More Problems at The Joint Corp (JYNT)

More Problems at The Joint Corp (JYNT)

Two weeks ago, The Bear Cave published on problems at The Joint (NASDAQ: JYNT — $1.20 billion), a franchisor of chiropractic clinics, concerning its franchise health and aggressive customer billing. Some smart investors in The Joint pushed back and argued that the franchise base is actually healthy. For example, The Joint’s own Franchise Disclosure Document seems to show that the median clinic makes between $70k-$150k in net profit. The Joint bulls also argued that the aggressive franchisor-franchisee terms The Joint uses are commonplace and that The Joint improves the standard of chiropractic care for patients. Investors and the sell-side want you to believe all is well with The Joint. Not so fast.

A more detailed investigation finds that The Joint excludes over half of its locations from its average net profit calculations. In addition, The Joint has removed or reduced its disclosures about clinic profitability in recent years. New evidence also shows The Joint’s expansion opportunities may be more difficult than anticipated. Moreover, The Joint has faced regulatory inquiries about its chiropractic care in at least seven states, including an undisclosed emergency doctor/whistleblower suspension in Texas.

The Joint’s 2021 Franchise Disclosure Document (“FDD”) is a 475-page legally mandated set of disclosures to potential franchisees that is publicly available on the Wisconsin Department of Financial Institutions’ website. The Joint bulls have highlighted The Joint’s franchise net profit disclosure, which appears to show that second and third quartile franchises make between $72,510 and $148,943 in net profit:

According to the FDD, franchisees invest between $203,797 and $380,697 to open a clinic, $39,900 of which goes to The Joint as an upfront fee. On that investment, franchisees typically earn around $70k to $150k — all looks great and healthy!

Reality is more nuanced.

First, The Joint only discloses financial metrics for “qualifying clinics.” According to the company, “qualifying clinics” have been open for at least twelve consecutive months, with an exception for temporary closures related to the pandemic. The Joint had 515 franchise clinics at the end of 2020 and 453 at the start of 2020. Of those, only 448 were “qualifying clinics.”

However, not all qualifying clinics are included in the net profit data. Only 246 qualifying franchise clinics provided The Joint with net profit data that was included in the FDD quartile calculations. The average length of operation for those clinics was slightly over five years. On top of that, The Joint discloses:

“For purposes of the Net Profit financial performance representation, we have excluded (i) any labor costs that were designated as owner compensation and (ii) any labor costs for an operations manager.”

Ignore sweat equity, ignore the potential under-compensation of chiropractor-owners, exclude costs for “operations managers,” ignore taxes, re-acquire underperforming clinics, exclude clinics that temporarily close for non-pandemic reasons, and only include the financial data for the half of clinics that voluntarily submit net profit data. Do all that and you get a picture of a mostly healthy franchise base; fourth quartile clinics still show an average net loss of $6,189.

Are there other signs of The Joint reducing disclosure around franchise health? Yes.

