Welcome to The Bear Cave! Our last premium articles were “More Problems at TriplePoint Venture Growth BDC (TPVG)” and “Problems at 100 Long-Term Underperformers” and our next special investigation comes out this Thursday, May 15.

New Activist Reports

Independent researcher Lauren Balik published on Klaviyo (NYSE: KVYO — $9.22 billion), an email marketing platform primarily used by Shopify-powered businesses. Ms. Balik said Klaviyo is “uniquely exposed among US publicly traded software companies to not only ongoing tariff issues among its customer base, but also the close of the de minimis loophole which has allowed Klaviyo’s customer base of dropshipping outlets to flourish.” Ms. Balik estimated that “over 50% of Klaviyo’s 167,000 SMB e-commerce customers are at extreme risk of going out of business by the end of calendar 2025” and highlighted several examples of small businesses that use Klaviyo struggling following tariffs from the Trump Administration.

Ms. Balik previously published on Klaviyo in May 2024 and alleged the company “is willfully ignoring rampant fraud on its platform.”

Morpheus Research published on Mercurity Fintech (NASDAQ: MFH — $387 million), a blockchain technology company. Morpheus called the company a “blatant scam run by repeat bad actors” and alleged that “Mercurity’s executives and key shareholders have extensive ties to a billion dollar Ponzi scheme, stock market pump and dumps, and crypto scams.” Morpheus concluded,

“Mercurity is a virtually zero-revenue business with a decade of failed business initiatives that now claims to operate at the forefront of AI hardware, financial technology, and blockchain.”

Wolfpack Research published on UFP Technologies (NASDAQ: UFPT — $1.82 billion), a medical device and packaging company. Wolfpack alleged that UFP’s largest customer, Intuitive Surgical (~29% of revenue), “is gutting [UFP] by insourcing and buying from a competitor.” Wolfpack also alleged that the company’s leadership sold ~$50 million in stock despite knowing its relationship with Intuitive Surgical was deteriorating.

White Diamond Research published on Pulse Biosciences (NASDAQ: PLSE — $1.15 billion), a medical technology company. White Diamond raised concerns about Pulse’s product efficacy, especially around thyroid treatment, and highlighted the company’s high executive turnover.

Prolific short-seller John Hempton published a brief post on Upstart Holdings (NASDAQ: UPST — $4.49 billion), an “AI-powered” consumer lending platform. Mr. Hempton raised concerns the company was extending more loans to risky borrowers.

Venture capitalist Auren Hoffman published a brief post on Booz Allen Hamilton (NYSE: BAH — $16.7 billion), a large government-focused consulting company. Mr. Hoffman alleged the company has “been preying on taxpayers and over-billing the government and building things the government does not need, over-budget, and massively delayed.” Mr. Hoffman said his short position is “a bet is that the government is becoming a smarter customer” and predicted “we will see IT government contracts in the tens of billions of dollars canceled in the next few months.”

Tanuki Research is a new anonymous short-focused account specializing in “shorting real businesses that actually trade on earnings, when they’re temporarily over-earning and the market is extrapolating a cyclical high as something permanent.” Tanuki shared short pitches on Kadant (NYSE: KAI — $3.57 billion), a potentially overearning paper mill machinery company, and Coca-Cola Consolidated (NASDAQ: COKE — $10.1 billion), a high-flying Coca-Cola bottling company. Follow Tanuki on Substack here and @TanukiResearch on X.

Recent Resignations

Notable executive departures disclosed in the past week include:

CFO of Axogen (NASDAQ: AXGN — $518 million) resigned after one and a half years “to pursue other opportunities.” The company’s CEO also “stepped down” in August 2024 after 13 years.

CEO of Hain Celestial (NASDAQ: HAIN — $143 million) departed with immediate effect after a little over two years and also resigned from the board. The company has had four CEOs and six CFOs in the last ten years.

