Welcome to The Bear Cave! Our last premium articles were “Problems at Two Paper Products Companies” and “More Problems at KinderCare (KLC).” Given the exchange holiday on Thursday, June 19, The Bear Cave did not publish our normally scheduled investigation. Our next investigation will be sent to paid readers on Thursday, July 3. We will use the extra time to make the next one extra special.

New Activist Report

Anonymous substack Crash Capital published on DroneShield (ASX: DRO — AUD1.67 billion), an Australian counter-drone defense company. Crash Capital highlighted the company’s aggressive valuation at ~30x sales, 8x growth in share outstanding over the last 8 years, and raised concerns that “inventory turn was 0.15x and days inventory climbed to ~1267 days (~3.5 yrs) in 2H’24.” In addition, Crash Capital noted the company’s reliance on sales to distributors and wrote, in part,

“ForcePro B.V was a DroneShield distributor in the Benelux region. In 2020, DronShield claims to have sold $100k to ForcePro. Yet bankruptcy documents appear to show ForcePro having managed only €20k sales (A$30k) in 2020…”

Recent Resignations

Notable executive departures disclosed in the past week include:

CEO of Fastly (NYSE: FSLY — $979 million) resigned after nearly three years and also departed the board for “an external opportunity.”

CFO of Vimeo (NASDAQ: VMEO — $654 million) separated without cause after a little over three years. The company’s Chief Product Officer also departed his hybrid remote/in-person role after a little over two years in September 2024. The company is down ~95% since its May 2021 spinoff from IAC.

CEO of Mobile Infrastructure Corp (NASDAQ: BEEP — $171 million) “will transition to the role of Executive Co-Chairman of the Board” after four years. On June 5, the company dismissed Deloitte as its auditor and engaged Grant Thornton as its replacement. The parking garage company is down ~60% since its August 2023 SPAC merger.

Mr. Martyn Buttenshaw, board member of Stardust Power (NASDAQ: SDST — $15 million), resigned with immediate effect after six months. The pre-revenue lithium refining company is down ~98% since its July 2024 SPAC merger.

Chief Executive of Strategy & Consulting at Accenture (NYSE: ACN — $179 billion), Mr. Jack Azagury, departed “to pursue other opportunities” after a little over three years. In addition, in its Friday evening 8-K Accenture disclosed its Chief Human Resources Officer and Chief Technology Officer both departed “to pursue other opportunities” after one year and disclosed it “will bring all of its services—Strategy, Consulting, Song, Technology and Operations, together into a single, integrated business unit called Reinvention Services”

President of Hospice Services at BrightSpring Health Services (NASDAQ: BTSG — $3.93 billion) resigned “effective immediately” after a little over four years. In March, the company’s CFO entered a separation agreement after a little over seven years and in October 2024 the company’s Chief Legal Officer retired after eleven years. In January 2025, BrightSpring Health was on the SEC B7A FOIA exemption list, indicating a potential undisclosed SEC investigation. The Capitol Forum previously alleged chronic understaffing and other ethical lapses at the KKR-backed community healthcare company, which is up ~100% since its January 2024 IPO.

Data for this section is provided by VerityData from VerityPlatform.com

News of the Week

“News Publishers See Google’s AI Search Tool as a Traffic-Destroying Nightmare” (WSJ)

The Wall Street Journal reported that news publishers are worried AI will disrupt traditional web traffic and lower direct engagement with their publications. The Journal wrote, in part,

“About 40% of the magazine’s web traffic comes from Google searches, which turn up links that users click on. A task force at the Atlantic modeled what could happen if Google integrated AI into search. It found that 75% of the time, the AI-powered search would likely provide a full answer to a user’s query and the Atlantic’s site would miss out on traffic it otherwise would have gotten.”

