Welcome to The Bear Cave! Our last premium articles were “Problems at Axos Financial (AX)” and “Problems at Flywire (FLYW)” and this Thursday, December 21, The Bear Cave will be posting our annual “Hedge Fund Analyst Christmas List” of our favorite free and paid equity research tools, with additional actionable content for paid readers.

In celebration of our 200th weekly edition of The Bear Cave, we have also decided to leave the comment section open on this post and will be replying to any reader who leaves a comment, question, or words of encouragement! As always, you can hit reply to this email and reach us directly and we will respond as soon as possible. Thank you for an amazing 200 weeks!

New Activist Reports

Hindenburg Research published a Twitter thread on Friday about Maison Solutions (NASDAQ: MSS — $49 million), a small Asian-themed grocery store chain. Hindenburg noted that the company roughly quadrupled since its October 2023 NASDAQ IPO, despite being “a loss-making business in dire financial straits.” Specifically, Hindenburg noted the grocery store chain was unprofitable, in violation of debt covenants, had “an apparently undisclosed federal tax lien,” and spent millions acquiring assets from the wife of the company’s CEO. In addition, Hindenburg found the company’s CFO obtained her accounting degree from the University of Phoenix, the company’s CEO and a related entity were “named as defendants in 2020 litigation alleging they used supermarkets as a front to defraud the EB-5 visa program,” and the company’s IPO underwriter, Joseph Stone Capital, has numerous FINRA violations including for stock promotion-related activity and “knowingly providing substantial assistance to salespeople conducting fraudulent and unethical sales practices.”

Maison Solutions stock fell roughly ~84% on Friday.

Separately, Nate Anderson, Hindenburg’s founder, tweeted that Chanson International Holding (NASDAQ: CHSN — $23 million) was being promoted by “China-based pump & dump chatroom operators” and was “another NASDAQ special that will collapse suddenly.”

Chanson International Holding stock also fell roughly ~88% on Friday.

Wolfpack Research published on Ramaco Resources (NASDAQ: METC — $767 million), a North American metallurgical coal and rare metals company. Wolfpack alleged that the concentration of rare metals at the company’s Brook Mine “appears to be 12% lower than the average found in the Earth’s crust” and therefore have little chance of being profitably mined. Wolfpack also noted that management and the company’s largest shareholder, PE firm Yorktown Energy Partners, have sold nearly $100 million in stock since November. In addition, Wolfpack highlighted that the company’s CEO was reportedly involved with an alleged fraud operated by his brother.

White Diamond Research published on Direct Digital Holdings (NASDAQ: DRCT — $114 million), a digital advertising company. White Diamond suggested that the majority of the company’s revenue, which is accruing to ballooning accounts receivable, “may be fake.” In addition, White Diamond noted that one of the company’s directors, Richard Cohen, has served as an executive or director at 15 other public – all of which have later fallen over 90%.

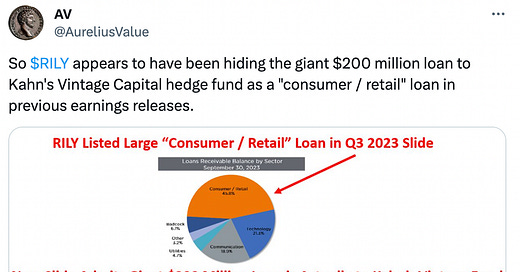

The Friendly Bear published a 37-slide presentation titled “Questions for B. Riley Analyst Day” concerning B. Riley Financial (NASDAQ: RILY — $625 million), an investment bank and financial services company. The Friendly Bear raised additional concerns about B. Riley’s entanglements with Brian Kahn and his affiliated companies given that Mr. Kahn’s private equity firm, Vintage Capital, was recently linked to an alleged Ponzi scheme.

Recent Resignations

Notable executive departures disclosed in the past week include:

CEO of Gyre Therapeutics (NASDAQ: GYRE — $1.88 billion) “retired for health reasons” after just three months and also departed the board. The company is up ~200% since its October 2023 reverse merger onto the NASDAQ.

CEO of RingCentral (NYSE: RNG — $3.15 billion) “mutually agreed that he would separate” after just three months and also departed the board. The outgoing CEO is “entitled to payments totaling $9.75 million” under his separation agreement. The company’s founder and prior CEO of 25 years, Vladimir Shmunis, will be returning to the role of CEO.

