Welcome to The Bear Cave! Our last premium articles were “Problems at 100 Long-Term Underperformers” and “Problems at Two Paper Products Companies” and our next special investigation comes out Thursday, June 5.

New Activist Reports

Culper Research published on Archer Aviation (NYSE: ACHR — $5.81 billion), an electric vertical take-off and landing (eVTOL) aircraft company. Culper alleged the company “systematically misled, deceived, or outright lied to investors about virtually every supposed milestone related to its development and testing of its eVTOL aircraft, Midnight.” Through a public records request, Culper obtained emails suggesting that Archer’s flight test team did not have the latest Midnight aircraft until this March, a timeline inconsistent with the company’s claims of conducting tests in February. In addition, Culper alleged that Archer “paid a whopping $25 to $30 million” to sponsor the 2028 Summer Olympics and paid Jimmy Fallon to appear at a promotional event.

In March 2024, The Bear Cave published on Archer and said the company is “spending money on some of the most eyebrow-raising celebrity partnerships in the public markets” including sponsoring the music video for “Whatever” by Norwegian DJ Kygo, partying at Super Bowl LVIII, and paying for a promotional campaign with Usher.

In August 2023, Grizzly Research, which has no affiliation with The Bear Cave, also alleged the company was “recycling heavily edited videos of their earlier test flights to portray longer flight performance, more frequent testing, and a generally more advanced product than reality.”

J Capital Research published on Marqeta (NASDAQ: MQ — $2.37 billion), a payment processing company. J Capital said they “discovered an FBI investigation into MQ’s partner, Sutton Bank, likely for alleged anti-money laundering failures” and added that switching away from Sutton Bank “would take years and is practically impossible,” according to unnamed former executives. J Capital further alleged that “top executives are being fired” over lackluster growth and concluded, in part,

“Ultimately, we think MQ is next to fall in a long line of BaaS companies that face increased regulatory scrutiny and competition from big banks. Its biggest partner is under investigation and large contracts have been few and far between.”

In April 2024, The Bear Cave published on Marqeta, highlighting its role in processing illicit payments and its high level of executive resignations.

Muddy Waters Research published a Substack post on Freedom Holding Corp (NASDAQ: FRHC — $10.2 billion), a Kazakhstan-based company that operates retail stock brokerages, banks, and margin lending services in Eastern Europe. Muddy Waters highlighted Hindenburg’s August 2023 report that alleged the company “i) brazenly skirts sanctions (ii) shows hallmark signs of fake revenue (iii) commingles customer funds then gambles assets in highly levered, illiquid, risky market bets (iv) and displays signs of market manipulation in both its investments and its publicly traded shares.” Muddy Waters alleged the company rented an office in New York that it represented as its principal offices in its SEC filings in order to game inclusion into the Russell 1000. Muddy Waters concluded, in part,

“The high rate of passive investing warps the U.S. equity markets in various ways. In this case, a simple lease agreement seems to be all that’s needed to significantly enrich some highly questionable characters who operate a financial business focused on Kazakhstan.”

Muddy Waters added it had no position in FRHC stock.

ShortFinder, a new Substack publication, published on Verastem (NASDAQ: VSTM -- $457 million), an oncology company, and suggested the company would fall as “dilution financiers keep dumping the 10 million shares that were registered earlier this week.”

ShortFinder says it is focused on “small- and micro-cap stocks that depend on risky financing and are susceptible to market manipulation.” Join The Bear Cave in following them here.

Recent Resignations

Notable executive departures disclosed in the past week include:

CFO of Ball Corp (NYSE: BALL — $14.4 billion) “will be stepping down from his role effective June 30, 2025 pursuant to a mutual agreement” after nearly two years.

CFO of Talos Energy (NYSE: TALO — $1.42 billion) resigned “effective as of June 27, 2025, to pursue a new opportunity” after two years.

CFO of Albany International (NYSE: AIN — $1.97 billion) “entered into a Voluntary Separation Agreement and General Release” after a little over two years. In March, the company’s Chief Accounting Officer resigned with ten days’ notice “to pursue another professional opportunity” after two years.

CEO of Protolabs (NYSE: PRLB — $875 million) departed effective immediately after four years and also resigned from the board.

CFO of Paramount Group (NYSE: PGRE — $1.28 billion) departed effective immediately after nine years. In addition, the company’s General Counsel departed effective immediately after sixteen years. The office REIT has been led by its 73-year-old CEO/Chair for the last 11 years, was previously accused of inappropriate payouts to its CEO, and was highlighted in The Bear Cave’s “100 Long-Term Underperformers” list. The company has a total return of -57% since its November 2014 IPO vs +239% for the S&P 500.

