Welcome to The Bear Cave! Our last premium articles were “Problems at a Billion Dollar Mess” and “More Problems at B. Riley (RILY)” and our next premium investigation comes out Thursday, March 7.

New Activist Reports

Kerrisdale Capital published on Altimmune Inc (NASDAQ: ALT — $471 million), an early-stage biopharmaceutical company focused on treating obesity and liver disease. Kerrisdale said the company’s only drug has “no chance of commercial success” and leads to “underwhelming weight-loss activity.” Kerrisdale also noted that the company is facing strong competition from the GLP-1 space and wrote:

“Bulls should also look at management history: CEO/CFO/CMO have all presided over the same series of huge pharmaceutical failures. Busted trials, failed commercializations, even a swing-and-a-miss at a COVID vaccine. Hard to imagine this crew going up against LLY/NVO and winning.”

Hindenburg Research published on Renovaro BioSciences (NASDAQ: RENB — $326 million), a biotech company focused on treating various cancers. Hindenburg called the company “a worthless AI shell game with a murderous magician past” and noted that the company’s co-founder and former CEO “was charged by the Department of Justice over allegations that he conspired to hire a hitman to murder one of the victims of his many scams, a father of six who was executed in a Vermont snowbank.” Now, the company is led by a doctor who worked under Anthony Fauci and in August 2023 Renovaro announced it would acquire GEDi Cube, an AI company. However, Hindenburg found:

“At the time of the announcement, GEDi was a 2-month-old entity with virtually ‘no operational history,’ product, revenue or assets. GEDi consisted of a term sheet to acquire an entity called Grace Systems, which it claimed had AI tech… Grace was a nearly insolvent tiny startup with no revenue and no commercial-ready product after 10 years.”

Hindenburg predicted “inevitable massive downside in shares of Renovaro.”

Hindenburg Research also published a second report this week on Temenos (Switzerland: TEMN — CHF4.37 billion), a Swiss financial software company. Hindenburg summarized:

“Our 4-month investigation into Temenos, involving interviews with 25 former employees, including senior leaders at the company, uncovered hallmarks of manipulated earnings and major accounting irregularities. This includes evidence of roundtripped revenue, sham partnerships, rampant pulling forward of contract renewals, backdated contracts, excessive capitalization of seemingly non-existent R&D investments, and other classic accounting red flags.”

One example highlighted by Hindenburg includes Temenos loaning money to a customer “the same hour” the customer signed a major purchase order. Hindenburg predicted the company would “soon run out of accounting tricks [and] investors willing to buy as executives continue to sell.”

Culper Research published on ACADIA Pharmaceuticals (NASDAQ: ACAD — $4.12 billion), a San Diego-based biopharmaceutical company. The company’s main drug, Daybue, treats a rare genetic neurological disease called Rett syndrome. Culper called the drug “a total flop” with many negative side effects. Culper specifically took issue with the company’s disclosed “4-month confirmed discontinuations" metric given that most patients only discontinue treatment after first meeting with their doctor after six months and many discontinuations are “unconfirmed” and therefore left out of the discontinuation data.

Wolfpack Research published on Innodata (NASDAQ: INOD — $235 million), a data management company. Wolfpack called the company “consistently unprofitable due to the declining relevance of its legacy business of manual data annotation via offshore labor” and alleged the company would promote spurious press releases about artificial intelligence to pump its stock so insiders could sell at inflated prices.

Recent Resignations

Notable executive departures disclosed in the past week include:

CEO of Cannae Holdings (NYSE: CNNE — $1.46 billion) resigned after four years and will be replaced by the company’s Chairman, William P. Foley II.

Toan Huynh, board member of New York Community Bancorp (NYSE: NYCB — $3.54 billion), resigned after a little over one year because “she is pursuing other interests.” Ms. Huynh also previously served on the board of Sunlight Financial Holdings for two years until the firm’s October 2023 bankruptcy. New York Community Bancorp stock is down ~50% in the last month over loan loss and liquidity concerns.

President of Funko (NASDAQ: FNKO — $396 million), who also previously served as the company’s CEO, resigned “for Good Reason” after a little over one year. The company has had four different CEOs and four different CFOs in the last four years.

Chief Operating Officer of Anywhere Real Estate Inc (NYSE: HOUS — $782 million) “stepped down” after two years.

General Counsel of Emerald Holding Inc (NYSE: EEX — $423 million) departed after two and a half years. The company’s Chief Operating Officer also departed after five years.

Chief Operating Officer of Instacart (NASDAQ: CART — $7.50 billion) resigned after three years and the company “does not plan to hire or appoint a new Chief Operating Officer at this time.” The company is down ~10% since its September 2023 IPO.

Chief Legal Officer of International Money Express Inc (NASDAQ: IMXI — $726 million) resigned “effective immediately” after three years. The company is up ~110% since its July 2018 SPAC merger. In September 2020, the company’s CFO resigned “in order to accept a position as Chief Financial Officer of BlockFi.”

Walter G. Lohr Jr., board member of Danaher Corp (NYSE: DHR — $185 billion), “decided not to stand for reelection” after 41 years of service. Danaher stock is up ~192,000% since Mr. Lohr Jr., a former assistant attorney general for the State of Maryland, joined the board in 1983.

Data for this section is provided by VerityData from VerityPlatform.com

What to Read

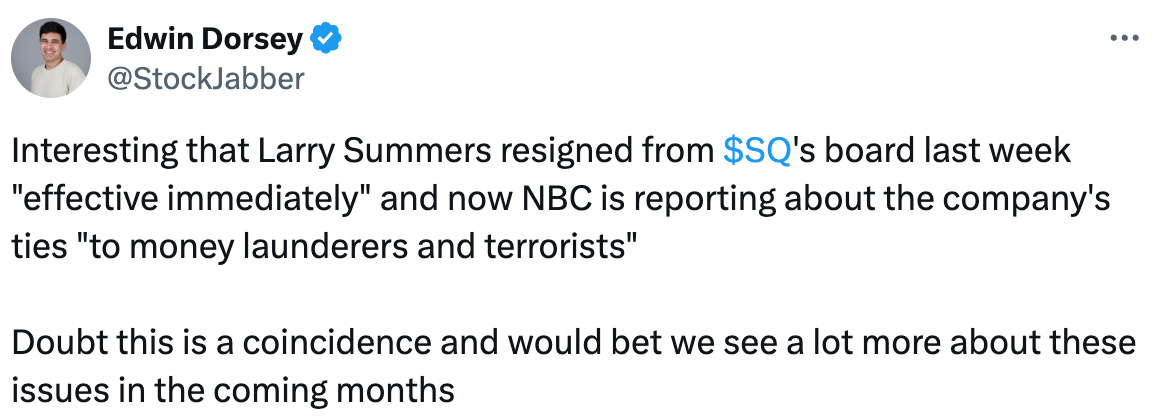

“Federal regulators are probing whether Cash App leaves door open to money launderers, terrorists” (NBC News)

“The payment app, used by millions and celebrated by rappers, ‘had no effective procedure’ to establish the true identity of customers, two whistleblowers told officials.”

“How an Unremarkable Deal Became a Big Threat to a Small Investment Bank” (WSJ)

“B. Riley’s loans to Kahn date back longer than previously known. It made at least 10 different loans to Kahn and entities he controlled from 2018 through 2023, according to financing statements filed with state agencies in Nevada, Delaware and Florida, known as Uniform Commercial Code filings. The UCC filings don’t show the amounts borrowed.”

Tweets of the Week

Until next week,

The Bear Cave