The Bear Cave #82 + Union Pacific Railroads Linked to Cancer

New Activist Reports, Union Pacific Linked to Cancer, Recent Resignations, Tweets of the Week

Welcome to The Bear Cave — your weekly source of short-seller news. If you are new, you can join here. Please hit the heart button if you like today’s newsletter and reply with any feedback.

New Activist Reports

Night Market Research published on BeyondSpring (NASDAQ: BYSI — $956 million), a lung cancer pharmaceutical company. Night Market Research said the company’s “Phase 3 lung cancer data is likely weaker than claimed” and highlighted that upwards of 80% of its trial patients are in China. Night Market Research also showed that the company made material changes between its investor presentation and slide deck filed with the SEC.

Viceroy Research published a second report on ReconAfrica (TSX: RECO — CAD$1.13 billion), a promotional oil exploration company.

Kerrisdale Capital published a bullish update on Korn Ferry (NYSE: KFY — $4.06 billion), a management consulting and executive search company. Kerrisdale wrote,

“In the 18 months since our original report on Korn Ferry, we’ve gained further conviction that the company’s combination of strong revenue growth, attractive incremental margins, and higher subscription revenue mix will continue to drive estimates and multiples higher.”

Kerrisdale highlighted the Korn Ferry competes in fragmented markets and will unlock value with its digital offerings (e.g., training software).

Union Pacific Railroads Linked to Cancer

Union Pacific (NYSE: UNP — $135 billion) used creosote, a tar-like cancerous material, as a preservative in its railroad wood and was recently linked to multiple cancer clusters and birth defects in an investigation by the Department of Health and Human Services in Texas.

In January of this year, Houston’s mayor publicly asked Union Pacific to help relocate families near the contaminated areas:

“This cluster involves children sickened with leukemia at nearly five times the expected rate… I am requesting that Union Pacific help to relocate affected residents and create a buffer between contaminated areas and homes in the neighborhood… Someone needs to be held accountable for the healthcare costs of these families and specifically these children.”

Union Pacific did not relocate families. And now the EPA is investigating.

On Thursday, the EPA sent Union Pacific’s CEO a 63-question letter about its lack of progress in decontaminating its Houston railyard linked to the cancer clusters. The EPA asked for responses to the questions by September 30th and said it would make Union Pacific’s response available to the public.

