Welcome to The Bear Cave! Our last premium articles were “Problems at Roblox (RBLX) #4” and “Problems at Roblox (RBLX) #5” and our next special investigation comes out Thursday, November 7.

New Activist Reports

Fuzzy Panda Research published on Stride Inc (NYSE: LRN — $2.79 billion), a for-profit education company that helps operate online public school systems. Fuzzy Panda found that Stride is a COVID-winner about to “fall off a COVID cliff.” Fuzzy Panda alleged the company downplayed its $330 million windfall from the COVID-era Elementary & Secondary School Emergency Relief Funds (ESSER) program that ended September 30, 2024. In addition, Fuzzy Panda alleged Stride “got paid for students it was not educating” and predicted a Harris Administration could crack down on these “ghost students” because as California Attorney General she reached a $168 million settlement with the company over similar issues. Fuzzy Panda also alleged that Stride’s competitors are taking share and Stride’s leadership created a toxic work environment.

Shares fell ~10% following Fuzzy Panda’s report.

Spruce Point Capital published on Erie Indemnity (NASDAQ: ERIE — $25.2 billion), an auto, home, property, and life insurance company. Spruce Point raised concerns about “the sustainability of ERIE’s 25% management fee collected on premiums written by [its related] Exchange.” Spruce Point noted “ERIE is the only public company that is structured in this way, with a publicly traded management company overseeing a policyholder-owned insurance exchange” and noted that “given recent deterioration of the Exchange’s financial performance and historical precedent, we believe it is increasingly likely that ERIE’s management fee will decline for the first time in decades.” Spruce Point concluded,

“Based on our investigation, we estimate a 35% - 55% downside risk, or approximately $217- $314 per share.”

Independent journalist Herb Greenberg wrote about similar issues last month, finding in part, “As the Exchange has lost money, Erie has been minting it, turning it into the kind of earnings growth story the algos love to chase.”

NINGI Research published on Merchants Bancorp (NASDAQ: MBIN — $2.06 billion), an Indiana-based bank. NINGI alleged the bank “has been aggressively expanding its loan book by lending money to bad actors” and “has used billions of dollars in brokered deposits to expand its loan book recklessly.” NINGI also found that Merchants Bancorp has among the highest percentage of brokerage deposits and commercial real estate exposure compared to peer institutions.

Iceberg Research reiterated its short on Eos Energy Enterprises (NASDAQ: EOSE — $702 million), a clean energy storage battery company. Iceberg highlighted that the company is up ~200% this year and despite a new debt deal the company’s “operations are deteriorating” and “its zinc batteries cannot compete with the rapidly declining prices of lithium batteries.”

Recent Resignations

Notable executive departures disclosed in the past week include:

CEO of Spectral AI (NASDAQ: MDAI — $22 million) resigned “to pursue other business opportunities” after seven months. The company is down ~90% since its September 2023 SPAC merger. The outgoing CEO previously served as CFO of MiMedx (NASDAQ: MDXG — $854 million) and currently serves on the board of White Mountains Insurance Group (NYSE: WTM — $4.82 billion).

CFO of Gladstone Investment Corporation (NASDAQ: GAIN — $522 million) resigned after three years.

CEO of CVS Health (NYSE: CVS — $75.9 billion) departed after three years, resigned from the board, and “will receive a monthly advisory fee of $375,000” for the next six months.

CEO of The Joint Corp (NASDAQ: JYNT — $175 million) “entered into a confidential separation agreement and release of claims” after eight years and also departed the board. The company has fallen ~85% since October 2021 when The Bear Cave “uncovered dozens of complaints concerning overbilling, forged transactions, and other misconduct.”

Chief Revenue Officer of The Beauty Health Co (NASDAQ: SKIN — $198 million) was “terminated without cause” after two years. In April the company’s Chief Operating Officer was also “terminated without cause” after one year and the company is down ~85% since February 2023 when The Bear Cave published on the company and wrote,

“Lackluster leadership, high executive turnover, internal accounting issues, and a dubious customer base add to the pressure on the company. Trading for ~5x revenue today, The Bear Cave believes Hydrafacial is about to faceplant.”

Data for this section is provided by VerityData from VerityPlatform.com

What to Read

“Federal Trade Commission Announces Final ‘Click-to-Cancel’ Rule Making It Easier for Consumers to End Recurring Subscriptions” (FTC)

“The Federal Trade Commission today announced a final ‘click-to-cancel’ rule that will require sellers to make it as easy for consumers to cancel their enrollment as it was to sign up. Most of the final rule’s provisions will go into effect 180 days after it is published in the Federal Register.

‘Too often, businesses make people jump through endless hoops just to cancel a subscription,’ said Commission Chair Lina M. Khan. ‘The FTC’s rule will end these tricks and traps, saving Americans time and money. Nobody should be stuck paying for a service they no longer want.’”

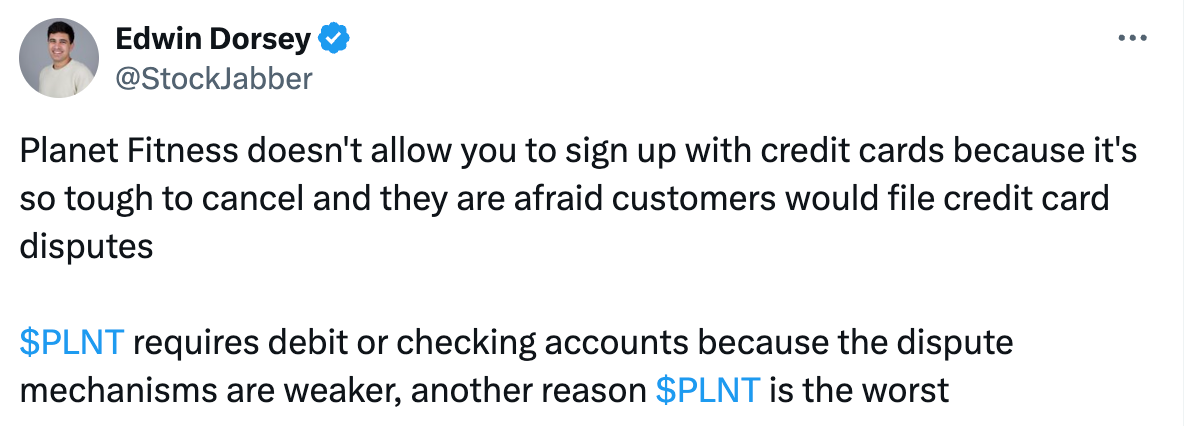

Tweets of the Week

In early 2023, The Bear Cave published on billing issues at Planet Fitness here and here and wrote, “After reviewing the evidence, The Bear Cave is left wondering whether Planet Fitness is actually a thriving gym franchise or an illegal billing operation with gyms on the side.”

Until next week,

The Bear Cave