The Bear Cave #270

New Activist Report, Concerning SEC Comment Letters, Recent Resignations, and Tweets of the Week

Welcome to The Bear Cave! Our last premium articles were “Problems at KinderCare Learning Companies (KLC)” and “More Problems at TriplePoint Venture Growth BDC (TPVG)” and our next special investigation comes out Thursday, May 1.

New Activist Report

New activist Callisto Research published on Bitdeer Technologies (NASDAQ: BTDR — $1.47 billion), a bitcoin mining company with operations in the U.S., Norway, and Bhutan. Callisto alleged “red flags in Bitdeer’s disclosures, governance, and related-party transactions.” Shortly after publication, Callisto’s website and most of its content on X were disabled after what Callisto alleged was a cyberattack. Follow Callisto Research @callistores on X.

Concerning SEC Comment Letters

SEC comment letters are informal exchanges between the SEC and public companies and often serve as early warning signs of deeper problems. The Bear Cave reviewed hundreds of SEC comment letters to U.S. companies, so we could highlight a few of the most notable for you.

1. FTAI Aviation (NASDAQ: FTAI — $9.45 billion), an aerospace products company, responded to three SEC comment letters on November 27, 2024, January 3, 2025, and January 17, 2025 concerning non-cash transactions and accounting in its aerospace products segment, among other issues. The November 2024 letter stated, in part,

“Please disclose in greater detail the nature of each non-cash activity shown in the supplemental disclosures. The revised disclosures should clearly discuss both sides of the non-cash transactions, so that it is transparent why the transactions are non-cash. For the transfers from leasing equipment, please also disclose the asset category to which the transfers were made and the circumstances surrounding the transfers. Also, tell us whether these assets were still under lease at the time of transfer and quantify the amounts for each period presented. Next, tell us and disclose whether the later cash inflows from the sale/disposition of leasing equipment transferred to inventory are included in investing activities or operating activities. If these later cash inflows are not included in investing activities, explain in detail how your inconsistent classification for the cash outflows and cash inflows complies with GAAP…”

On January 15, 2025, Muddy Waters Research published on FTAI Aviation and alleged the company engaged in accounting games and inflated EBITDA in its Aerospace Products segment by over-depreciating assets in its connected leasing segment.

2. Primo Brands (NYSE: PRMB — $12.8 billion), a private equity-backed bottled water company that recently went public, has received several comment letters in recent months. A notable one asked, in part:

“Please revise the risk factor caption on page 35 that states, ‘[W]e may not be able to generate sufficient cash flows from operations,’ for consistency with disclosure on page 76 that, ‘[W]e do not expect to generate sufficient cash from operations to repay at maturity the entirety of the then-outstanding balances of our indebtedness.’” (February 7, 2025)

3. Brookfield Wealth Solutions (NYSE: BNT — $12.1 billion) responded to a 27-point comment letter on September 30 and was asked “to provide relevant information about your mortgage and private loan portfolios” and “to provide quantitative information related to the sale of annuities by product type or other relevant characteristic for each period presented to allow an investor to understand your key products and relevant trends,” among many other issues.

These comment letters were found using software The Bear Cave built to identify high-risk SEC correspondence. Paid subscribers can get a free early look by replying: “Please tell me more!”

Recent Resignations

Notable executive departures disclosed in the past week include:

CFO of Warner Music Group (NASDAQ: WMG — $15.2 billion) “will enter into a Separation Agreement” after about one and a half years. The company has had four CFOs in the last five years.

CEO of First American Financial (NYSE: FAF — $6.10 billion), Mr. Ken DeGiorgio, “ceased to serve as Chief Executive Officer and a member of the Board” and “was terminated without cause” after three years. Mr. DeGiorgio’s departure comes three weeks after he was charged with misdemeanor assault after an altercation with another guest on a cruise ship.

CFO of Lockheed Martin (NYSE: LMT — $108.9 billion) “will pursue other opportunities outside of the company” effective immediately after a little over three years.

CFO of Sun Country Airlines (NASDAQ: SNCY — $472 million) “informed the Board that he would be stepping down from his position with the company and as a member of the Board, effective immediately” after seven years. In addition, the company’s Chief Operating Officer also resigned effective immediately after six years. The budget airline is down ~75% since its March 2021 IPO.