The Bear Cave believes this trend of direct AI-powered answers will become a headwind for other websites like Yelp (NYSE: YELP — $2.20 billion), Tripadvisor (NASDAQ: TRIP — $1.70 billion), NerdWallet (NASDAQ: NRDS — $797 million), and companies like Taboola (NASDAQ: TBLA — $1.13 billion), which provides programmatic ads on publisher websites. Read The Bear Cave’s ChatGPT Deep Research query on the subject here.

“Obscure Chinese Stock Scams Dupe American Investors by the Thousands” (WSJ)

“Victims are typically recruited through social-media ads or messages on WhatsApp advertising investment advice. Unlike as in many other online scams, they are told to buy shares in real companies, often obscure Chinese firms that fizzled after going public on U.S. stock exchanges.”

“Idea Brunch with Maj Soueidan of GeoInvesting” (Sunday’s Idea Brunch)

A masterclass of microcap investing from Maj Soueidan.

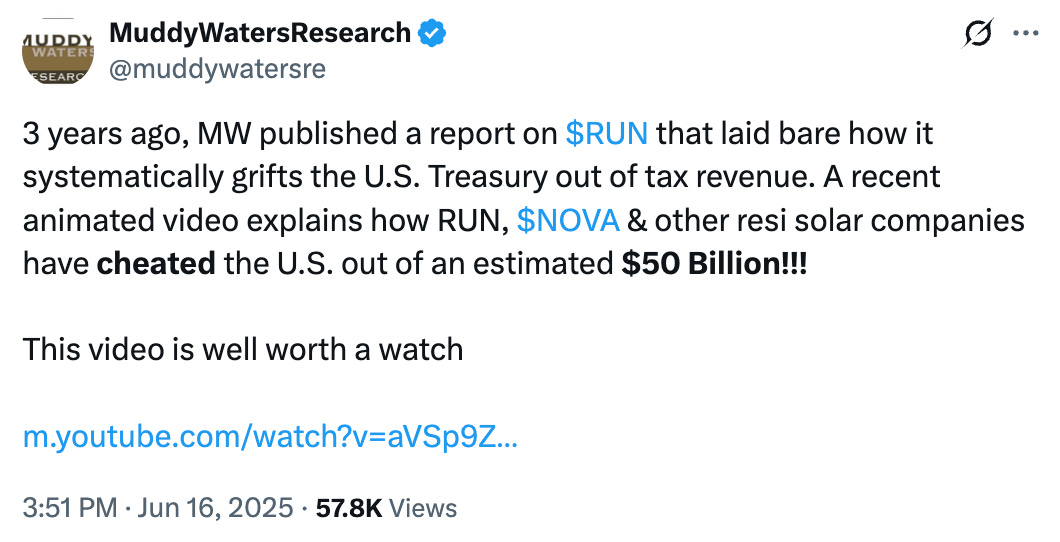

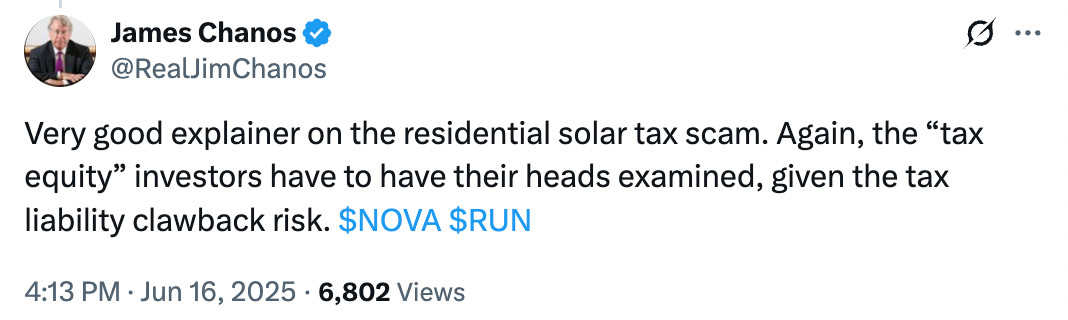

Tweets of the Week

Until next week,

The Bear Cave