The Bear Cave #66: The Golden Age of Fraud

New Activist Reports, The Golden Age of Fraud, and Tweets of the Week

Welcome to The Bear Cave — your weekly source of short-seller news. If you are new, you can join our email list here.

New Activist Reports

Muddy Waters Research published an open letter on Lemonade (NYSE: LMND — $4.42 billion), an app-based insurance company. Muddy Waters wrote that “Lemonade’s site contains an unforgivably negligent security flaw that potentially exposes its customers’ personally identifiable information.” The Friendly Bear previously questioned Lemonade’s philanthropic promises and high insider selling.

Alex Pitti published a Seeking Alpha article on PureCycle Technologies (NASDAQ: PCT — $1.40 billion), a zero-revenue ESG-themed SPAC merger that claims to revolutionize plastic recycling. Pitti called PureCycle “the next Nikola” and highlighted manufacturing delays and other problems with PureCycle’s technology. Last week, Hindenburg Research published on the company and the questionable track record of the management team.

The Golden Age of Fraud

We are living in the Golden Age of Fraud, a time when corporate deception goes unpunished if not rewarded.

As one example look at Triterras (NASDAQ: TRIT — $410 million), a Singapore-based “blockchain-enabled” trade finance lending platform that went public through a SPAC in November of 2020. Triterras was spun out of a commodity trading firm, Rhodium Resources, which was an instrumental counterparty according to its SPAC prospectus:

“We rely on Rhodium to both use our platform for their transactions and to promote the use of our platform to their trading counterparties and contacts in the trade finance, credit insurance and logistics markets.”

“Substantially all of the users of our platform… were referred to the platform by Rhodium Resources…”

However, by December, one month after its SPAC merger, Triterras disclosed that its sister company Rhodium received “a statutory demand for payment” and was looking to “restructure its debts.”

In a business update call, Triterras’s CEO changed tune and said,

“We are not reliant on Rhodium” and “while the circumstances with Rhodium are unfortunate, it does not affect our expectations for our results for this year or next.”

In January, KPMG resigned as Triterras’s auditor and in May two board members resigned. One wrote that the “Chairman and the company’s interim general counsel’s office have very different views to my own as to the optimal path forward.”

Triterras raised ~$200 million from its SPAC deal and still has an equity valuation of $410 million. The Bear Cave previously highlighted problems at the company.

Triterras is no anomaly. AgEagle Aerial Systems (NYSE: UAVS — $310 million) describes itself as a “pioneer in advanced commercial drone technologies” and reached a peak market cap of nearly $1 billion by promoting rumors of an Amazon partnership. In reality, the company owns no patents, currently uses an external part-time Chief Technology Officer, and has spent approximately $40,000 on research and development in the last three years.