CFO of Bank of Hawaii (NYSE: BOH — $2.59 billion) “will step down as CFO effective June 30, 2025” after about eight and a half years. In addition, the bank’s Principal Accounting Officer resigned with one week’s notice “to pursue other opportunities” in October 2024 after just two years. In February 2024 and October 2024, Bank of Hawaii was on the B7A FOIA exemption list, indicating a potential long-running undisclosed SEC investigation.

Chief Operating Officer of Sweetgreen (NYSE: SG — $2.17 billion) departed “effective immediately” after a little over one year.

Mr. Godfrey Sullivan and Ms. Helen Riley, board and audit committee members of Marqeta (NASDAQ: MQ — $1.93 billion), both resigned after four and five years, respectively. Both Mr. Sullivan and Ms. Riley continue to serve on other public company boards. In April 2024, The Bear Cave published on problems at Marqeta (MQ) and noted the company and its close partner Block (SQ) have seen a large exodus of executives and board members amid whistleblower allegations.

Data for this section is provided by VerityData from VerityPlatform.com

Potential Undisclosed SEC Inquiries

The SEC recently released its March 2025 FOIA Logs, which are publicly accessible CSV files with copies of all the FOIA requests the SEC received that month and all requests met with a B7A exemption, which can often indicate an undisclosed SEC inquiry.

Two notable companies on the March 2025 B7A list include:

Fulgent Genetics (NASDAQ: FLGT — $551 million). In January 2021, The Bear Cave published on Fulgent and wrote that “a series of related party transactions raise concerns about whether the company is being run in the best interest of shareholders” and highlighted its one-time gain from selling coronavirus test kits.

Arista Networks (NYSE: ANET — $89.8 billion). In August 2024, November 2024, and January 2025, Arista responded to SEC comment letters in which the SEC wrote, in part:

“Please tell us why you believe sales rebates and return reserves should be netted against accounts receivables. Refer us to your basis in the accounting literature...” (August 2024)

“It appears that you manage your business by three primary types of customers: Cloud and AI Titans, Enterprise and Providers. This is evident since you track revenue for these sectors and discuss the sectors in your earnings calls. In future filings please disclose revenue by these categories in your MD&A. Provide us with your proposed future disclosure.” (November 2024)

The letters were only published publicly on EDGAR on February 28, 2025, suggesting the SEC’s comment letter matter lasted about six months. In March 2024, the SEC announced insider trading charges against Arista’s founder and former chairman, Andy Bechtolsheim.

Other companies on the March 2025 B7A exemption list include:

C3 ai (NYSE: AI — $2.57 billion)

MBIA (NYSE: MBI — $221 million)

Chegg (NYSE: CHGG — $54 million)

Hologic (NASDAQ: HOLX — $12.9 billion)

Danaher (NYSE: DHR — $134 billion)

Dropbox (NASDAQ: DBX — $7.81 billion)

AppFolio (NASDAQ: APPF — $7.96 billion)

Bank OZK (NASDAQ: OZK — $4.73 billion)

AAR Corp (NYSE: AIR — $1.91 billion)

Citi Trends (NASDAQ: CTRN — $173 million)

Zeta Global (NYSE: ZETA — $2.72 billion)

MarineMax (NYSE: HZO — $427 million)

Cytokinetics (NASDAQ: CYTK — $4.71 billion)

Herc Holdings (NYSE: HRI — $3.35 billion)

CNH Industrial (NYSE: CNH — $13.88 billion)

Fluence Energy (NASDAQ: FLNC — $670 million)

Vertiv Holdings (NYSE: VRT — $27.9 billion)

Dentsply Sirona (NASDAQ: XRAY — $2.56 billion)

General Electric (NYSE: GE — $194 billion)

3D Systems Corp (NYSE: DDD — $252 million)

U-Haul Holding Co (NYSE: UHAL — $10.3 billion)

America Movil SAB (NYSE: AMX — $49.5 billion)

Nektar Therapeutics (NASDAQ: NKTR — $118 million)

Patterson-UTI Energy (NASDAQ: PTEN — $2.34 billion)

Tenet Healthcare Corp (NYSE: THC — $11.5 billion)

Cognizant Technology Solutions (NASDAQ: CTSH — $34.4 billion)

Science Applications International (NASDAQ: SAIC — $5.57 billion)

Sapiens International Corporation (NASDAQ: SPNS — $1.45 billion)

Check Point Software Technologies (NASDAQ: CHKP — $23.3 billion)

Academic research has found that B7A exemptions are “associated with significant negative future abnormal returns.” You can search through all SEC FOIA requests and B7A exemptions since October 2019 on FOIAsearch.com. Two of the largest filers of SEC FOIA requests are Probes Reporter and Canary Data.

