Welcome to The Bear Cave! Our last premium articles were “Problems at DeFi Technologies (DEFTF)” and “Even More Problems at eXp World Holdings (EXPI)” and our next premium investigation comes out on Thursday, July 18.

New Activist Reports

New activist Black Mamba Research published on Amphastar Pharmaceuticals (NASDAQ: AMPH — $1.85 billion), an American specialty pharmaceutical company. Black Mamba “uncovered obvious competitive threats up and down Amphastar's product portfolio” and specifically noted the company would face competition from three new entrants in the glucagon market and that the patent expiration of its Primatene MIST inhaler “[will] allow private label copycats in early 2026.” Black Mama concluded,

“We think the market is severely unprepared for the likely revenue declines in several of the major products at Amphastar. Gross margins are near all-time highs due to contributions from glucagon, epinephrine and Primatene MIST. As those sales decline, so too should consolidated margins. We see 50%+ downside to the stock today as these catalysts unfold and competitors bust the non-competitive markets that Amphastar is benefiting from today.”

Join us in following @blackmambashort on Twitter.

Spruce Point Capital published on Floor & Decor Holdings (NYSE: FND — $9.97 billion), a specialty flooring retailer. Spruce Point claimed the company will face growing competition, is opening new stores in less attractive markets, recently modified various accounting policy language, and has “growing risks to earnings from potential tariff increases under a Trump re-election given that 25% of sales are products imported from China.”

Hindenburg Research published a response to Indian financial regulators following its reporting on Adani Group, a collection of seven publicly traded Indian infrastructure companies controlled by one of the world’s richest men, Gautam Adani.

In January 2023, Hindenburg called the Adani Group “the largest con in corporate history.” This week, Hindenburg claimed that the Indian regulators engaged in a spurious legal battle, “pressured brokers behind the scenes to close short positions in Adani under the threat of expensive, perpetual investigations,” and misrepresented Hindenburg’s financial interests.

Hindenburg specifically disclosed:

“We have made ~$4.1 million in gross revenue through gains related to Adani shorts from that investor relationship. We made just U.S.~ $31,000 through our own short of Adani U.S. bonds held into the report… Net of legal and research expenses (including time, salaries/compensation, and costs for a 2-year global investigation) we may come out ahead of breakeven on our Adani short.”

Recent Resignations

Notable executive departures disclosed in the past week include:

CFO of Nio Inc (NYSE: NIO — $9.65 billion) “tendered his resignation for personal and family reasons” after four and a half years. The company is down ~50% over the last year.

CEO of Bridger Aerospace Group Holdings (NASDAQ: BAER — $176 million), Tim Sheehy, resigned after ten years and left the board because he “is running for the U.S. Senate in the State of Montana.” Mr. Sheehy is a former Navy Seal and said he decided to run after watching our chaotic withdrawal from Afghanistan, a country where he served. The company is down ~65% since its January 2023 SPAC merger.

Chief Accounting Officer of Rivian Automotive (NASDAQ: RIVN — $14.7 billion) resigned after three years “to pursue another opportunity.” In May, the company’s Chief Operating Officer “stepped down” and in August 2023 the company’s Chief Growth Officer “separated” from the company. Rivian is down ~40% over the last year.

Data for this section is provided by VerityData from VerityPlatform.com

What to Read

“Exposing Corporate Misconduct” (We Study Markets)

