The Bear Cave #305

New Activist Reports, Recent Resignations, and Tweets of the Week

Welcome to The Bear Cave! Our last premium articles were “Problems at Pattern Group (PTRN)” and “Problems at Serve Robotics (SERV)” and our next special investigation comes out Thursday, January 8.

New Activist Reports

Bleecker Street Research published on Via Transportation (NYSE: VIA — $2.70 billion), a public transit technology company. Bleecker Street called Via “a low-margin services contractor in a brutal industry masquerading as a SaaS company” and highlighted that almost all the company’s revenue “is tied to service hours, driver hours, and vehicle utilization - not software licenses.” Bleecker Street noted that some customers have renegotiated pricing or migrated to competitors and Bleecker Street alleged the company inflates its financials “by booking large upfront implementation fees” and “[excluding] insurance from cost of revenue, [which] inflates reported gross margins.”

Hunterbook Media published on RadNet (NASDAQ: RDNT — $5.92 billion), a large U.S.-based radiology company. Hunterbrook claimed that RadNet’s AI pivot is more hype than substance and estimated that “~57% of RadNet’s reported same-center growth from 2022–2025” came from consolidations of its centers rather than true incremental organic growth.

Capybara Research published a second report on Nutex Health (NASDAQ: NUTX — $1.22 billion), an emergency healthcare company. Capybara called the company “a mediocre business propped up by alleged arbitration fraud, medical billing fraud, inflated receivables, and misleading accounting.”

Capybara first published on Nutex last month, and in July, Blue Orca Capital also published on Nutex, highlighting similar allegations of fraudulent billing.

Recent Resignations

Notable executive departures disclosed in the past week include:

CFO of Vestis Corp (NYSE: VSTS — $906 million) resigned “to pursue other opportunities” after just ten months.

CFO of Navan (NASDAQ: NAVN — $3.76 billion) “entered into a transition agreement” after one and a half years. The corporate travel company is down ~25% since its October 2025 IPO.

CFO of Alight (NYSE: ALIT — $1.03 billion) “is resigning to pursue another opportunity outside the benefits administration space” after a little over one and a half years. Last month, the company’s CEO departed after one and a half years. In March, three board members resigned and in January the company’s President departed. The HR-tech company is down ~80% since its July 2021 SPAC merger.

CEO of Kraft Heinz (NASDAQ: KHC — $29.0 billion) “entered into a Severance Separation Agreement and General Release” after two years. The company has had three CEOs and four CFOs over the last ten years and was included in The Bear Cave’s July 2025 list of “Problems at 130 Long-Term Underperformers.” The Bear Cave wrote:

“Kraft Heinz, packaged food conglomerate with brands including Kraft Mac & Cheese, Oscar Mayer meats, and Philadelphia cream cheese, flat to slightly declining revenues, potential Ozempic and Make America Healthy Again headwinds, consumer shift towards private label, 2021 SEC charges for inflating results, $20 billion in long-term debt, recovering from mismanagement/underinvestment under 3G Capital. Total return of +1% since September 2012 vs +433% for S&P 500.”

CFO of Mativ Holdings (NYSE: MATV — $683 million) was terminated without cause after nearly three years. The tobacco and paper products company was also previously included in The Bear Cave’s July 2025 list of “Problems at 130 Long-Term Underperformers” on concerns of “declining end markets [and] intense competition from dozens of Asian and European specialty-paper houses.”

Executive Chair and founder of Shift4 Payments (NYSE: FOUR — $5.68 billion), Jared Isaacman, “was sworn in as the 15th Administrator of NASA on December 18, 2025” and departed the board after 27 years. In April 2023, Blue Orca Capital alleged the company engaged in accounting games and stock promotion.

