ESPN)

“MrBeast -- whose real name is Jimmy Donaldson -- will advertise his Feastables logo on the Hornets' uniforms and media backdrops for news conferences, the team said on Monday.”

“DOJ Offers More Incentives to Self-Report Wrongdoing in M&A Transactions” (WSJ)

“Companies acquiring other businesses can face more lenient treatment if they report potential criminal misconduct uncovered during the merger and acquisition process to prosecutors”

Tweets of the Week

Until next week,

The Bear Cave