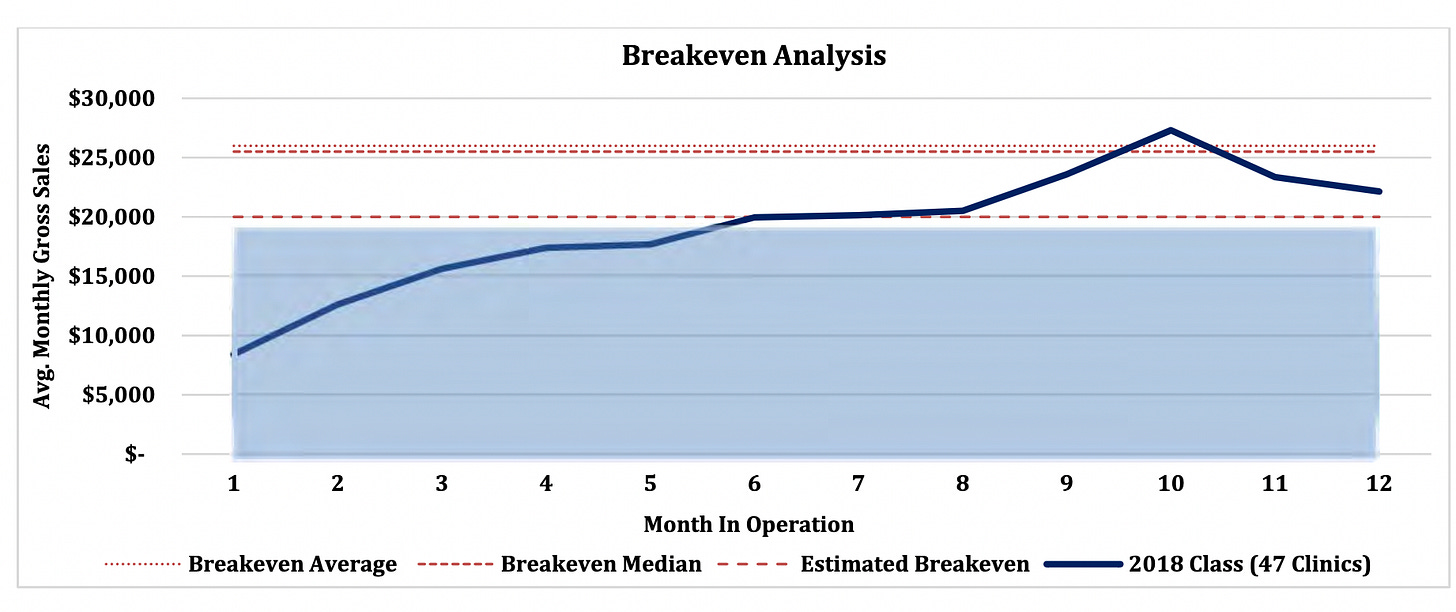

For example, on page 64 of The Joint’s 2019 FDD, the company discloses a somewhat unimpressive breakeven analysis of its 2018 class of new clinics:

The Joint has no break-even analysis in its 2021 FDD, but does disclose general sales ramp-up data. The Joint also tells franchisees in footnote 14 of its fee chart:

“The Company estimates that, in general, you should expect to put additional cash into the business until you achieve sales and incur operating expenses that allow you to achieve monthly operating break-even at your Location Franchise… The estimate of additional funds is based on an owner-operated business and does not include any allowance for an owner’s draw or account for charges for their applied labor.”

The Joint’s investor presentations have reduced franchise health disclosures too. For example, on slide six of its Q3 2019 investor presentation, The Joint shows 2019 cohort data that is underperforming prior years. In Q4 2019, The Joint claimed that the cohort underperformance was due to four underperforming clinics “that chose not to fully utilize The Joint’s new grand opening program.” Since then, the company has taken out its time-to-breakeven slide.

Other signs of trouble loom on the horizon. The Joint has sold investors on aggressive franchise expansion to 1,000 clinics in operation by the end of 2023. The company’s main states are currently Arizona, California, Texas, Florida, Georgia, Colorado, South Carolina, North Carolina, and Tennessee. Expansion in new states may be difficult.

For example, The Joint had two franchised clinics in Idaho at the end of 2018. One of those clinics closed in 2019. The second closed in 2020. The company now has two clinics in the state, both of which opened in 2020.

In Indiana, the company had five clinics at the end of 2018. In 2020, two of those clinics “ceased operations.”

In Oregon, The Joint had ten clinics at the end of 2018. One of them ceased operations in 2019 and one closed in 2020.

In New Jersey, The Joint had five franchised clinics at the start of 2018. Two “ceased operations” in 2018 and another closed in 2020.

A July 2018 lawsuit in New Jersey (Case 2:18-cv-11858-ES-MAH) highlights other problems with franchisees in that state. The lawsuit alleged that a 22-year-old traumatic car crash survivor was duped into using his settlement income to open a Joint location with a multi-unit franchisee. That location ended up failing and the victim allegedly suffered in excess of $300,000 in losses.

Other problems in franchise quality may stem from The Joint’s use of a regional developer model to rapidly grow its franchise base. Regional developers are responsible for selling new franchises within a territory and help guide new franchisees in their early years. In exchange, The Joint splits 50% of the upfront fee with regional developers and ~42% of ongoing royalties. (The Joint takes 4% of gross sales and regional developers receive 3% of gross sales). In 2020, regional developers were responsible for 83% of new franchise license sales.

