Welcome to The Bear Cave! Our last premium articles were “Problems at a $6 Billion+ Recent Tech IPO” and “Problems at a Billion Dollar Mess” and our next premium investigation comes out this Thursday, February 15.

New Activist Reports

Independent Researcher Lauren Balik published a second article on CAVA Group (NYSE: CAVA — $6.01 billion), a fast-growing chain of Mediterranean restaurants. Ms. Balik raised additional food safety concerns about Cava and alleged that the company’s unique way of cooking its ground lamb meatballs “presents a significant risk of E. coli contamination.” Ms. Balik also highlighted numerous examples on social media of users purportedly claiming to get food poisoning from Cava and wrote, in part,

“I do not believe Cava can absorb a health crisis, and I strongly believe equity holders will be wiped out within a year of a Cava-attributed public health crisis. I believe a Cava-attributed public health crisis in 2024 is a near certainty given the health and food safety standard throughout this chain.”

GlassHouse Research published on Soho House & Co (NYSE: SHCO — $1.10 billion), a New York City-based members-only club. GlassHouse highlighted that the company “has never been profitable in its 28-year history” and recently “stopped reporting retention data after the numbers started to turn south.” GlassHouse also called the company “a broken business model [with] terrible accounting, mounting debt, and poor internal controls” and gave the company a price target of $0.

Muddy Waters Research published a 72-slide presentation on Fairfax Financial Holdings (Toronto: FFH — CAD$31.1 billion), a Canadian financial conglomerate. Muddy Waters found that Fairfax “has consistently manipulated asset values and income by engaging in often value destructive transactions to produce accounting gains.” As one example, Fairfax carries its investment in publicly traded EXCO Resources at over twice its trading price. Muddy Waters concluded that “a conservative adjustment to book value should be ~$4.5 billion or ~18% lower than reported” and called the company “far more akin to GE than to Berkshire Hathaway.”

Jehoshaphat Research published on Dun & Bradstreet Holdings (NYSE: DNB — $4.87 billion), a Jacksonville-based business analytics company. Jehoshaphat wrote, in part,

“This is a classic accounting short: Low short interest, struggling business with a ton of debt, cash flows and earnings inflated by a bunch of gimmicks, and analysts mis-modeling key metrics. Unsurprisingly, corporate governance is poor and inflation-adjusted organic growth, on our math, is negative.”

Recent Resignations

Notable executive departures disclosed in the past week include:

CEO of Grifols (NASDAQ: GRFS — $6.85 billion) “decided to transition out” after eleven months. The company said the departure was “part of a long-planned, carefully architected corporate governance evolution strategy.” Last month, Gotham City Research published on the company and alleged that Grifols “manipulates reported debt & EBITDA to artificially reduce reported leverage.”

CFO of HF Foods Group (NASDAQ: HFFG — $250 million) “is taking a leave of absence for personal reasons” after one and a half years. The company has had six different CFOs in the last five years and in March 2020, Hindenburg Research alleged the company was backed by pump-and-dump artists and “transacted with at least 43 separate related-party entities.”

CFO of Enerpac Tool Group (NYSE: EPAC — $1.67 billion) resigned “to assume an executive role at a private equity firm” after nearly two years.

CFO of Allego (NYSE: ALLG — $276 million) “is transitioning away from the company to pursue new opportunities” after nearly three years. The electric charging station company is down ~90% since its March 2022 SPAC merger.

CEO and Chairman of Forward Air (NASDAQ: FWRD — $1.28 billion) was “terminated without cause” after about five and a half years. The company is down ~60% in the last year.

Chief Operating Officer of Vestis Corp (NYSE: VSTS — $2.49 billion) “resigned for personal reasons, effective immediately” after less than six months. The company is roughly flat since its September 2023 spinoff from Aramark (NYSE: ARMK — $8.01 billion).

Chief Revenue Officer of Sprinklr Inc (NYSE: CXM — $3.58 billion) “stepped down” after a little over a year. The company is down ~35% since its June 2021 IPO.

Larry Summers, former United States Secretary of the Treasury, resigned from the board of Block Inc (NYSE: SQ — $41.1 billion) “effective immediately, in order to devote more time to his other professional and personal commitments” after almost thirteen years. Mr. Summers continues to serve on the board of two other public companies: Doma Holdings (NYSE: DOMA) and Skillsoft (NYSE: SKIL). In the last twelve months, the company’s CEO of payment subsidiary Square, a board member, and the company’s Chief Legal Officer have all departed. In March 2023, Hindenburg “alleged the company turned a blind eye to criminal activity facilitated on its app.”

