Welcome to The Bear Cave! Our last premium articles were “Problems at Roblox (RBLX) #4” and “Problems at Roblox (RBLX) #5” and our next special investigation comes out Thursday, November 7.

New Activist Reports

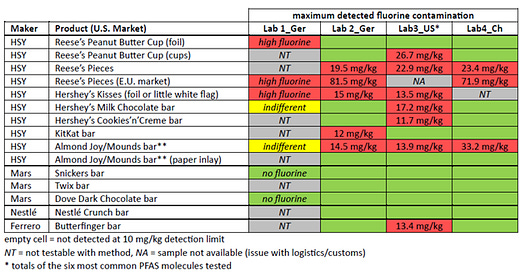

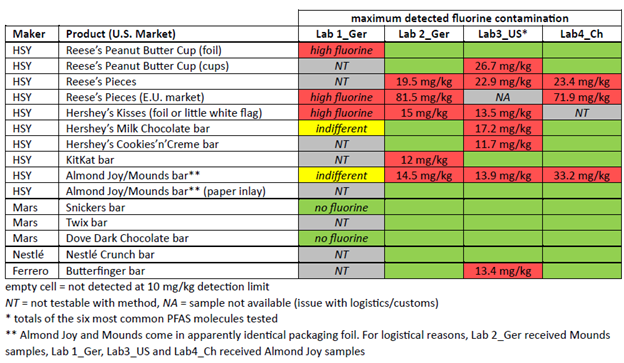

Grizzly Research published on Hershey (NYSE: HSY — $36.7 billion), America’s dominant chocolate company with brands including Reese’s, Hershey, and Almond Joy. Grizzly Research claimed that it found cancer-causing PFAS “forever chemicals” in Hershey products through various lab tests. Grizzly “commissioned the mass testing of the packaging of about 40 different food products for U.S. consumer retail” and found that Hershey’s brands had excessive contamination while competing brands did not. Below are some of the test results:

Grizzly Research added that it “informed the relevant regulatory agencies of our findings” and said the issue “seems too important to ignore.”

The Bear Cave previously published on Hershey in July 2023 and March 2024 and highlighted growing competition from Feastables, a chocolate brand founded by YouTube star MrBeast.

Independent researcher Lauren Balik published two articles on Zeta Global Holdings (NYSE: ZETA — $6.14 billion), a data and marketing automation company. On Monday, Ms. Balik called the company an “AI scam” and raised concerns about its reliance on Indian outsourcers and its large business as a Snowflake reseller. On Friday, Ms. Balik alleged the company is “manipulating revenue guidance through creative wordsmithing.” For example, Zeta may be misleading investors about the growth coming from this election cycle by narrowing their revenue disclosure for “political and advocacy customer revenue” down to just “political candidate revenue.”

Iceberg Research published on Lilium NV (NASDAQ: LILM — $94 million), an early-stage German electric aircraft company. Iceberg noted the company’s subsidiaries are filing for insolvency and estimated the parent company would run out of cash by January. The company is down ~80% in the last month and down ~95% since Iceberg’s first report in March 2022.

Hunterbrook Media published on Universal Stainless & Alloy Products (NASDAQ: USAP — $404 million), a steel products company. Hunterbrook alleged the company has “a decades-long history of product defects, financial red flags, and toxic workplace culture” and raised doubts about whether its recent deal to be acquired for $45/share would “survive due diligence and regulatory review.”

Recent Resignations

Notable executive departures disclosed in the past week include:

CFO of ServisFirst Bancshares (NYSE: SFBS — $4.51 billion) resigned after just eight months. ServisFirst is audited by FORVIS LLP.

CFO of AppFolio (NASDAQ: APPF — $7.70 billion) resigned after three years.

Rodney Williams, board member of Caesars Entertainment (NASDAQ: CZR — $9.56 billion), resigned “effective immediately” after just four months.

Mark G. Parker, chair of Disney (NYSE: DIS — $172 billion), “informed the company of his decision to resign from the Board, effective as of January 2, 2025” and will be replaced by James P. Gorman, the former CEO of Morgan Stanley. In July, Safra A. Catz, CEO of Oracle, resigned from the board effective immediately after six and a half years, and in November 2023, Francis A. Desouza, the former CEO of Illumina, also disclosed he would not stand for re-election on Disney’s board.

General Counsel of Stride Inc (NYSE: LRN — $3.95 billion) resigned “to pursue an opportunity with another company outside of the company’s industry” after six years. Last week, Fuzzy Panda Research alleged the company “got paid for students it was not educating” and predicted the company was “about to fall off a COVID cliff.”

Data for this section is provided by VerityData from VerityPlatform.com

What to Read

“Be Careful Tweeting About Stocks” (Bloomberg)

“That same day at 2:04 pm, Citron Research published a tweet stating ‘Getting emails about shorting $VUZI. NO WAY we would short this flyer. Small market cap with story that is tied to 5G, $AMZN and $PLUG and Covid. There has to be easier pickings...still doing research. Risk/Reward easier on other high flyers.’”

“A Small Bank’s Failure Leaves Big Depositors Feeling the Pain” (WSJ)

“In general, the FDIC insures deposits up to $250,000 per person, per bank, although some customers with multiple accounts may qualify for more. If a bank fails, depositors whose accounts are above the limit face potential losses.

That was the case for uninsured depositors of First National Bank of Lindsay in Lindsay, Okla. Federal regulators announced late Friday that it had failed and that another small lender agreed to assume its insured deposits—but not its $7 million of deposits that exceeded FDIC insurance limits.”

“Miners BHP, Vale Sign $32 Billion Settlement for Deadly 2015 Dam Collapse” (WSJ)

“BHP Group and Vale on Friday signed a $32 billion settlement with Brazilian authorities over the disastrous 2015 collapse of a mine-waste dam that killed 19 people and polluted more than 400 miles of rivers.”

Tweets of the Week

Until next week,

The Bear Cave