🐻The Bear Cave #38🐻

Fraud Allegations at GSX, New Activist Reports, What to Read, and Tweets of the Week

Welcome to The Bear Cave — your weekly source of short-seller news. If you are new, you can join our email list here.

More Fraud Allegations at GSX

GSX Techedu (NYSE: GSX — $15.8 billion), the controversial Chinese online education company, is under more scrutiny from a new website: deloittefraud.com

The website criticizes Deloitte and its “unreasonable recklessness” as GSX’s auditor. The website alleged: the company’s founding CFO resigned three months before its IPO, the new CFO previously worked for an alleged fraudulent education company, the company’s SEC filings do not match Chinese filings, the company uses related party entities to hide expenses, and the company’s revenue per instructor is 14x better than competitors.

The website also highlighted that GSX’s board currently has only four members, that a former executive was charged with fraud, and that the company inflates user metrics. As evidence of inflated numbers, the website claimed that "63.9% of their students used the exact same IP address” and “52.8% of their students joined their classrooms at the exact same second.”

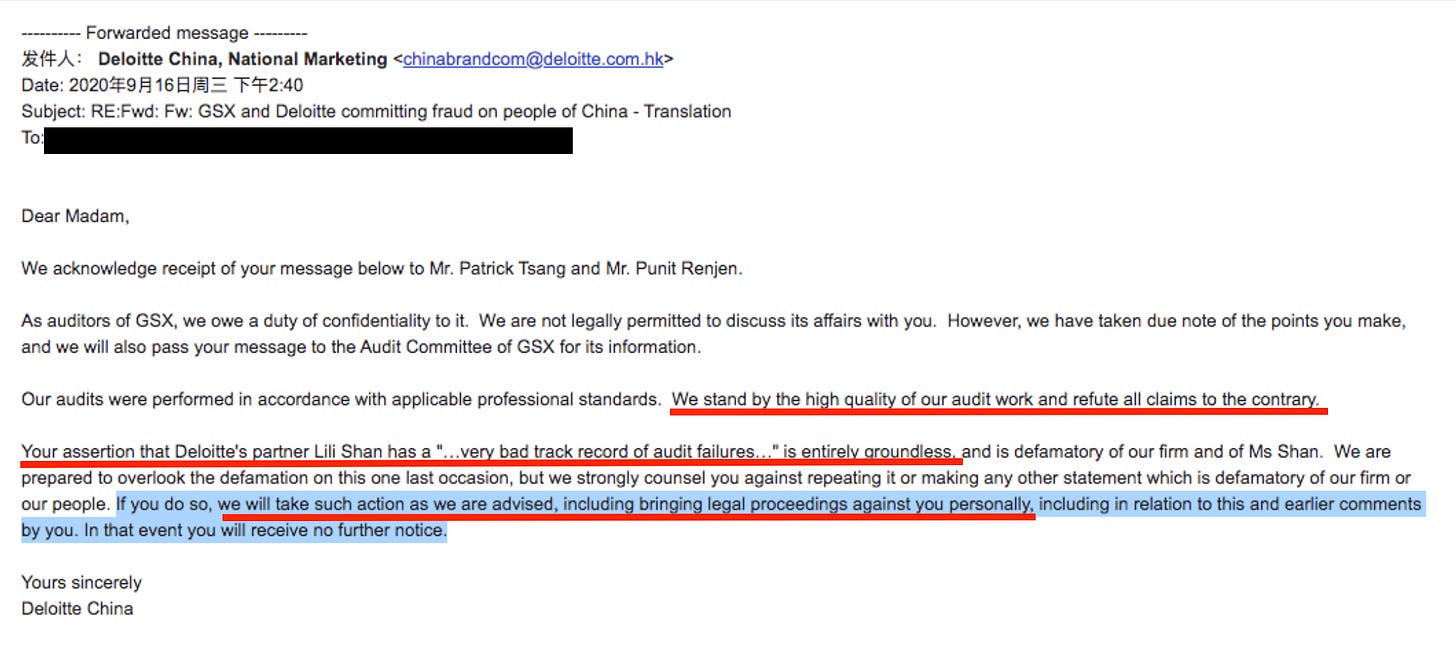

According to the website, Deloitte threatened a whistleblower after sharing information about GSX’s misconduct. Deloitte also said, “We stand by the high quality of our audit work.”

