Welcome to The Bear Cave! Our last premium articles were “More Problems at TriplePoint Venture Growth BDC (TPVG)” and “Problems at 100 Long-Term Underperformers” and our next special investigation comes out Thursday, May 15.

New Activist Reports

Kerrisdale Capital published on D-Wave Quantum (NYSE: QBTS — $2.30 billion), a quantum computing company. Kerrisdale alleged the company “is built around quantum annealing, a niche offshoot of quantum computing developed decades ago and largely abandoned by the industry,” and said that multiple interviews with customers found little benefit from the company’s products and that “quantum is little more than a marketing gimmick.”

Kerrisdale concluded, in part,

“D-Wave trades at over 50x 2026E consensus revenue – 128x by our estimate. Pure delusion for a company with narrow commercial relevance, flat customer growth and zero path to profitability.”

Spruce Point Capital published on CLEAR Secure (NYSE: YOU — $3.35 billion), a digital identity company that helps frequent fliers get through airport security faster. Spruce Point wrote that the company “faces pressures from a decreasing value proposition for customers, displacement risk from competing technologies, and short-term headwinds from reduced travel demand.”

Grizzly Research published on Nexstar Media Group (NASDAQ: NXST — $4.61 billion), a Texas-based local news broadcasting company. Grizzly Research alleged the company is “failing with its digital strategy and will face its Kodak moment soon” and said the company is losing relevance as “consumers are migrating to social media platforms for news.” Grizzly Research also added,

“We interviewed sixteen former NXST executives and directors, who all expressed great frustration regarding NXST’s poor digital strategy. All of them—without exception—see Nexstar in deep trouble.”

New activist Callisto Research published a new thread on X about allegations against various associates of Bitdeer Technologies (NASDAQ: BTDR — $2.16 billion), a bitcoin mining company with operations in the U.S., Norway, and Bhutan.

Recent Resignations

Notable executive departures disclosed in the past week include:

CEO of Kohl's (NYSE: KSS — $835 million), Ashley Buchanan, was “terminated for cause” after just three months following “an investigation conducted by outside counsel and overseen by the Audit Committee of the Board, during which it was found that Mr. Buchanan had directed that the company conduct business with a vendor founded by an individual with whom Mr. Buchanan has a personal relationship on highly unusual terms favorable to the vendor and that he also caused the company to enter into a multi-million dollar consulting agreement wherein the same individual was a part of the consulting team.” The Wall Street Journal reported that the unusual vendor agreement was with a company founded by Ms. Chandra Holt, Mr. Buchanan’s romantic partner.

CFO of Critical Metals Corp (NASDAQ: CRML — $166 million) “stepped down from his role to pursue other opportunities” after just five months. The European Lithium company is overseen by a five-person board and has fallen ~85% since its February 2024 SPAC merger.

CFO of Bloom Energy (NYSE: BE — $3.82 billion) “is departing the company” with one day’s notice after one year. The company has been led by its founder/CEO for the last 23 years.

CEO of Helen of Troy (NASDAQ: HELE — $647 million) departed after a little over one year and also left the board. The company is down ~90% from its November 2021 highs and was a prominent short call by Marc Cohodes.

CEO of Teledyne Technologies (NYSE: TDY — $22.4 billion) “retired” at the age of 60, a little over one year after being promoted into the role. The company has had four CEO transitions in the last ten years.

CEO of Scholar Rock Holding Corp (NASDAQ: SRRK — $3.12 billion) departed after two and a half years. The biotech company has had four CEO transitions in the last five years.

CEO of Insulet Corp (NASDAQ: PODD — $18.1 billion) departed after three years and also left the board. The company has had four CEOs and four CFOs in the last ten years and in May 2024 Blue Orca Capital published on the company and raised concerns about international competition coming for the company’s insulin delivery products.

CFO of Accel Entertainment (NYSE: ACEL — $911 million) resigned after nearly three years. The Illinois-based roll-up of gaming terminals is up about 6% since its November 2019 SPAC merger.