CEO of Instacart (NASDAQ: CART — $11.5 billion), Ms. Fidji Simo, resigned after nearly four years “to pursue another opportunity.” Ms. Simo joined OpenAI, where she was on the board, as CEO of Applications. In April 2025, Frank Slootman, former CEO of Snowflake, disclosed he was not standing for re-election on Instacart’s board after four and a half years. In May 2024, the company’s CFO also resigned after four and a half years and in February 2024 the company’s Chief Operating Officer resigned after three years. The company is up roughly 45% since its September 2023 IPO.

CFO of Conduent (NASDAQ: CNDT — $364 million) departed with immediate effect after almost four years. The business process services/technology consulting company is down ~85% since its December 2016 spinoff from Xerox.

CFO of NetScout Systems (NASDAQ: NTCT — $1.55 billion) “entered into a transition agreement” with three weeks’ notice after 13 years. In addition, the company’s Chief Operating Officer “entered into a transition agreement” with three weeks’ notice after 18 years. The company has been led by its 70-year-old founder/CEO for the last 32 years and was featured in The Bear Cave’s list: “Problems at 100 Long-Term Underperformers.”

Board member of Kohl's (NYSE: KSS — $747 million), Ms. Christine Day, the former CEO of Lululemon, resigned with immediate effect after four years. On May 8, the company initially disclosed that Ms. Day’s decision “was not due to any disagreements with the company on any matter relating to the company’s operations, policies or practices.” However, on May 9, the company filed an amended 8-K and disclosed that “Ms. Day sent emails indicating that she has disagreements with the Board.” In a May 8 email, Ms. Day wrote, in part,

“In the 8K filing, for my departure, it would not be accurate to say I have no disagreements with the board. Unfortunately I have been continually disappointed with the level of governance process. The 8k needs to reflect this.”

And in a May 9 email, Ms. Day highlighted additional governance concerns, writing in part,

“As directors, we all get sued together - so transparency with risks is a requirement for trust and accountability. To place other directors in position of making a decision without full disclosure of risks is unacceptable. And it has been going on far too long…”

Last week, Kohl's CEO, Ashley Buchanan, was “terminated for cause” after just three months following an investigation conducted by outside counsel concerning unusual vendor agreements with the company’s CEO's romantic partner.

