Welcome to The Bear Cave! Our last premium articles were “More Problems at eXp World Holdings (EXPI)” and “Problems at AMC Entertainment (AMC)” and our next premium investigation comes out this Thursday, June 6.

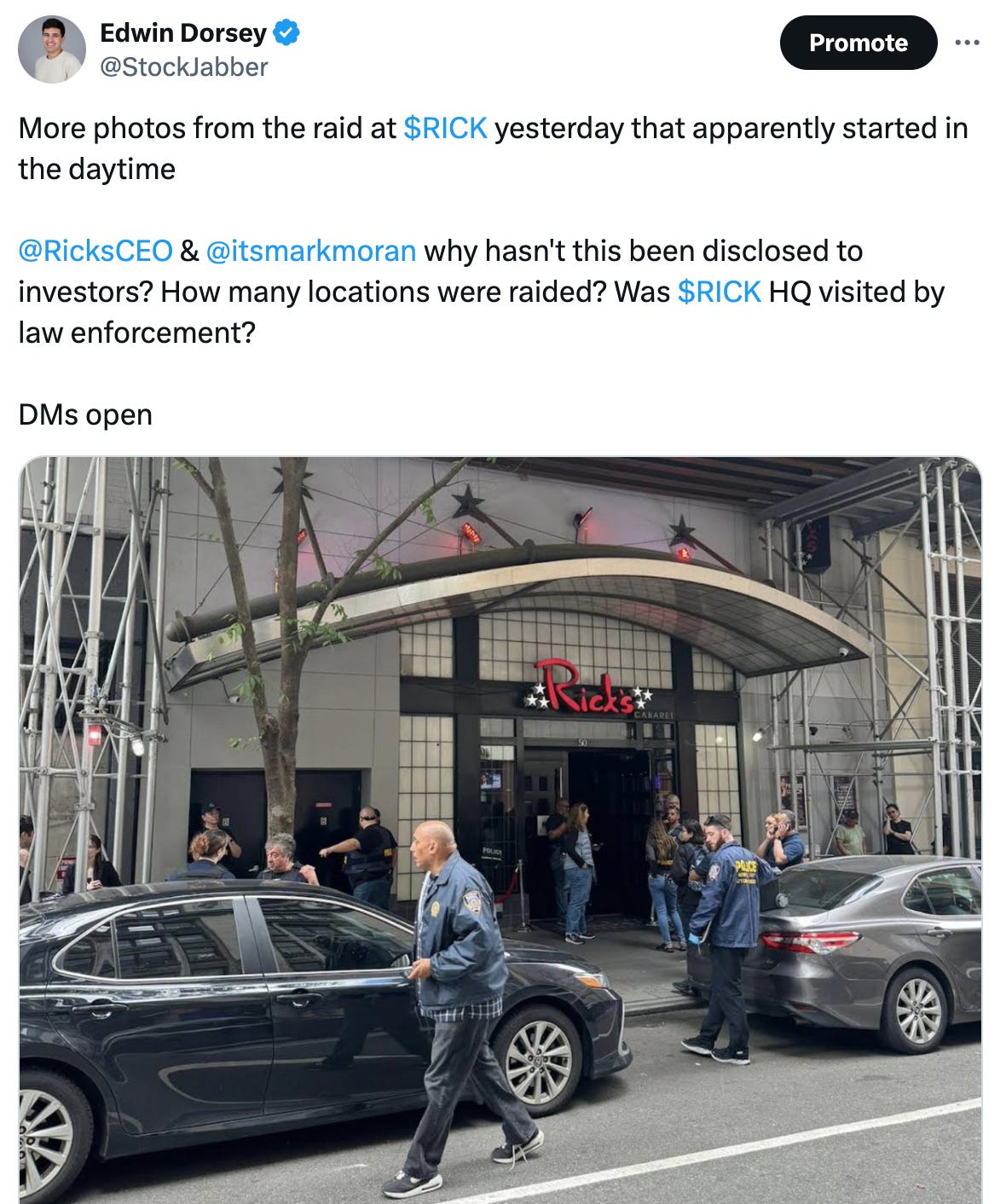

In addition, this week The Bear Cave published a special mini-investigation into “More Problems at RCI Hospitality Holdings (RICK)” and raised concerns that the company has not disclosed law enforcement raids at its corporate headquarters in Texas and its nightclubs in New York.

