Welcome to The Bear Cave! Our last premium articles were “Problems at Airbnb (ABNB)” and “Problems at Hercules Capital (HTGC)” and our next premium investigation comes out this Tuesday, May 2.

New Activist Reports

Culper Research published on Rumble (NASDAQ: RUM — $2.22 billion), a conservative-leaning video platform. Culper alleged Rumble’s user base is a fraction of its claimed size of 80 million monthly active users and wrote, in part,

“SimilarWeb estimates that in Q4, Rumble.com saw a unique web-based audience of just 28.9 million, SEMrush estimates 38.8 million unique web visitors, and we estimate Rumble’s cumulative mobile app downloads totaled just 9.5 million through Q4 2022. Combined, the web and app data suggest to us that Rumble has only 38 to 48 million unique users, and the company has overstated its user base by 66% to 108%.”

Culper also criticized the company for an outdated advertising tech stack, noted a huge September 2023 lock-up expiration, and called Rumble “a doomed operation.”

White Diamond Research published a one-page report on Presto Automation (NASDAQ: PRST — $171 million), a restaurant technology company. White Diamond accused the company of engaging in stock promotion and noted the company added and then deleted the McDonald’s logo from its website — creating the impression among some investors of a McDonald’s partnership when none appears to actually exist.

Recent Resignations

Notable executive departures disclosed in the past week include:

CFO of Whole Earth Brands (NASDAQ: FREE — $101 million) “separated” after a little over one year. The company has had four different CFOs since its June 2020 SPAC merger.

CFO of Taylor Morrison Home Corp (NYSE: TMHC — $4.70 billion) stepped down after a little over one year “to attend to family commitments that will require him to relocate out of Arizona.”

CFO of Tarsus Pharmaceuticals (NASDAQ: TARS — $399 million) resigned after three years “to pursue other professional interests.” In December the company’s Chairman also departed “to pursue his passion of early-stage biotech formation and leadership in new opportunities.”

CEO of Helen of Troy Limited (NASDAQ: HELE — $2.41 billion) disclosed his intent to retire in February 2024 after over ten years with the company. In March, the company’s CFO resigned “to pursue a new opportunity” after one and a half years. The company is audited by Grant Thornton LLP and was a top short idea of prolific short-seller Marc Cohodes in a January Hedgeye interview.

General Counsel of REV Group (NYSE: REVG — $638 million) was “terminated” after almost five years. In January 2023, the company’s CEO “mutually agreed” to depart the company and in 2020 the company’s COO and CFO both departed.

Chief Technology Officer of Mitek Systems (NASDAQ: MITK — $403 million) resigned after seven years “to pursue other professional interests.” In February, the company’s CFO also resigned “to pursue another career opportunity.”

Data for this section is provided by VerityData from VerityPlatform.com

Making Our Mark

On Friday the Federal Deposit Insurance Corporation published a supervisory report concerning the collapse of Signature Bank. On page 16, the FDIC cites a Twitter Spaces discussion between The Bear Cave’s author, Edwin Dorsey, and short seller Marc Cohodes:

“On March 9, 2023, a short seller who was reported to have predicted the fall of FTX and Silvergate, alleged SBNY was involved with FTX and Silvergate in a money laundering scheme using Signet, and claiming that 25 percent of SBNY's deposits were related to the cryptocurrency sector. The Twitter audio conversation involving this short seller was more widely reported in news reports on March 10, 2023.”

Readers can listen to the March 9 Twitter Spaces with Marc Cohodes here. Moreover, The Bear Cave was among the very first publications to raise concerns about Signature Bank and other crypto banks in our November 2022 investigation.

What to Read

“SPACs Delivered Easy Money, but Now Companies Are Running Out” (WSJ)

“The SPAC boom took hundreds of risky companies to the stock market. The next stop for many is bankruptcy court. Dozens of companies that merged with SPACs are running out of cash, joining at least 12 that have already gone bankrupt after combining with special-purpose acquisition companies.”

“Why the Banking Mess Isn’t Over” (WSJ)

“Deposit flight and higher funding costs risk squeezing small businesses beyond big cities…”

MCB 8-K (EDGAR)

“On March 6, 2023, the company purported to make a loan to Mr. DeFazio in the amount of $7,468,000… to pay the exercise price of certain existing stock options... the company determined that the 2023 Loan and the 2021 Loan were likely impermissible under applicable law and/or regulations.”

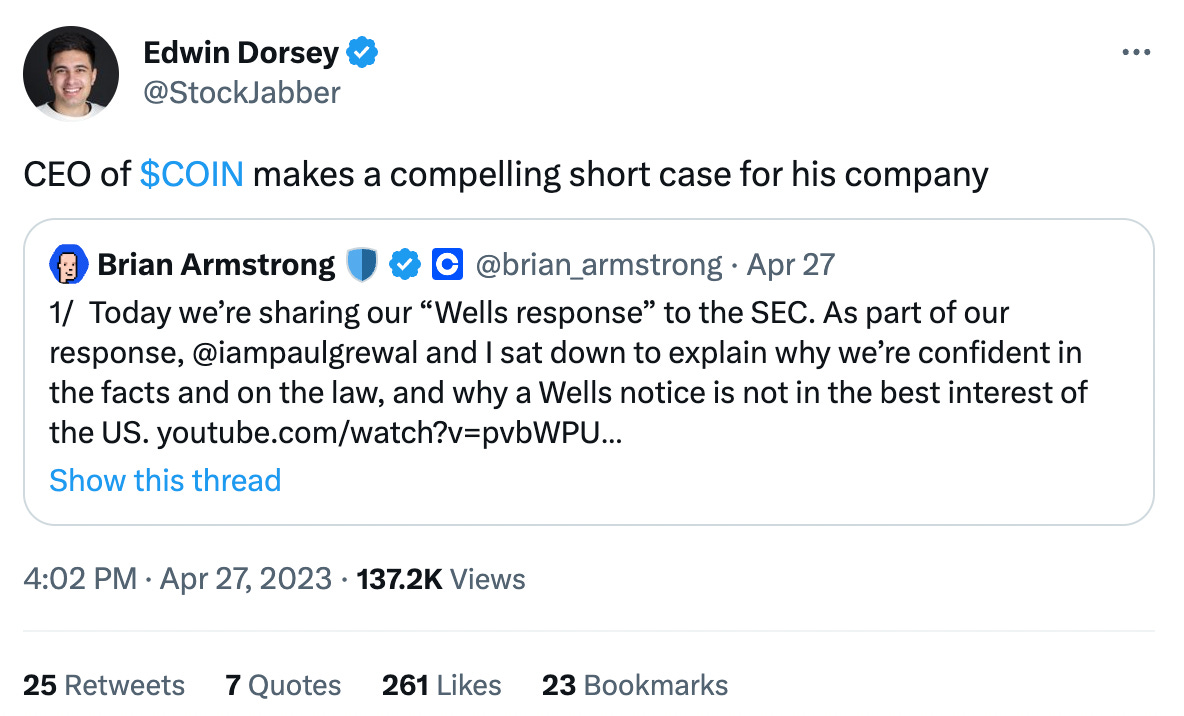

“Coinbase responds to the SEC’s Wells notice” (Coinbase)

“Coinbase has never wanted to litigate with the Commission. The Commission should not want to litigate either. Litigation will put the Commission’s own actions on trial, erode public trust cultivated over decades, undermine incentives for market participants to engage with the Commission in good faith, and present significant risks to broad aspects of the Commission’s enforcement program.” (Page 8)

Tweets of the Week

Until next week,

The Bear Cave