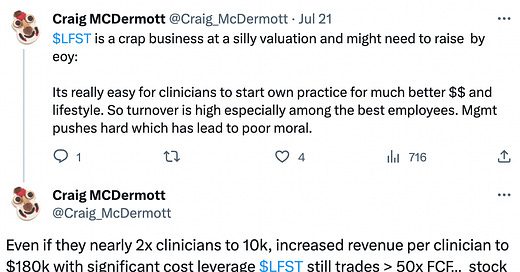

Welcome to The Bear Cave! Our last premium articles were “Even More Problems at Rumble (RUM)” and “Problems at LifeStance Health (LFST)” and our next premium investigation comes out Thursday, November 2.

New Activist Reports

Culper Research published on XPEL (NASDAQ: XPEL — $1.43 billion), a manufacturer of car paint protection products. Culper alleged the company “has understated its reliance on Tesla by 5-6x” and faces “an existential threat in its long-time supplier entrotech, which is rendering XPEL useless by going direct to OEMs with paint giant PPG.” Specifically, Culper interviewed over 100 XPEL paint wrap installers and found Tesla, which is now launching a competing service, accounts for around 30% of XPEL’s revenue. Culper also highlighted that within the next five years, XPEL’s supplier entrotech will directly integrate its paint protection product into the car manufacturing process, diminishing the need for the XPEL aftermarket. Culper concluded,

“Insiders have dumped $52M in stock in the past year and an astounding $375M since early 2020, both in open market sales and 10b5-1 plans. We think there will be little left of XPEL as investors realize its Tesla and entrotech engines have both flamed out.”

Jehoshaphat Research published on R1 RCM (NASDAQ: RCM — $4.90 billion), a revenue cycle management company focused on the U.S. healthcare industry. Jehoshaphat alleged that the company’s “financial accounting is so misrepresentative, its corporate governance so surprisingly bad, and the reflexivity of its business model so misunderstood that its stock is practically uninvestible today.” Jehoshaphat raised concerns about aggressive revenue recognition and potentially “under-reserving for customer bad debts” and noted that the company’s CEO, CFO, Chief Commercial Officer, and Chief Strategy Officer have all departed in the last eighteen months. Jehoshaphat also added,

“Lastly, we believe that RCM’s business model is dangerously reflexive and requires a high stock price for the business to work: the company continually issues stock to win/retain customers, but needs to win and retain customers to keep the stock price high.”

Bleecker Street Research published on LL Flooring Holdings (NYSE: LL — $103 million), a large U.S. flooring retailer. The company recently rallied 40% on a high-premium acquisition offer from Live Ventures (NASDAQ: LIVE — $89 million). Bleecker Street believes that the offer is spurious and noted that the SEC “is seeking to ban LIVE’s CEO from serving as a director of public companies.”

Iceberg Research published on NuScale Power (NYSE: SMR — $871 million), a small-scale nuclear power company. Iceberg raised concerns about the viability of some of the company’s contracts including a recent deal with Standard Power, a power company whose managing director has previously been charged by the SEC for securities fraud.

Citron Research tweeted critically about Grand Canyon Education (NASDAQ: LOPE — $3.51 billion), a for-profit education company that operates Grand Canyon University. Citron said the company “receives more taxpayer student funding than any university in the US” and criticized the company for a recent press release alleging that government agencies are unfairly scrutinizing the company. Grand Canyon’s press release reads, in part,

“Government officials associated with the U.S. Department of Education, Federal Trade Commission and under the authority of the Department of Veterans Affairs are coordinating efforts to unjustly target GCU in what appears to be retaliation for the university filing an ongoing lawsuit against [the U.S. Department of Education] regarding its nonprofit status.”

Recent Resignations

Notable executive departures disclosed in the past week include:

CFO of Avangrid (NYSE: AGR — $11.8 billion) resigned after one and a half years “due to personal reasons.” In July, the company’s Controller resigned after five years and the company has had four different CEOs in the last five years.

CFO of Aspen Technology (NASDAQ: AZPN — $11.7 billion) resigned after three years “to pursue another opportunity.”

CFO of Bio-Rad Laboratories (NYSE: BIO — $9.04 billion) resigned after four and a half years “to pursue another opportunity.” In August, the company’s Chief Accounting Officer also resigned after three and a half years.

CEO of Macatawa Bank (NASDAQ: MCBC — $301 million) “announced his retirement effective November 1, 2023” after serving over 14 years as CEO. In September 2020, Macatawa’s Chief Commercial Banking Officer separated after just one and a half years.

Chief Marketing Officer of Vail Resorts (NYSE: MTN — $8.24 billion) “involuntarily separated” from the company after two years. In the last two years, the company’s CEO, CFO, and Mountain Division President have also all departed. In March 2022, The Bear Cave published on the company and said “the Vail Resorts ecosystem is oversold, overworked, and has goodwill stretched thin.”

Michael Stanley Whittingham, board member of Microvast Holdings (NASDAQ: MVST — $415 million), resigned after two years “to pursue another opportunity.” Last year, the company’s CFO and another board member resigned and the company is down ~85% since its July 2021 SPAC merger.

Reza Kazerounian, board member of Allegro MicroSystems (NASDAQ: ALGM — $5.55 billion), “retired” effective immediately after five and a half years. Last year, the company’s CEO and CFO departed and the company’s General Counsel departed in December 2021. In May, The Bear Cave published on Allegro and said the company “is rife with conflicts and irregularities including numerous executive resignations, two auditor dismissals, and a major supplier that is owned by the company’s largest customer and controlling shareholder.”

Data for this section is provided by VerityData from VerityPlatform.com

What to Read

“Carl Icahn Criticizes Short Sellers at Investor Conference” (Bloomberg)

“‘I think there’s a place for short sellers without question but to go out and spread rumors that are basically untrue or close to untrue, there’s no place for that,’ Icahn said at the 13D Monitor Active-Passive Investor Summit. ‘I think it is unconscionable, and I’m very much against that.’”

“Months after the closure of Xperience Fitness customers still struggle with cancellations and refunds” (Green Bay Press-Gazette)

“Most of the complaints were from those trying to cancel their transferred memberships, mainly because of Planet Fitness policy of not accepting cancellations via phone.”

Tweets of the Week

Until next week,

The Bear Cave