Welcome to The Bear Cave! Our last premium articles were “Problems at Progress Software (PRGS)” and “Problems at Axos Financial (AX)” and our next premium investigation comes out Thursday, December 7.

New Activist Reports

Muddy Waters Research published on CPI Property Group (Frankfurt: 05G — EUR7.99 billion), a Luxembourg-based real estate holding company. Muddy Waters said it was short the company’s credit and alleged that the company’s controlling shareholder, Radovan Vitek, “has been brazenly looting the company while significantly overstating the value of its assets.” One example provided by Muddy Waters is a 2014 transaction where the company sold undeveloped land to a proxy for Radovan Vitek and then repurchased the same undeveloped land for over three times the original price in 2017.

Capybara Research published on Safety Shot Inc (NASDAQ: SHOT — $145 million), “the first patented beverage on Earth that helps people feel better faster by reducing blood alcohol content and boosting clarity.” Capybara called the company “Boca Raton snake oil” and alleged that “the company’s CEO and former Chief Compliance Officer worked together at Stratton Oakmont.” Capybara also alleged that the company’s leadership “have faced financial troubles, including lawsuits for unpaid debts, evictions, foreclosures, and adverse court judgments.”

J Capital Research published on Microvast Holdings (NASDAQ: MVST — $320 million), a lithium-ion battery company. J Capital alleged that the company’s China sales, ~57% of revenue, “may be fake” because the company’s Chinese factory “shows almost no activity.” J Capital also noted that “Microvast China has disappeared from Chinese procurement lists, and local competitors say the company is not making discernible sales.” J Capital also raised concerns about the company’s SPAC merger and wrote,

“Microvast is a Chinese EV battery business that has failed. Microvast, whose operations were almost all in China before the merger with [the Tuscan Holdings SPAC], nearly went bankrupt in 2019 but was saved by the SPAC. Tuscan had been seeking cannabis targets but settled on batteries.”

Microvast has fallen ~90% since its July 2021 SPAC merger.

Recent Resignations

Notable executive departures disclosed in the past week include:

CEO of Banco Bradesco (NYSE: BBD — $33.4 billion) was “replaced” after nearly six years.

Chief Accounting Officer of Fisker Inc (NYSE: FSR — $782 million) resigned “effective immediately” after eight days. The resignation was effective November 14 and the company disclosed the resignation on November 20. Fisker’s CFO, Dr. Geeta Gupta Fisker, is married to Fisker’s Chairman and CEO, Mr. Henrik Fisker. The company’s Chief Technology Officer and prior Chief Accounting Officer have also both resigned in the last two months.

In addition, in its 10-Q filed on November 22, the company disclosed that it “identified approximately $20 million of expenses that were… incorrectly recorded primarily as selling, general and administrative expenses in our preliminary earnings results, but were later determined to be associated with production set-up activities and are now appropriately reflected in cost of revenues. Additionally, other inventory adjustments were recorded resulting in a $4.0 million increase in net loss subsequent to the preliminary earnings results.”

Chief Operating Officer of Kohl’s Corp (NYSE: KSS — $2.56 billion) “will be departing” after just eight months. Last December, the company’s CEO departed to become the CEO of Levi Strauss (NYSE: LEVI — $6.11 billion).

Chief Accounting Officer of Valmont Industries (NYSE: VMI — $4.43 billion) resigned after a little over one year “to pursue other opportunities and to relocate closer to family.” In July, the company’s CEO resigned after five and a half years and departed the board “to pursue other opportunities.”

Principal Accounting Officer of Beyond Meat (NASDAQ: BYND — $436 million) resigned after a little over one year “to pursue another opportunity.” The company has had four different CFOs in the last five years.

Larry D. Frazier, board member of Great Southern Bancorp (NASDAQ: GSBC — $629 million), passed away after nearly 32 years on the board. In 2016, another active board member, Grant Q. Haden, passed away at the age of 62. Great Southern Bancorp currently has two board members over the age of 80, including William V. Turner, the bank’s Chairman for the last 50 years and father of CEO Joseph W. Turner.

Data for this section is provided by VerityData from VerityPlatform.com

What to Read

“The Strange $55 Million Saga of a Netflix Series You’ll Never See” (NYT)

“Soon after he signed the contract, Mr. Rinsch’s behavior grew erratic, according to members of the show’s cast and crew, texts and emails reviewed by The New York Times, and court filings in a divorce case brought by his wife. He claimed to have discovered Covid-19’s secret transmission mechanism and to be able to predict lightning strikes. He gambled a large chunk of the money from Netflix on the stock market and cryptocurrencies. He spent millions of dollars on a fleet of Rolls-Royces, furniture and designer clothing.”

“A Top Mutual Fund Executive Made Millions for Himself Trading the Same Stocks His Giant Fund Was Trading” (ProPublica)

“In late 2015, Dodge & Cox, one of the nation’s largest mutual fund managers, began buying large quantities of shares of a cloud-computing company called VMware. Over three quarters, Dodge & Cox amassed almost $700 million in shares. That was good news for anyone who already owned shares of VMware, since big purchases tend to push a stock price upward. One such shareholder was David Hoeft, a member of the Dodge & Cox committee that made the decision to buy the shares and an advocate for investing in technology companies.”

