Earlier today I published The Bear Cave’s year in review recapping the best Bear Cave content from this year (read it here). In 2020, The Bear Cave sent over 250,000 emails and grew to over 8,000 email subscribers. We are at the start of something big and I am incredibly grateful for your ongoing support. Thank you.

New Activist Reports

The “Up in Smoke” newsletter profiled Innovative Industrial Properties (NYSE: IIPR — $4.18 billion), a medical marijuana REIT. Innovative Industrial Properties buys medical marijuana facilities from operators and then leases them back, often at lucrative rates because other lenders do not want the regulatory risk associated with the industry. “Up in Smoke” argued that as the medical marijuana industry is legitimized new lenders may enter the industry and compete with Innovative Industrial Properties.

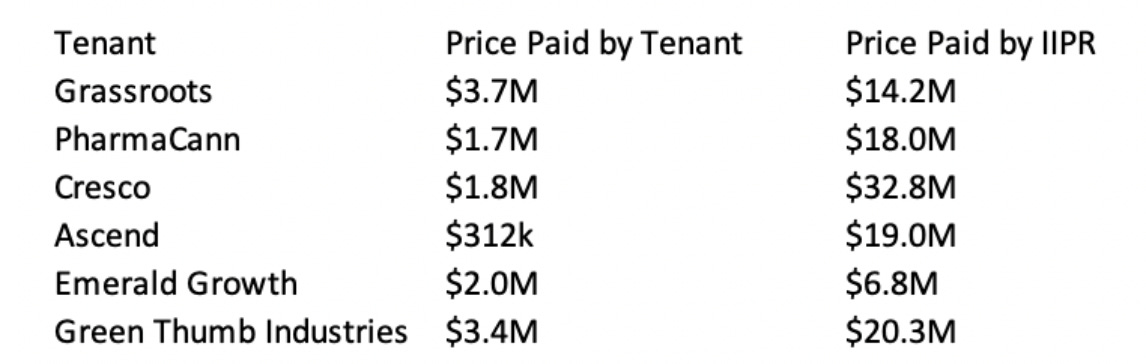

In addition, the newsletter alleged Innovative Industrial Properties routinely overpaid to buy properties to lease back to its tenants.

The company’s auditor is BDO and IIPR stock is up 900% since its 2016 IPO.

ShadowFall Capital published a 54-slide report on Network International Holdings (LON: NETW — GBP1.67 billion), a UK payments company. ShawdowFall highlighted the company’s consistently high losses from “discontinued operations,” poor acquisition history, and a recent acquisition of DPO Group, an African payment processor with ties to Wirecard.

ShawdowFall also published an open letter to Network International’s chairman. Matthew Earl, the managing partner at ShadowFall, was also an early skeptic of Wirecard.

Citron Research tweeted that it is long XL Fleet (NYSE: XL — $3.87 billion), a vehicle electrification company that went public through a SPAC in November. Citron cited a “TAM of over $1 trillion.”

Hindenburg Research published a Twitter thread criticizing Microvision (NASDAQ: MVIS — $959 million), a laser tech company whose stock is up around 1,000% this year.

Sheen Bay Research published a Seeking Alpha article on Mack-Cali Realty (NYSE: CLI — $1.15 billion), a heavily indebted office and multifamily REIT that may cut its dividend in 2021.

Marcus Aurelius Research called GSX Techedu (NYSE: GSX — $13.1 billion) a “complete and utter fraud.” Two weeks ago Marcus Aurelius Value Research also published a 16-page document detailing seven employee whistleblowers alleging fraud at the Chinese online education company.

Numerous other activist reports have also alleged fraud at GSX. Citron Research called GSX “The Most Blatant Chinese Stock Fraud since 2011.” Muddy Waters called GSX “a near-total fraud. Grizzly Research called GSX “too good to be true.” Scorpio VC called GSX “a long-planned listing scam.” GSX stock is down about 50% since August.

What to Read

“Grant’s Interest Rate Observer Reports on Corporate Fraud. Now It’s the Victim of It.” (Institutional Investor)

“Eric Ian Whitehead, 53, pled guilty to one count of wire fraud for a years-long scheme to embezzle approximately $1.3 million from a financial publishing company… “It seems that, with this revelation, my profitable publishing business is even more profitable than I thought,” said James Grant.”

“The Profile Dossier: Charlie Munger” (The Profile Newsletter)

“Deliver to the world what you would buy if you were on the other end."

“Investors Double Down on Stocks, Pushing Margin Debt to Record” (WSJ)

“Mr. Burnworth, a civil engineer in Incline Village, Nev., who is nearing retirement age, is using all of those strategies after turning a roughly $23,000 options gamble on Tesla last year into a nearly $2 million windfall… he also sold his own home and used some of the proceeds to buy more Tesla options.”

Tweets of the Week

Until next week,

The Bear Cave