Welcome to The Bear Cave! Our last premium articles were “Problems at Primerica (PRI)” and “More Problems at eXp World Holdings (EXPI)” and our next premium investigation comes out this Thursday, May 16.

New Activist Reports

Viceroy Research published a follow-up report titled “Fraud” on Arbor Realty Trust (NYSE: ABR — $2.47 billion), a mortgage REIT focused on bridge financing. Viceroy wrote,

“Viceroy’s investigations have discovered an elaborate and intentional con, where Arbor has financed purchases of assets from its own foreclosures, with Arbor loans, via off-balance sheet entities run by former Arbor associates, and entirely financed with Arbor equity capital.”

Specifically, Viceroy published a property deed that appeared to show that an entity 99% financed by Arbor “[acquired] foreclosed Arbor properties at an apparent premium” so that Arbor could “fraudulently overstate the value of its loan book.”

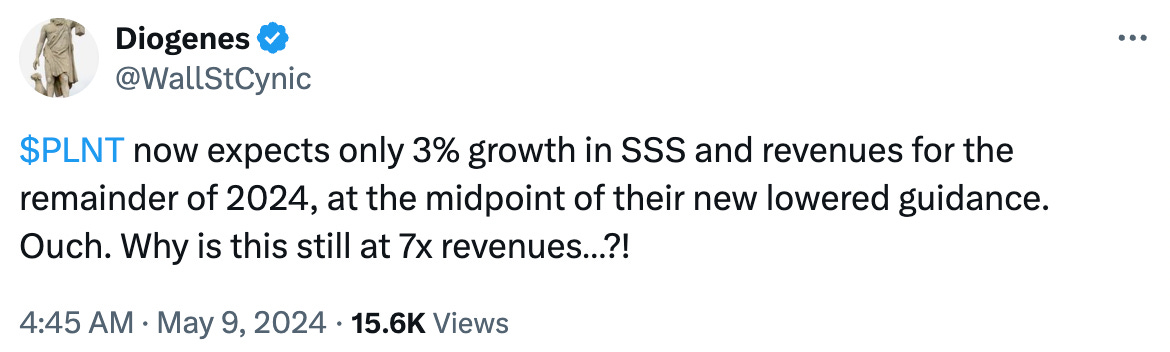

The day before Viceroy published its report, Arbor put out a press release that read, in part,

“As you may be aware, Arbor has been, and continues to be the subject of certain ‘reports’ by short sellers… In light of the current environment and the continued elevated short interest in our company, we anticipate more of these short seller ‘reports’ in the near future… In an effort to minimize any confusion in the marketplace or with our investors, and instead of responding to each article that cites these ‘reports,’ we want to reiterate that we stand by Arbor’s detailed filings, audited financial statements and the comments made on our earnings call.

Hunterbrook Media, a new media outlet that shares its stories in advance with an affiliated hedge fund, published on New Fortress Energy (NASDAQ: NFE — $5.52 billion), a liquified natural gas company. Satellite imagery obtained by Hunterbrook appears to show that the company’s new liquefaction unit in the Gulf of Mexico, which was supposed to go live in April, has not yet made its first shipment.

Hunterbrook Media also published on Safety Shot Inc (NASDAQ: SHOT — $59 million), a beverage company that claims to make “the world’s first alcohol detoxifier that reduces blood alcohol content in as little as 30 minutes.” An experiment conducted by Hunterbrook found that subjects who drank Celsius experienced a steeper drop in blood alcohol content than those who drank Safety Shot.

Spruce Point Capital published on Boot Barn Holdings (NYSE: BOOT — $3.14 billion), the largest U.S. retailer of western apparel and cowboy boots. Spruce Point alleged the company is “pursuing a non-sensical large store physical retail expansion strategy” and that “recent short-term hype around western wear from Taylor Swift’s Eras Tour and Beyoncé’s Cowboy Carter album is masking otherwise poor performance.”

Recent Resignations

Notable executive departures disclosed in the past week include:

CEO of Methode Electronics (NYSE: MEI — $385 million) resigned “effective immediately” after just three months on the job. The company retained an interim CEO from AlixPartners. Last month, the company’s CFO “retired” after six years and in December 2023 the company’s Chief Operating Officer was “terminated” following a leave of absence and the company disclosed that his “restricted stock units were forfeited and cancelled prior to vesting.” In its last 10-K, the company also disclosed “a material weakness in internal control over financial reporting” and the company is down ~75% over the last year.