Data for this section is provided by VerityData from VerityPlatform.com

What to Read

“How the Funeral Industry Got the FTC to Hide Bad Actors” (WSJ)

“Unethical funeral homes have exploited grieving customers for decades. What consumers don’t know is that many of the industry’s bad actors have been hidden from the public thanks to a sweetheart deal struck between the Federal Trade Commission and the funeral industry more than 25 years ago.

In that deal, unlike any known to exist between the FTC and any other industry, the names of funeral homes that violate rules requiring price transparency and fair practices aren’t made public to consumers, as long as they complete a virtual remedial program run by the funeral industry’s own lobbying group.”

“SEC Charges China-Based Tech Company Cloopen Group with Accounting Fraud” (SEC)

“According to the SEC’s order, two senior managers who led Cloopen’s strategic customer contracts and key accounts department orchestrated a fraudulent scheme from May 2021 through February 2022 to prematurely recognize revenue on service contracts. The order finds that, facing pressure to meet strict quarterly sales targets, the two senior managers directed their employees to improperly recognize revenue on numerous contracts for which Cloopen had either not completed work or, in some instances, not even started work.”

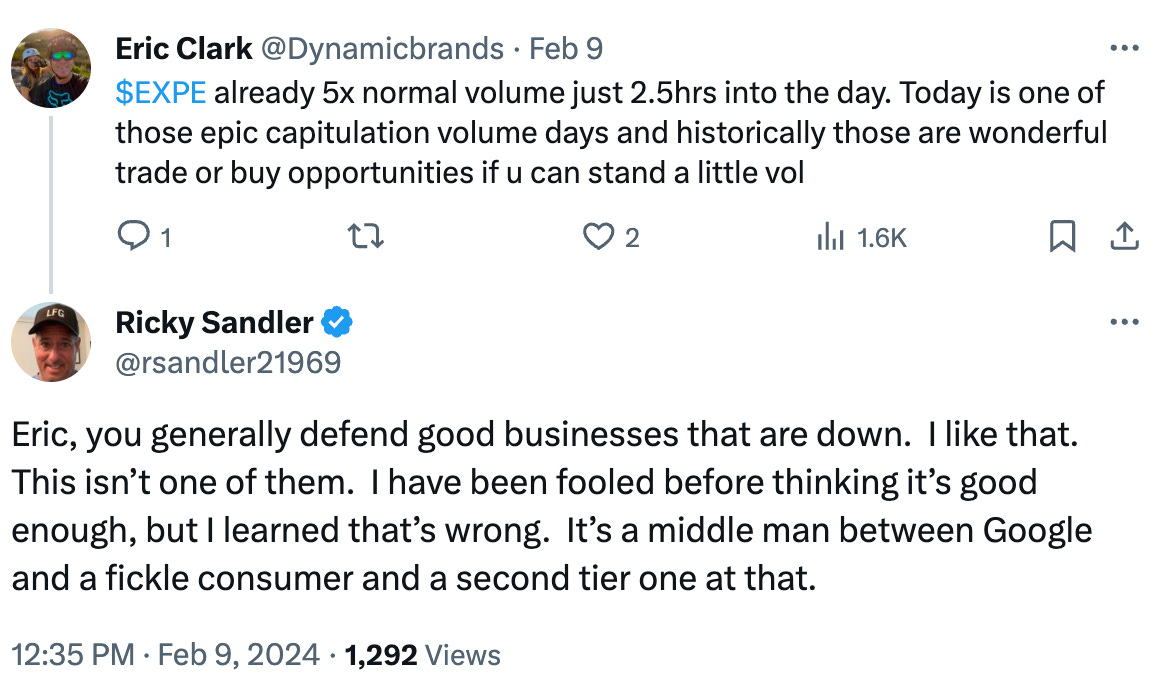

Tweets of the Week

The Bear Cave also recently hosted a recorded Twitter Spaces interview with short-seller Marc Cohodes on problems at B. Riley, available here.

If you love The Bear Cave, please consider hitting the heart button and sharing us with a friend!

Until Thursday,

The Bear Cave