Welcome to The Bear Cave! Our last premium articles were “Problems at Flywire (FLYW)” and “Our 2023 Hedge Fund Analyst Christmas List” and our next premium investigation comes out this Thursday, January 4.

New Activist Reports

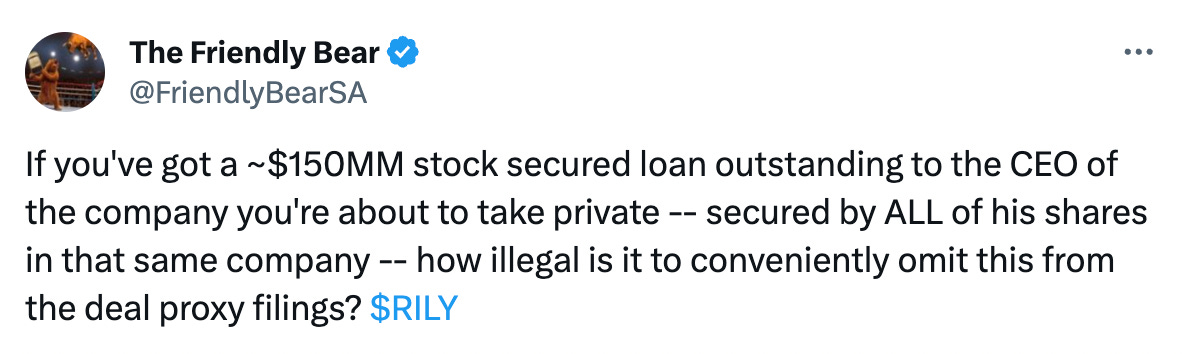

The Friendly Bear published a Twitter thread on B. Riley Financial (NASDAQ: RILY — $642 million), an investment bank and financial services company. The Friendly Bear highlighted recently unsealed litigation alleging that Brian Kahn “misappropriated almost $200 million to build his controlling stake in Franchise Group back in 2019-2020.” Franchise Group was recently acquired by B. Riley and B. Riley loaned Brian Kahn $201 million against his Franchise Group shares, collateral The Friendly Bear says is worthless because the stock was misappropriated from victims of Prophecy Asset Management, an alleged Ponzi scheme linked to Mr. Kahn’s private equity firm, Vintage Capital.

Wolfpack Research also published a Twitter thread on B. Riley and highlighted that Jeremy Nowak, a prop trader at B. Riley, previously worked at Vintage Capital and “appears to be a key player in the RILY/Vintage/Bryant Riley/Brian Kahn network of schemes.”

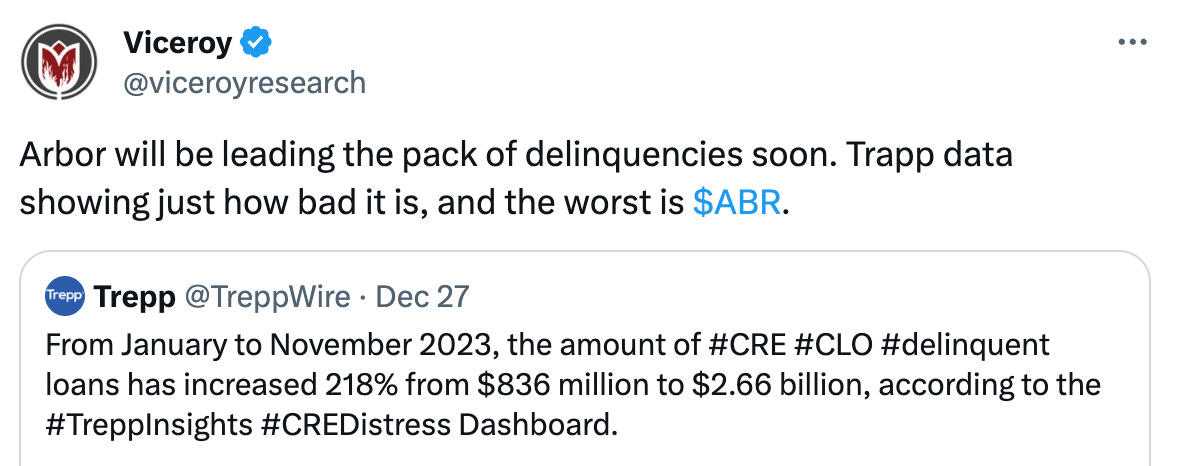

Viceroy Research published another case study on delinquent loans at Arbor Realty Trust (NYSE: ABR — $2.86 billion), a mortgage REIT focused on bridge financing. Viceroy found that many property groups that borrowed money from Arbor appear to be highly levered, illegally evicting tenants, or operating outside the bounds of the law.

Recent Resignations

Notable executive departures disclosed in the past week include:

CFO of Life Time Group Holdings (NYSE: LTH -- $2.96 billion) “will cease his service to the company” after one and a half years. The company is down ~15% since its October 2021 IPO.

CFO of Energy Fuels Inc (NYSE: UUUU — $1.15 billion) “will cease to be the Chief Financial Officer” after one and a half years. In July, the company’s Chief Operating Officer “departed” after one year and in June 2022 the company’s Chief Accounting Officer “submitted her formal resignation.”

CFO of Inspired Entertainment (NASDAQ: INSE — $260 million) resigned after a little over one and a half years. The company has had four different CFOs in the last three years and is roughly flat since its December 2016 SPAC merger. In addition, the company hired KPMG as auditor in March 2023 and then dismissed KPMG in November 2023 and engaged Marcum LLP.

Herbert C. Buie, board member of Southside Bancshares (NASDAQ: SBSI — $946 million), was appointed “as Director Emeritus… in accordance with the mandatory age requirement set forth in the company's Director Departure Policy.” Mr. Buie had served on the board for 36 years and is 92 years old.

Data for this section is provided by VerityData from VerityPlatform.com

What to Read

“Building an Unfair Advantage” (MicroCapClub)

“Justin Ishbia is likely the best microcap investor in the world. He is the founding partner of Shore Capital Partners, a $7 billion private equity firm utilizing a systematic approach to acquire hundreds of private microcap businesses. Since 2009, Shore Capital has acquired 600 small businesses, which makes them the #1 most active private equity firm in the world.

More importantly, Shore Capital is ranked in the top 1% of all private equity firms globally by performance. They have compounded investor capital at 50% net per year for 10+ years. The firm’s success has made Justin Ishbia a billionaire, and the co-owner of the Phoenix Suns/Phoenix Mercury along with his brother Mat Ishbia (CEO of United Wholesale Mortgage).”

“Quality Investing Outside the Blue Chips” (Alluvial Capital)

“Even with those caveats, ‘quality investing’ is a valid strategy. I think investors will continue to do well paying high but not stratospheric prices for the world’s truly exceptional businesses. While many of these businesses are household names with widely-held shares, there are numerous lesser-known enterprises that are no less commendable. Allow me to present a few.”

Tweets of the Week

Happy New Year,

The Bear Cave