Welcome to The Bear Cave! Our last premium articles were “More Problems at Hershey (HSY)” and “Problems at Marqeta (MQ)” and our next premium investigation comes out this Thursday, April 18.

New Activist Reports

Fuzzy Panda Research published on Globe Life (NYSE: GL — $5.56 billion), a supplemental life insurance company that operates through a network of independent salespeople. Fuzzy Panda alleged it “uncovered extensive allegations of insurance fraud” especially around Globe Life’s American Income Life subsidiary, which accounts for about half of Globe Life’s underwriting profit. Fuzzy Panda alleged American Income Life salespeople wrote policies for dead people, forged signatures, and set up fictitious policies to hit bonuses.

Fuzzy Panda also alleged the company “borders on an illegal Pyramid Scheme” and that the cultural issues at American Income Life were widespread with at least 16 independent agencies having “corroborated fraudulent insurance production.” Fuzzy Panda noted that “multiple states have sanctioned American Income Life salespeople” and that some salespeople explained that “recruiting new agents is more lucrative than selling policies.”

Fuzzy Panda said it believed that “multiple Globe Life executives will likely be going to prison for insurance fraud” and in an email to readers concluded,

“It is as though a group of people decided to get together and watch Wolf of Wall Street and then go out and commit every financial crime they could think of.”

The Fuzzy Panda report led to a ~55% decline in Globe Life stock on Thursday, one of the largest single-day moves in activist short history. In response, Globe Life issued a statement that read, in part,

“The short seller analysis by Fuzzy Panda Research mischaracterizes facts and uses unsubstantiated claims and conjecture to present an overall picture of Globe Life that is deliberately false, misleading and defamatory. Globe Life intends to explore all means of legal recourse against the parties responsible.”

Night Market Research published on Verses AI (OTC: VRSSF — $102 million), a Canadian cognitive computing company. Night Market alleged the company “misrepresented partnerships” and spent over $200,000 on a marketing stunt involving a billboard in front OpenAI’s offices. Night Market also noted that “Verses has engaged at least 18 entities for stock promotion and investor relations” in the past year or so.

Recent Resignations

Notable executive departures disclosed in the past week include:

CFO of Illumina (NASDAQ: ILMN — $20.2 billion) “has decided to leave” after a little over one year. The company has had three different CEOs, three different CFOs, and three different Chairmen in the last three years.

CEO of Angi Inc (NASDAQ: ANGI — $1.08 billion), Joseph Levin, who also serves as CEO of Angi’s parent IAC (NASDAQ: IAC — $4.14 billion), stepped down as CEO of Angi after one and a half years. The company has had four different CEOs and four different CFOs in the last three years.

Chief Financial Officer of Customers Bancorp (NYSE: CUBI — $1.54 billion) “was notified of her termination from employment with the company on April 10, 2024, for ‘cause’ under her employment agreement for violating company policy, effective immediately.” The company also disclosed that the outgoing CFO, who had served for five and a half years, “has disputed the company’s characterization of her separation from the company.” In September 2023, the bank also disclosed its Chief Credit Officer, Andrew Bowman, was departing “to pursue entrepreneurial interests.” Mr. Bowman’s LinkedIn shows he is currently an “independent consultant.”

Chief Customer Officer of Petco Health and Wellness Company (NASDAQ: WOOF — $529 million) was “terminated without cause” after a little over one and a half years. The company’s Chairman/CEO also “entered into a separation and consulting agreement and general release of claims” in March after nearly six years. The company is down ~90% since its January 2021 IPO.

Data for this section is provided by VerityData from VerityPlatform.com

What to Read

“Boeing Reveals Executives Got an Extra $500,000 in Private-Jet Perks” (WSJ)

“An internal Boeing review found that Chief Executive David Calhoun and other top executives took personal trips worth more than $500,000 on the company’s private jets and other planes that were improperly recorded as business travel.”

“Idea Brunch with Altay Capital” (Sunday’s Idea Brunch)

“What’s surprising to me though is that despite this opportunity, very few people are looking at these kinds of Japanese stocks. My posts on X about some of these smaller companies are almost always the only posts discussing these names. Even on Yahoo! Finance Japan, the message boards for most of the companies I’m interested in are totally dead. These are completely overlooked names.

I think in 5-10 years everyone is going to look back at this period and say ‘duh, of course you had excellent returns, you were buying net-nets with 10+ years of profitability at 7 P/E!’”

“Rep. Luetkemeyer and Rep. Foster Send a Letter on Market Volatility Attributed to Short Selling” (Congressman Luetkemeyer)

“We are aware of assertions that some issuers have experienced falling stock prices due to market-moving information that was untrue. This information has been disseminated through traditional media, publishing sourced reporting, and over social media. The speed and pseudonymity of social media can frustrate the correction of inaccurate information while also facilitating concurrent, if not coordinated, investing by many retail investors. This presents new and growing challenges to the SEC’s market surveillance.”

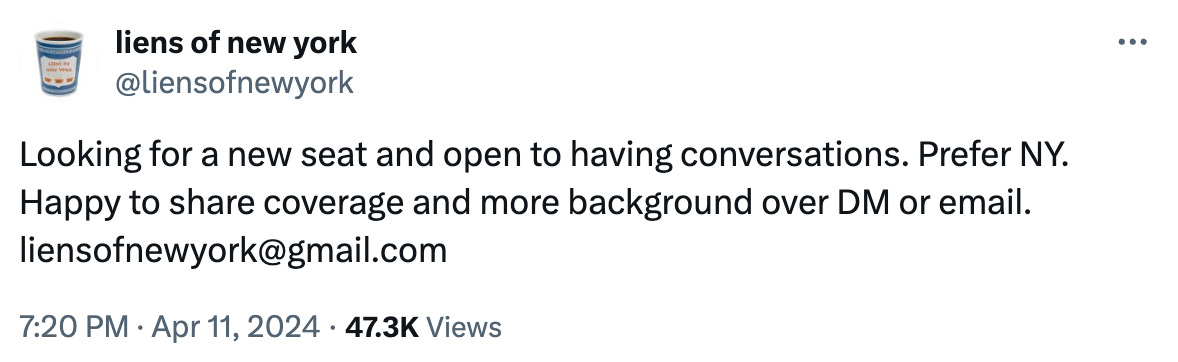

Tweets of the Week

Until Thursday,

The Bear Cave