Chief Legal Officer of Target (NYSE: TGT — $42.8 billion) “will step down” just nine months after joining the company. In addition, the company’s Chief Strategy and Growth Officer stepped down after about four years. In January, the company’s Chief Stores Officer retired after about five years and the company’s Chief Information Officer departed after about three years.

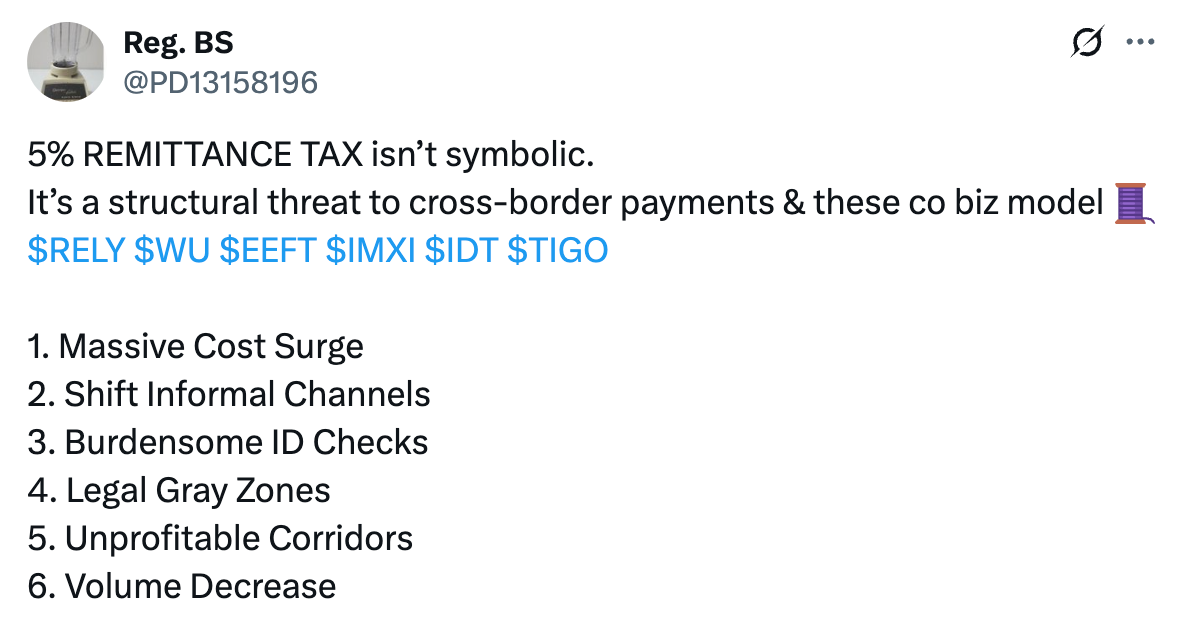

Chief Operating Officer of Western Union (NYSE: WU — $3.11 billion) resigned “for personal reasons” after three years. The company’s Chief Accounting Officer also retired in January after five years. In March 2025, Hunterbrook Media said the company faced a triple threat from “slowing growth, rising competition, and now federal scrutiny of transfers by cartels designated as terrorist groups.”

Data for this section is provided by VerityData from VerityPlatform.com

News of the Week

Marcel Smits, a founder, venture capitalist, and close follower of the eVTOL industry, published a lengthy critical LinkedIn post about Archer (NYSE: ACHR — $5.81 billion) and wrote, in part,

“The more pertinent debate is whether Archer has a fundamental design problem. I believe it does. The combination of fixed and tilting propellers probably isn’t a winner. Beta’s and Eve’s all fixed position propellers is nice and simple but not optimized for performance. Joby’s and Supernal’s all tilt propellers is optimized but more complex. Archer’s Midnight is neither simple nor optimized. Archer’s demonstrator plane ‘Maker’ never demonstrated its range and speed specifications and as yet neither did Midnight. Both Maker and Midnight ‘transitions’ failed to prove the ability to turn off the fixed positioned aft propellers. That was how it was supposed to work.

Midnight is heavy, noisy and expensive. It cost $5 million to build. Archer aims to over time squeeze its suppliers but it isn't clear how, their components aren't easily replaceable. Heavy also means longer charging times on the ground and less time in the air. Midnight has never published noise data, but it doesn't appear optimized for sound in the way Joby Aviation’s S4 is.

The efficacy of Midnight’s design is the bigger problem.”

On LinkedIn, an engineer at Bell Flight replied in part,

“At this point we are witnessing Theranos-level gaslighting from Archer…”

If you come across industry expertise that should be included in The Bear Cave, please email edwin@585reserch.com. Tips are always welcome.

Tweets of the Week

Until next week,

The Bear Cave