This issue marks our six-month anniversary! Because of your support The Bear Cave now goes out to over 3,000 readers🎉🎉 I’m excited to see what the next six months hold for us.

If you enjoy reading The Bear Cave please consider sharing it and if you are new, join here.

New Activist Reports

Anne Stevenson-Yang of J Capital Research criticized STAAR Surgical (NASDAQ: STAA — $2.15 billion) in a presentation at the Contrarian Investor Virtual Conference and wrote, “We think STAAR’s China sales are overstated by at least 33%.” Black Stork Research also highlighted questionable distribution and accounting in a great short report on the company in February 2019.

At the same conference, Bradley Safalow of PAA Research shared a short thesis on Trupanion (NASDAQ: TRUP — $2.13 billion), a Seattle-based pet insurance provider.

Eric Chung of Lighthaven Capital presented a short thesis on Energous Corp, (NASDAQ: WATT — $137 million).

Dan David of Wolfpack Research shared a short thesis on digital media company Remark Media (NASDAQ: MARK — $136 million).

This past April, Wolfpack Research alleged the Chinese streaming service IQIYI Inc (NASDAQ: IQ — $14.1 billion) inflated revenues and profits. Last week the company disclosed it was under investigation by the SEC, largely over concerns raised in Wolfpack Research’s report. You can follow Wolfpack Research on Twitter @WolfpackReports and get email alerts about new reports from their new website.

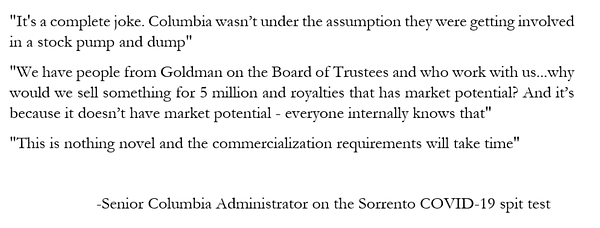

Hindenburg Research published a critical twitter thread on Sorrento Therapeutics (NASDAQ: SRNE — $3.01 billion):

I Was Wrong on Accel Entertainment

Last week I predicted Accel Entertainment (NYSE: ACEL — $837 million), an operator of video gambling terminals in Illinois, would be hurt by coronavirus despite encouraging guidance from management. I could not have been more wrong.

July 2020 was the best month for video gambling in Illinois history, according to a monthly report released by the Illinois Gaming Board last Friday. Net terminal income statewide was $166 million in July 2020, compared to $134 million in July 2019.

Resignations and Departures

Notable executive departures disclosed last week include:

CFO of Avis Budget Group (NASDAQ: CAR — $2.18 billion) after about one and a half years on the job.

CFO of Cooper Tire & Rubber (NYSE: CTB — $1.74 billion) after almost two years.

CFO of General Motors (NYSE: GM — $38.9 billion) after two years.

Data for this section is provided by InsiderScore.com

What to Read

“Chinese Video-Streaming Firm Faces SEC Probe After Short-Seller Report” (WSJ)

“The disclosure comes amid heightened scrutiny of accounting at U.S.-listed Chinese companies, and four months after short-seller investment-research firm Wolfpack Research queried iQiyi’s user numbers, sales, expenses and a sizable 2018 takeover.”

“Kodak Insider Makes Well-Timed Stock Gift of $116 Million to Religious Charity He Started” (WSJ)

“The Karfunkels’ donation could generate tens of millions of dollars in income-tax benefits for the couple, who property records show have homes in New York City and Florida. Charitable deductions are capped in various ways, but taxpayers have five years to use them up.”

“Losing Money Is a Winning Pandemic Tax Strategy for Some Companies” (WSJ)

“Companies can now use losses incurred before and during the pandemic to offset up to five years of past profits. What makes this moment particularly attractive: Congress is letting companies get refunds of taxes they paid at the 35% corporate rate that existed before 2018 rather than at today’s 21% rate.”

Tweets of the Week

Until next week,

The Bear Cave