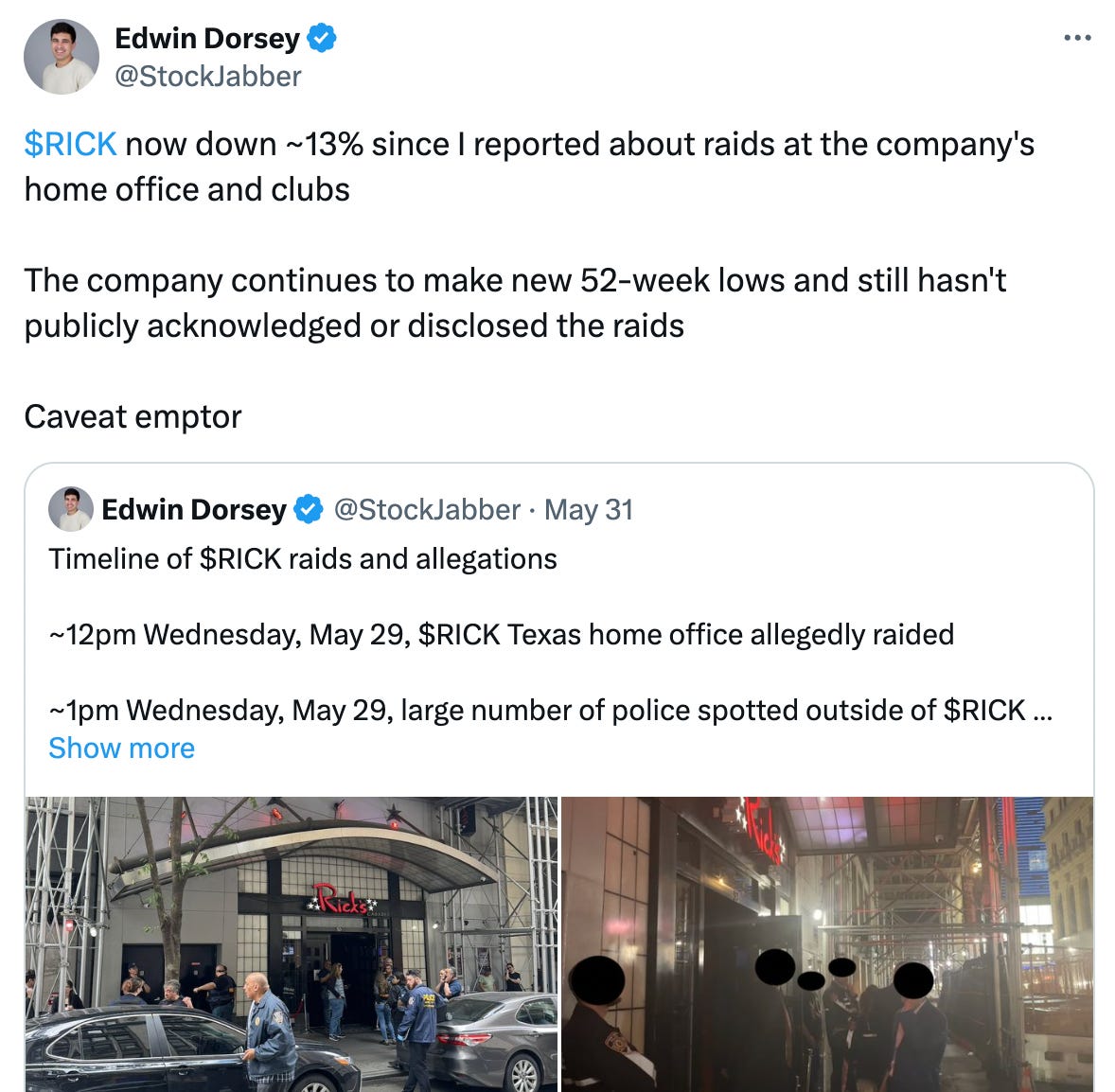

“When Edwin Dorsey published a deep dive about The Joint Corp., a nationwide network of chiropractors, the company was valued at $1.39 billion. Its shares had recently run up about 3,500%, trading at roughly 80x profit. But Dorsey uncovered dozens of complaints concerning its overbilling, forged transactions, and other misconduct.

Less than a year after his October 2021 report, the company’s shares fell from over $80 to around $15 — an 80% decline.”

“How Tractor Supply Decided to End DEI, and Fast” (WSJ)

“The effectiveness of Starbuck’s campaign—and Tractor Supply’s swift and decisive reversal—show how the tide has turned against efforts to promote diversity and inclusion in American corporations. Four years ago many companies saw it as a necessity to support these policies. Today some see it as too much of a risk.”

“U.S. Healthcare Firm Embroiled in Malta Corruption Scandal Spent Millions on Private Spies” (OCCRP)

“As they sat at home watching TV one evening last spring, British businessman Fraser Perring and his partner had no idea they were being secretly filmed… Viceroy had just released a bombshell investigation into Steward’s relationship with Medical Properties Trust, a real estate investment trust that was also its biggest shareholder, alleging Steward had fraudulently overvalued its Colombian assets by around $50 million in a sale to MPT.”

Tweets of the Week

Until next week,

The Bear Cave