Welcome to The Bear Cave! Our last premium articles were “Even More Problems at B. Riley (RILY)” and “Problems at Signet Jewelers (SIG)” and our next special investigation comes out this Thursday, February 6.

New Activist Reports

Wolfpack Research published on Mercury General (NYSE: MCY — $2.76 billion), a Los Angeles-based home and auto insurance company. Wolfpack estimated that the company “faces more than $2 billion in losses following the LA wildfires” based on Wolfpack’s analysis of “an obscure, ~4,000-page rate filing which reveals the number of homes and condominiums [Mercury] insures in each California zip code.” Wolfpack also highlighted that Mercury’s losses materially exceed the company’s ~$1.3 billion in reinsurance, among other issues.

In response, hedge fund manager Guy Baron tweeted bullishly on Mercury and alleged Wolfpack’s analysis was flawed because it used values of land and dwellings instead of just dwellings, ignored the fact that many homeowners are underinsured, and incorrectly interpreted Mercury’s reinsurance coverage.

Snowcap Research published on FTAI Aviation (NASDAQ: FTAI — $11.0 billion), an aerospace products company. Snowcap alleged the company is overstating its inventory value and estimated that “as much as 50% of FTAI’s Aerospace profits are repackaged one-off gains from its Leasing Business.”

Two weeks ago, Muddy Waters Research published on FTAI and alleged a series of similar accounting problems at the company.

NINGI Research tweeted critically on Bakkt Holdings (NYSE: BKKT — $240 million), a digital asset marketplace company. NINGI highlighted that Bakkt stock rose ~150% on rumors of a potential merger with Trump Media & Technology (NASDAQ: DJT), which instead recently announced a partnership with Charles Schwab, rendering the Bakkt speculation moot.

Restrinct, an anonymous account on X, published on Fabrinet (NYSE: FN — $7.84 billion), an optical product manufacturing company. Restrinct said the company’s tailwinds from providing optical interconnect solutions for data centers are diminishing and wrote,

“Current outer-year estimates imply that FN’s 100% share of NVDA designed transceivers remains constant, however this isn’t possible as 3 - 4 other NVDA suppliers have been or are under process of being qualified.”

Launching FOIAsearch.com

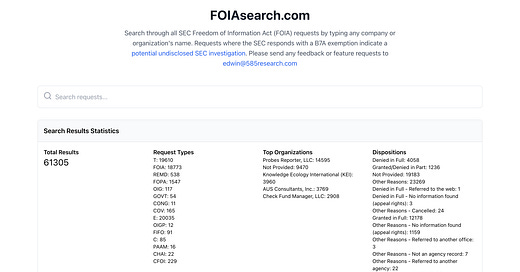

The Bear Cave is excited to launch FOIAsearch.com, an easy way to search all SEC FOIA requests and find undisclosed SEC investigations.

Every year, the SEC spends ~$14 million responding to 10,000+ FOIA requests. If the SEC responds to a FOIA request with a B7A exemption, that indicates the subject company is likely under an undisclosed SEC investigation, which is “associated with significant negative future abnormal returns.”

To help reduce the edge some individuals have from filing FOIA requests, the SEC uploads its entire FOIA logs monthly in huge, distinct, and difficult to navigate CSV files.

With FOIAsearch.com, you can easily find all past FOIA requests on a company and B7A investigation exemptions in a single search.

For some examples of companies likely under SEC investigation, search Roblox, B. Riley, or Chegg. Each had a B7A exemption applied in the last year, indicating a potential undisclosed SEC investigation.

On the other hand, the SEC received two FOIA requests for Sezzle in late 2024, neither of which resulted in a B7A exemption, meaning the company is likely not under an SEC investigation.

You can also search the names of hedge funds, asset management firms, or news organizations to see FOIA requests filed by their reporters.

By making this information publicly available and easily searchable, U.S. citizens can have a better understanding of how our government works, corporate bad actors can be detected earlier, and we are all one step closer in our search for truth.

Recent Resignations

Notable executive departures disclosed in the past week include:

CFO of Compass Minerals International (NYSE: CMP — $483 million) resigned “for personal reasons” after eight months. In January 2024, the company’s CEO entered into “a separation and consulting agreement” after nearly five years and also departed the board. The company has had seven different CFOs in the last ten years.

CFO of NextEra Energy Partners LP (NYSE: NEP — $985 million) “resigned as part of the Partnership’s strategic repositioning” after nine months. The partnership’s CEO resigned after three years as well. The partnership has had six different CFOs in the last ten years.

CEO of Coursera (NYSE: COUR — $1.22 billion) “decided to retire effective February 3, 2025” after nearly eight years and will also depart the board. The company is down ~80% since its March 2021 IPO.

Data for this section is provided by VerityData from VerityPlatform.com

News of the Week

Activist Shorts Want Regulatory Clarity

Lawyers representing Andrew Left filed a formal petition with the SEC “for rulemaking to clarify the legality of trading by investors who publicly comment on securities.” The petition states, in part,

“In short, the SEC’s enforcement actions make clear that the SEC can and may consider it fraud to say something positive (in support of a long position) or negative (in support of a short position) about a stock, and then trade in that security even weeks or months after a social media post, even in small quantities. This belief, which runs smack into the protections of the First Amendment, leaves individual investors with no guidance at all on a fundamental question: ‘After publicly commenting on a security, how long must an individual wait to make a trade?’”

Trading around reports is a common, but not universal, practice for activist short sellers, and some activists like Muddy Waters and Kerrisdale have bolstered disclaimers in recent months. Institutional Investor summarized the issue well:

“The problem is that the SEC has no rule prohibiting such trading, which is common practice among short sellers, nor any trading bans surrounding short selling. If the commission wants to charge Left, short sellers argue it needs to create a rule instead of trying to legislate through enforcement.”

SEC Knocks DEI

A recent speech from SEC Commissioner Hester M. Peirce stated, in part:

“Public companies are confronting a symptom of a larger societal malady—importing politics and contentious social issues into everything we do. The SEC, so-called stakeholders, and the burgeoning industry of advisers, consultants, accountants, and attorneys peddling their costly wares to public companies, sometimes with the agreement of corporate executives, drag companies into social and political melees. Their efforts, an insidious form of rent-seeking, are often quite convincingly disguised in a cloak of ethics and morality.”

Tweets of the Week

Until Thursday,

The Bear Cave