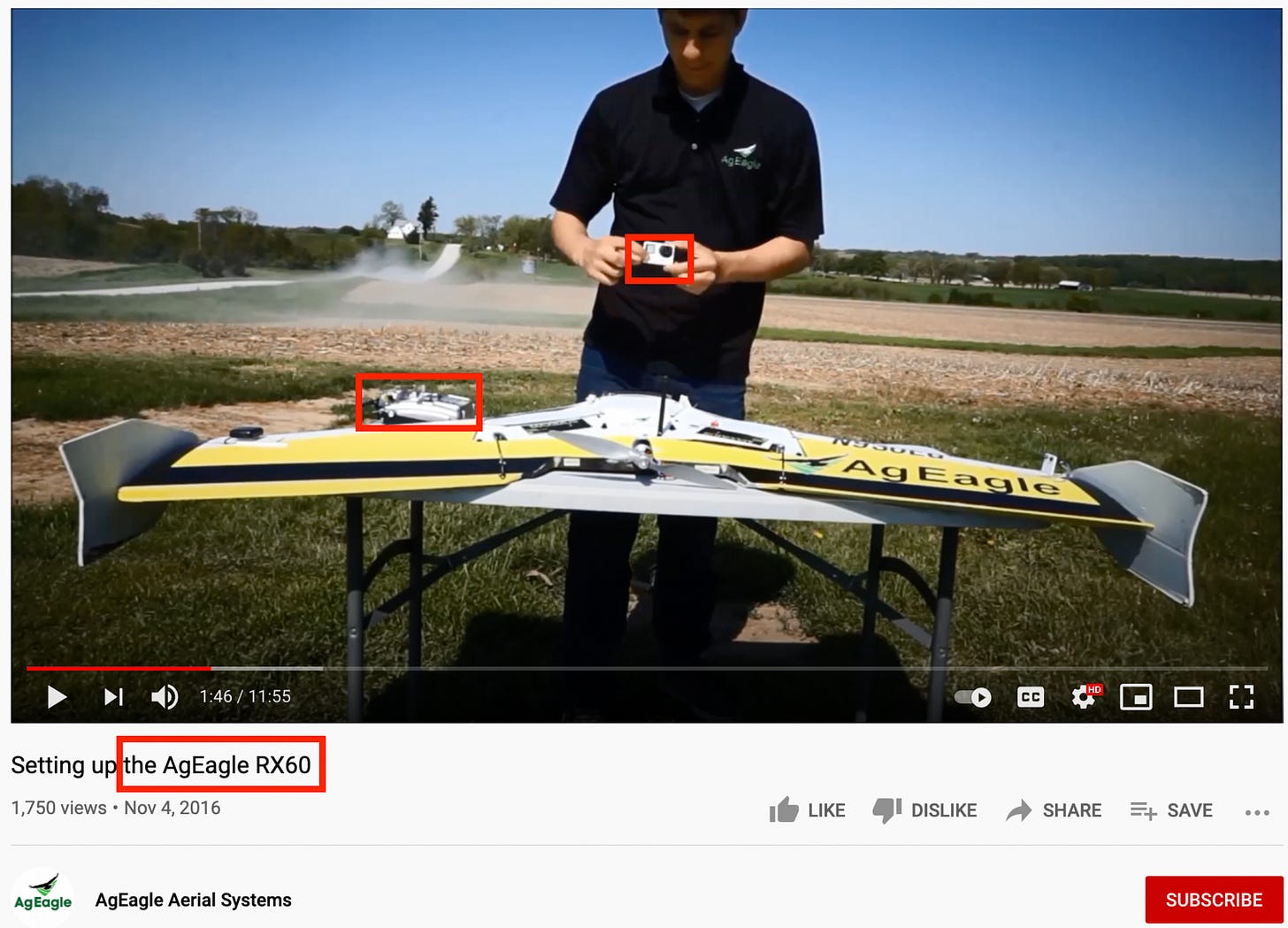

Unsurprisingly, AgEagle’s “drone” appears to be a remote-controlled plane hooked up to a GoPro camera:

An Amazon spokesperson has denied any partnership.

Similar to AgEagle, Nano Dimension (NASDAQ: NNDM — $1.53 billion), an Israeli 3D printing company, has risen over 700% on optimism that its printer can be used to make electronic circuit boards.

Nano Dimension’s current CEO has been previously accused, but never convicted, of an “extortion attempt” and the company’s former Chairman was arrested on charges of money laundering, aggravated fraud, and securities violations. Nano Dimension’s history includes consistent unprofitability, serious dilution, an OTC to NASDAQ uplisting, a 50 for 1 reverse split, and 253 press releases.

In total, Nano Dimension raised approximately $1.5 billion from investors over four equity offerings. Recently, the company used $70 million of that cash to acquire a start-up founded by two of its board members.

NNDM stock is down 60% from its February peak.

The losses of retail investors in AgEagle Aerial Systems and Nano Dimension are profits for Alpha Capital Anstalt, a Liechtenstein-based hedge fund that was an early backer of both companies.

Other companies backed by Alpha Capital that have seen ~90% declines after retail hype include: Friendable (FDBL), Iconic Brands (ICNB), Aethlon Medical (AEMD), Precipio (PRPO), BioSig Technologies (BSGM), Natur International (NTRU), Bantec (BANT), XpresSpa Group (XSPA), Vapor Corp (HCMC), Emerald Medical Applications (VBIX), ShiftPixy (PIXY), GT Biopharma (GTBP), Andrea Electronics (ANDR), Generex Biotechnology (GNBT), ReShape Lifesciences (RSLS), MV Portfolios (MVPI), Artelo Biosciences (ARTL), Vivene Medical (VIVE), Akers Biosciences (AKER), and Real Goods Solar (RGSEQ).

Alpha Capital was previously mentioned in a 2018 SEC complaint involving stock promoter Barry Honig, but continues to trade in U.S. markets unrestricted.

U.S. listed Chinese companies are often no better. OneSmart International Education Group (NYSE: ONE — $351 million), a Chinese online education and daycare company, has fallen over 80% since its 2018 IPO that raised $179 million. The SEC had raised questions about the company before its NYSE listing. In a March 2018 letter, the company responded to an SEC question trying to reconcile revenue and enrollment growth. OneSmart wrote,

“The Company respectfully advises the Staff that there was an error in the average monthly enrollment figures in fiscal years 2016 and 2017…”

Nonetheless, OneSmart was allowed to list and, since then, the CFO and audit chair have resigned and investors have lost around $1.5 billion.

In all these cases, regulatory enforcement has been missing and individuals, short-sellers, or The Bear Cave newsletter were the first to highlight problems. Until that changes, the Golden Age of Fraud will continue.

This Thursday The Bear Cave will publish a report for premium subscribers on another company that exemplifies our Golden Age of Fraud.

What to Read

“‘Shadowy’ Private Investigator Promised Catalyst Intel on Short Sellers — But Came Up Short, New Legal Documents Reveal” (Institutional Investor)

The anonymous emailer eventually revealed himself to be Danny Guy who, according to the documents, had lost about $250 million in Concordia International, a Canadian company that had been a short target of Cohodes….”

“Secret Sharers: The Hidden Ties Between Private Spies and Journalists” (New York Times)

“A booming, renegade private intelligence industry is increasingly shaping (and misshaping) the news.”

“Bottom Drops Out of the Red-Hot Market for Electric Vehicle Start-Ups” (New York Times)

“Lordstown Motors said it would start producing and selling electric pickup trucks this year, but there is little evidence it is ready to do so. Its stock has tumbled from a high of about $30 last year to around $8.”

Tweets of the Week

Until Thursday,

The Bear Cave