It seems contradictory. On one hand, The Joint has said the unit economics of franchises are so attractive that the company is re-acquiring them to operate internally. On the other, the company is sacrificing a large portion of its royalty and fee income, just to accelerate growth. If The Joint truly had excellent results, why would it need third parties to help grow?

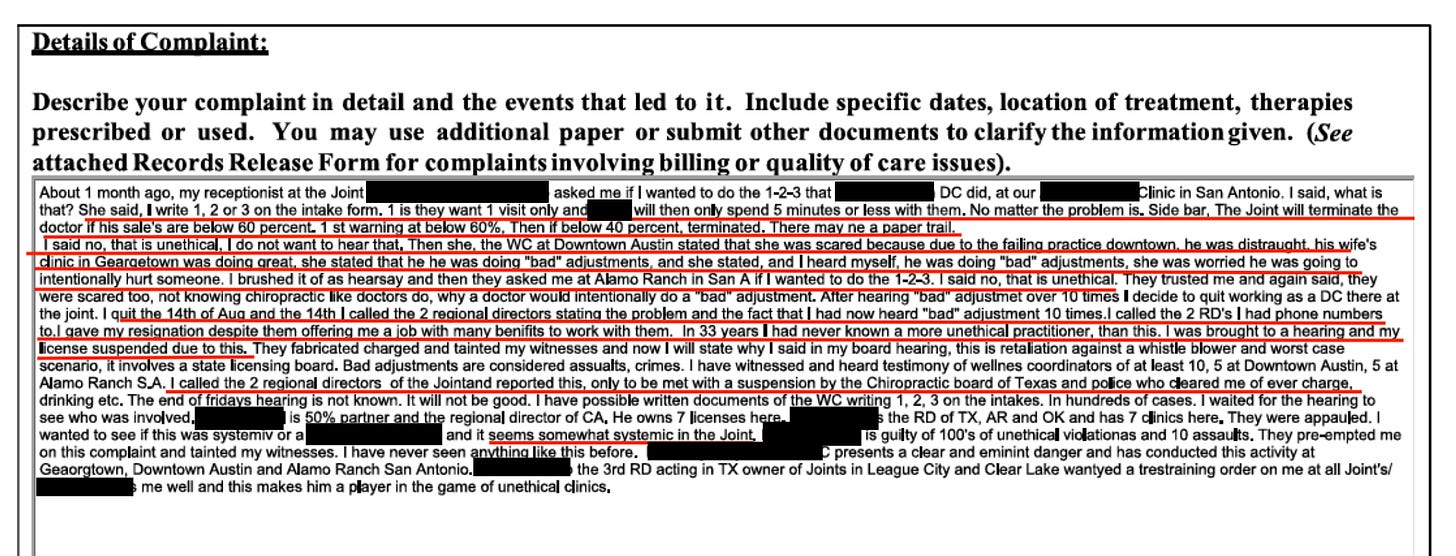

One problem with regional developers is that they further separate The Joint from its franchisees and end customers. This can lead to quality control issues. For example, one doctor wrote to the Texas Attorney General in September 2020 about safety and quality issues at The Joint franchises under regional developers. The doctor wrote, in part,

“I reported the clinics unethical and illegal activities only to have them retaliate against me and suspend my license.”

According to documents reviewed by The Bear Cave, The Texas Board of Chiropractic Examiners extended a temporary emergency suspension of The Joint’s doctor’s license “Based on the evidence of appearing at work and seeing a patient under the influence of either alcohol, medication that altered his functioning, or both.” The doctor claimed that The Joint employees provided fabricated, exaggerated, or retaliatory testimony.

In a complaint to the Texas Board of Chiropractic Examiners’ Compliance and Investigation Division, the doctor alleged that The Joint clinics under regional developers would provide subpar levels of care to customers that did not have recurring billing and engaged in other unethical practices. The doctor wrote, in part,

“I quit on the 14th of August and called the two regional directors stating the problem and the fact that I had heard of ‘bad’ adjustments 10 times…. I gave my resignation despite them offering me a job with many benefits. In 33 years, I had never known a more unethical practitioner.”

