Welcome to The Bear Cave! Our last premium articles were “Problems at Flywire (FLYW)” and “Our 2023 Hedge Fund Analyst Christmas List” and our next premium investigation comes out Thursday, January 4.

New Activist Reports

Bleecker Street Research published an update on PureCycle Technologies (NASDAQ: PCT — $630 million), an emerging plastic recycling company. Bleecker Street highlighted that the company was again shutting down its recycling facility “due to unforeseen mechanical issues” and was at risk of technical default on certain bond covenants related to the facility’s operation. Moreover, Bleecker Street alleged the company continued to mislead investors and that management “is boastful when something works, and is silent when something doesn’t.”

NINGI Research published on SMA Solar Technology (Frankfurt: S92 — EUR2.02 billion), a German solar energy equipment supplier. NINGI alleged the company “has been doctoring its financial statements for the past five years” and “[unjustly] capitalized EUR 146 million in expenses.” In addition, NINGI highlighted that the company’s audit chairwoman “currently runs a horse breeding business” and alleged company’s “intellectual property is threatened by several lawsuits from competitors.”

Viceroy Research published an update on Arbor Realty Trust (NYSE: ABR — $2.53 billion), a mortgage REIT focused on bridge financing. Viceroy found that “sixty-nine of Arbor’s CLO loans are now delinquent: a 50% growth in the number of delinquencies month-on-month.” Viceroy concluded,

“If it was not already obvious in our November CLO update, it is now. The writing is on the wall. We believe Arbor is a donut.”

Recent Resignations

Notable executive departures disclosed in the past week include:

CFO of Markel Group (NYSE: MKL — $18.3 billion) “mutually agreed” to depart after just nine months.

CFO of Clover Health Investments (NASDAQ: CLOV — $488 million) stepped down “in order to pursue another professional opportunity” after one and a half years. In June, the company’s General Counsel resigned after a little over one year “to pursue a new role” and in March the company's Chief Growth Officer also resigned. The company has had three different CFOs since its January 2021 SPAC merger and has since fallen ~90%.

CFO of Dave & Buster's Entertainment (NASDAQ: PLAY — $2.14 billion) “retired” after two and a half years. The company has had four different CEOs and four different CFOs in the last ten years.

CEO and CFO of LianBio (NASDAQ: LIAN — $486 million) both resigned after two and a half years “to pursue other opportunities.” The company is down ~70% since its November 2021 IPO.

CFO of C.H. Robinson Worldwide (NASDAQ: CHRW — $10.2 billion) “retired” after nearly five years. In January, the company’s CEO departed after four years following “an involuntary termination by the company without cause.” The company has had four different CEOs and three different CFOs in the last five years.

Chief Medical Officer of CRISPR Therapeutics (NASDAQ: CRSP — $5.06 billion) resigned after nearly two years. In September, the company’s Chairman resigned after nearly six years, and in March another board member resigned effective immediately after ten years and the company’s CFO resigned after one and a half years “to pursue external opportunities.” In October 2022, the company’s Chief Operating Officer also departed “to pursue external opportunities.”

Chief Accounting Officer of Compass Minerals International (NYSE: CMP — $1.09 billion) “retired” after about two years. The company has had six different CFOs in the last ten years.

John Collins, board member of betting and gaming company Super Group (NYSE: SGHC — $1.52 billion), resigned after two years “in connection with his investment into a National Hockey League team.”

Chief Human Resources Officer of Calavo Growers (NASDAQ: CVGW — $510 million) resigned after a little over two years. The company has had five different CEOs and seven different CFOs in the last five years.

Data for this section is provided by VerityData from VerityPlatform.com

What to Read

“Burned Investors Ask ‘Where Were the Auditors?’ A Court Says ‘Who Cares?’” (WSJ)

“Audit reports operate on a pass-fail model, and their language is standardized. Either a company gets a clean opinion on its financial statements from the outside auditor, or it doesn’t.

The notion that the standardized language is essentially meaningless raises larger questions about whether audit reports serve a useful purpose. Total audit fees at U.S.-listed companies were almost $17 billion last year, according to the research firm Ideagen Audit Analytics. Independent audits have been a legal requirement for public companies since Congress passed the Securities Act of 1933, four years after the stock market crash that spurred the Great Depression.”

“SEC Charges Tingo Mobile Founder, Three Companies with Massive Fraud and Obtains Emergency Relief” (SEC)

“For instance, Tingo Group’s fiscal year 2022 Form 10-K filed in March 2023 reported a cash and cash equivalent balance of $461.7 million in its subsidiary Tingo Mobile’s Nigerian bank accounts. In reality, those same bank accounts allegedly had a combined balance of less than $50 as of the end of fiscal year 2022. According to the SEC’s complaint, Defendants also fabricated the customer relationships that formed the basis of their purported businesses. The complaint alleges that Mmobuosi and the entities he controls have fraudulently obtained hundreds of millions in money or property through these schemes, and that Mmobuosi has siphoned off funds for his personal benefit, including purchases of luxury cars and travel on private jets, as well as an unsuccessful attempt to acquire an English Football Club Premier League team, among other things.”