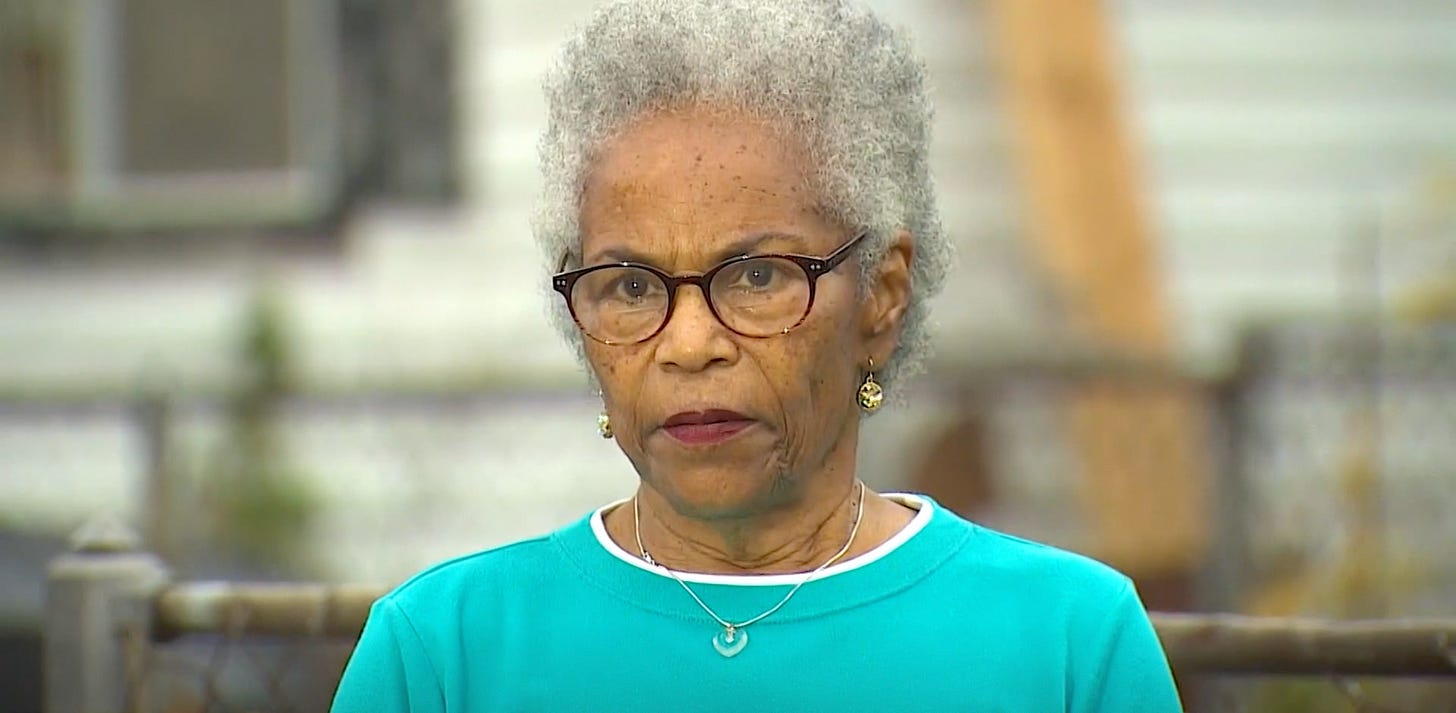

Barbara Beal, a resident who lived near the Union Pacific site, told a local news station,

"Something is definitely going on… It makes me angry, because this is involving the babies.”

One year ago, the Houston Chronicle highlighted the story of Regina Martin-Morgan, whose father, mother, and brother all developed cancer. She has joined a wrongful death lawsuit against Union Pacific.

A Bear Cave investigation found this is not the first time Union Pacific has been linked to cancer cases.

In 2017, a jury in Madison County, Illinois awarded a Union Pacific employee $7.5 million after he developed Leukemia from creosote exposure.

Union Pacific also previously maintained a railroad tie treating site that used creosote along the Laramie River in Laramie, Wyoming. The site was shut down in 1983, the same year the EPA put it on a “national priority list” for cleanup.

According to data from the NIH, for the years 2014-2018 Laramie County had an “age-adjusted incidence rate” for cancer twice that of Wyoming’s average.

A similar pattern appears in The Dalles, Oregon, where Union Pacific operated a wood treatment facility that used creosote until 1987. The EPA added that Union Pacific location to its “superfund site” list. The location is currently operated by AmeriTies and still makes wood for Union Pacific.

An investigation by a local news team found that air pollution from the site could cause cancer and found that “some residents of The Dalles have been advised by their doctor to move.” Another new station found that “the Oregon [Department of Environmental Quality] received 225 complaints from 49 addresses regarding AmeriTies West.”

AmeriTies has said that “safety is engrained in our culture.”

In Illinois, a nine-year-old child who loved trains and regularly visited the Union Pacific rail tracks developed a rare form of terminal cancer. He was buried in a Union Pacific-themed casket.

Recent Resignations

Notable executive departures disclosed in the past week include:

CEO of Calavo Growers (NASDAQ: CVGW — $689 million) resigned after one and a half years.

CFO of HUYA Inc (NYSE: HUYA — $2.39 billion) resigned after less than two years “due to personal reasons.”

CEO of Meta Financial Group (NASDAQ: CASH — $1.63 billion) resigned after about three years to “focus on entrepreneurial and philanthropic endeavors.”

COO of Latham Group (NASDAQ: SWIM — $2.19 billion), a swimming pool company, resigned after about ten months on the job “in order to pursue other opportunities.” The company’s stock is down ~33% since its April 2021 IPO.

Data for this section is provided by InsiderScore.com

What to Read

“BlackRock’s China Blunder” (George Soros WSJ Op-Ed)

“Pouring billions into the country now is a bad investment and imperils U.S. national security…”

“Andreessen Pulls a Bezos”(Dror Poleg Blog)

“The firm is on a hiring spree, recruiting new partners and former government officials, writers, editors, and more. A16Z is no longer building a venture capital firm; it is building a new type of company with a thick management layer that helps support its multiple portfolio companies with marketing, legal, lobbying, and technical resources. It's no longer venture capital; it's a venture corporation.”

“What's in your mutual fund? The collapse of Infinity Q is a warning to investors” (NBC News)

“The fall of the almost $2 billion Infinity Q Diversified Alpha Fund is a reminder to investors about the risks that can lurk in their holdings and the heavy costs and frustrations that liquidating funds bring. Glickman, for one, is especially upset that the fund's trustees have set aside $750 million of investors' money to cover potential costs associated with lawsuits against the fund and its officials.”

Tweets of the Week

Until Thursday,

The Bear Cave