The Bear Cave #276

New Activist Reports, Recent Resignations, and Tweets of the Week

Welcome to The Bear Cave! Our last premium articles were “Problems at 100 Long-Term Underperformers” and “Problems at Two Paper Products Companies” and our next investigation comes out this Thursday, June 5.

New Activist Reports

Spruce Point Capital published on Tempus AI (NASDAQ: TEM — $9.55 billion), a healthcare technology company. Spruce Point alleged the company “relies on weakening partnerships” and noted that Tempus’s founder, Eric Lefkofsky, previously co-founded Groupon, which later fell ~95% following its IPO. Spruce Point also alleged,

“Evidence shows signs of aggressive accounting and financial reporting, including a joint venture between Japan’s SoftBank and Tempus that appears to involve round-tripping capital to create revenue and income for Tempus.”

Tempus responded on X, in part,

“Yesterday we were the target of a small short seller that apparently makes its living publishing inaccurate content designed to mislead investors. We do not intend to respond through the media to a report that is riddled with inaccuracies, conjecture, and ill-informed hypotheticals. It also fails to address Tempus' history of strong financial performance and impressive growth.”

In September, Two Natural Cap, an anonymous substack, published on Tempus AI and highlighted the company only earned ~1% of its 2023 revenue from AI offerings, none of which use generative AI. Two Natural concluded,

“[Tempus] is not yet an AI company, and it doesn’t deserve to trade at an AI multiple.”

Iceberg Research published on The Metals Company (NASDAQ: TMC — $1.62 billion), a deep-sea metals mining company. Iceberg highlighted that the company is up recently after President Trump expedited deep-sea mining licenses and warned,

“TMC is a reincarnation of Nautilus, a failed deep-sea mining venture. TMC CEO Barron was an investor. Nautilus understated its OPEX by 63%, was delisted and filed for creditor protection. The Prime Minister of Papua New Guinea, a backer of the project, called it a total failure.”

Iceberg added:

“Insiders are treating TMC as a personal cash machine. CEO Barron paid himself a compensation more than 8 times higher than the median for executives at comparable companies. Furthermore, Barron and other insiders established an underutilized credit facility with TMC that carried an effective interest of 39% per annum via high commitment fees.”

The company is down ~55% since its September 2021 SPAC merger.

Recent Resignations

Notable executive departures disclosed in the past week include:

CFO of Eos Energy Enterprises (NASDAQ: EOSE — $948 million) was “terminated without cause, effective immediately” after just three months. The company has had four CFOs in the last three years and its Chief Compliance Officer resigned “due to personal reasons” in January 2024 after two and a half years. The clean energy battery company is down ~60% since its November 2020 merger with a B. Riley SPAC.

CFO of TriSalus Life Sciences (NASDAQ: TLSI — $189 million) “stepped down for personal reasons” after five months. In April 2025, two board members resigned “effective immediately” after less than two years and in April 2024 the company dismissed KPMG as its auditor and engaged Grant Thornton. The company is down ~50% since its August 2023 SPAC merger.

CFO of Evolus (NASDAQ: EOLS — $592 million) resigned “to pursue another opportunity” after nearly three years. The company is down ~20% since its February 2018 IPO.

CEO of Vail Resorts (NYSE: MTN — $5.98 billion) resigned after three and half years and will be replaced by Robert A. Katz, who previously served as CEO from 2006 to 2021. In March 2022, The Bear Cave published on Vail Resorts and wrote,

“The Bear Cave has uncovered hundreds of complaints that show the Vail Resorts ecosystem is oversold, overworked, and has goodwill stretched thin. Vail’s future may be downhill.”

Shares have since fallen ~40%.

Chief Operating Officer of Flowco Holdings (NYSE: FLOC — $1.56 billion) resigned after a little over one year. The Houston-based oil and gas production solutions company is down ~40% since its January 2025 IPO.

Data for this section is provided by VerityData from VerityPlatform.com

News of the Week

“The Campaign Goldman’s CEO Waged to Silence Powerful Internal Critics” (WSJ)

“The frequent structural changes contributed to an exodus of partners. In asset management, nine of the 11 partners named as leaders in early 2022 are gone. ‘When you restructure an entire division, leadership changes are sometimes inevitable,’ the firm’s spokesman said. At times, when partners came to Solomon’s office to tell him they were leaving, the CEO would yell at them.”

“US court proceeds with Grifols defamation case against Gotham City, but narrows scope” (Reuters)

“A New York court has found enough evidence to proceed with a defamation lawsuit filed by Grifols against short seller Gotham City Research, though it dismissed many of the Spanish pharmaceutical company's claims… In its judgement, the court said that even though short sellers have an economic interest in driving down a company's stock price, they have ‘the same right to express opinions and analysis as any other market participant.’”

“Founder of Granite Recovery Centers Indicted for Scheme to Harass and Intimidate Journalists and Their Families” (DOJ)

“Beginning in or about March 2022 and continuing through at least May 2022, Spofford allegedly devised a scheme to harass and terrorize the journalist who authored the article, the journalist’s immediate family members, as well as a senior editor at NHPR in response to, and in retaliation for, NHPR’s reporting. It is alleged that the scheme involved vandalizing the victims’ homes at night with large rocks and bricks, and by spray painting the homes with lewd and threatening language.”

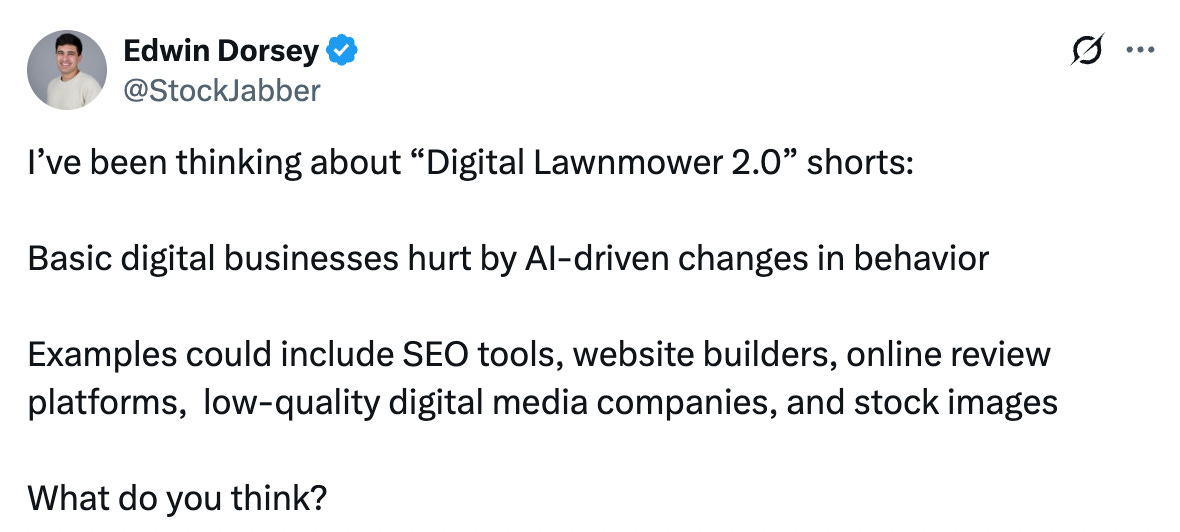

Tweets of the Week

The Bear Cave is going abroad! We will be in Saudi Arabia from June 4 to June 7, Thailand from June 8 to June 13, Turkey from June 14 to June 20, and Italy from June 21 to June 25. Please hit reply or email edwin@585research.com if you would like to connect.

Until Thursday,

The Bear Cave