This is not the first time The Joint has come under the scrutiny of regulators. The company discloses:

“In February 2020, the State of Washington Chiropractic Quality Assurance Commission delivered notices that it was investigating complaints made against three chiropractors who own clinics, or are (or were) employed by clinics, in Washington for which our franchisees that are not owned by chiropractors provide management services. The notices contained allegations of fee-splitting… [and] appear to question our business model. The Commission posed a number of questions to the chiropractors and requested documentation describing the fee structure and related matters… The investigations initiated by the Commission are in the early stages, and we are not yet aware of the full extent of the Commission’s concerns.”

“In February 2019, a bill was introduced in the Arkansas state legislature prohibiting the ownership and management of a chiropractic corporation by a non-chiropractor… This bill has since been withdrawn… We have no assurance that another bill posing a similar or greater challenge to our business model will not be introduced in the future. Previously, in 2015, the Arkansas Board had questioned whether our business model might violate Arkansas law in its response to an inquiry we made on behalf of one of our franchisees.”

“In February 2019, the North Carolina Board of Chiropractic Examiners delivered notices alleging certain violations to sixteen chiropractors working for clinics in North Carolina for which our franchisees that are not owned by chiropractors provide management services. We retained legal counsel in this matter… The North Carolina Board issued its findings to each of the individual chiropractors, which generally included an overall finding that probable cause existed to show that the chiropractors violated one or more of the North Carolina Board’s rules… the allegations consisted primarily of quality of care and advertising issues.”

“In November 2018, the Oregon Board of Chiropractic Examiners adopted changes to its rules to prohibit a chiropractor from owning or operating a chiropractic practice as a surrogate for a non-chiropractor. As in the case of the proposed Arkansas bill, it is questionable whether this prohibition is applicable to our business model in Oregon; however, depending upon how the amended rules are interpreted, they could similarly pose a threat. Since our franchisees began operating in Oregon, the Oregon Board has made several inquiries with respect to our business model.”

The Joint also discloses past inquiries and administrative proceedings from the California Board of Chiropractic Examiners and the Kansas Healing Arts Board.

None of these regulatory inquiries have stopped The Joint from marketing to children and parents of disabled children. For example, one franchise posted an article on The Joint’s website titled, “Chiropractic Care Aims to Alleviate Autism Symptoms” and asked,

“Do you know of any autistic children who could use your help in finding the right chiropractic care for their needs?”

The Joint offers 50% discounts for children under the age of 17.

Another webpage on The Joint is titled, “Chiropractic Care is Shown to Ease the Life of Autistic Children.” As evidence, The Joint quotes from and links to an article titled, “Chiropractic adjustments shown to reverse autism in three-year-old girl.”

Other headlines on The Joint’s website include:

“Kids and Chiropractic Care: Yes, It's a Thing!” (The Joint)

“Set for Life: Why Your Kids Should Get a Chiropractic Adjustment” (The Joint)

“This Is Why Kids Need Chiropractic Care” (The Joint)

“How Your Child Can Benefit from Chiropractic Care” (The Joint)

“Children Can Benefit from Chiropractic Care” (The Joint)

In light grey 9-point font, some of the pages warn consumers the content is “not intended to provide or be a substitute for professional medical advice” and “never disregard professional medical advice… because of something you have read on this page.”

Last week, the Wall Street Journal published a skeptical article on The Joint and wrote,

“The average customer sticks around for six months, according to the company, though some return later. That high churn could be a problem as the chain matures. More than 10% of franchise licenses sold are no longer active… Even on projected 2023 numbers, by which time the company expects to have about 1,000 stores, [the stock] is a stretch. The stock fetches more than 100 times projected earnings and 10 times revenue for that year based on the consensus of analysts polled by FactSet.”

Caveat emptor.

This article is not investment advice and represents the opinions of its author, Edwin Dorsey. You can reach the author by email at edwin@585research.com or on Twitter @StockJabber. This article is for paid subscribers of The Bear Cave newsletter. If this article was forwarded to you, please consider becoming a paid subscriber to receive articles like this twice every month for $44/month. Learn more here.