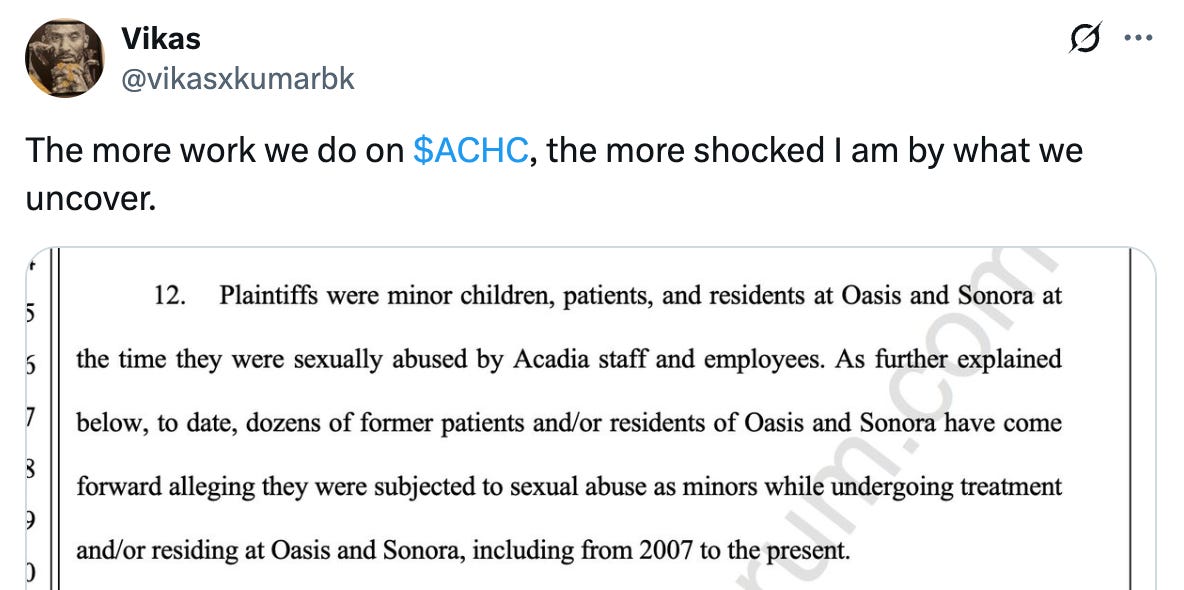

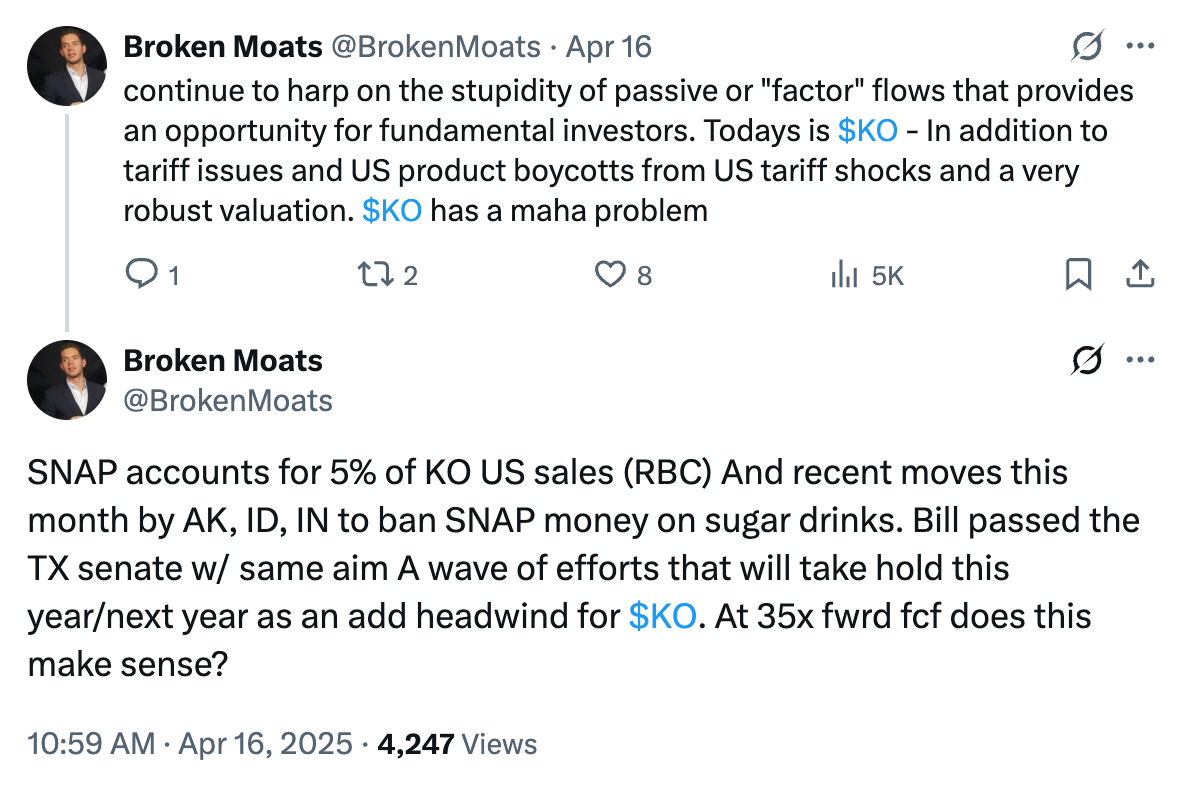

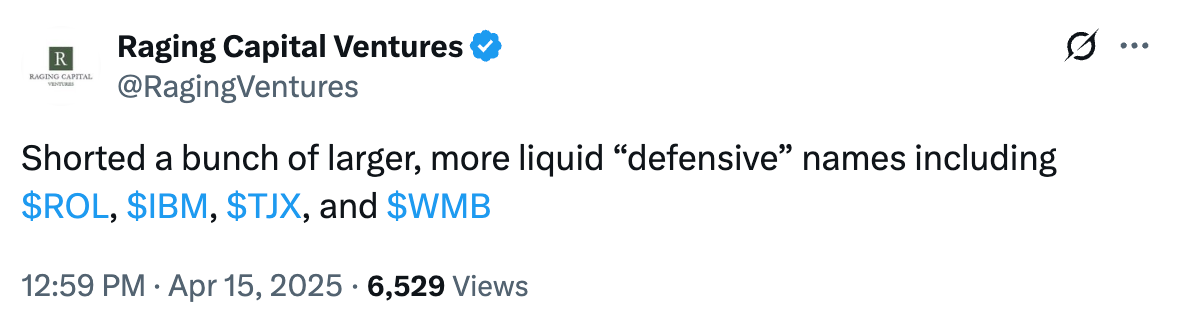