Data for this section is provided by VerityData from VerityPlatform.com

News of the Week

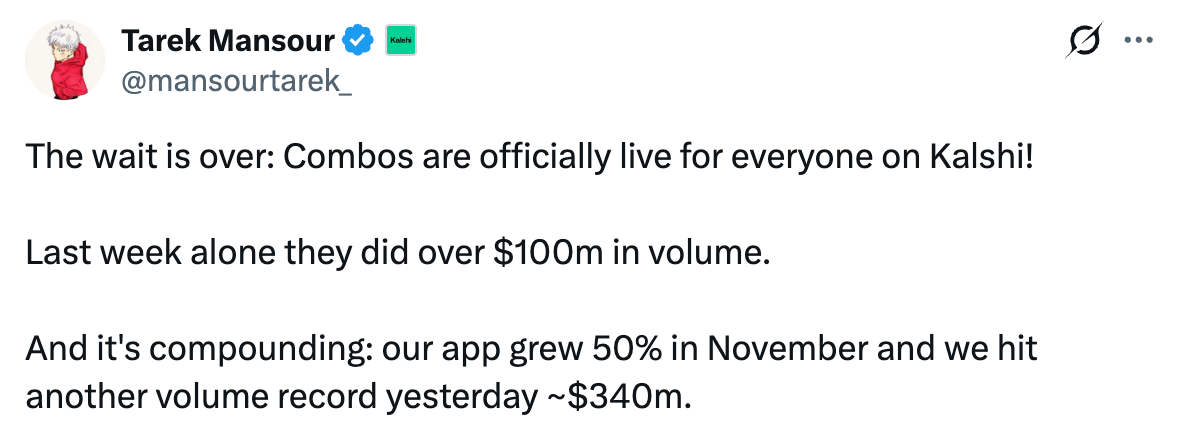

“Robinhood to Offer Custom Sports Parlays Using Kalshi Tech” (Sportico)

“Robinhood will start offering customizable sports parlays early next year as it looks to fend off competition from other financial technology companies that have embraced betting.”

“How Warren Buffett Did It” (The Atlantic)

“The most successful investor of all time is retiring. Here’s what made him an American role model. By Seth A. Klarman.”

Tweets of the Week

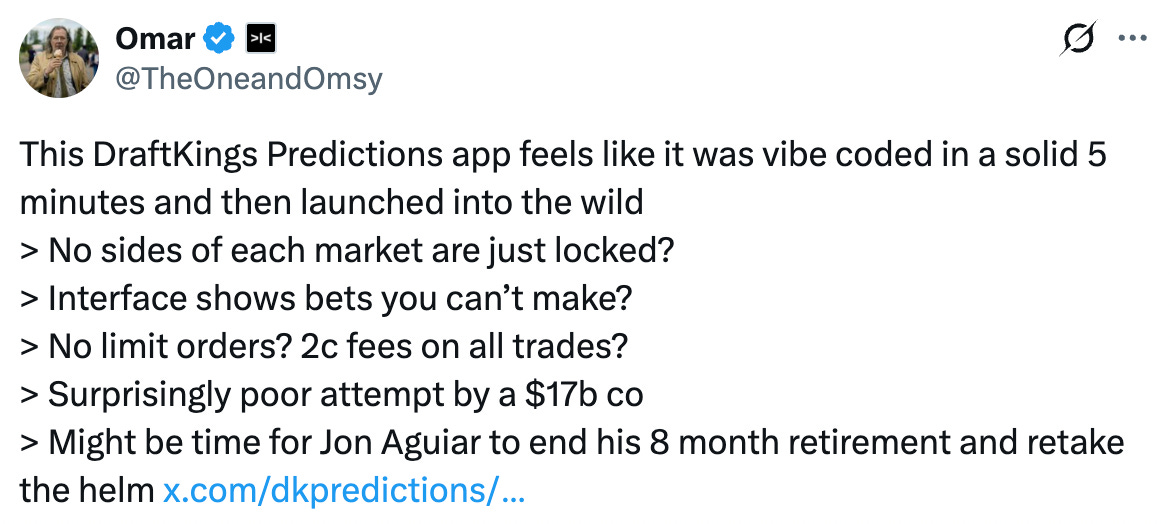

Read The Bear Cave’s past investigations: “Problems at DraftKings (DKNG)”, “More Problems at DraftKings (DKNG)”, “Betting on Tomorrow: A Primer on Prediction Markets”, for more on how the growth of prediction markets can harm DraftKings and other incumbents.

Until next week,

The Bear Cave