Welcome to the fifth issue of The Bear Cave! Your weekly source of what’s going on in the short world. Feedback is welcome and if you like this newsletter please share with friends and encourage them to sign up.

New Activist Shorts

Citron Research put out a $5/share price target on Peloton (NASDAQ: PTON — $5.53 billion). Citron Research also called for the SEC to halt Inovio Pharmaceuticals (NASDAQ: INO — $992 million) over concerns of coronavirus-themed stock promotion.

Hindenburg Research announced it was short Opko Health (NASDAQ: OPK — $1.27 billion):

Spruce Point released a short report on Australian packaging company Amcor (NYSE: AMCR — $10.94 billion).

Coronavirus Stock to Watch: Yext

I believe Yext (NYSE: YEXT — $1.55 billion) will suffer a lot from coronavirus, but the market has not realized it and the stock was down less than 1% last week.

Yext is a New York-based software company that helps businesses, largely restaurants and retail, manage their online web presence. Yext does this through its listing service (i.e., helping businesses be represented on Yahoo, Yelp, Alexa, Siri, etc…) and Yext Answers, which manages the internal search box on company websites.

In the risk factors section of its 10-K Yext states,

“Negative effects [on revenue] could be exacerbated by… marketing and sales methods away from physical location retailing.”

In addition, on its March 3rd Q4 conference call Yext CEO Howard Lerman listed some new Yext customers:

“During the quarter, we signed the largest international enterprise deal in the history of the company with Accor Hotels… we also signed contracts with leading brands like First Citizens Bank, Good Year Tire, The Vanguard Group, and we expanded and renewed contracts with amazing brands like Great Clips and Hilton and Wendy's.”

These are the exact types of businesses that are getting hit hardest by coronavirus. As Yext’s customer base goes into cash conservation mode it will be incredibly difficult for Yext to sign new deals. In fact, Yext may be the type of discretionary spending companies look to cut.

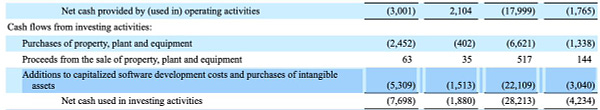

Most troubling is that Yext is chronically unprofitable. In fiscal 2020 Yext lost $122 million on $299 million in revenue. This is up from a $75 million loss in fiscal 2019. The company had $256.1 million in cash as of January 31, 2020. On March 11th Yext amended its revolving credit facility.

From my perspective, Yext is a deeply troubled SAAS company that will be stunted by the coronavirus outbreak. Moreover, Yext customers have accused the company of extortion and I believe the company has a variety of governance issues. You can read more about Yext here.

SEC News

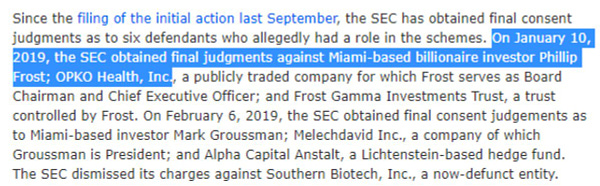

The SEC entered final consent judgments against “a group of South Florida-based microcap fraudsters led by Barry Honig” that “generated over $27 million from unlawful stock sales.”

SEC Commissioner Wants less Regulation (SEC Statement)

In a public statement SEC commissioner Hester Pierce wrote,

“In my ideal regulatory regime... [auditors’ opinion on controls] would be optional for every company… The market is a powerful regulator, one that we are often too quick to dismiss.”

“SEC becomes first federal agency to ask DC employees to work from home” (CNN)

“The Securities and Exchange Commission is asking all personnel based at its headquarters to work from home due to an employee who may have coronavirus, according to an SEC spokesperson.”

Tweets of the Week

Until next week,

The Bear Cave

(Feedback Welcome, Forwarding Is Very Appreciated)

The Bear Cave is not Investment Advice / sign up here

Contact: edorsey@stanford.edu / (718) 873-2362 / @StockJabber