New Activist Report

Viceroy Research published another mini-update on Globe Life (NYSE: GL — $7.64 billion), a supplemental life insurance company that operates through a network of independent salespeople. Viceroy alleged agents of Globe Life’s subsidiary, American Income Life, “continue to lie to consumers” by wrongly claiming to have an “A+” financial stability rating from AM Best, a credit rating agency, when in reality American Income Life was downgraded to just an “A” rating in 2020.

Four weeks ago, Viceroy also published a 109-page report on Globe Life and concluded the multi-level-marketing structure within its American Income Life subsidiary was “a perfect petri dish for fraudulent, dishonest, and unethical conduct.”

Recent Resignations

Notable executive departures disclosed in the past week include:

Co-CEO of Paycom Software (NYSE: PAYC — $8.44 billion) resigned “for personal reasons” just four months after being promoted into the role. The company’s current CEO, Chad Richison, has led the company since its founding in 1998. Paycom is audited by Grant Thornton and has had the same CFO for the last 18 years.

CFO of bluebird bio (NASDAQ: BLUE — $171 million) “will cease serving as Chief Financial Officer” after one and a half years. The company has had eight different CFOs in the last ten years.

CFO of eHealth (NASDAQ: EHTH — $172 million) resigned after nearly two years. The company has had six different CFOs in the last ten years and in April 2020 Muddy Waters criticized the company’s revenue recognition and churn disclosures.

CEO of UiPath Inc (NYSE: PATH — $6.98 billion) resigned after two years and will also depart the board just five months after joining. The company is down ~85% since its April 2021 IPO.

CFO of Farmland Partners (NYSE: FPI — $523 million) “mutually agreed to separate” after two and a half years. The company previously sued Rota Fortunae following an activist short report in 2018 that sent the stock down ~39% in a day. That lawsuit led to a formal retraction and apology by Rota Fortunae for “inaccuracies and false allegations.” The company is currently overseen by a five-person board.

Chief Operating Officer of Portillo’s (NASDAQ: PTLO — $734 million) “will depart” after three years. The company is down ~75% since its October 2021 IPO.

Satya Nadella, the CEO of Microsoft, resigned from the board of Starbucks (NASDAQ: SBUX — $90.9 billion) “effective immediately” after seven years. In his resignation letter, Mr. Nadella wrote, in part,

“While I may be retiring from my role on the board, my belief in Starbucks’ mission and my support for our partners remain steadfast. I will continue to be one of the company’s biggest fans, cheering on from the sidelines as you propel Starbucks to even greater heights.

I have the utmost confidence in Laxman and our senior leadership team… I look forward to watching Starbucks flourish and am excited for the new chapters that await us all.”

Last month, Howard Schultz, the company’s influential former leader who resigned from his third stint as CEO in 2022, publicly criticized his successor in a lengthy LinkedIn post.

Data for this section is provided by VerityData from VerityPlatform.com

What to Read

“SEC Charges Robert Scott Murray and Trillium Capital with Fraudulent Scheme to Manipulate Getty Images Stock” (SEC)

“Trillium Capital issued a press release announcing Trillium’s supposed proposal to buy all outstanding stock of Getty Images for $10 a share, nearly twice the prior trading day’s closing price. The supposed offer caused the company’s stock price to spike. The SEC’s complaint alleges that the buyout announcement was false and misleading because Murray and Trillium had no real intention of acquiring Getty... Although Murray and Trillium pledged in the press release that they would hold their shares, Murray started to liquidate his Getty Images stock within minutes after the market opened.”

“RCI Hospitality Shares Swing Wildly Following Raid Allegations From Short Report” (Benzinga)

“In the report, Dorsey said RCI Hospitality should disclose to investors if there was a raid, how many locations were raided and why law enforcement was at its properties.”

“Vista Equity writes off PluralSight value, after $3.5 billion buyout” (Axios)

“Vista Equity Partners has written off the entire equity value of its investment in tech learning platform Pluralsight, three years after taking it private for $3.5 billion, Axios has learned… What to watch: Vista's negotiations with lenders, including Blue Owl and BlackRock.”

Tweets of the Week

Until Thursday,

The Bear Cave