Welcome to The Bear Cave — your weekly source of short-seller news. If you are new, you can join our email list here. The Bear Cave is also launching a new free newsletter about SEC comment letters. Check it out here: CommentLetterKing.substack.com

New Activist Reports

Citron Research published a bullish video and report on Esports Entertainment Group (NASDAQ: GMBL — $297 million), an esports betting company. Citron highlighted Esports Entertainment as a potential acquisition target for GameStop or other gaming companies.

White Diamond Research published on Blue Bird Corp (NASDAQ: BLBD — $699 million) and called the company “an undervalued electric vehicle manufacturer… with $100 billion of Federal contracts in its grasp.”

Gotham City Research tweeted bullishly on Criteo (NASDAQ: CRTO — $2.09 billion), an ad tech company with “transformational change” and a chance of a potential buyout.

The Hobbes’s Newsletter published on Blink Charging (NASDAQ: BLNK — $1.66 billion), an EV charging company that is up over 1,500% over the last twelve months. The newsletter called the company “a $1.8bn pump-and-dump scheme with negligible sales ($4mm LTM), questionable management, and customers actively avoiding the brand.”

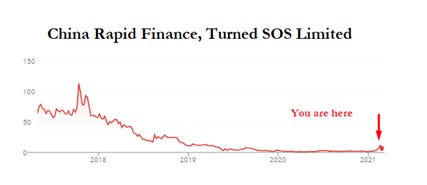

Hindenburg Research published a critical Twitter thread on SOS Limited (NYSE: SOS — $778 million), a Chinese blockchain cloud company:

Culper Research also published on SOS Limited and wrote,

“SOS is a China-based reverse merger which has languished since its April 2017 IPO until its torrent of crypto-related hype has taken shares up over 600% at their peak. However, we find the Company’s claims regarding its supposed cryptocurrency mining purchases and acquisitions to be extremely problematic, if not fabricated entirely.”

In response, SOS said the reports “were purposefully designed to manipulate the price of the Company's shares, with the aim of causing a stock price decline in order to economically benefit the short sellers.”

Potential Accounting Problems at SCI

Service Corporation International (NYSE: SCI — $8.09 billion), a funeral and cemetery company, received two SEC comment letters and held two phone calls with SEC staff according to comment letters made public last week.

The SEC comment letter said, in part,

“In discussing your trust investments on page 40, you also state that your market-sensitive instruments and positions are considered to be ‘other-than-trading’. Please tell us how you concluded the cash flows related to your trust investments represent operating activities, rather than investing activities.”

In a 19,036-word response (inclusive of exhibits) the company wrote,

“Our financial reporting for preneed funeral and cemetery contracts with customers has been the subject of significant research, deliberation, consultation, and discussion with the Staff and the Office of the Chief Accountant over the last 15 years. State laws generally require… funds collected for preneed funeral and cemetery merchandise and service contracts to be placed into merchandise and service trusts… The Trusts hold investments in marketable securities that we have generally considered other-than-trading…”

SCI later made small changes to its accounting “based on further conversation with the [SEC] Staff.”

Comment letters are public informal correspondence between public companies and the SEC about accounting or disclosure issues. Other companies with notable recent comment letters include JOYY Inc (NASDAQ: YY — $9.55 billion), a Chinese video-based social media platform, and The Children’s Place, Inc (NASDAQ: PLCE — $1.01 billion), a U.S. retailer.

Learn more about comment letters in The Comment Letter King, a free weekly newsletter on SEC comment letters👇

What to Read

“Special Edition: Will ARK Invest Blow Up?” (The Bear Cave)

“ARK’s illiquid holdings are problematic because if ARK ever faced outflows, or the threat of potential outflows, hedge funds could take predatory short positions in ARK’s illiquid holdings and create a performance death spiral…”

“New Short-Only Research Firm Rejects ‘Activist’ Business Model” (Integrity Research)

“The Bindle Paper is embracing a subscription-based revenue model that does not take short positions in researched names. Co-founded by veteran short investor Kurt Feshbach, the new firm champions classic short ideas research…”

“Nikola Internal Review Confirms Some Claims in Short Seller’s Report” (WSJ)

“Nikola said Thursday that its review of Hindenburg’s allegations found that nine statements by the company or Mr. Milton were wholly or partially inaccurate. Among the things cited by Nikola was the video of the truck moving.”

Tweets of the Week

Until next week,

The Bear Cave