VerityData provides data for this section from VerityPlatform.com

News of the Week

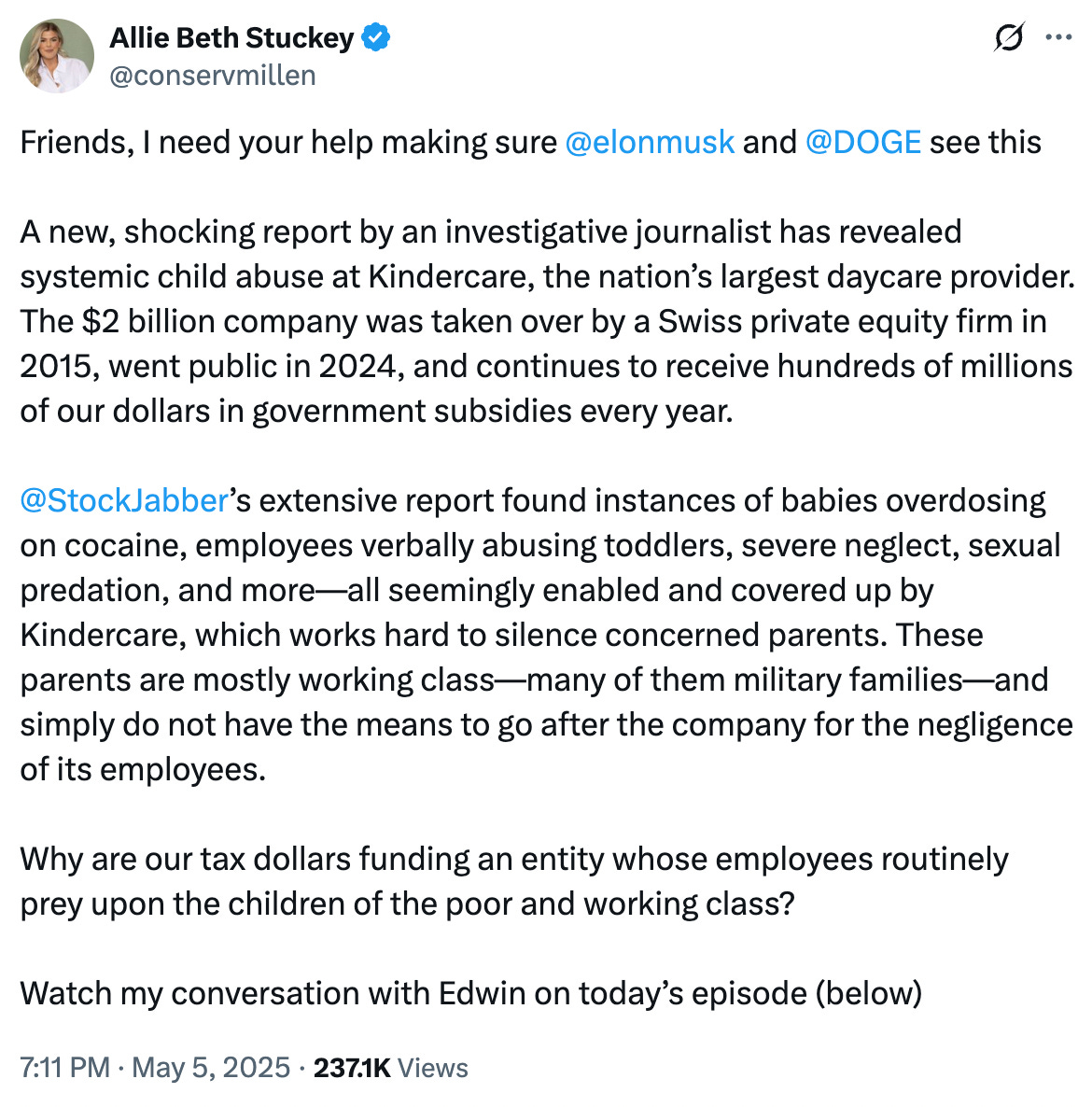

KinderCare Scandal Grows

The Bear Cave recently went on Relatable with Allie Beth Stuckey to discuss safety issues at KinderCare (NYSE: KLC — $1.56 billion), the largest daycare chain in the United States. Our conversation is available on Spotify here and YouTube below:

Following the interview, Rep. Anna Paulina Luna, a Republican representing Florida’s 13th congressional district, tweeted that she was “writing to House leadership and DOGE to address this disgusting report” and added:

“If you can’t keep children safe—and worse, are complicit in their abuse—you do NOT deserve a dime of taxpayer funding.”

In its March 2025 earnings call, KinderCare told analysts that about 35% of its revenue (~$930 million) comes from the Childcare and Development Block Grant, a federal program that sends money to states to subsidize childcare for working families.

On April 25, Evie Magazine amplified The Bear Cave’s concerns about KinderCare said the alleged behavior “might be the worst scandal in America’s childcare system.” The Bear Cave first brought concerns about KinderCare into the mainstream in our April 3 investigation “Problems at KinderCare Learning Companies (KLC).”

Don’t Trust Trustpilot

Several viral posts from small business operators on X alleged questionable business practices by Trustpilot (LON: TRST — GBP989 million), a consumer review platform. Pieter Levels, a respected serial entrepreneur, tweeted in part,

“Trustpilot is a pay-to-play racket and should be investigated by FTC. Everyone in the startup chat groups already know this btw, we know if you pay your scores go up. Half of us don't want to pay so we don't have good ratings…”

Other entrepreneurs also raised concerns about unethical practices by Trustpilot.

Tweets of the Week

Until Thursday,

The Bear Cave