Welcome to The Bear Cave! Our last premium articles were “Problems at KinderCare Learning Companies (KLC)” and “More Problems at TriplePoint Venture Growth BDC (TPVG)” and our next special investigation comes out this Thursday, May 1.

New Activist Reports

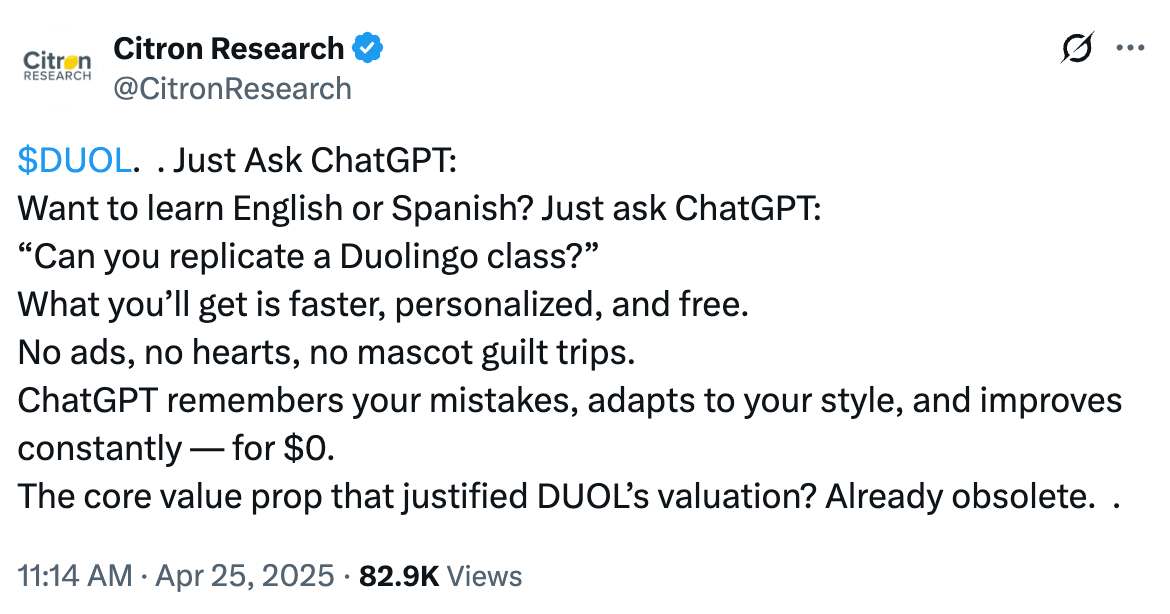

Citron Research published several critical tweets on Duolingo (NASDAQ: DUOL — $17.3 billion), a popular app to help users learn new languages. Citron called Duolingo “a slow moving Chegg” and said its 15x revenue multiple was too high for “a gimmicky ed-tech app that’s going to lose 30%+ of its growth to free AI competition.” Citron also tweeted:

Morpheus Research published on Backblaze (NASDAQ: BLZE — $247 million), a cloud storage company. Morpheus noted that Backblaze has reported losses every quarter since its November 2021 IPO and highlighted a pair of lawsuits “alleging accounting fraud, inflated projections, and whistleblower retaliation.” Morpheus also said the company was losing share to competitors and concluded, in part,

“In our view, BLZE is a failed growth story with an undifferentiated storage offering trying to capitalize on the AI frenzy while resorting to accounting tricks to sustain exit liquidity for insiders.”

Recent Resignations

Notable executive departures disclosed in the past week include:

CEO of Spire (NYSE: SR — $4.49 billion) “was terminated without cause” after one and a half years and also resigned from the board. The company’s CFO also retired in January after 11 years of service.

CFO of Weatherford International (NASDAQ: WFRD — $3.10 billion) departed effective immediately after a little over two years. The company has had six different CFOs in the last five years.

Mr. Xudong Chen, board member of ZTO Express (NYSE: ZTO — $15.5 billion), resigned after two years with immediate effect “due to change in his work arrangement.” In March 2023, Grizzly Research published on the Chinese logistics company and alleged “the financials are fake and insiders are stealing from the company.”

Chief Accounting Officer of Playtika Holding Corp (NASDAQ: PLTK — $1.97 billion) resigned after nearly six years. In December 2022, a Playtika board member resigned after observing “significant deficiencies in the company’s current governance practices” and in November 2021 The Bear Cave published on the gaming app company and wrote,

“Playtika is reliant on large tech platforms, is positioned against social winds, is encumbered by $2.5 billion in debt, plays in a highly competitive industry with low barriers to entry, profits off of gambling addicts, and faces major and immediate headwinds in its most profitable games. Don’t play with Playtika.”

Mr. Ming Liao, board member of Gaotu Techedu (NYSE: GOTU — $747 million), formerly known as GSX Techedu, resigned as independent director with immediate effect “for personal reasons.” The Chinese online education company is overseen by a four-person board.

Data for this section is provided by VerityData from VerityPlatform.com

What to Read

Order Denying Andrew Left’s Motion to Dismiss

On Tuesday, the judge overseeing the case of the Securities and Exchange Commission v. Andrew Left, the Honorable Sherilyn Peace Garnett, denied Mr. Left’s motion to dismiss. The ruling (available here) makes two notable statements around Citron’s disclaimer in its activist short reports:

“Defendants ask the Court to make two key inferences. First, Defendants’ purported disclaimer adequately informed their readers that they have no duty to disclose internal trading activities. Second, in light of the disclaimer, no reasonable investor would find the publications—and particularly the omitted fact that Plaintiff alleges Defendants immediately traded contrary to their published target prices—misleading. As discussed below, the mere existence of a disclaimer, alone, does not automatically absolve one of his duty to disclose certain information to make his statements not misleading…” (Page 11)

“Plaintiff alleges that Defendants always intended to trade contrary to their publications, thereby using their platform as a fraudulent scheme to gain profit from the market; such allegations do not present circumstances where a short seller activist genuinely changed his mind about a trade subsequent to releasing a trade publication.” (Page 27 footnote)

The Bear Cave interprets the ruling as furthering the idea that activist short sellers must publicly disclose their trading intentions and positioning around short reports. One person who may disagree with that view is former SEC Chairman Jay Clayton. In a February 2022 CNBC interview, former Chairman Clayton was asked by Andrew Ross Sorkin:

“One of the things that folks have called for is this idea that short-sellers should have to disclose when they get out of positions. Do you agree with that?” (1:52)

Former Chairman Clayton replied:

“Andrew, let me put it this way, there is a lot of debate going on right now about what should and should not be disclosed by individual participants in our marketplace. I am a believer that when they have large positions, and we have rules around this, 5% as an individual or a group, delayed reporting pursuant to 13-F of positions by large money managers, that reporting on an individual basis is beneficial. That said, I don’t think that individual position reporting, in particular short position reporting, is a good idea. The reason is short-selling is a benefit in many ways to our marketplace. It puts information into the marketplace that wouldn’t otherwise be there. Not all sentiment in the marketplace can be positive, some has to be negative…” (2:00)

“EXCLUSIVE: Why Are Babies Testing Positive For Cocaine At The Nation’s Biggest Daycare Chain?” (Evie Magazine)

“A damning new investigative report has pulled back the curtain on what might be the worst scandal in America’s childcare system at KinderCare, the nation’s biggest daycare company.”

Tweets of the Week

Until Thursday,

The Bear Cave