Chief Accounting Officer of Olaplex Holdings (NASDAQ: OLPX — $912 million) resigned after just five weeks with a one-day notice “to pursue other interests and for personal reasons.” The company has had three CEOs and three CFOs in the last three years. In August 2022, The Bear Cave published on the healthy hair products company and wrote,

“Today, Olaplex faces aggressive new competition and waning social media support. With shares priced to perfection, the company’s future looks less than perfect.”

Shares have since fallen ~90%.

Warren E. Buffett, CEO of Berkshire Hathaway (NYSE: BRK.A — $1.16 trillion), disclosed he plans to retire at year-end after 60 years leading the conglomerate. Under his leadership, Berkshire shares rose approximately 5,502,284% compared to 39,054% for the S&P 500. Mr. Buffett paid himself only $100,000 per year as CEO and received a lengthy standing ovation from shareholders after announcing his retirement at the end of Berkshire’s annual shareholder meeting. The applause ended with Mr. Buffett’s parting comment:

“The enthusiasm shown by that response can be taken in two ways, but I’ll take it. Thank you.”

Data for this section is provided by VerityData from VerityPlatform.com

News of the Week

Edwin Dorsey Breaks CEOs and Finds Fraud | Ep. 21

The Bear Cave recently went on the Weekend Rip with Ben & Emil for a fun and informative podcast interview about The Bear Cave’s research process and growth. Our conversation is available on X here and YouTube below:

An Unclear Future

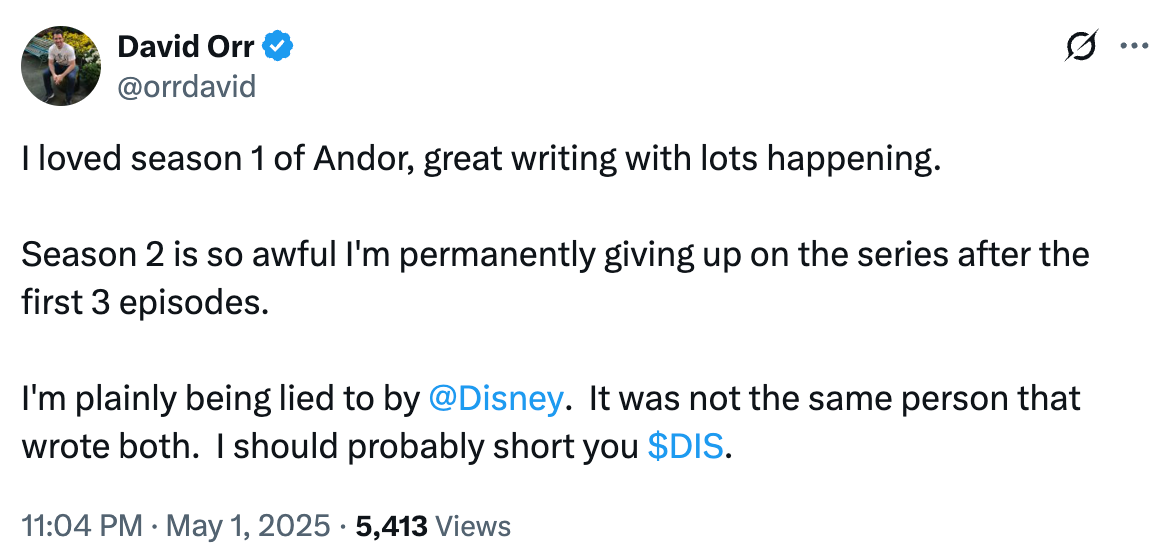

Blake Scholl, CEO of Boom Supersonic, published several critical tweets about CLEAR Secure (NYSE: YOU — $3.35 billion). Mr. Scholl tweeted, in part,

“Hey CLEAR, your service has gotten so bad that your employees are now telling your customers just to get in the regular security line.” (link)

And later added:

“I think all the paying CLEAR members are going to quit and then they’ll be left just with the free/discounted ones they did through partnerships” (link)

In September 2021 The Bear Cave published on CLEAR and wrote, in part,

“CLEAR has sold investors on its hopes for massive growth post-COVID and revenue streams from other venues like stadiums and restaurants. In reality, CLEAR is a consistently unprofitable saturated airport concession with poor economics, worse customer reviews, and limited potential for growth.”

Tweets of the Week

Until next week,

The Bear Cave