CFO of Savers Value Village (NYSE: SVV — $2.21 billion) departed after a little less than two years. In February, the company’s board chair resigned after nearly three years “effective immediately.” The company is down ~45% since its June 2023 IPO.

Executive Chair and founder of Marqeta (NASDAQ: MQ — $2.85 billion), Jason Gardner, “stepped down” as Executive Chair after one and a half years. As part of his resignation, Mr. Gardner will forfeit a large portion of stock options granted before he transitioned from CEO to Executive Chair and the company disclosed “the forfeiture is expected to result in a one-time reversal of stock-based compensation expenses of $157.8 million.” Last month, The Bear Cave published on problems at Marqeta (MQ) and noted the company and its close partner Block (SQ) have seen a large exodus of executives and board members amid recent whistleblower allegations.

CFO of Quaker Chemical Corp (NYSE: KWR — $3.33 billion) was “terminated” after three years in a matter “unrelated to any issues regarding the preparation of the company's financial statements.” In September 2023, the company’s Chief Accounting Officer also resigned after two and a half years “to pursue another career opportunity.”

CFO of International Flavors & Fragrances (NYSE: IFF — $24.8 billion) “notified the company of his plans to retire” after three and a half years. The company has had six different CFOs and four different CEOs in the last ten years.

CEO of Xponential Fitness (NYSE: XPOF — $408 million), Anthony Geisler, “was removed by the company's Board of Directors from his duties and suspended indefinitely” after seven and a half years. The company added that it “received notice on May 7, 2024 of an investigation by the U.S. Attorney's Office for the Central District of California” in addition to a previously disclosed SEC investigation. In July 2023, Fuzzy Panda Research published on Xponential Fitness and alleged that Mr. Geisler previously “was CEO of a reverse merger, pink sheets, pump & dump that used boiler rooms” and was “arrested for pulling a gun and threatening to kill a court appointed process server.”

Co-CEO and Co-Chairman of Boston Omaha Corp (NYSE: BOC — $483 million), Mr. Alexander Buffett Rozek, “left the company to pursue new entrepreneurial opportunities” after nine years. Mr. Buffett Rozek is the grandson of Warrant Buffett’s sister, Doris Buffett, and the company is roughly flat since its 2017 IPO.

Chief Operating Officer of LifeStance Health Group (NASDAQ: LFST — $2.62 billion) resigned after two years. The company’s CEO, CFO, Chief Medical Officer, and Chief People Officer have all departed in the last two years. In October 2023, The Bear Cave raised concerns about numerous billing irregularities at LifeStance and wrote,

“After reviewing the evidence, The Bear Cave is left wondering whether LifeStance is a thriving therapy franchise or an illegal billing operation with therapy on the side.”

In February 2024, Hindenburg Research also published on LifeStance and alleged the company “needs to raise cash imminently” given its high debt and declining cash balance.

Data for this section is provided by VerityData from VerityPlatform.com

What to Read

“Howard Schultz Urges Starbucks to Fix its U.S. Business” (WSJ)

“Schultz said in a LinkedIn post Sunday that Starbucks should start by improving its U.S. operations, which were ‘the primary reason for the company’s fall from grace… The stores require a maniacal focus on the customer experience, through the eyes of a merchant. The answer does not lie in data, but in the stores,’ wrote Schultz, who served as the company’s chief executive three times prior.”

“The CEO Who Hired His Wife, Gave His Dog a Title, and Brought Down a Bank” (WSJ)

“Hill, now 78 years old, thought a lot of bank rules were stupid. At the three different lenders he ran over the past 50 years, he wanted to upend how consumers bank.”

“SEC Charges Pennsylvania Resident with Insider Trading in Dick’s Sporting Goods Securities” (SEC)

“According to the SEC’s complaint, between November 2019 and May 2021, Poerio knew a Dick’s employee who had access to multiple internal sources of material nonpublic information about the company’s financial results. The SEC alleges that Poerio frequently asked the employee for updates on the company’s performance, and, at times, the employee responded with statements to the effect that the company was ‘doing very well,’ coupled with requests that Poerio not trade in Dick’s securities.”

Tweets of the Week

Until Thursday,

The Bear Cave