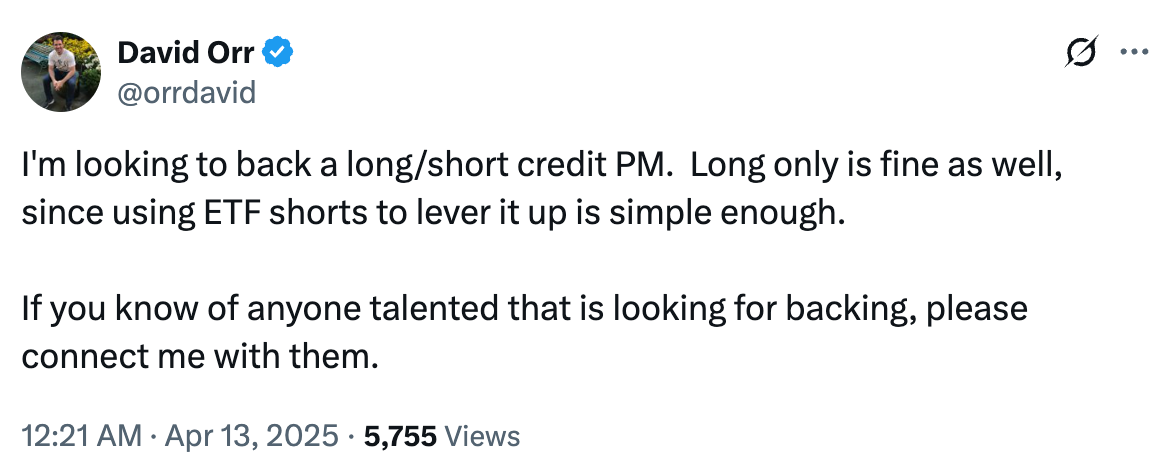

Tweets of the Week

Until next week,

The Bear Cave