Welcome to The Bear Cave! Our last premium articles were “Problems at TransDigm (TDG)” and “Problems at POET Technologies (POET).” This Thursday, December 19, The Bear Cave will share our annual “Hedge Fund Analyst Christmas List” of the best free and paid equity research resources for professional investors. View last year’s list here.

New Activist Reports

Old Time REITster published on Ready Capital (NYSE: RC — $1.26 billion), a mortgage REIT focused on commercial real estate. Old Time REITster alleged that recent changes in Ready’s accounting policy allowed it to realize non-cash income and found that “loan problems are accelerating, not abating, and many modified but not impaired loans are of dubious quality.” Old Time REITster concluded, in part,

“While Ready Capital has found numerous ways to ensure that its reported Distributable Earnings stays elevated, a dividend not supported by cash flows will eventually need to be cut.”

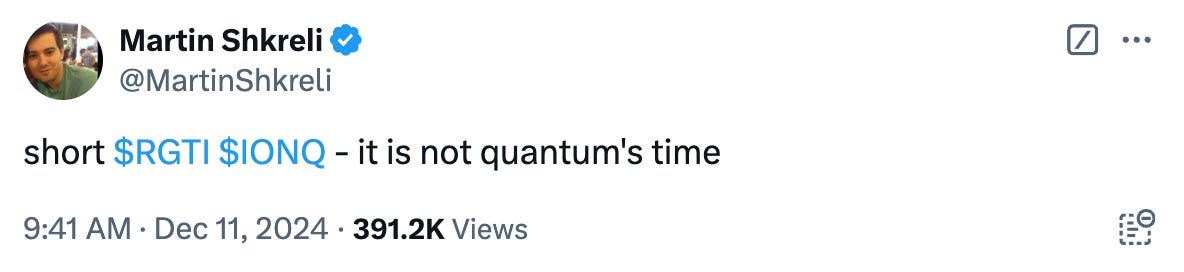

Iceberg Research published an update on Quantum Computing Inc (NASDAQ: QUBT — $793 million), an early-stage quantum computing hardware company. Iceberg said the company “has chased every possible hype over the last few years” and compared the company’s manufacturing facilities to a basic lab. Two weeks ago, Iceberg also called the company a “perma-scam.”

White Diamond Research published on Telomir Pharmaceuticals (NASDAQ: TELO — $154 million), an early-stage pharmaceutical company focused on age-reversal science. White Diamond highlighted that the company “still has not reported results from any earlier announced preclinical mammal studies” and noted the company’s founder, Jonnie. R. Williams Sr., “has an alarming history of corruption, pump and dumps, and [ties to] companies that went bankrupt.” White Diamond quoted from a 2014 lawsuit against Williams and his business partner that read, in part,

“The two men followed a similar script in nearly each of their business. They would take over a medical-related product or service company, proclaim it had developed a medical breakthrough without providing reliable data to prove it, pump up the stock price with those false claims, pay themselves generous salaries and options out of proceeds from stock offerings, then sell their shares before leaving behind a company that collapsed in financial ruin.”

Recent Resignations

Notable executive departures disclosed in the past week include:

CFO of MoneyHero (NASDAQ: MNY — $44 million) “is stepping down to move back to China to be closer to his family” after seven months. The company is down ~90% since its September 2023 SPAC merger.

CEO of European Wax Center (NASDAQ: EWCZ — $344 million) resigned after five months. The company has had three CEOs and three CFOs in the last three years and is down ~75% since its August 2021 IPO.

CFO of ACELYRIN (NASDAQ: SLRN — $324 million) resigned “to pursue an external opportunity” after one and a half years. The company’s CEO, Chief Operating Officer, Chief People Officer, and Chief Legal Officer have all departed this year and the company is down ~85% since its May 2023 IPO.

CEO of Dave & Buster’s Entertainment (NASDAQ: PLAY — $1.06 billion) “resigned to pursue other interests” after two and a half years. The company has had four CEOs and three CFOs in the last five years.

CFO of Critical Metals Corp (NASDAQ: CRML — $576 million) resigned “effective immediately” after nine years. In addition, the company disclosed that Carolyn Trabuco, an independent board member, resigned “to pursue other opportunities” after three years. The European lithium mining company is now overseen by a four-person board and is down ~40% since its February 2024 SPAC merger.

CEO of iLearningEngines (NASDAQ: AILE — $151 million) was “placed on administrative leave pending the conclusion of the internal investigation being conducted by outside counsel with respect to allegations raised in a report issued on August 29, 2024 by Hindenburg Research LLC.” Hindenburg previously alleged that “the company’s revenue and expenses are largely fake” and noted that ~96% of the company’s revenue came from a UAE-based entity with undisclosed ties to the company’s CEO.

David Sacks, board member of Rumble (NASDAQ: RUM — $2.36 billion), resigned “effective immediately, to pursue a position in government” after one and a half years. The Bear Cave has published extensively on Rumble and wrote,

“In sum, The Bear Cave believes Rumble is a business model that simply doesn’t work.”

Chief Accounting Officer of Astec Industries (NASDAQ: ASTE — $846 million) “gave notice of her intention to resign in order to pursue another opportunity” after four years. In March 2024, the company’s CFO resigned “effective immediately” after four years and in March 2023 the company switched auditors from KPMG to Deloitte.

Data for this section is provided by VerityData from VerityPlatform.com

What to Read

“Short Sellers’ Secret Talks and Alliances Emerge in Court Battle” (Bloomberg)

“A section of the Hindenburg report focused on the company’s announced plans for a Covid contact-tracing product. Emails disclosed in the Toronto lawsuit indicate an Anson analyst persuaded a Facedrive partner to confirm in email messages that the company was unlikely to meet a development timeline it made public.

Exhibits show the Anson analyst turned over those emails to Hindenburg’s Anderson and that for roughly two weeks he worked with Anson on the report. Directions from Anson employees included how the report should be arranged, what the price target should be and requests to keep Anson’s name out of it.”

The Friendly Bear and Nate Anderson responded to the story here and here.

“‘Wanted’ Signs Targeting Wall Street and Healthcare Executives Pop Up in New York City” (WSJ)

“The posters seen around lower Manhattan this week showed the names and faces of Wall Street and healthcare executives. The signs encouraged violence against them. ‘Health care CEOs should not feel safe,’ the posters said. One displayed Brian Thompson, the UnitedHealthcare chief who was killed, with a red X over his face.”

Tweets of the Week

Until Thursday,

The Bear Cave