“SEC Charges Former CEO of Medical Device Startup Stimwave with $41 Million Fraud” (SEC)

“The SEC’s complaint alleges that Perryman knew, or was reckless in not knowing, that the smaller receiver was, in reality, fake and nothing more than a piece of plastic. According to the complaint, Perryman misrepresented to investors that the PNS Device was approved by the U.S. Food and Drug Administration and was the only effective device of its kind on the market. The complaint also alleges that Perryman made false and misleading statements to investors about Stimwave’s historical revenues, revenue projections, and business model.”

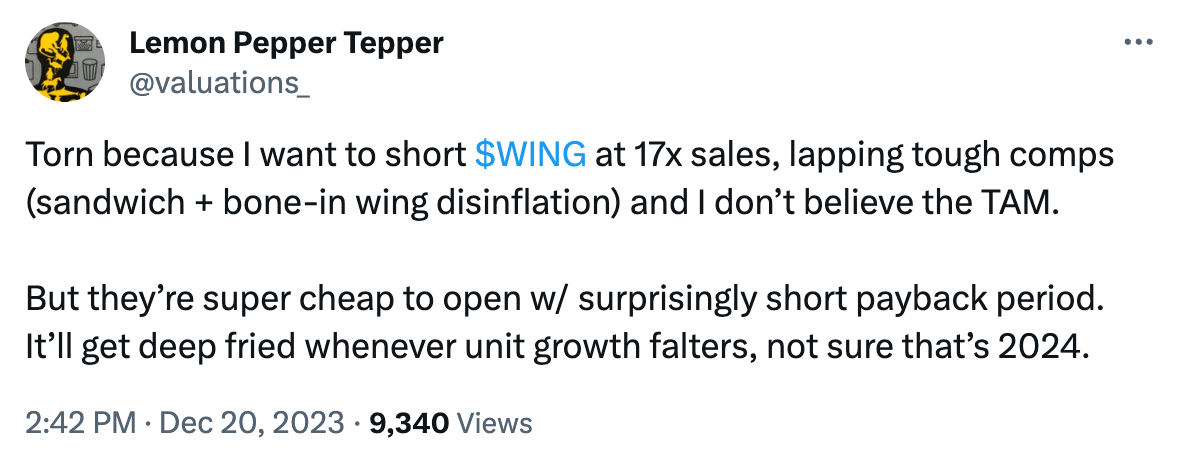

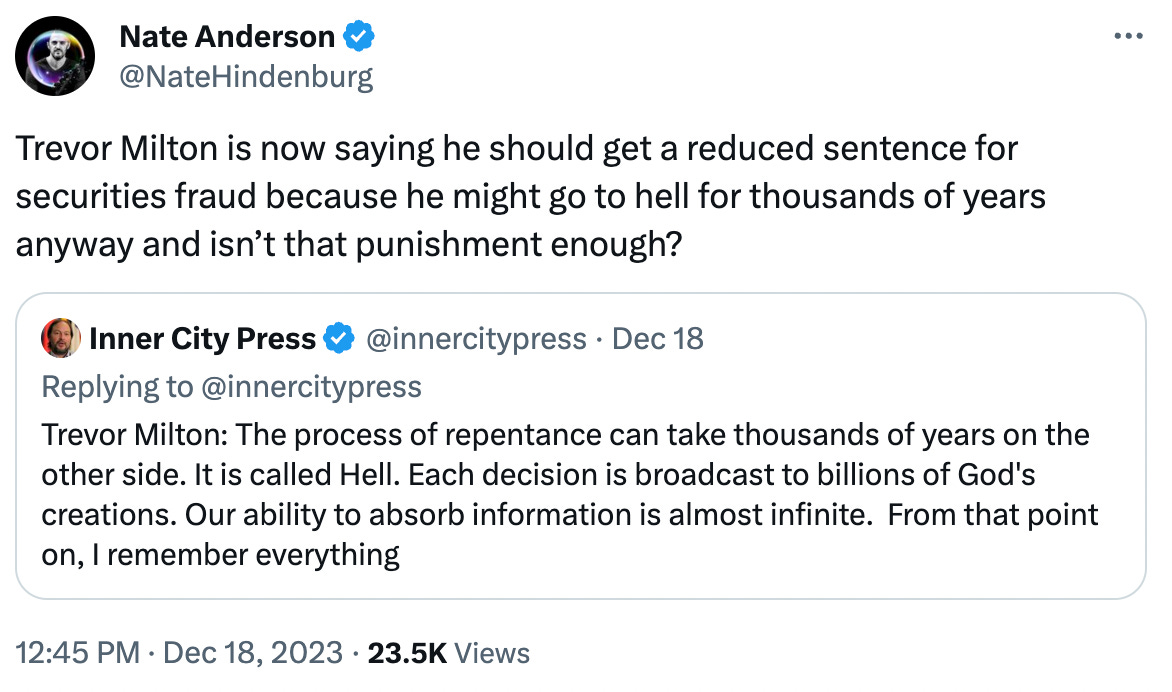

Tweets of the Week

Happy holidays,

The Bear Cave