“Apple CEO Tim Cook on what it takes to run the world's largest company” (Dua Lipa Podcast)

“In a rare podcast appearance, Apple CEO Tim Cook joins Dua Lipa to dive into the profound impact of artificial intelligence, the ever-evolving tech landscape and their response to climate change. Join Dua as she discovers Tim’s personal journey, from his life growing up to his philanthropic endeavors, as well as his perspective on tackling global challenges.”

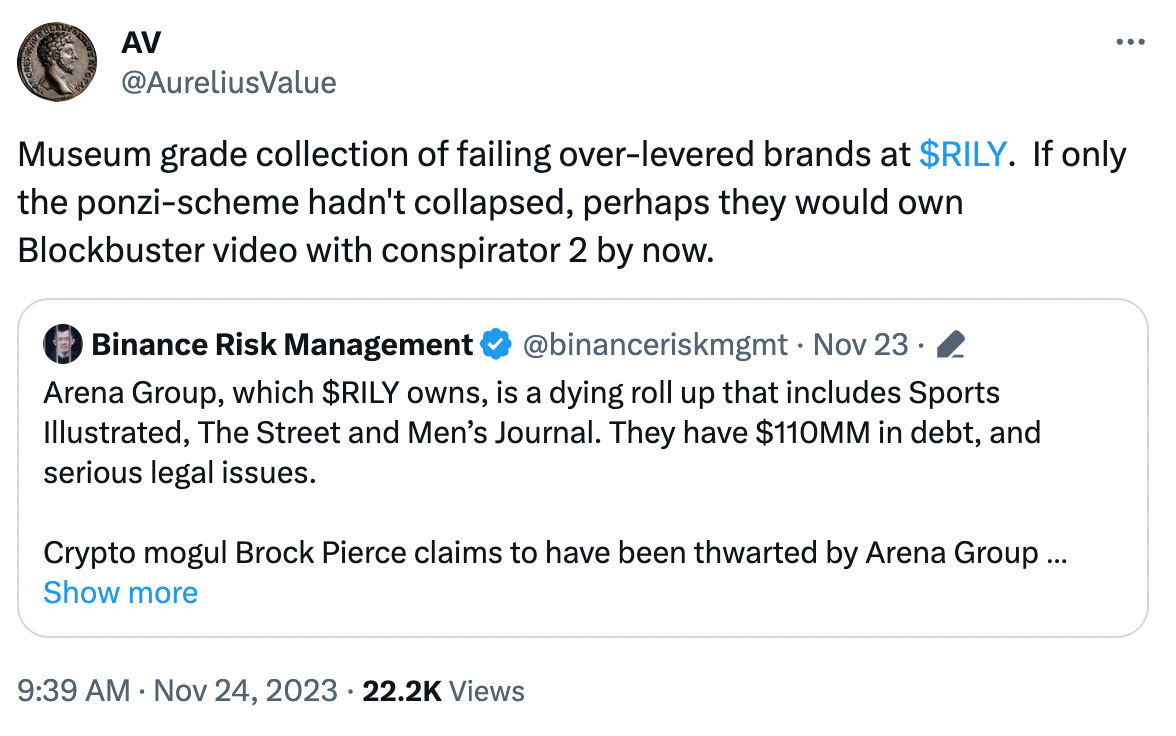

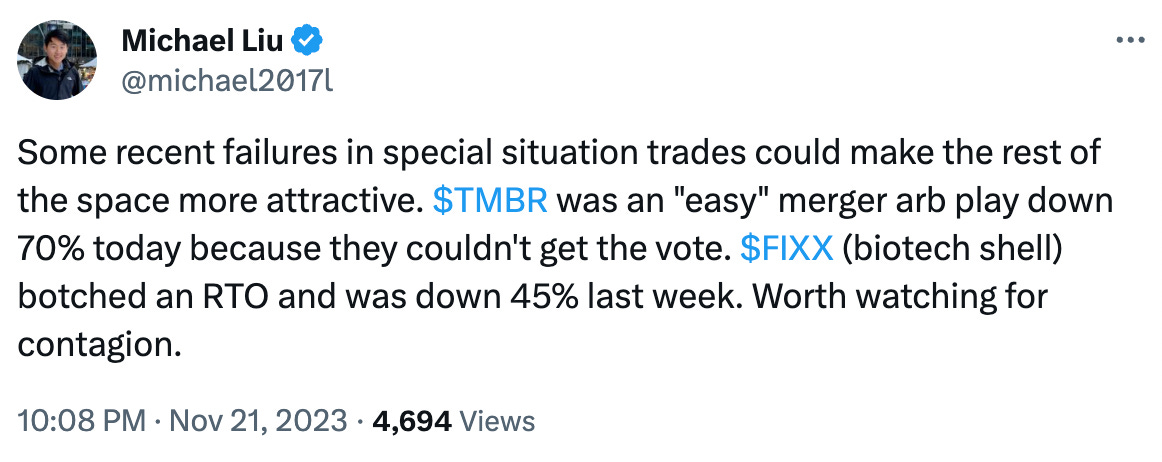

Tweets of the Week

Until next week,

The Bear Cave