The engagement partner from Deloitte responsible for GSX is Li Li Shan. According to PCAOB records Ms. Shan has served as the engagement partner for two other public Chinese education companies. The first, RYB Education (NYSE: RYB — $76 million) is down 90% since its 2017 IPO. The second, Puxin Ltd (NYSE: NEW — $643 million) is down 65% since its 2018 IPO. There is no public record of audit failures by Ms. Shan.

Numerous activist reports have also alleged fraud at GSX.

Citron Research called GSX “The Most Blatant Chinese Stock Fraud since 2011.”

Muddy Waters called GSX “a near-total fraud.”

Grizzly Research called GSX “too good to be true.”

Scorpio VC called GSX “a long-planned listing scam.”

In addition, an anonymous letter to Senator Marco Rubio raised concerns about market manipulation and fraud at the company. A letter to the SEC called GSX an “unmistakable fraud and market manipulator.” A different letter to the SEC claimed GSX is “fraudulently overstating revenue.”

In its September Q2 press release, GSX Techedu disclosed an SEC investigation. The company said, “the SEC’s Division of Enforcement contacted the Company, requesting it to produce certain financial and operating records dating from January 1, 2017.”

In addition, in June 2020, the SEC Division of Corporation Finance sent GSX Techedu a comment letter requesting additional disclosure around the company’s revenue growth.

The lawyer listed as GSX’s U.S. counsel in its comment letter response is Julie Gao of Skadden, Arps, Slate, Meagher & Flom LLP. Ms. Gao also did work for iQIYI (NASDAQ: IQ — $18.1 billion), a Chinese streaming company that recently disclosed an SEC investigation.

In addition, Ms. Gao did work for Bilibili (NASDAQ: BILI — $15.5 billion), a Chinese video game developer. The CFO of Bilibili, Xin Fan, is also chairman of the audit committee for GSX.

GSX stock remains up 560% since its 2019 IPO.

New Activist Reports

GeoInvesting published on mattress company Purple Innovation (NASDAQ: PRPL — $1.54 billion). GeoInvesting highlighted related party transactions, governance issues, and high insider selling. The Utah-based company is up 180% since going public via a SPAC in 2018.

Blue Orca Capital published on Seek Limited (ASX: SEK — AUD$7.53 billion), an Australian roll-up of online recruiting platforms. Blue Orca highlighted potential fraud at the company’s Chinese job search platform subsidiary.

Become a Premium Member

If you are enjoying The Bear Cave please consider becoming a paid subscriber. For $34/month you will get two deep-dive reports every month exposing issues the market is missing at public companies. The next report comes out on Thursday, November 5.

The research reports for paid subscribers focus on auditor issues, disclosure issues, SEC comment letters, accounting issues, public litigation, executive turnover, business model issues, and complaints obtained through FOIA requests. (See this example.)

Learn more here or contact me at edwin@585research.com with any questions.

What to Read

“Fraud on the Board II: Conflicted CEO Tilts Company Sale in PE Firm’s Favor” (JDSUPRA)

“In what is becoming an increasingly common claim in M&A litigation, the court found it reasonably conceivable that the CEO, unbeknownst to the Company’s board of directors, favored Vista in the sale process due.”

“The Six-Billion Dollar Stare” (The Generalist Substack)

“An explanation of why The Generalist’s initial piece on compounders was removed from the website, and why it has returned in a revised form… If they want to, if they consider it in their interest, Durable [Capital] could sue me… They can bleed me of time and energy and money, without merit. My mother has asked me not to write this piece.”

“Kyle Bass’s Texas Feud Spotlights Short-Selling Tactics” (Bloomberg)

“Anonymous blog posts, a call to the FBI and a bold bet against a real estate investment trust led to lawsuits, investigations.”

Tweets of the Week

Until next week,

The Bear Cave