CFO of Offerpad Solutions (NYSE: OPAD — $289 million) “mutually agreed that he would separate” after five months. The company is down ~90% since its September 2021 SPAC merger.

CFO of RBB Bancorp (NASDAQ: RBB — $358 million) “is voluntarily resigning from his position as CFO due to personal reasons and will be pursuing other opportunities” after ten months. Last month, RBB Bancorp filed its 10-Q one day late after RBB’s auditor “identified an adjustment to the company’s noninterest income and net income.”

In May 2023, Paul Lin, a board member for 11 years and member of the audit committee, resigned “due to corporate governance matters and concerns that we have discussed many times, including: conflicts of interest among certain current and former board directors and members of management of the Bank… adequacy and accuracy of one or more of the internal investigation undertaken by the Bank, as well as of its remedial responses… [and] insufficient communication and processes concerning these and other board matters.”

In April 2022, the CEO of RBB “resigned effective immediately following the completion of an internal investigation” after nearly fifteen years. The investigation “was conducted by an independent outside law firm on behalf of a special committee of the Board of Directors [and] identified violations of company policies and procedures, including those relating to personnel decisions, as well as resulting adverse effects on officer and employee morale.”

CFO of Lucid Group (NASDAQ: LCID — $10.9 billion) resigned “effective immediately, in order to pursue other opportunities” after two and a half years.

CFO of HP Inc (NYSE: HPQ — $30.4 billion) resigned after three years “to pursue an opportunity outside of HP.” Last month, the company’s controller also resigned after two years.

CEO of Autohome Inc (NYSE: ATHM — $3.41 billion), China’s leading marketplace for auto sales, resigned “due to his other personal commitments, effective immediately” after three years. In July, two board members also resigned “due to other personal commitments.”

Thomas A. Fanning, Executive Chairman of The Southern Company (NYSE: SO — $77.3 billion), retired after eight months. Before becoming Executive Chairman, Mr. Fanning served as CEO and Chairman for over twelve years, and in June of this year, the Wall Street Journal reported that Mr. Fanning was the target of a spying operation — potentially from his subordinates.

Chief Operating Officer of Establishment Labs Holdings (NASDAQ: ESTA — $660 million) “departed” after just one year.

Chief Accounting Officer Radius Recycling, previously known as Schnitzer Steel Industries, (NASDAQ: RDUS — $812 million), resigned after one and a half years “for personal reasons.” In the last twelve months, the company’s Vice President of Operations, General Counsel, and two board members have all departed.

Chief Development Officer of Sweetgreen (NYSE: SG — $1.21 billion) “will no longer be with the company” after a little over four years. In May, the company’s Chief Marketing Officer resigned after two and a half years, and in December 2022 the company’s Chief Operating Officer resigned after nearly three years. The company is down ~80% since its November 2021 IPO.

Data for this section is provided by VerityData from VerityPlatform.com

What to Read

“He’s Wanted for Wirecard’s Missing $2 Billion. He’s Now Suspected of Being a Russian Spy.” (WSJ)

“Marsalek already stands accused of stealing hundreds of millions of dollars from investors. Following multiple international investigations, officials from intelligence, police and judiciary agencies in several countries now say the 43-year-old native of Austria used his defunct payments company to illegally help Russian spy agencies move money to fund covert operations around the world.”

“BP Docks Former CEO Bernard Looney as Much as $40 Million Over ‘Serious Misconduct’” (WSJ)

“The board in recent months has received still more reports of allegations, and has continued to investigate details of those reports, according to a person close to the company. A spokesman said allegations made to the board were confidential and that the company can’t discuss details. The board’s decision about Looney’s pay is tied to his disclosures, not specifics of the allegations, and BP doesn’t expect to release a public report on its findings, he said.”

“Women at Fast-Growing Realty Firm Say They Were Drugged and Assaulted” (NYT)

“In two lawsuits, the first filed in February and the second on Thursday, five women described a yearslong pattern of predatory behavior by two marquee agents. The women said the agents drugged them during alcohol-soaked eXp events, and four of the women said they were then sexually assaulted. Executives ignored complaints about the men for years, acting only after the first lawsuit was filed, agents said.”

Tweets of the Week

Until Thursday,

The Bear Cave

Edwin, congratulations on the 200th issue of the Bear Cave and thanks for a profitable idea in PLNT this year. 👍🏻

you are one of the best ......keep it up